We map out the signals you need to source the right companies in a rapidly growing AI landscape. Learn how CB Insights data can help accelerate your AI strategy.

The AI landscape has exploded over the last 10 years.

Startups are flooding the market — alongside billions of dollars in funding — as AI advances enable applications from drug discovery to code development.

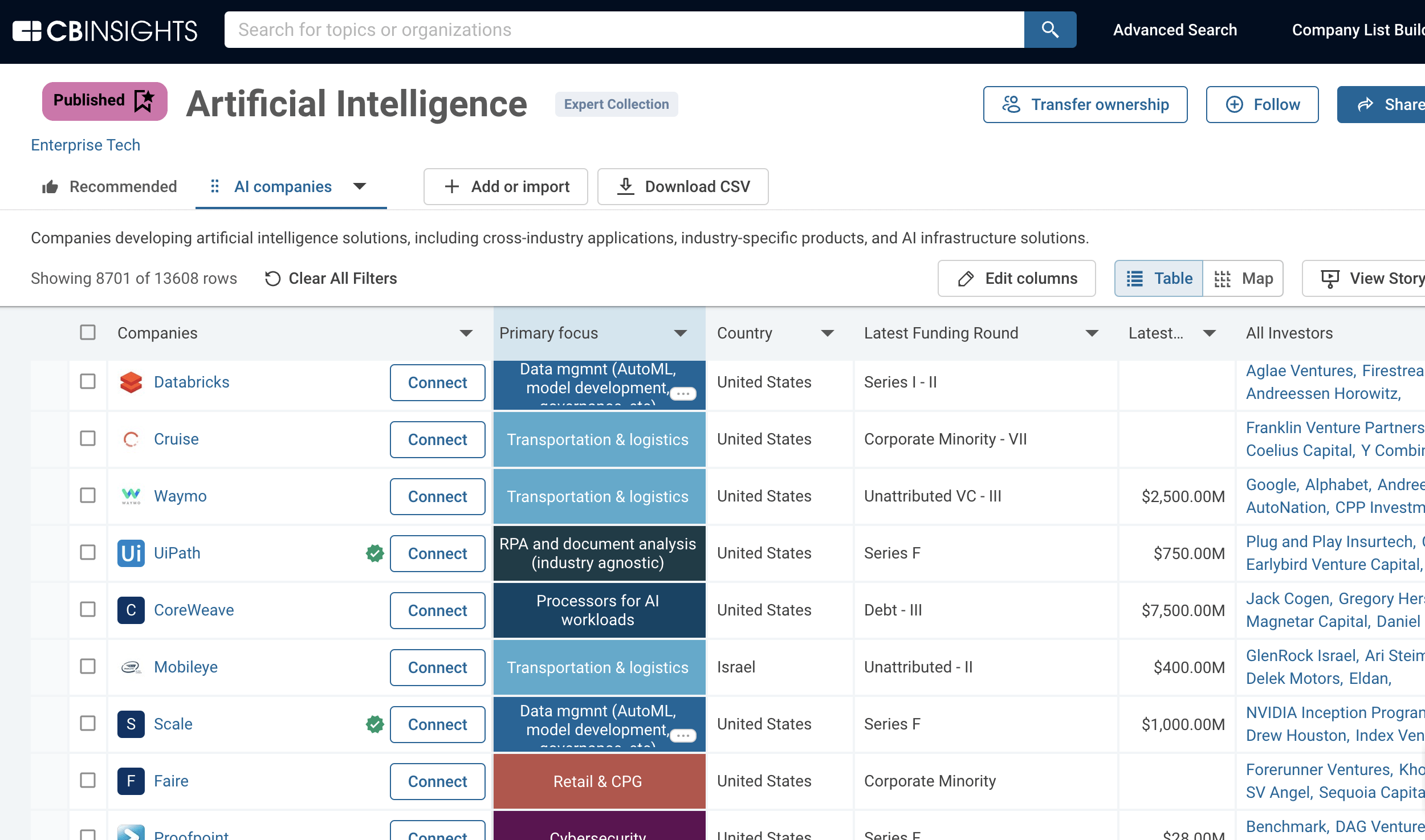

The CB Insights platform tracks 10,000+ AI companies across infrastructure, horizontal, and vertical applications.

Source: CB Insights — Artificial Intelligence Expert Collection

Meanwhile, as companies look to harness the AI moment, many are rebranding as “AI-first.”

Cutting through the noise — and determining a company’s actual level of AI differentiation — is a common challenge we see among enterprises looking to engage with AI startups.

Below, we’ll show you how to leverage CB Insights data and insights to shortlist promising companies and understand how they could impact your business.

The key signals and data that buyers should look for when evaluating AI companies include:

- Proven track record: Assess commercial progress and customer adoption with Commercial Maturity scores and business relationship data.

- Team expertise: Evaluate a team’s level of AI experience using its Management Mosaic score.

- Investor quality: Notable investors or industry backers can help validate a startup’s technology.

- Use cases and results: Find evidence of successful implementations using buyer interviews and get up to speed quickly on a company’s recent activity with scouting reports.

Proven track record

Commercial progress and customer adoption are clear signals of a company’s potential.

Commercial maturity

CB Insights Commercial Maturity scores allow enterprises to see at a glance which AI companies have products ready to go.

This proprietary metric is built on top of 30+ signals — including headcount, revenue, partnership, and investment data — to measure where a company lies in its development and growth process across 5 levels.

For example, in the AI development platforms market, while Predibase is expanding its customer base (Level 3: Deploying), Glaive is still in the earlier stages of development (Level 1: Emerging). Both companies are focused on small & task-specific model development.

Source: CB Insights — Advanced Search

Depending on your use case, you may want to narrow your focus to companies with a Commercial Maturity score of 3 or higher. These companies have at least already started deploying their solutions and are growing commercial distribution.

