Despite a slowdown in funding, the space has seen notable acquisitions and partnerships in 2023 involving BioNTech, Eli Lilly, and others. We assess the market's momentum.

Artificial intelligence has transformed drug discovery. Companies are now using AI to design new proteins, understand viral structures, identify small-molecule drug candidates, and much more.

As well as efforts by big tech companies like Nvidia and Google DeepMind, over 200 startups are going after opportunities in the space. Our analysis includes vendors selling drug R&D software to pharma companies, as well as AI-powered pharma & biopharma companies.

Despite a slowdown in funding — in line with the slowdown in the venture market at large — the space has seen some notable deals and partnerships in 2023. In January this year, BioNTech acquired startup InstaDeep for $682M to embed its AI capabilities across its therapeutic platform. Eli Lilly inked a $250M deal with startup XtalPi in May. And Recursion acquired 2 startups — Cyclica and Valence — to boost its generative AI capabilities.

Below we’ll dive into:

- Global funding trends

- AI drug discovery & design funding vs. overall healthcare AI funding

- Top-funded companies

- Most active investors

Global funding trends

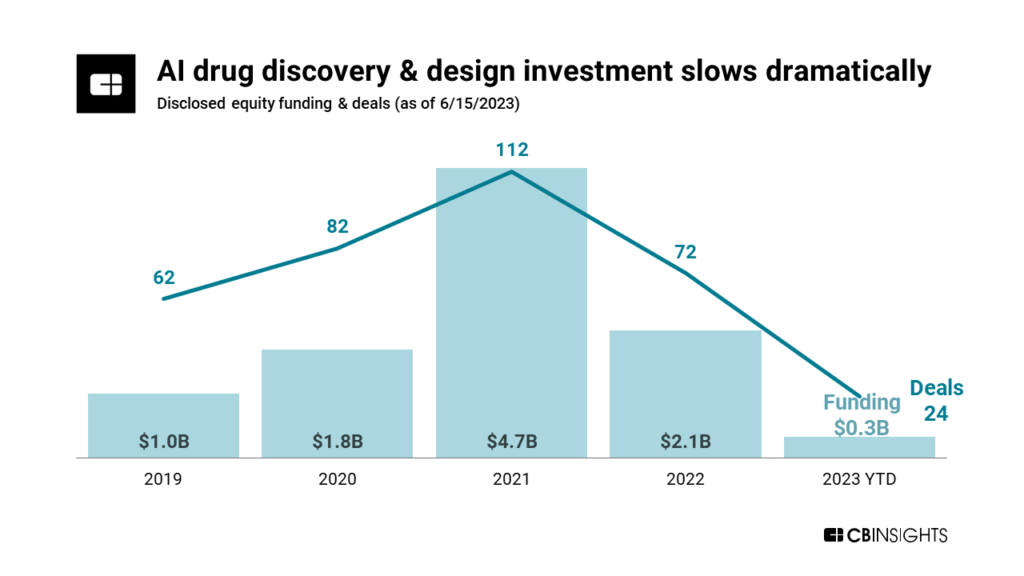

Executive attention toward AI has soared in 2023 following the release of ChatGPT by OpenAI late last year. However, global venture activity has slowed and investors are backing far fewer AI deals compared to the level seen during the 2021 venture boom.

Reflecting this, investors have also pulled back on funding and deals to AI drug discovery companies — there has been a particularly dramatic fall in $100M+ mega-rounds. While mega-rounds accounted for 70% of funding to the space in 2021, this share dropped to 30% in 2022 and there have been no mega-rounds in the space so far this year.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.