We look at the most active players and how the trend has changed in 2023.

A unique feature of the recent venture boom was seeing startups invest in other startups.

Before going public in April 2021, Coinbase took stakes in 23 companies in just the first quarter of 2021. Coinbase Ventures went on to become one of the most active corporate VCs in 2021.

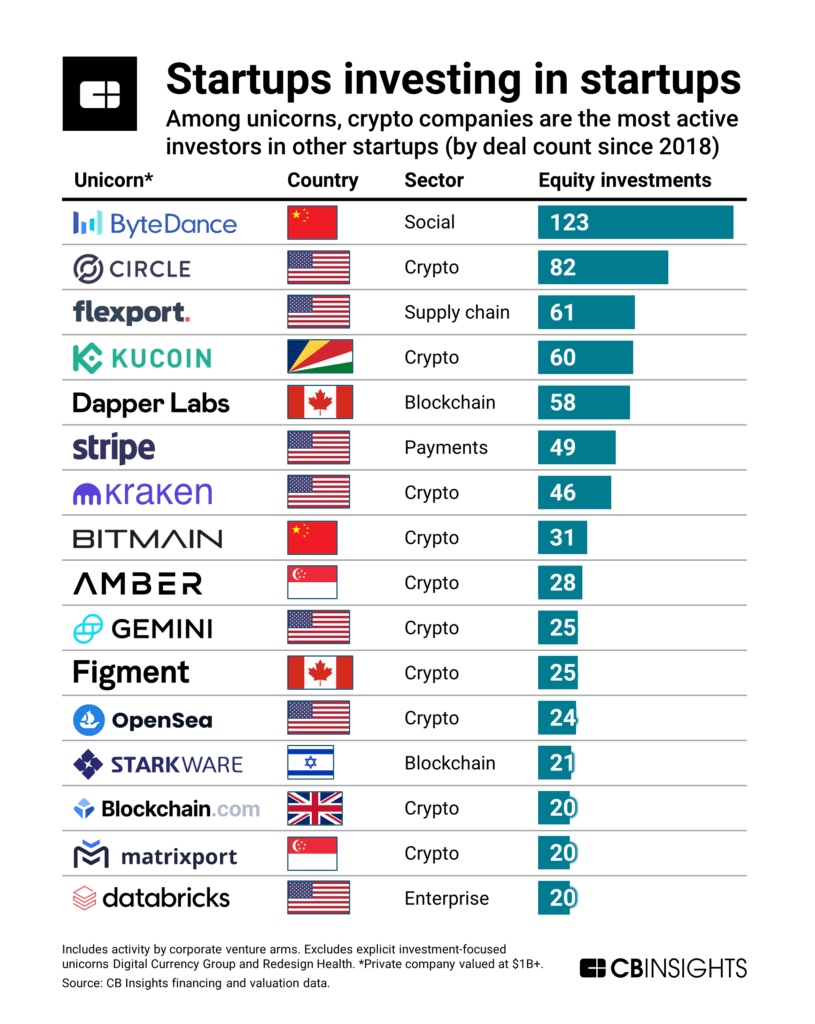

Many private companies also invest as their corporate entity. TikTok-owner ByteDance (the world’s most valuable unicorn at $225B) and Stripe (the No. 4 most valuable unicorn at $50B) are notable examples.

Of the current 1,200+ unicorns, 24 have venture arms. This includes Databricks (Databricks Ventures) and Flexport (Flexport Ventures).

Half of these CVCs — such as Circle Ventures and Kraken Ventures — belong to crypto companies.

