We take a close look at how the challenger bank market is evolving amid a widespread correction in valuations.

N26, one of the top-funded fintech companies in Europe, is facing mounting pressure. Allianz X, the venture arm of Allianz and one of N26’s biggest backers, is reportedly looking to sell its stake in the challenger bank at a valuation of $3B — a steep discount from the $9.2B valuation N26 earned in 2021.

Along the same lines, Schroders recently wrote down its investment in Revolut, another top-funded challenger bank, by 46%.

It’s not a great look for the sector.

N26 and Revolut, like other challenger banks, take a digital-first approach to offer competitive and transparent retail banking services. These companies often offer a range of services, such as checking and savings accounts, loans, insurance, and credit cards.

In this piece, we explore what these valuation pressures indicate about the future of challenger banking.

Key Takeaways

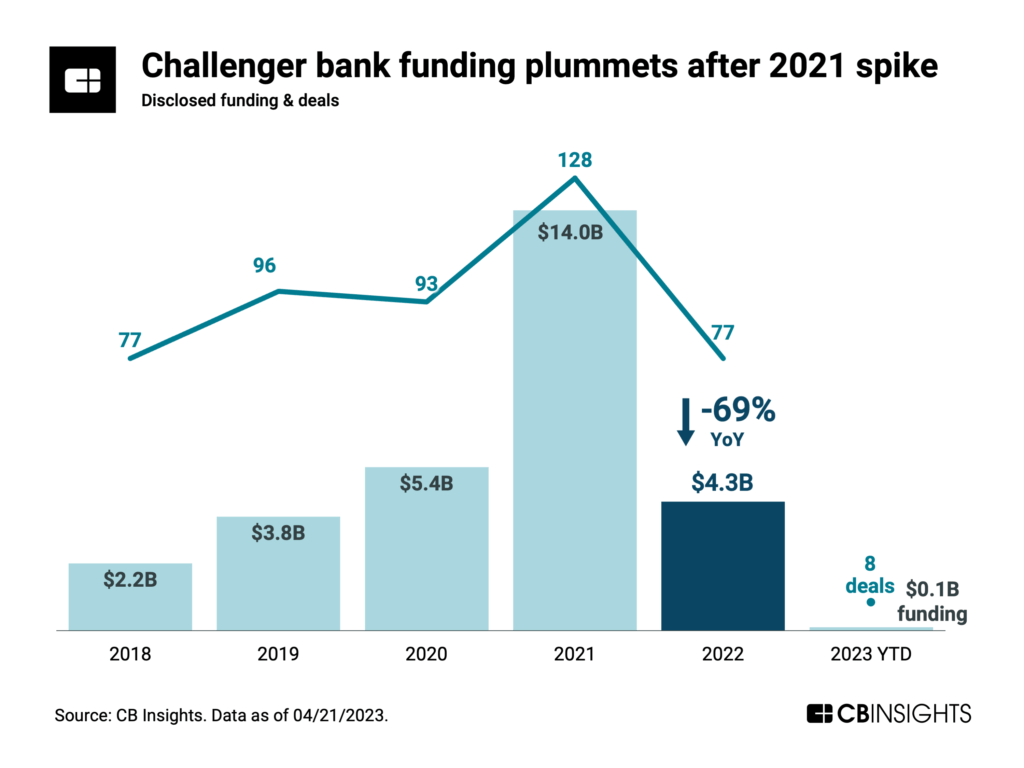

- Funding is drying up after years of mounting investment activity, as competition intensifies and more investors question challenger banks’ unique selling proposition.

- Valuations will be corrected across other market leaders. N26 and Revolut aren’t isolated events. Brazil’s Nubank, the biggest public company in the space, has seen its market cap fall by more than 50% since its 2021 IPO.

- Profitable challenger banks will come into the spotlight. Leaders are focusing on building “super app” functionality to reach and maintain profitability.

Funding in free fall

Challenger banks are facing a private market slowdown after years of rapid expansion and sky-high valuations. Funding peaked in 2021, reaching $14B, before plunging 69% to $4.3B last year. Based on 2023 YTD activity through April, the market looks on pace for an even higher funding drop this year.

Deal activity also took a significant hit in 2022, dropping 40% YoY, as investors grew hesitant to sign checks at steep valuations with little promise of near-term profitability.

For challenger bank funding data and more granular market views, clients can access CB Insights’ interactive platform dashboard here.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.