We explore how Latin America's challenger banking landscape is evolving following the fintech boom of 2021.

Latin America’s largest challenger bank, Nubank, delighted its investors in Q1’23 when it reported record quarterly revenue of $1.6B, up 87% YoY. Shares jumped following the news, taking Nubank’s market value to over $30B.

Nubank isn’t the only challenger seeing tailwinds in Latin America, which offers fertile ground for these digital-first banks. The banking penetration is considerably low in the continent, with around 70% of the population unbanked or underbanked. In contrast, 3 in 4 people have mobile phones, suggesting that a significant portion of Latin America is digitally connected, but excluded from the traditional banking system.

Nevertheless, the region’s challenger banks face a stiff competitive landscape and have seen funding dry up in 2023 so far.

Below, we dive into how the landscape is shaping up across:

- Total equity funding

- Geographical distribution of funding

- Largest deals

- Highest-valued challenger banks

- Expanding breadth of competitors

Challenger bank funding tumbles in 2023

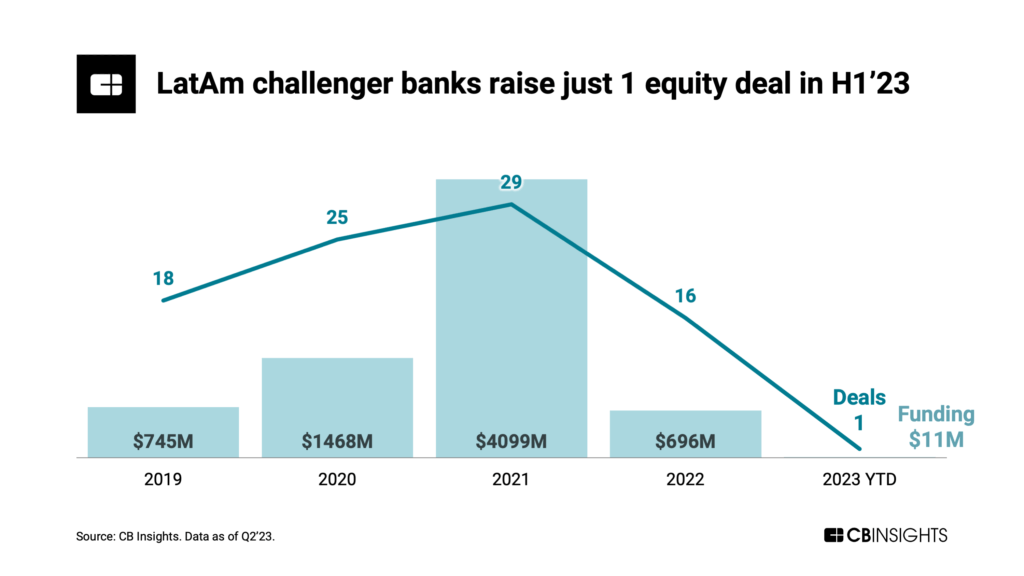

The LatAm opportunity, along with the post-Covid fintech boom, led to challenger banks enjoying significant investor attention in 2021. Funding set a new record at $4.1B across 29 deals that year, largely driven by rounds to Brazil’s Nubank, Banco Inter, and C6 Bank.

Fast forward to 2023: Challenger banks have seen a significant drop in both funding and deal activity. In the first half of the year, the category raised just 1 deal worth $11M — Brazil-based teen banking app Z1‘s Series B. On top of the global venture slowdown, the market’s long-standing reputation for unprofitability has likely cooled investor sentiment.

Brazil-based challenger banks take the majority of funding in recent years

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.