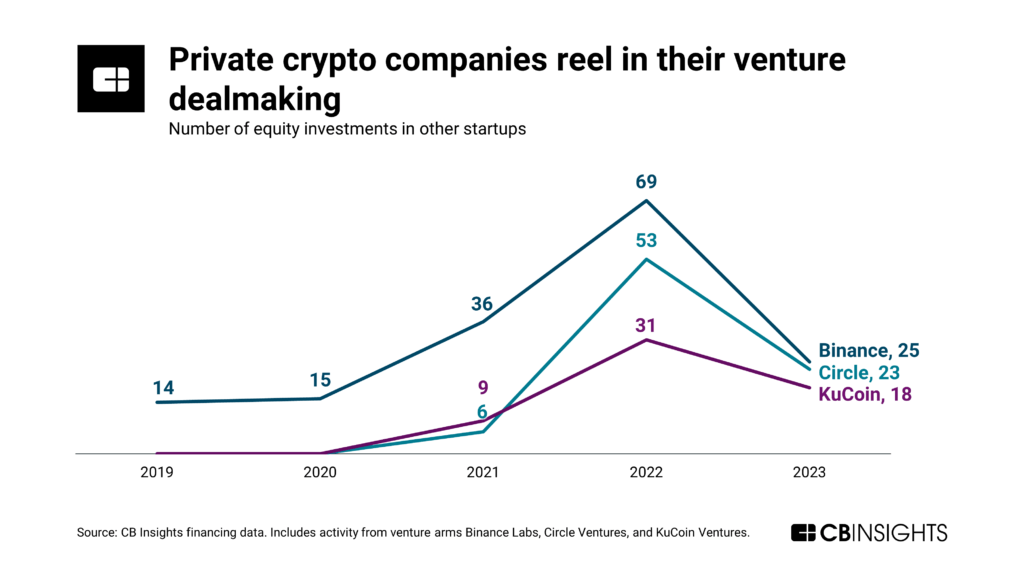

Crypto winter chills crypto venture

Private crypto companies are notable for their investments in other startups, particularly for those in other crypto startups.

FTX Ventures, for example, backed equity deals to more than 40 unique companies in 2022 before the crypto exchange collapsed in November 2022.

The crypto downturn has since chilled investment activity in the sector significantly.

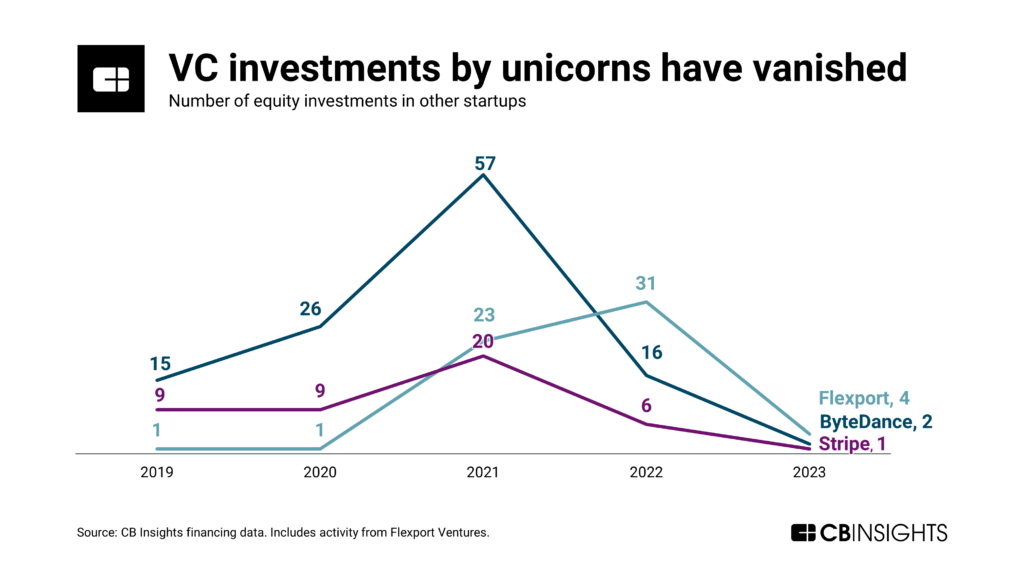

VC downturn hits unicorns

More broadly, belt-tightening across the venture landscape has crushed unicorn investment activity. For example, ByteDance, Stripe, and Flexport were very active in 2021 but have now almost stopped investing in startups.

One exception is Databricks, which maintained its activity in 2023. Its venture arm backed 10 equity deals, including 2 deals to AI search engine Perplexity AI.

Large startups have engaged in venture investing to stay on top of emerging market trends and create business development opportunities down the line.

For example, Stripe’s investments through mid-2021 signaled its intent to expand internationally and grow beyond its core e-commerce business. Stripe acquired Nigeria-based Paystack in 2020 — extending its reach in Africa — after participating in the payment startup’s Series A in 2018.

At the same time, these deals were also bets on the startups themselves, the growth of their ecosystems (like crypto), and potential financial returns.

But with unicorns facing pressure to maintain their lofty valuations, private companies and their venture arms are reevaluating their strategies.

If you aren’t already a client, sign up for a free trial to learn more about our platform.