In a crowded expense management space, we predict Airbase — backed by AmEx Ventures in 2022 — is an attractive target for the payment card giant.

This analysis is part of our series on 2024 M&A predictions. See all 10 matchups here.

Airbase is part of the crowded expense management space with well-capitalized competitors like Brex, Ramp, Navan.

We predict it will be an attractive target for AmEx in 2024.

Keep reading for the market data and our rationale for the deal.

Market data

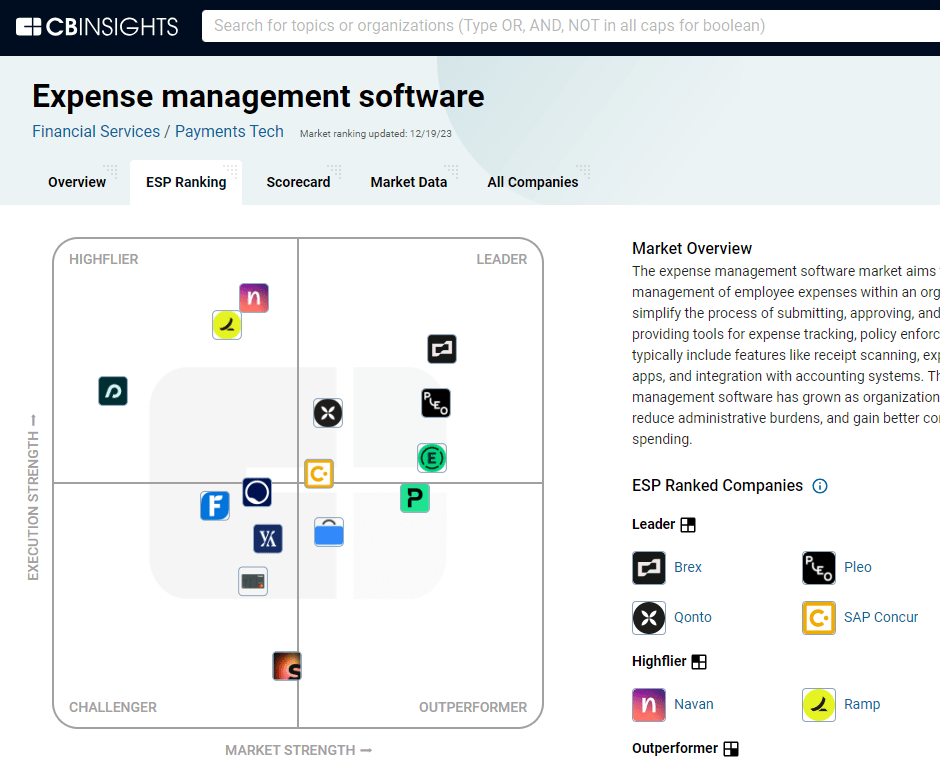

Airbase doesn’t make it onto the CB Insights expense management software ESP vendor matrix below, highlighting its commercial traction being light relative to peers.

