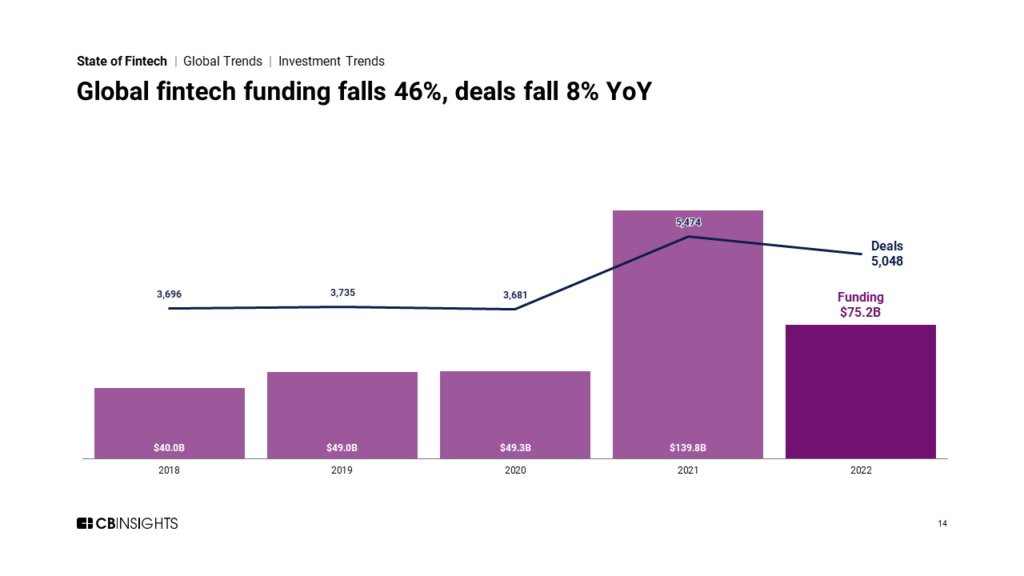

Global fintech investment activity steadily declined throughout 2022, with funding dropping by 46% from 2021's record levels.

Global fintech funding reached $75.2B in 2022 — marking a 46% drop from 2021, but up 52% compared to 2020. The funding slowdown was especially severe in the second half of the year, with Q4’22 funding clocking in at $10.7B — the lowest quarterly level since 2018.

Overall, deals fell 8% year-over-year to reached 5,048 in 2022. Africa was the only major region to see deals increase compared to 2021.

Below, check out a handful of highlights from our 178-page, data-driven State of Fintech 2022 Report. For deeper insights, all the record figures, and a ton of private market data, download the full report.

Other 2022 highlights across fintech include:

- $100M+ mega-rounds accounted for $36.5B in funding in 2022, marking a 60% drop from 2021.

- Banking funding declined 63% YoY — the sharpest drop across fintech sectors analyzed — to return to pre-Covid levels.

- US fintech funding fell 50% YoY to $32.8B. Despite the drop, 2022 was the second-highest funding year for US fintechs on record.

- Africa-based fintechs saw a record 227 deals in 2022, a 25% increase YoY.

- Insurtech M&A exits reached a new high, rising 40% in 2022 to 81 deals.

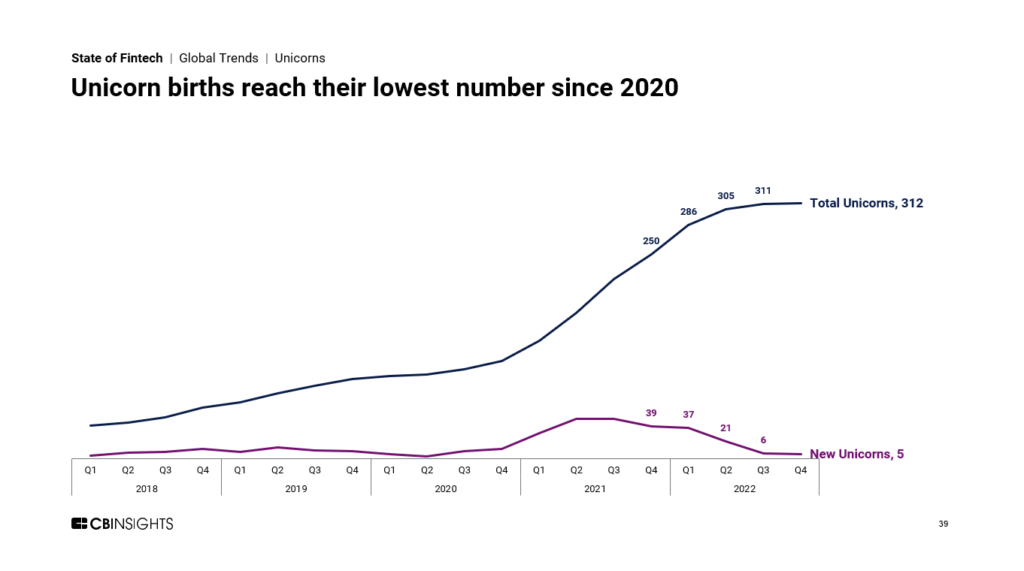

- Fintech unicorn births steadily declined throughout 2022, sinking to a low of 5 new unicorns in Q4’22 — an 87% drop compared to Q4’21.

Download the full State of Fintech 2022 Report to dig into all these trends and more.