As a leading venture debt firm, SVB frequently invested alongside technology VCs. We used CB Insights data to map out some of its key relationships in the VC ecosystem.

Prior to its sudden closure, Silicon Valley Bank (SVB) was one of the most active venture debt lenders. This, of course, necessitated building strong relationships with venture capital investors in both tech and life sciences/healthcare. (Note: We detail SVB’s healthcare VC relationships here.)

Within tech, SVB focused on 6 key areas, as shown in the below graphic. Its focus areas included:

- Edtech

- Industrial technology

- Enterprise software

- Digital infrastructure & tech services

- Consumer software, internet, and info services

- Fintech

Note: We discuss SVB’s fintech partners here.

Source: Silicon Valley Bank

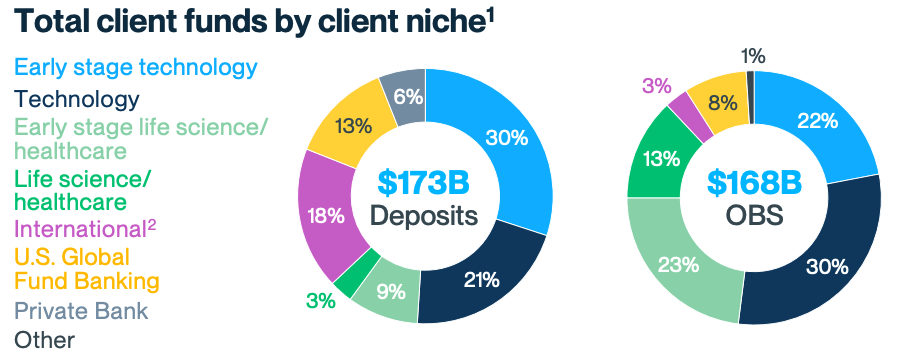

Technology was SVB’s biggest sector, representing 51% of its deposits and 52% of its off-balance sheet assets, as revealed in its Q4’22 financial highlights issued in January 2023.

Source: Silicon Valley Bank

Partner VCs within tech served as SVB’s main source of confidence and validation in evaluating loan targets, and access to future venture funding was the main way a borrower would repay its debt. The warrants that SVB took in these companies also represented upside for the bank and were largely driven by its faith in the VC partners it worked alongside.

In light of that, we dug into CB Insights data on SVB’s investments across multiple SVB entities — including SVB Capital, Silicon Valley Bank, SPD Silicon Valley Bank (its joint venture with China’s SPD Bank), and others — to see which investors it partnered with most often.

The SVB Investment Syndicate Map below highlights who invested in companies before SVB participated, who invested alongside SVB (i.e., taking an equity stake at the same time as the debt round), and who tended to invest in rounds post-SVB.

As you can see, SVB worked with many VC funds and their portfolio companies. We also note some of its LP commitments into VC funds below, which again highlights the history of SVB’s close ties with top-tier funds.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.