Business relationships

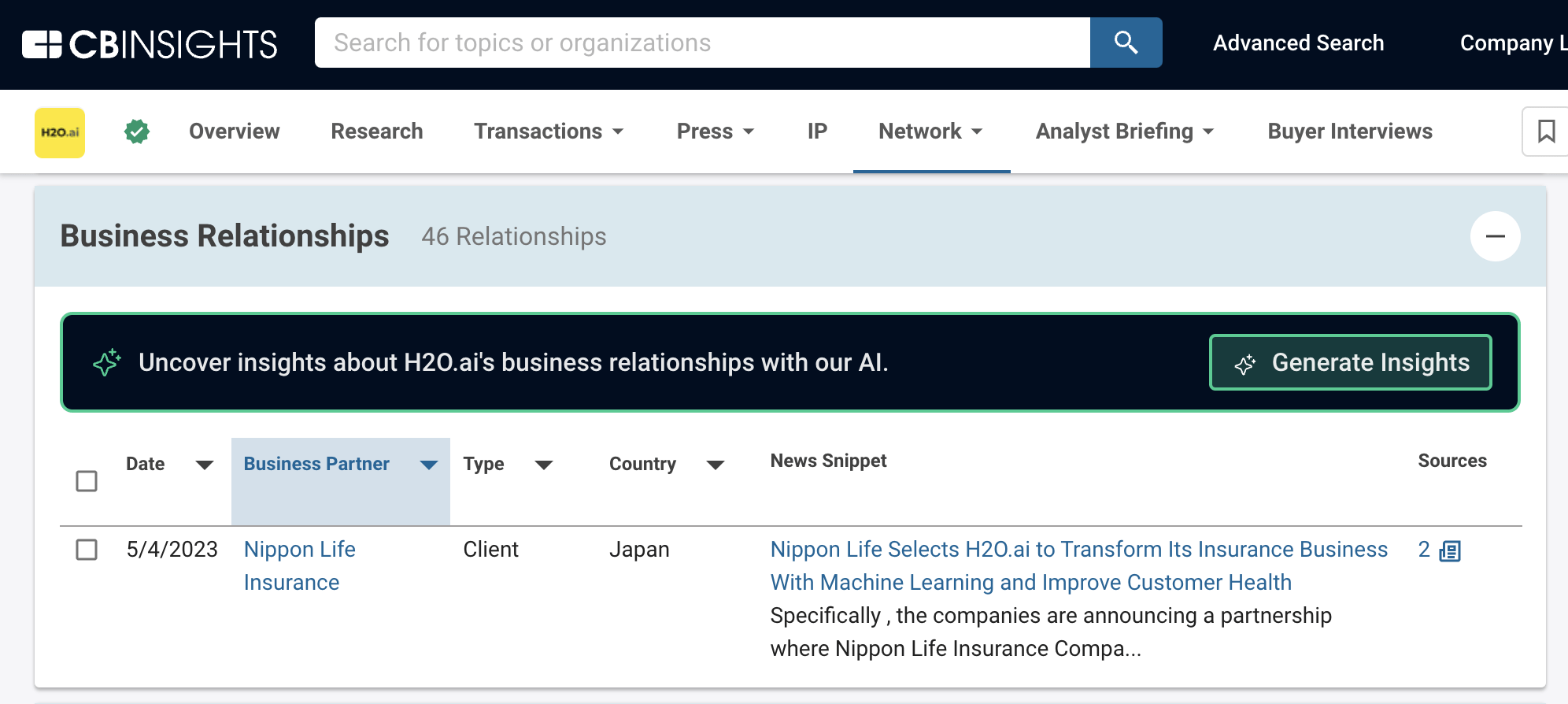

Once you’ve built your shortlist, drill down further by using CB Insights company profiles to dig into each company’s business relationships — which encompass partnerships, licensing agreements, customers, joint ventures, and other alliances.

One approach is to look at companies that have completed pilots with organizations similar in scale to yours, as this is a signal that the company can handle your needs.

For example, major Japan-based life insurer Nippon Life Insurance selected machine learning platform H2O.ai to advance its AI initiatives in May 2023.

Source: CB Insights — H2O.ai business relationship data

Team expertise

The level of AI and machine learning expertise among team members is an important indicator of an AI company’s potential, especially for early-stage startups.

When customer adoption is limited, it is crucial to consider team expertise when assessing a company’s prospects.

