Global venture funding shows signs of life — rebounding 11% quarter-over-quarter — while depressed deal volume and a dearth of new unicorns paint a more sober picture.

Global venture funding reached $64.6B in Q3’23 — an 11% increase from the previous quarter, driven by massive deals in areas like electric vehicles, sustainable manufacturing, and AI.

Overall deal count, on the other hand, fell for the sixth straight quarter, reaching 6,111 — the lowest quarterly level since 2016.

Using CB Insights data, we highlight key takeaways from our State of Venture Q3’23 Report, including:

- Global venture funding increases 11% QoQ to $64.6B.

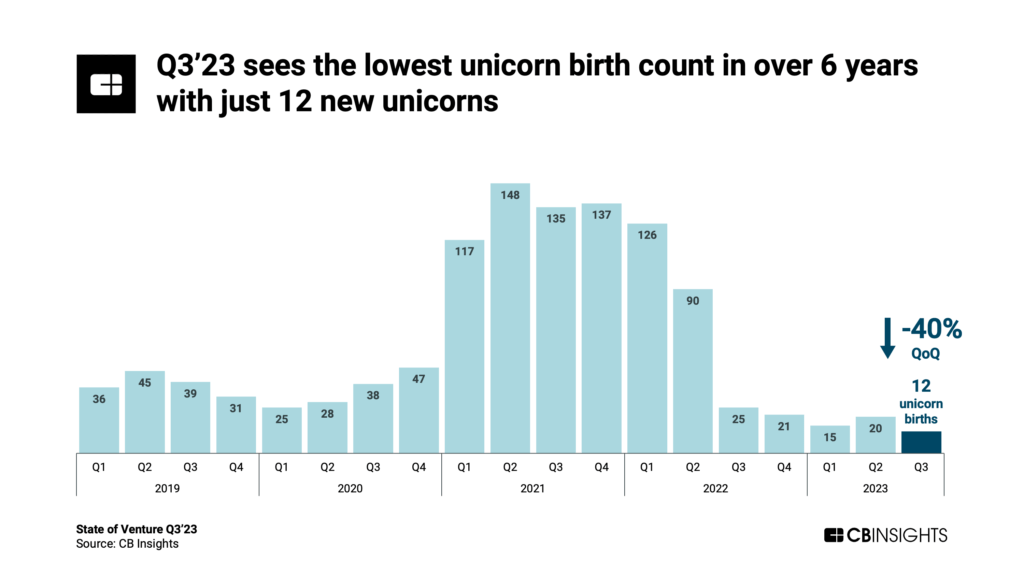

- New unicorn births drop 40% in Q3’23 to the lowest total in years.

- The global IPO market continues to rebound, with IPOs up 24% QoQ.

- Half of the top 10 largest equity deals go to the electric vehicle industry.

- Europe leads global exit share at 38%, with the US close behind at 35%.

Let’s dive in.

Global venture funding reached $64.6B in Q3’23, an increase of 11% from the previous quarter. This was the strongest quarterly percentage growth since Q2’21, though the funding total was still less than half the levels seen that year.

Meanwhile, global deal count fell for the sixth straight quarter to just 6,111 deals in Q3’23 — the lowest level since Q4’16.

Unicorn births (private companies reaching $1B+ valuations) fell 40% QoQ to just 12 in Q3’23 — the lowest level in over 6 years.

Among companies reaching unicorn status, artificial intelligence is well-represented given the sustained interest in the tech. Q3’23’s new unicorns included 4 AI companies:

- Helsing, a Germany-based defense startup using AI for security ($1.8B valuation)

- AI21 Labs, an Israel-based startup that provides language models for AI developers ($1.4B valuation)

- Imbue, a US-based developer of custom AI agents ($1B valuation)

- Zhipu AI, a China-based AI developer for both consumer and enterprise applications ($1B valuation)

Most major regions saw quarterly drops in the number of new unicorns in Q3, though the US continued to lead unicorn births with 5 total. This was followed by Asia with 4 new unicorns and Europe with 2.

Global IPOs increased for the second quarter in a row. Q3’23 saw 126 companies go public via IPO — 24 more than the 102 in Q2’23.

This points to a noticeable improvement in the IPO market, especially in the US. The top 2 IPOs by valuation went to Instacart ($9.9B) and Klaviyo ($9.3B), both based in the US.

Meanwhile, M&A deals continued to decline by 8% QoQ, reaching 1,887 exits — the lowest quarterly volume since 2020.

Half of the top 10 deals went to the electric vehicle industry, while an additional 2 deals focused on clean energy and sustainable manufacturing (H2 Green Steel and HiTHIUM).

Investors are prioritizing clean tech investments — a trend that parallels a major push by governments around the world to reduce emissions in industries like automotive, steelmaking, mining, and more.

Northvolt and Redwood Materials, both in the lithium-ion battery space, each raised $1B+ deals in Q3’23.

At 38%, Europe led in the share of global exits for the fourth quarter in a row, while the US came close behind at 35%. Asia saw 16% of exits — its highest share since Q3’20.

The overall number of exits decreased for the seventh straight quarter. This highlights ongoing struggles in the market, particularly for investors looking for liquidity.