Funding for wealth tech startups reached new heights in 2021 and shows no signs of slowing. We discuss the sector's market drivers, emerging themes, and key implications.

Startups are changing how retail and institutional investors manage wealth.

Wealth tech companies aim to help individuals manage their finances and make more asset classes and services accessible to lower-income investors. Some offer platforms and tools to help wealth management professionals improve portfolio management, investment-tracking, and advising.

free report: The Future Of the wallet

Digital wallets are transforming the way people manage every aspect of their lives. Download the report to learn how.

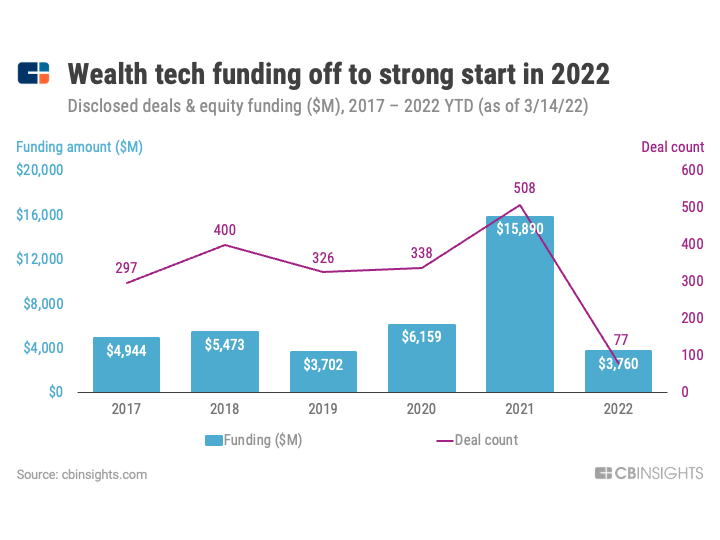

Funding activity in the space reached new levels in 2021, with deal count up 27% from the previous high set in 2018 and dollars more than doubling from 2020. And at the current rate, 2022 could be another record-breaking funding year for wealth tech.

In this brief, we’ll look at:

- The topline findings & implications for this growth

- The market drivers underlying this boom

- The categories receiving the most attention

- Notable mega-rounds in 2021

To dig into all of the underlying data in this brief, sign up for a free trial to CB Insights here.

Findings & implications

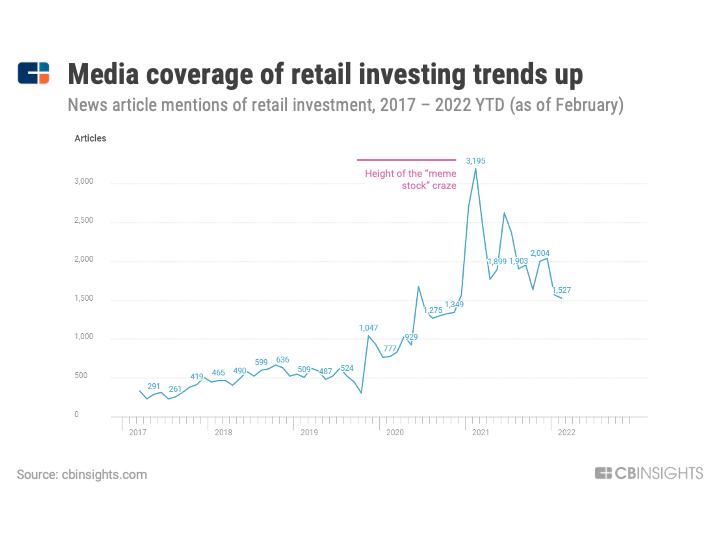

- The number of individual investors has doubled since 2019, now accounting for 23% of equity trading in the US, according to Bloomberg. The majority of these investors are millennials. This uptick is likely due to individuals having more time at home during the Covid-19 pandemic and due to digital platforms like Robinhood, Wealthsimple, and Groww making investing more accessible. Professional advisors will have to take this into account when advising clients and adjust their strategies accordingly.

- Traditional advisors are hesitant to embrace cryptocurrency due to lack of regulations — which could give wealth management startups a major competitive advantage. For example, startups like Tesseract and Fraxtor are using blockchain tech to streamline investment processes for digital and global real estate assets. Watch for more startups to embrace blockchain, crypto, and NFTs to tackle challenges in the wealth tech space like increasing transaction transparency while maintaining security.

Market drivers

The wealth tech sector is seeing both major growth and major disruption. After a record funding year, here’s what to keep an eye on:

- Wealth management companies are acquiring to keep up with technological innovations. The number of wealth tech acquisition deals grew by 350% from 2019 to 2021, with a 5-year high of 72 acquisitions in 2021. Robinhood, a well-known commission-free investment platform, recently acquired Cove Markets to expand its cryptocurrency trading offering, while UBS acquired Wealthfront and plans to keep the robo-advisory platform running as a separate unit. Mergers and acquisitions will continue to be a popular method for incumbents and tech leaders to keep up with changing client demands and shifting markets.

- Wealth tech is coming for financial advisors. Startups like Altruist, Onramp, and AdvisorPeak (acquired by Addepar) provide tech solutions to help financial advisors counsel their clients. Some of these tools consolidate a client’s financial information in one place while others are designed to make crypto market research more accessible to advisors.

- Startups are making investing more accessible for the average person. For example, digital investment platform Stash lets novice investors start investing with small sums. Some startups, such as StockGro and Commonstock, are also integrating social elements into their platforms to allow users to follow investment experts, share their trades, and more.

Where investment is going

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.