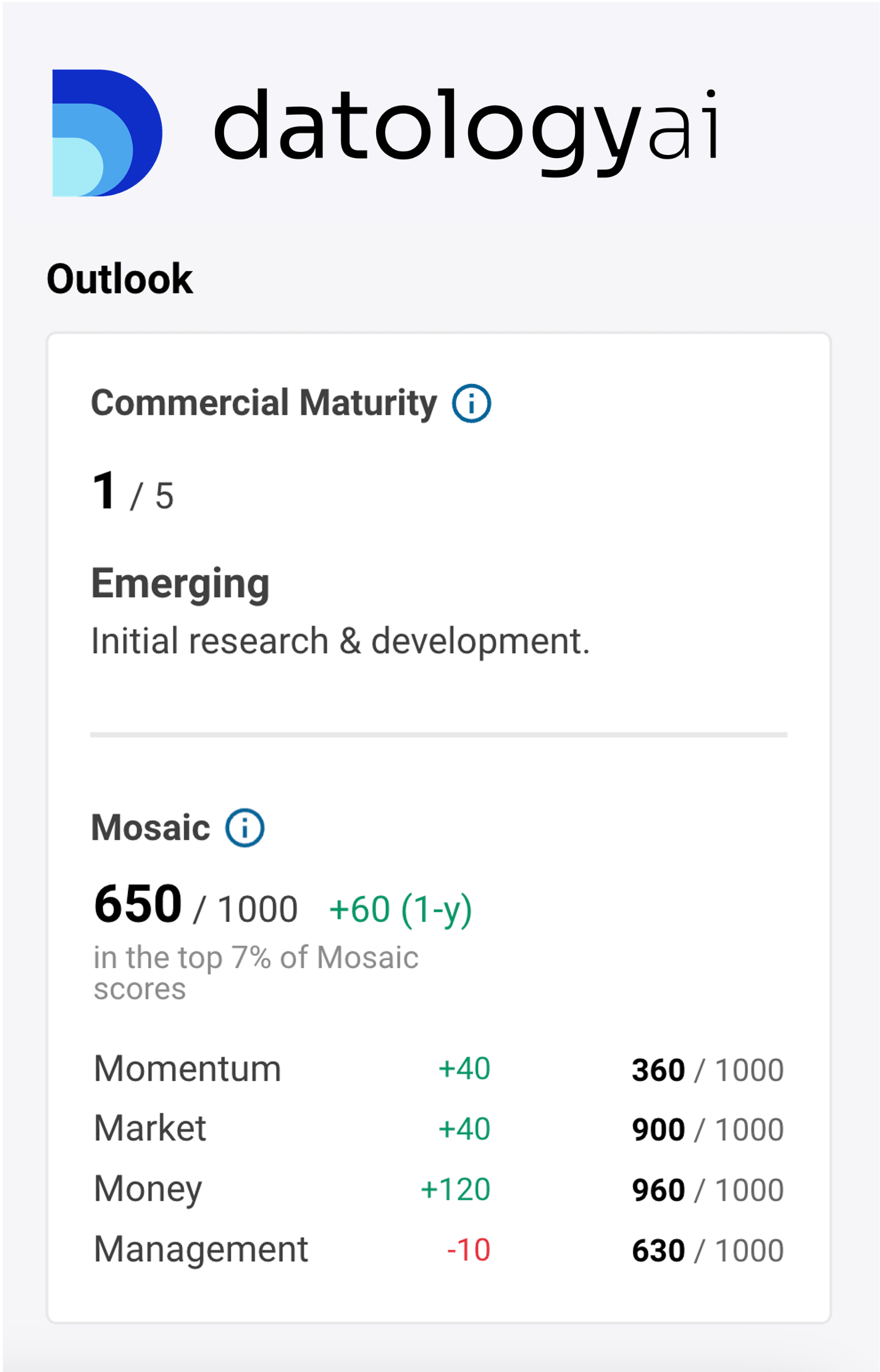

Mosaic scores

CB Insights Mosaic scores assess company-level traction and management team quality, allowing you to identify promising teams and companies quickly.

For example, while DatologyAI — a 2024 AI 100 winner — has limited commercial maturity, its Mosaic score highlights its strengths across factors related to market, money, and management team quality.

Source: CB Insights — DatologyAI Commercial Maturity and Mosaic scores

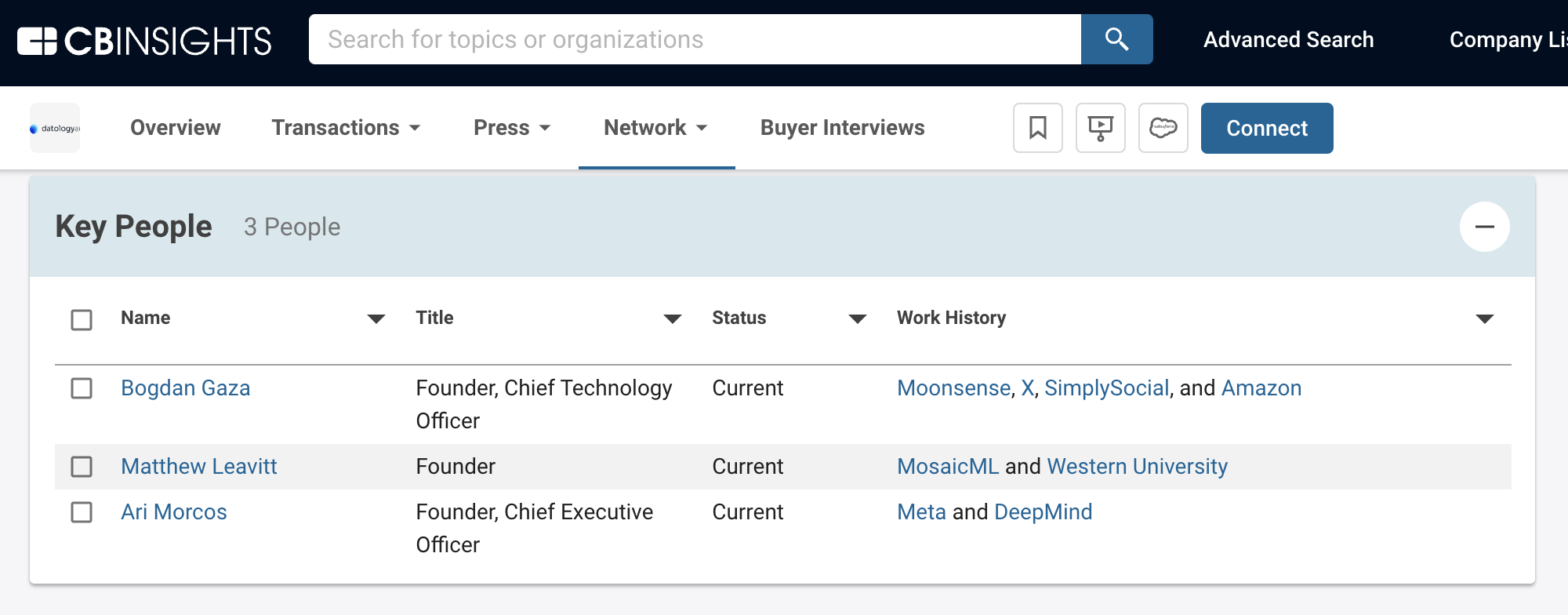

DatologyAI’s founders have experience across Meta’s AI research team, DeepMind, MosaicML, and other big tech companies, as highlighted by CBI key people data.

Management team profiles can also help determine if the founding team has a technologist with an AI background.

Source: CB Insights — DatologyAI key people data

Investor quality

Another way to evaluate early-stage startups is to consider the pedigree of their investors.