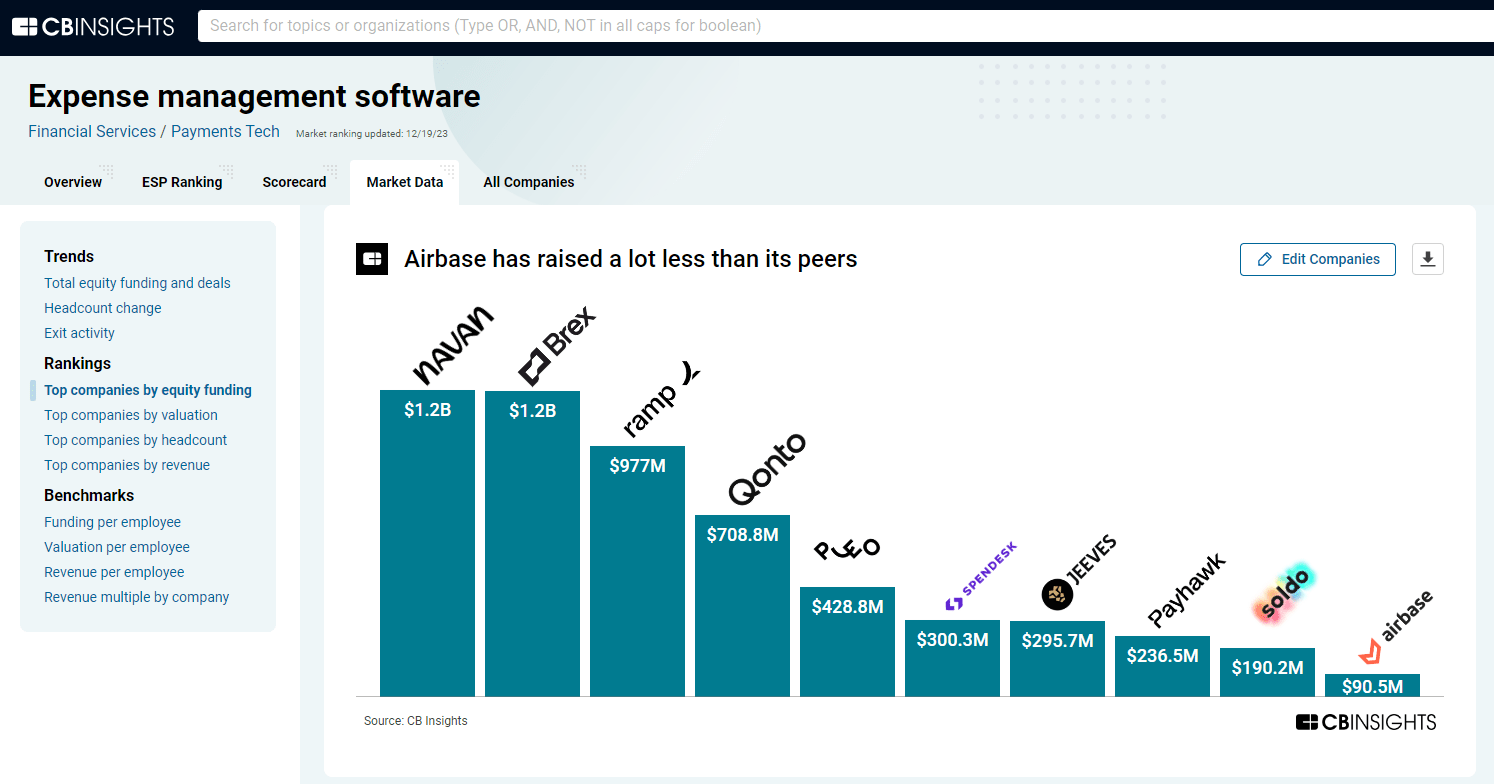

The company has also raised a fraction of the funding of its peers.

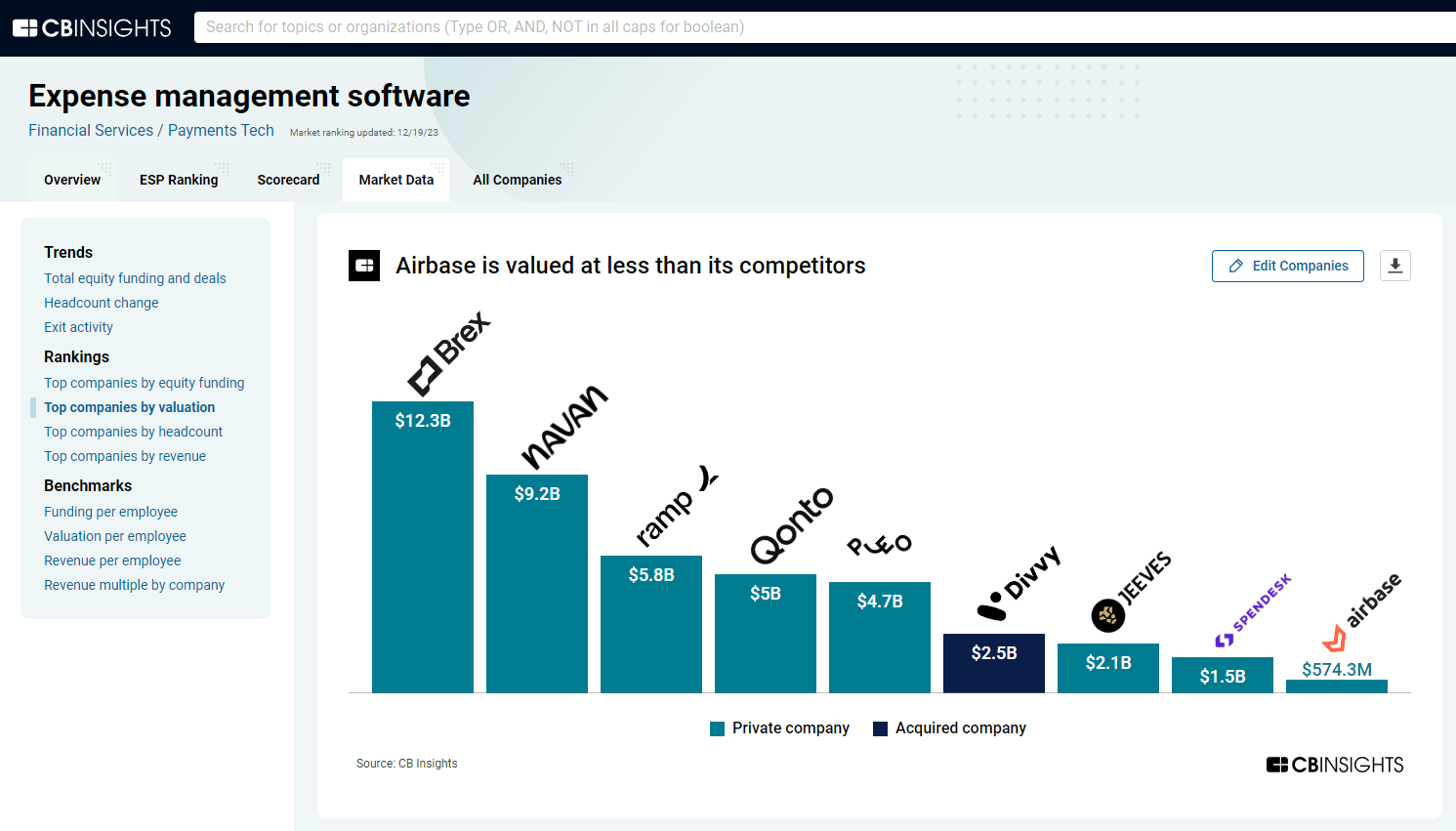

And Airbase is valued at significantly less than competitors.

RATIONALE

So why would AmEx acquire Airbase?

- Enhance AmEx’s B2B card and expense management offerings with a modern spend management platform.

- Broaden AmEx’s appeal to SMBs seeking streamlined financial tools.

- Become a platform for next-gen corporate finance products, combining credit, payments, and accounting.

- AmEx Ventures is already an investor in Airbase.

Find our next M&A prediction in this series — Rippling acquires Pulley — here.

If you aren’t already a client, sign up for a free trial to learn more about our platform.