Our fintech analysts uncover 3 key trends emerging from our capital markets industry data.

Turbulent market conditions have rattled capital markets tech funding, which fell 84% YoY in Q3’22.

Nevertheless, continued investment and partnership activity in the space highlight emerging technologies that are helping firms use data to improve efficiency and maximize planning process outcomes. These technologies enable capital markets firms not only to adapt to market volatility, but also to pursue new growth opportunities.

Using CB Insights data, we surface 3 capital markets tech trends to watch and highlight what’s next across:

- Equity management practices

- ESG reporting requirements

- Trade analytics and execution

EQUITY MANAGEMENT PRACTICES

Tech to watch: Equity management platforms

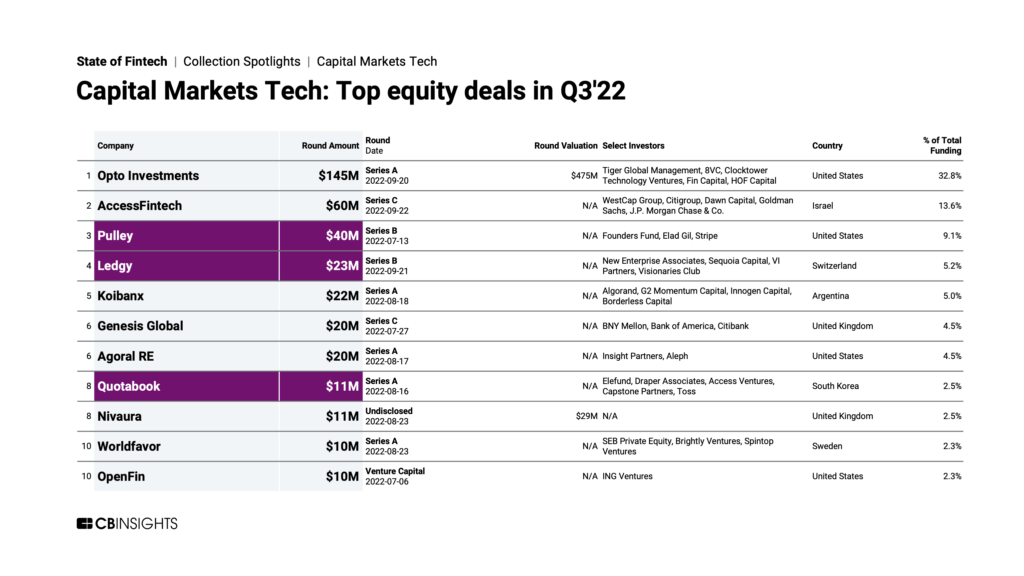

Why we’re paying attention: Three of the top 10 capital markets tech deals in Q3’22 went to companies developing equity management platforms, which offer technology for companies and their stakeholders (e.g., investors, law firms, etc.) to manage data related to shareholder equity over time.

These platforms simplify administrative efforts — across areas like accounting, human resources, and legal — and employ data and software modules to help companies plan for future equity changes (such as before a funding round).

Raising $40M in a Series B deal, Pulley offers an equity management platform that enables startups to manage cap tables and fundraising activities. The company also partners with law firms, which offer Pulley’s service to their startup clients.

Meanwhile, Switzerland-based Ledgy, which raised $23M in a Series B, enables startups and investors to automate and manage equity activities across international environments. In addition, the company offers an analytics module that allows firms to model potential funding and exit scenarios.

Quotabook, a South Korea-based equity management platform that raised $11M in a Series A, also targets both investors and startups. For investors, the platform includes broader solutions for fund and portfolio management.

Why it matters: Companies use these platforms to manage existing equity structures, as well as plan for changes to equity related to future funding rounds. Funding to these 3 companies follows a record year for venture investment in 2021, which suggests a strong, ongoing need among startups for solutions to manage equity given the influx of capital.

What’s next: Although funding is down from 2021 highs, startups will continue to raise funding to fuel growth. For instance, half of insurtechs plan to raise funding in the next 12 months. Expect continued demand for equity management solutions that help with preparation for future funding rounds.

ESG REPORTING REQUIREMENTS

Tech to watch: ESG intelligence

Why we’re paying attention: ESG intelligence technology helps capital markets firms gain insight from ESG-related data. This can support firms’ reporting on progress to meet environmental, social, and governance (ESG) standards.