Investor data

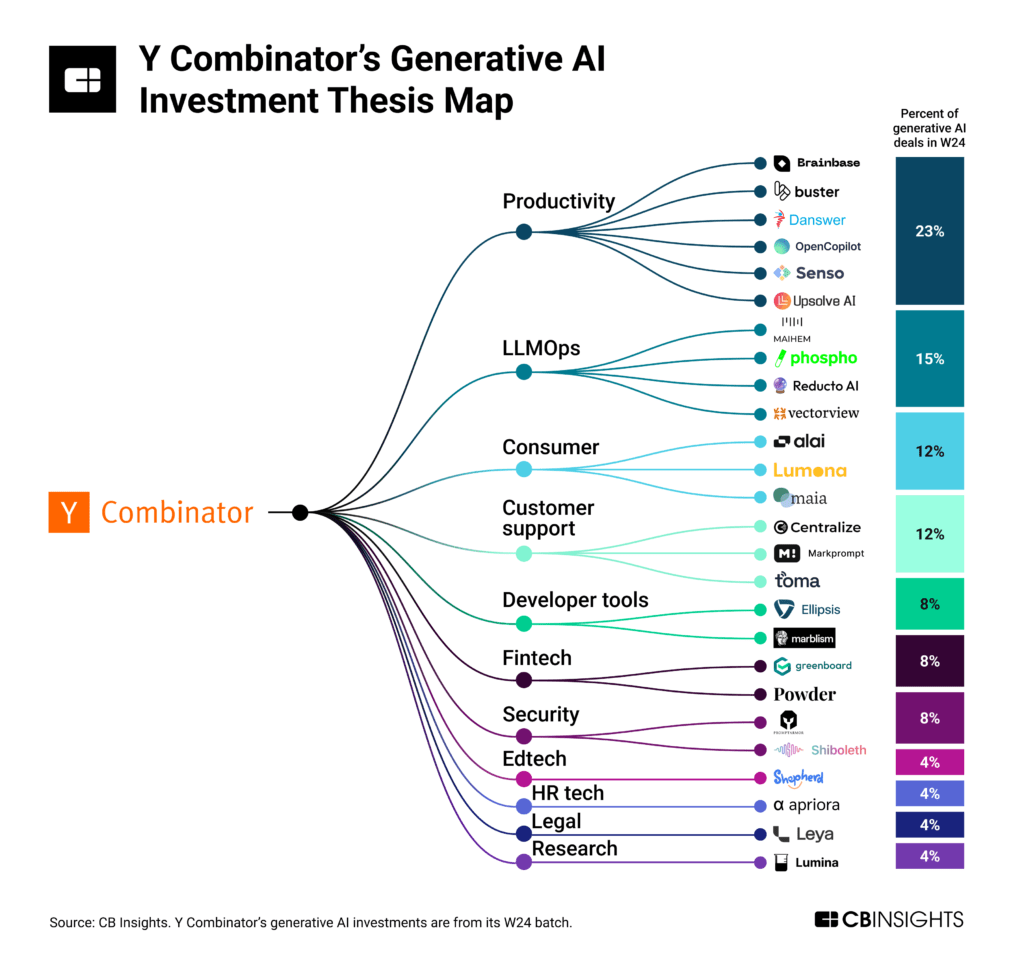

Tracking where notable AI investors like Andreessen Horowitz (a16z), Index Ventures, and Y Combinator are placing their bets can indicate validation of specific markets or technologies.

For example, we analyzed Y Combinator’s latest startup batch to discern the investor’s priorities in generative AI in this research brief.

Customers can stay on top of Y Combinator’s latest AI investments with this advanced search on CB Insights.

Also consider the presence of industry leaders among a startup’s backers, as this indicates the startup has connections within the sector and may be better positioned to navigate that specific market.

For example, a number of AI 100 2024 winners in the healthcare category have notable industry investors — like Gesund.ai (backed by Merck) and Iambic Therapeutics (backed by Illumina Ventures).

Dive into investor data directly on CB Insights company profiles as well as in search.

Use cases and results

Evidence of successful implementations, such as case studies or real-world examples where the AI has delivered results, can be one of the best ways to assess the potential impact of an AI company.

