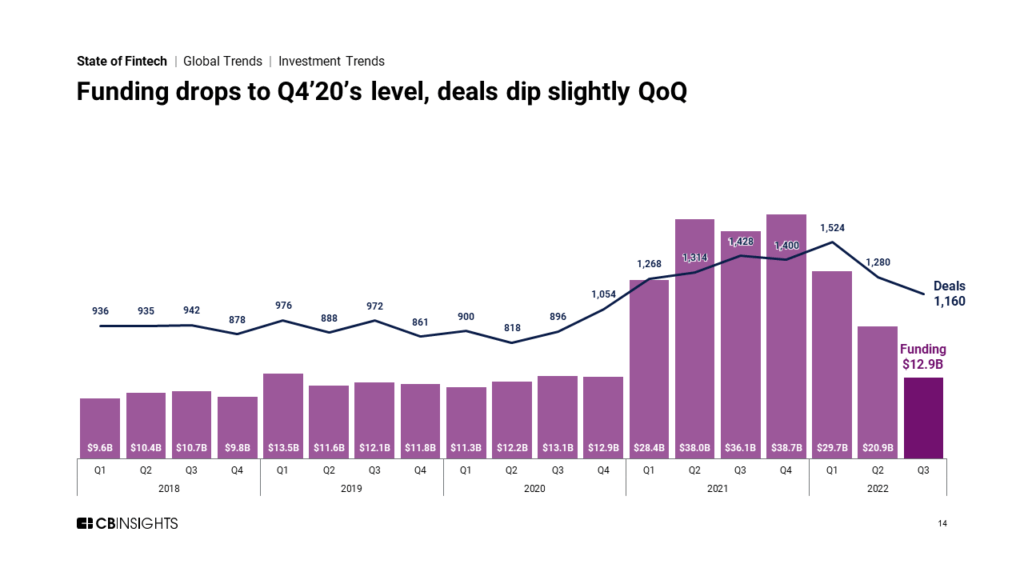

Fintech investment activity continues to slow down in Q3'22 as quarterly funding returns to pre-2021 levels.

Global fintech funding fell 38% quarter-over-quarter (QoQ) to hit $12.9B — matching Q4’20’s level. Deals fell slightly, dropping 9% QoQ to reach 1,160.

Mega-rounds also accounted for a smaller percentage of total funding (34%) compared to the average of 66% in 2021.

Below, check out a handful of highlights from our 150-page, data-driven State of Fintech Q3’22 Report. For deeper insights, all the record figures, and a ton of private market data, download the full report.

Other Q3’22 highlights across fintech include:

- Mega-round funding came in at $4.4B, the lowest level seen since 2018.

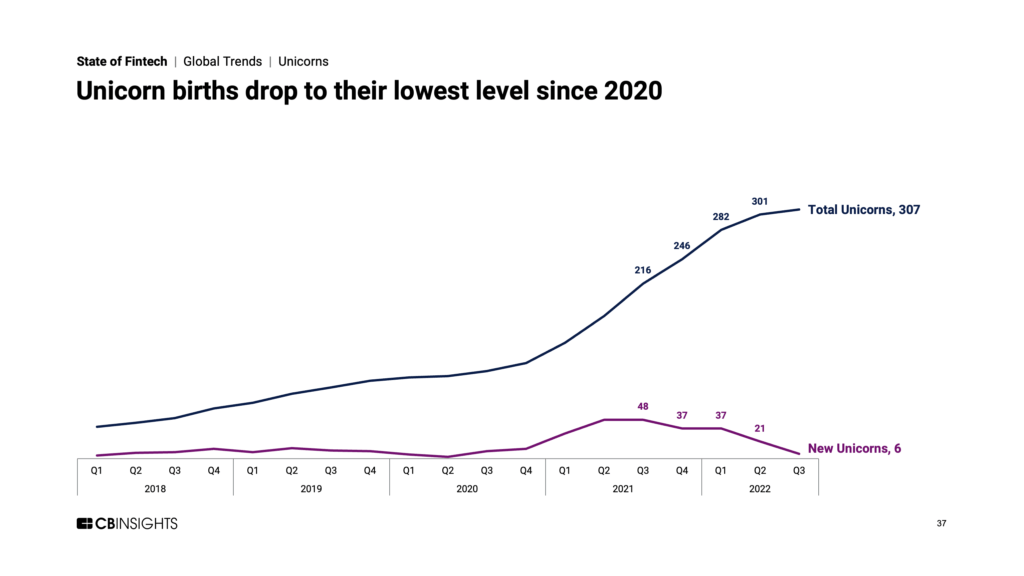

- Fintech unicorn births fell below double digits for the first time since 2020, with just 6 new unicorns in Q3’22.

- M&A deals dropped 14% QoQ to 155 deals, an 8-quarter low. The number of SPACs surpassed IPOs for the first time ever.

- Europe (32%) surpassed the US (24%) in late-stage deal share for the first time since Q4’18.

- US fintech funding fell 43% QoQ to $5.1B, reaching its lowest point since Q1’20.

- Coinbase Ventures was the most active fintech investor in Q3’22, backing a total of 16 fintechs and surpassing Tiger Global Management, which topped the list during the previous 2 quarters.