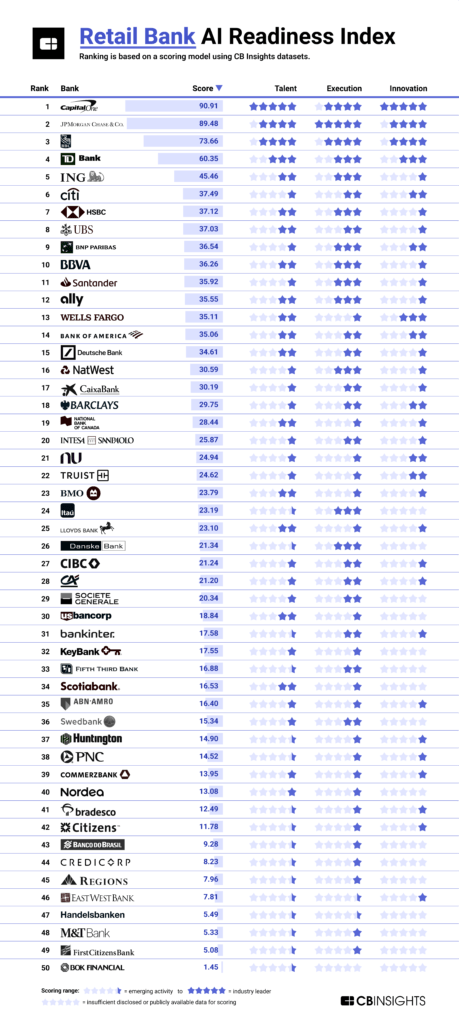

The Retail Bank AI Readiness Index assesses how prepared top banks are to adopt and respond to rapidly evolving AI technologies.

CB Insights has launched the Retail Bank AI Readiness Index — a ranking of the 50 largest retail banks in the Americas and Europe by market cap, based on their demonstrated ability to attract top AI talent, execute AI projects, and innovate through R&D and investments.

The index is calculated based on CB Insights datasets including patent applications, partnership & licensing agreements, dealmaking activity, acquisitions, key people, product launches, and earnings transcripts.

To dive deeper into this data, sign up for a CB Insights free trial here.

Our analysis found that most retail banks have already hired for AI-related roles, and more than half of the banks have invested in at least 1 AI startup since 2019. All told, these 50 banks have backed nearly 150 AI startups across a wide range of use cases, including property intelligence, anti-fraud, and continuous integration/continuous delivery (CI/CD) automation.

However, our analysis indicates that US-based Capital One and JPMorgan Chase are leading their competitors by a wide margin. Both banks have recruited a number of top AI researchers, invested in and acquired AI startups, and are actively patenting AI-related technologies.

Below, we look at how prepared the top 50 banks are to adapt to a rapidly evolving AI landscape across 3 key pillars: talent, execution, and innovation.

- Talent: The talent score measures a bank’s ability to attract and retain AI specialists. This score is based on CB Insights data including employee headcount and key AI hires.

- Execution: The execution score measures a bank’s ability to bring AI-powered products and services to market, as well as deploy AI internally across banking functions. This score is based on CB Insights data including business relationships, product launch media mentions, and earnings transcripts.

- Innovation: The innovation score measures a bank’s track record of developing or acquiring novel AI capabilities. This score is based on CB Insights data including patents, acquisitions, and dealmaking activity.

Talent

The largest banks have successfully recruited and retained top AI researchers from big tech companies and academia. For instance:

- JPMorgan Chase hired Manuela Veloso, a professor and former head of the machine learning department at Carnegie Mellon University, to lead its AI initiatives. The bank has also hired researchers from S&P Global, University of Maryland, and Google.

- Capital One hired Abhijit Bose, a head of engineering at Facebook AI Research, to lead its enterprise machine learning department. Capital One has also hired scientists and engineers from Fidelity and Bell Labs.

Execution

Over 20 of the 50 largest banks have entered into partnership or licensing agreements with AI companies in an effort to develop and deploy the technology across banking functions.

To highlight a few recent business relationships and internal product launches:

- Brazil’s Itaú Unibanco partnered with QC Ware to apply quantum machine learning to improve customer retention.

- The Royal Bank of Canada’s AI research institute, Borealis AI, launched Turing text-to-SQL, a tool that converts natural language queries into SQL code.

- As of 2021, JPMorgan Chase had spent around $100M on the development of AI-powered anti-fraud systems for consumer payments. The investment reportedly brought the bank’s annual fraud losses down by 14% from 2017 to 2021.

Innovation

Most top banks are lagging behind in AI innovation.

Only 6 of the top 50 have made an AI acquisition. Fewer than 20 have participated in 3 or more deals to AI startups.

- Among the 50 largest banks, Citi is the top investor in AI startups, backing nearly 30 deals since 2019 (including deals from its venture arm). It recently invested in a follow-on Series C round to AI-powered data governance startup Securiti.

- Notably, ING’s incubator ING Labs spun out Weaviate, a developer of vector database technologies, in 2019 — years before the vector database market would take off amid the generative AI boom. ING Ventures has since backed the company across 2 funding rounds.

Leaders in applying for AI-related patents include JPMorgan Chase, Capital One, and Bank of America.

Since 2021, JPMorgan Chase has applied for 7 patents pertaining to federated learning — a privacy-preserving and decentralized AI training method. For more, read our report on what the top retail banks are patenting in AI.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.