Buyer interviews

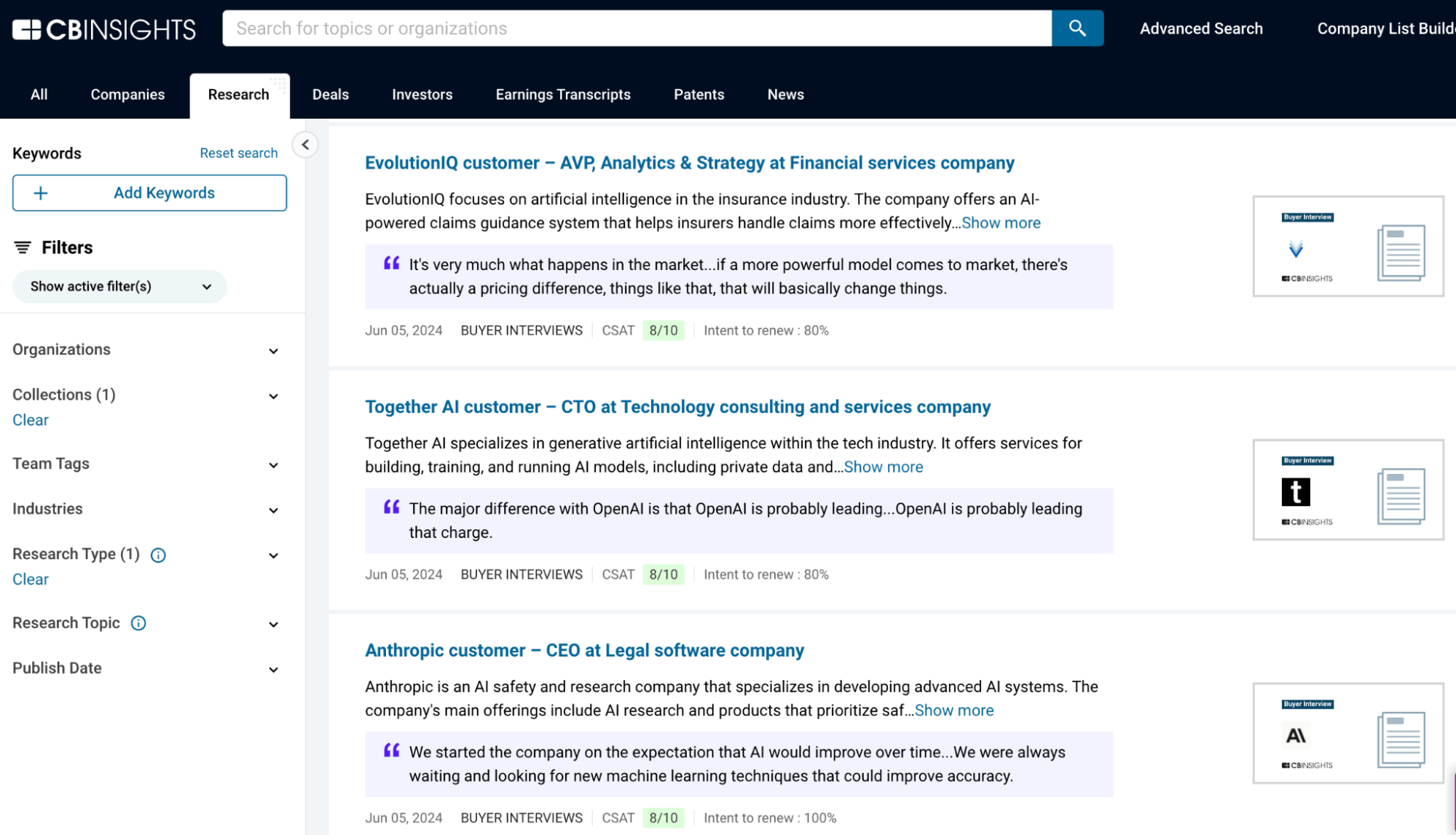

Direct feedback from real customers is a valuable resource for getting a quick view of a company’s products.

CB Insights conducts detailed interviews with a company’s existing customers to gain insight into the company’s technology quality, customer satisfaction (CSAT), pricing, customer intent to renew, and more.

Our transcript library has more than 1,000 interviews on emerging to established AI players.

Source: CB Insights — AI buyer interviews

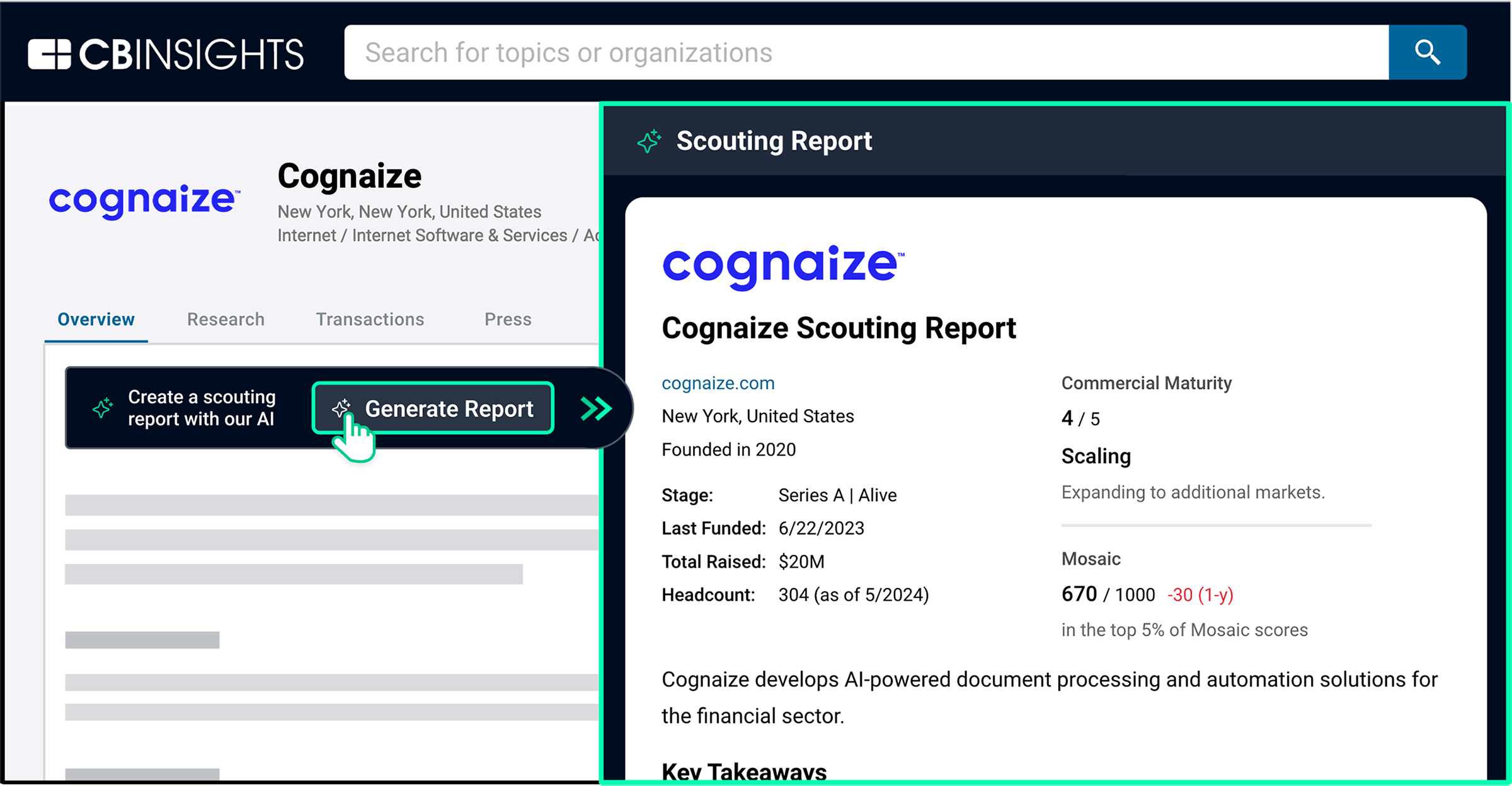

Scouting reports

Before engaging with a company, you can quickly gain insight into its traction by using our instantly generated scouting reports to get up to speed on its business model, notable milestones, and other relevant metrics.

