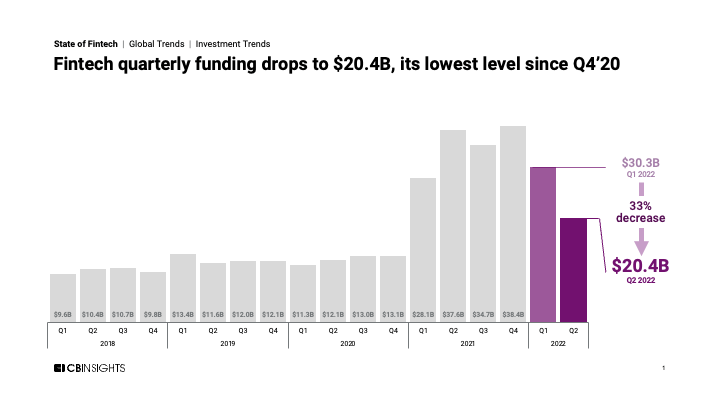

Fintech sees its slowdown accelerate in Q2'22 as quarterly funding plummets toward 2020 levels.

Global fintech funding fell 33% quarter-over-quarter (QoQ) to hit $20.4B — its lowest level since Q4’20. Deals also hit a 6-quarter low, dropping 17% QoQ to reach 1,225.

In line with this trend, $100M+ mega-rounds also accounted for a smaller percentage of total deals (4%) and funding (47%) than they did at any quarterly point last year.

Below, check out a handful of highlights from our 197-page, data-driven State of Fintech Q2’22 Report. For deeper insights, all the record figures, and a ton of private market data, download the full report.

Here are some of the fintech highlights from Q2’22:

- Mega-round funding came in at $9.7B, a 45% drop QoQ.

- Just 20 fintech unicorns were born, marking the first time this figure has fallen below 30 since Q4’20. New entrants to the unicorn club include KuCoin ($10B), Coda Payments ($2.5B), and Newfront Insurance ($2.2B).

- M&A deals took a 30% QoQ hit, dropping to 181 deals from 257 in Q1’22. In contrast, wealth tech saw a 24% jump in M&A deals QoQ.

- While Europe fintech funding sank across most fintech sectors, wealth tech startups in the region saw funding increase. European banking startups, on the other hand, saw funding drop by more than 50% QoQ.

- Foreshadowed by the previous 2 points, wealth tech was the only sector that saw deals increase QoQ. Startups in the space secured 188 deals, a 36% increase QoQ.

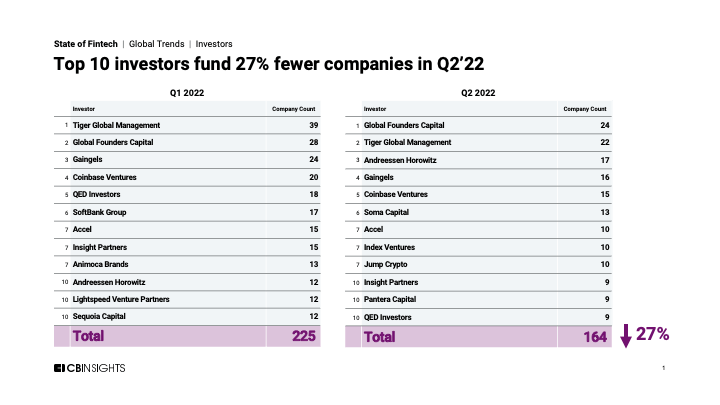

- Tiger Global Management lost its top investor crown to Global Founders Capital in Q2’22, investing in 22 fintechs vs. the latter’s 24. On the whole, the top 10 investors funded 27% fewer companies in comparison to the previous quarter.

Download our Q2’22 State of Fintech Report to dive into all these trends and more.