Better's valuation currently sits at $6.9B. Here are the top-line bullets you need to know.

Better, a digital mortgage lender, has raised $750M in a Series F round that drew participation from Aurora Acquisition and SoftBank Group.

How’s the company performing?

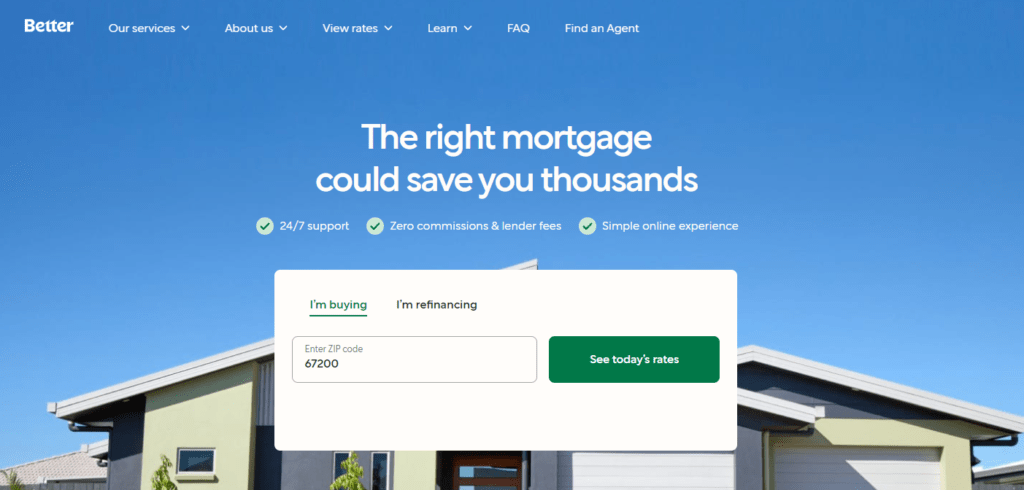

- New York-based Better provides mortgage, real estate, title insurance, and homeowners insurance services without charging commissions or lender fees.

- In May, the company announced that it would be going public via a SPAC — the deal has yet to close.

- The company recently laid off 9% (900) of its 10K employees in a single day.

- Better provides services without charging commissions or lender fees.

Source: Better

Why does the market matter?

- The global digital lending platform market is expected to reach a value of $20.3B by 2027, growing at a CAGR of 16.7%, according to Allied Market Research.

- The Covid-19 pandemic created a hot residential housing market, fueled by record-low interest rates and a trend of deurbanization in major cities across the country. The rising demand for homeownership led to record-high home loan and refinancing applications throughout the year, incentivizing several mortgage lenders to file for IPOs.

- Mortgage tech funding surpassed the $1.2B mark in March 2021, marking a 24% increase from 2020’s year-end total.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.