Source: CB Insights — OpenAI scouting report

Go deeper with vendor-submitted Analyst Briefing data as well as relevant CBI research.

Connect

Once you’ve sharpened your understanding of the market landscape and know who to engage, simply click “Connect” on a company’s CB Insights profile to start a conversation.

Bringing it all together: Industry examples

By combining the signals and data points mentioned above, you can understand a company’s true technology maturity and compare capabilities across similar companies to inform your evaluation and ultimate decision.

Below, we’ll highlight examples of the data available on AI companies across industries, including healthcare, financial services, insurance, and cybersecurity.

Healthcare

The virtual medical scribe market has grown rapidly thanks to genAI advances. The CB Insights platform gives a comprehensive view of players in the market, like Abridge.

Source: CB Insights — Abridge profile and scouting report

- Mosaic score of 860 (top 1% of all Mosaic scores)

- Commercial Maturity score of 4 out of 5 (i.e., Scaling: Expanding to additional markets.)

- Investors include Lightspeed Venture Partners, NVentures, CVS Health Ventures, Kaiser Permanente Ventures, and Mass General Brigham Ventures

- Business relationships with Nvidia and Epic

- Buyer transcripts, including this conversation with a chief medical informatics officer:

- Question from an analyst: “Where does Abridge have room to grow and to build itself into a better product for you guys specifically or for the market in general?”

- Answer from the customer: “More EHR penetration. I need to see it work in other EHRs. It can’t just be Epic only. Number two, we’ve got to continue to improve that accuracy. We need something in the low- to mid-90 percentile and above. We’ve got to get further along there. Number three, I would say at some point we’ve got to look at the product at being able to go multiple places. It cannot just be an outpatient product. I’ve got tons of asks on the inpatient and ED side for products in AI space. I know of another vendor that’s already there. They’re not. The Abridge size is not there yet and that to me is a differentiator that I’d hope to see get solved.”

- Research: Abridge is featured in our generative AI market map alongside 430+ other startups targeting applications across horizontal and vertical AI.

Financial services

In intelligent document processing, one vendor is financial services platform Cognaize — a 2023 Fintech 100 winner.

Source: CB Insights — Cognaize profile and scouting report

- Mosaic score of 670 (top 5% of all Mosaic scores)

- Commercial Maturity score of 4 out of 5 (i.e., Scaling: Expanding to additional markets.)

- Business relationships with Moody’s Analytics

- Buyer transcripts, such as with a senior vice president at a publicly traded financial management company:

- Question from an analyst: “What product or solution features stood out to you as strengths when reviewing the vendor’s overall product offering? Weaknesses?”

- Answer from the customer: “We developed a scorecard that we evaluated all vendors on…We were interested in how good the machine was at extracting data, learning through human interventions in subsequent cycles of extraction and other operations, how quickly it evolved, how accurate it was, how user-friendly it was, and how flexible the solution was to meet our specific objectives…Amongst 6 vendors, we chose Cognaize because it was the closest solution to our needs, although not yet a hundred percent overlapping with the full set of our needs, it was close enough to make us comfortable that we could have achieved the ultimate objective.”

