The funding will help Mondu support its expansion in Europe. Here are the top-line bullets you need to know.

Mondu, a B2B buy now, pay later (BNPL) platform, has raised $43M in a Series A. The round drew participation from Valar Ventures, Cherry Ventures, and FinTech Collective, among others.

HOW’S THE COMPANY PERFORMING?

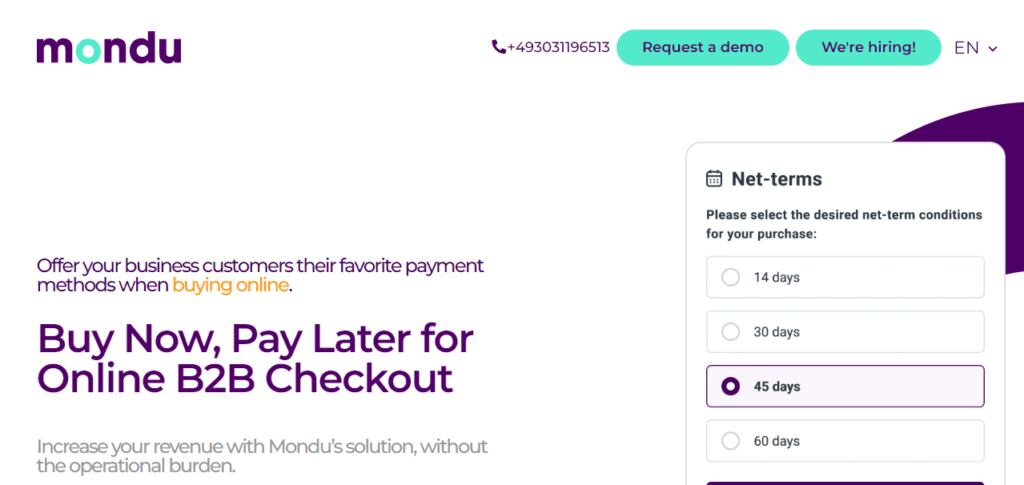

- Germany-based Mondu offers flexible payment methods for B2B merchants and marketplaces.

- The platform caters to the wholesale, manufacturing, beauty, cleaning, and other B2B marketplace segments.

- Mondu is supported by a team of 100+ employees.

Source: Mondu

WHY DOES THE MARKET MATTER?

- Today, BNPL represents a small portion of overall spending on payment cards (including credit, debit, and prepaid cards), with the US seeing around $8T in overall annual spending. However, BNPL is at an inflection point and is expected to witness a 10-15x growth in spend volumes and exceed $1T in annual gross merchandise value by 2025. This projected growth has attracted the attention of major merchant businesses and enabled the enhancement of online users’ payment experiences.

- BNPL players have seen record funding in recent years. There have been major acquisitions in this space as well, such as Square acquiring AfterPay for $29B.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.