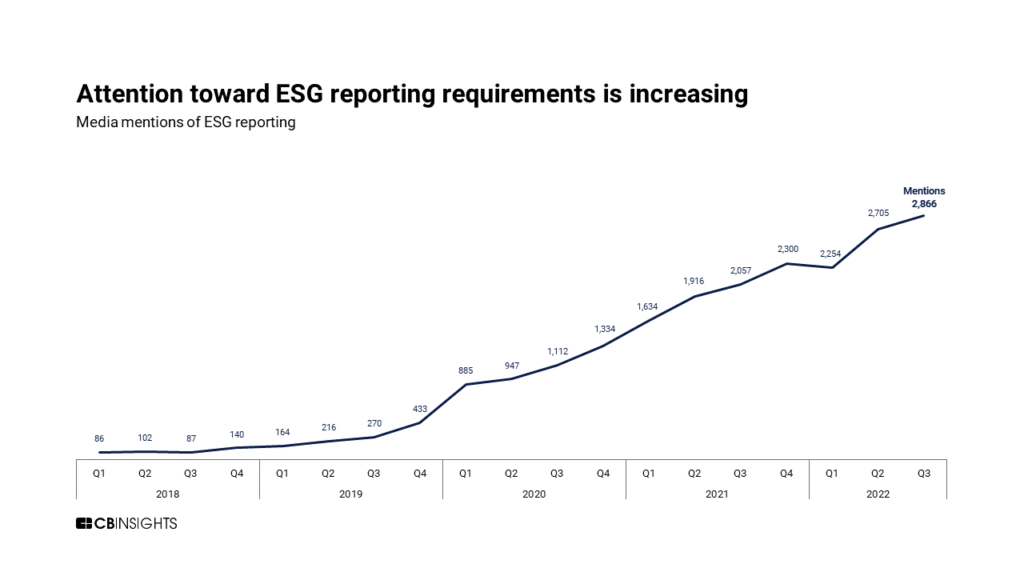

Demand for ESG reporting is growing as investors, ratings agencies, and regulators push for firms to adopt ESG standards. News coverage of ESG reporting has grown dramatically, more than doubling over the past 2 years.

Q3’22 saw 1 early-stage deal and 1 exit among ESG intelligence companies:

- In August, Worldfavor raised a $10M Series A round. Worldfavor offers a SaaS platform for firms to manage ESG-related information, including capabilities for sustainable investment monitoring.

- alva uses machine learning and natural language processing to help firms understand ESG-related risks and build ESG profiles. The company merged in September with several research and analytics firms to form Penta, which provides solutions to help businesses and their stakeholders improve decision-making related to risk and strategy.

Why it matters: ESG standards are evolving, and investors are grappling with an increasing number of reporting requirements. Proper data not only helps capital markets firms ensure ESG agreements and standards are met, but also improves decision-making related to ESG-focused strategies, investments, and partnerships.

What’s next: Expect to see further investment in companies that offer data-driven solutions to make ESG reporting more efficient and transparent. ESG intelligence products may take different forms, but the underlying technology will broadly improve how capital markets firms use data for ESG-related initiatives. For more, explore how AI could transform the ESG space here.

TRADE ANALYTICS AND EXECUTION

Tech to watch: Trade APIs

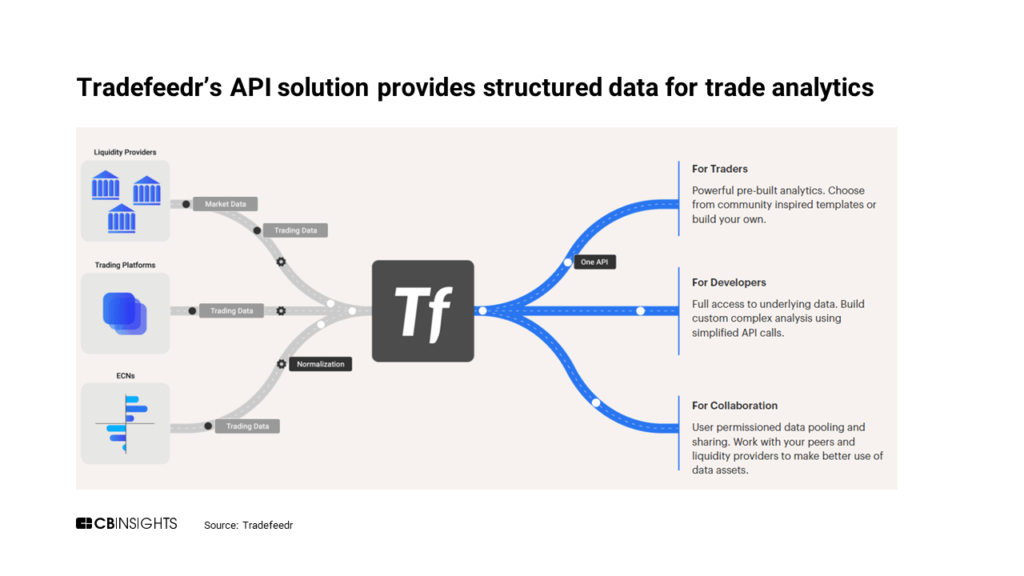

Why we’re paying attention: Trade application programming interfaces (APIs) provide structured data for use in trading activities to simplify data acquisition, engineering, and management for capital markets firms.

Q3’22 saw 2 early-stage deals and 1 partnership among companies developing trade API technology:

- Thalex is a trading platform for cryptocurrency derivatives. In addition to its online portal, the company’s platform offers traders an API to facilitate trade execution. It raised $7.6M in a Series A deal in July.

- Meanwhile, Tradefeedr’s trade API platform provides traders with access to trade analytics and technology teams with normalized data for model development. The company raised $1M in a seed deal in July.

- In July, Tradier announced a partnership with TradingView — which is used by over 30M investors — to embed its API-enabled trade execution capabilities within TradingView’s charts and dashboards.

Why it matters: Capital markets firms that adopt trade API technologies can streamline trading operations and build more efficient workflows for trade execution, which can ultimately lead to improved trade decision-making based upon data that would otherwise be unavailable or unusable. Trade APIs also improve connections to markets, which can increase the pool of available investment opportunities for capital markets firms.

What’s next: The adoption of trade APIs aligns with a broader shift within financial services toward embedded finance, which uses APIs to embed financial services across third-party platforms. Expect to see further investment in trade API technologies, given the decreased cost of data management and the revenue potential from increased trade opportunities. Watch for more firms, ranging from large investment banks to small trading firms, to adopt these technologies to achieve broader market reach.

If you aren’t already a client, sign up for a free trial to learn more about our platform.