Insurance

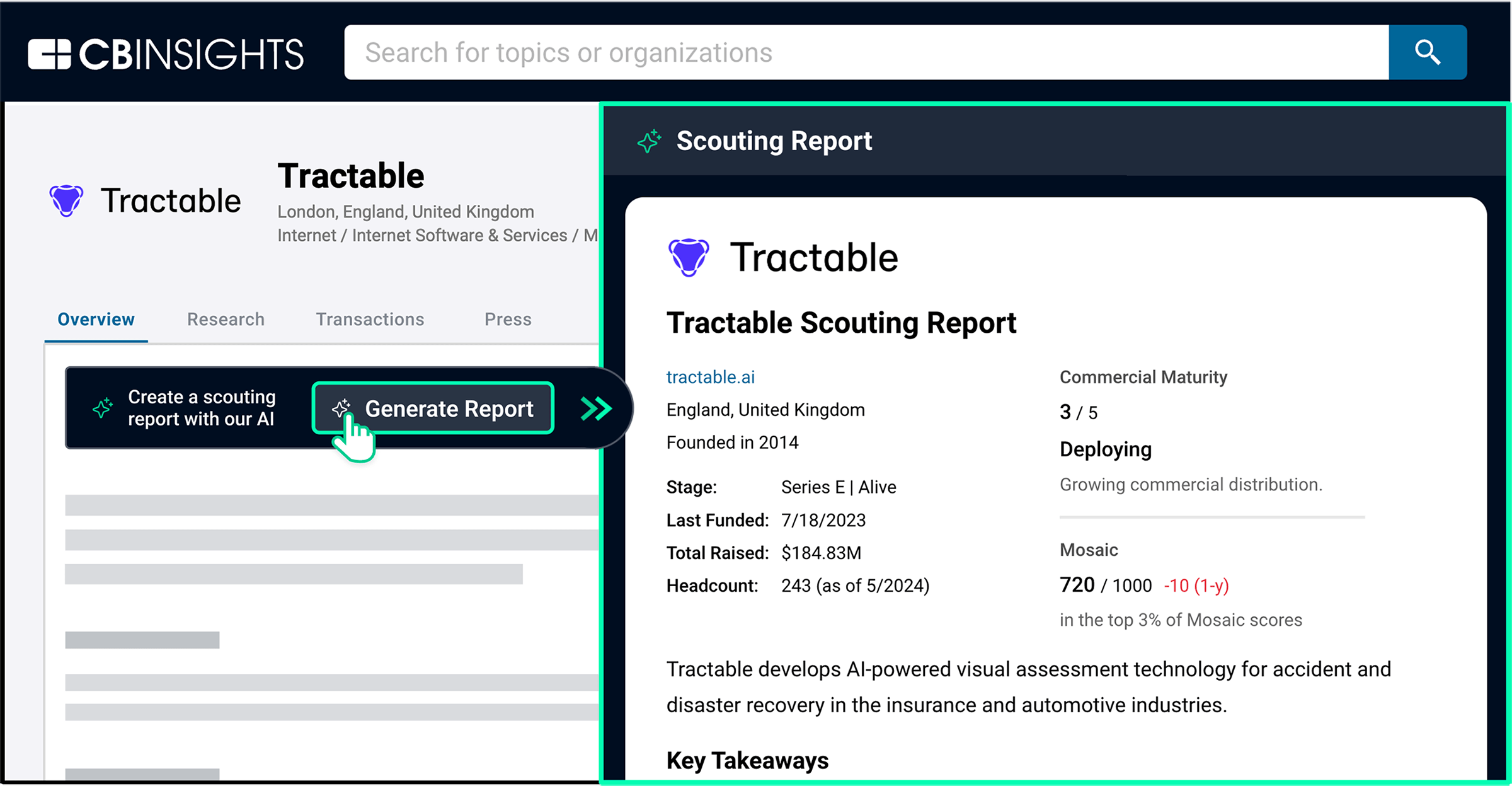

If you want to explore virtual auto claims assessment vendors, many of which use computer vision (i.e., image assessment) technology, you could use CB Insights to dig deeper into a leader like Tractable.

Source: CB Insights — Tractable profile and scouting report

- Mosaic score of 720 (top 3% of all Mosaic scores)

- Commercial Maturity score of 3 out of 5 (i.e., Deploying: Growing commercial distribution.)

- Business relationships with insurers like Aviva and MAPFRE

- Buyer transcripts, including this question and answer from a senior manager at an insurance company:

- Question from an analyst: “What was the level of effort required by your team to deploy the solution?”

- Answer from the customer: “We spent a couple of months evaluating a Tractable solution, because at first, Tractable was aligned to British standards, which had nothing to do with Spanish standards. So, we had to train the AI solution. We sat with our engineers and the engineers; we did like three to four rounds of calibration. We were calibrating the AI tool until we found a fair level of calibration in which the AI tool was replicating our standards of damage estimation. So, we spent around two to three months on the calibration of the tool. Then, we did the integration using an API integration with Tractable’s systems. It didn’t take more than, I would say, two months to do the hard integration.”

- Research: Tractable was also selected as an Insurtech 50 winner last year. The Insurtech 50 list highlights the world’s most promising insurtech startups based on CB Insights datasets — including R&D activity, Mosaic scores, business relationships, and more. It also factors in criteria such as tech novelty and market potential.

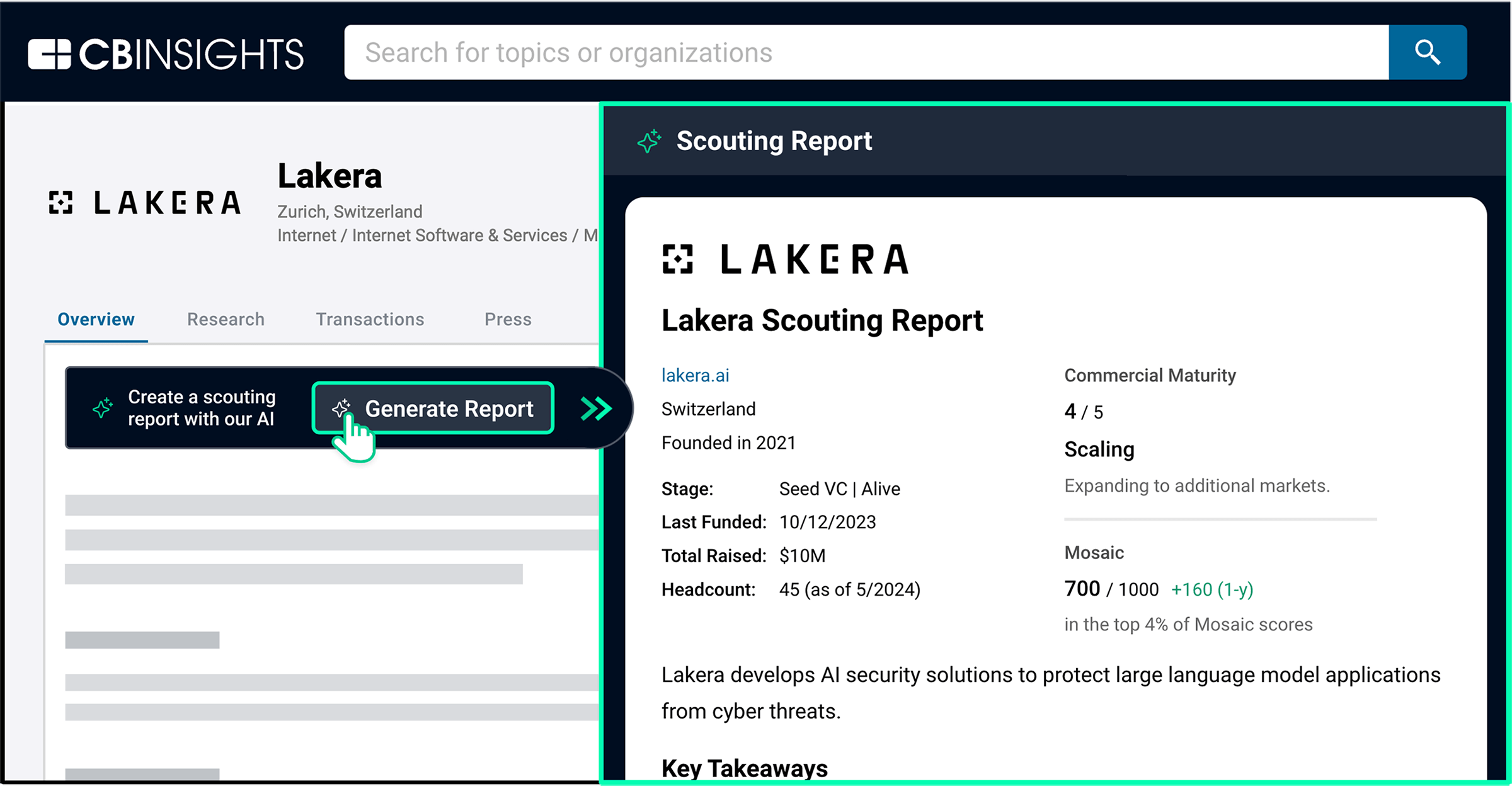

Cybersecurity

Enterprises deploying large language models (LLMs) are moving to secure their AI applications against emerging cybersecurity threats. One leading vendor in the nascent LLM security space is Lakera, which we dive into below.

Source: CB Insights — Lakera profile and scouting report

- Mosaic score of 700 (top 4% of all Mosaic scores)

- Commercial Maturity score of 4 out of 5 (i.e., Scaling: Expanding to additional markets.)

- Buyer transcripts, including this question and answer from a senior director of engineering at a Fortune 500 company:

- Question from an analyst: “What do you feel differentiates Lakera from the rest of the competitors?”

- Answer from the customer: “The biggest thing which they have going for them is their Lakera Guard product, where they are looking at the prompts and analyzing them for any sort of malicious information and then taking action based on that. They have a good protection against existing known prompts. What we loved in that area was that they were keeping it up to date, and they have a good system for quickly responding to newly discovered day-zero vulnerability and any new prompt which comes in. That for us was very appealing because that’s exactly what we need, which is a very fast turnaround for a new day-zero vulnerability in these kinds of prompts detected and using Lakera to guard while the LLM vendors themselves fix the actual LLMs against those newly discovered vulnerabilities. That was their biggest differentiator. Nobody else is doing it that way.“

- Research: Lakera is highlighted in our LLM security pricing report, which examines how buyers are evaluating vendors in the space and what they’re paying.

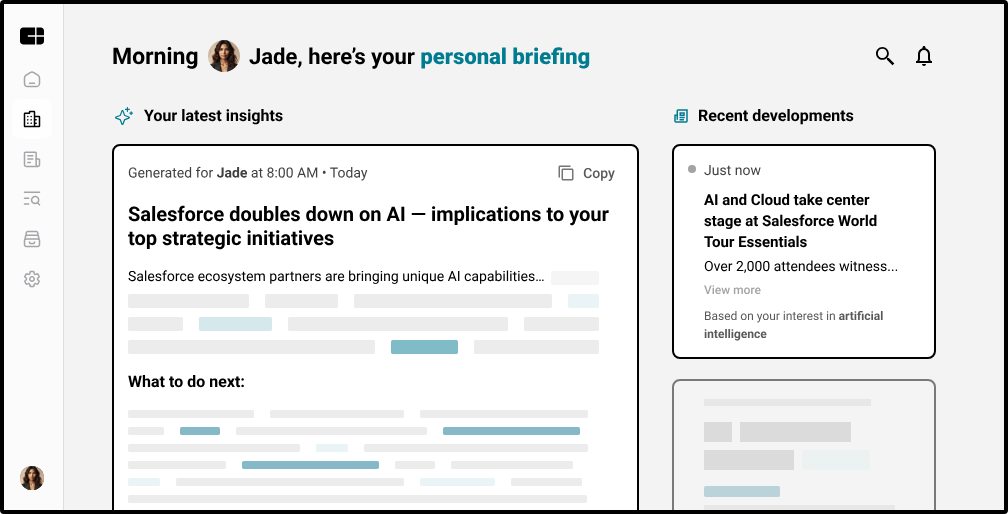

Meet your AI-powered personal briefing

All signal. No noise.

Made just for you.

Decision-makers are drowning in information. Missing something could mean disaster. Meet your AI-powered personal briefing. It’s like a research team working 24/7 to surface what’s important to you — and what you should do about it.

Go deeper

Use CB Insights research — which includes the most comprehensive and insightful library of generative AI research in the world — to understand the AI market landscape and quickly find the areas where you need to focus.

Bet on the right AI markets

Essential resources to understand the future of AI:

- The Enterprise AI Roadmap

- The generative AI market map

- AI strategies for 11 of the world’s largest companies: Where Eli Lilly, Visa, Oracle, and 8 other giants are making moves

- Generative AI Bible: The ultimate guide to genAI disruption

- Generative AI predictions for 2024

Simplify complex landscapes with market maps:

- The generative AI market map

- The AI training data market map

- The open-source AI development market map

- The responsible AI market map

- The large language model operations (LLMOps) market map

- The generative AI in healthcare market map

Stay ahead of your rivals’ AI strategies

Ranking industry leaders’ AI activity

- Which insurance giants have the most AI innovation? Our AI Readiness Index shows Cigna is leading the pack

- Pharma AI Readiness Index: Who’s best-positioned for the AI boom?

- Retail Bank AI Readiness Index: Who’s best-positioned for the AI boom?

Revealing the strategies of companies focused on AI

- Analyzing Nvidia’s growth strategy: How the chipmaker plans to usher in the next wave of AI

- Analyzing Google’s healthcare growth strategy: Can the tech giant become the sector’s go-to AI provider?

- Databricks wants to be a one-stop shop for AI. Here’s how it plans to get there

- Analyzing Accenture’s AI strategy: How the consulting firm is looking to ride the AI wave