Many unicorns have raised funding at rapid rates to reach that $1B+ valuation — but their capital efficiency has suffered as a result. We dive into unicorn funding, valuations, and capital efficiency metrics to show what the future holds for unicorns.

Despite strong headwinds in private market funding, the number of global unicorns — private companies with a $1B+ valuation — recently surpassed 1,200 for the first time ever.

Reaching a 10-figure valuation is a startup status symbol, highlighted by the fact that more than 20% of unicorns have an exact valuation of $1B.

In the pursuit of this status, many startups have looked to fundraise their way to growth. Of the 263 unicorns with an exact valuation of $1B, only 1 out of 10 have raised less than $100M.

Sometimes referred to as the “foie gras phenomenon,” investors pump significant capital into startups to boost their market reach and valuations. Interestingly, past data indicates that companies that raise relatively lower amounts of capital have historically outperformed high raisers.

In this brief, we dive into what overfunding looks like for today’s unicorns, as well as what it means for investors.

Key takeaways

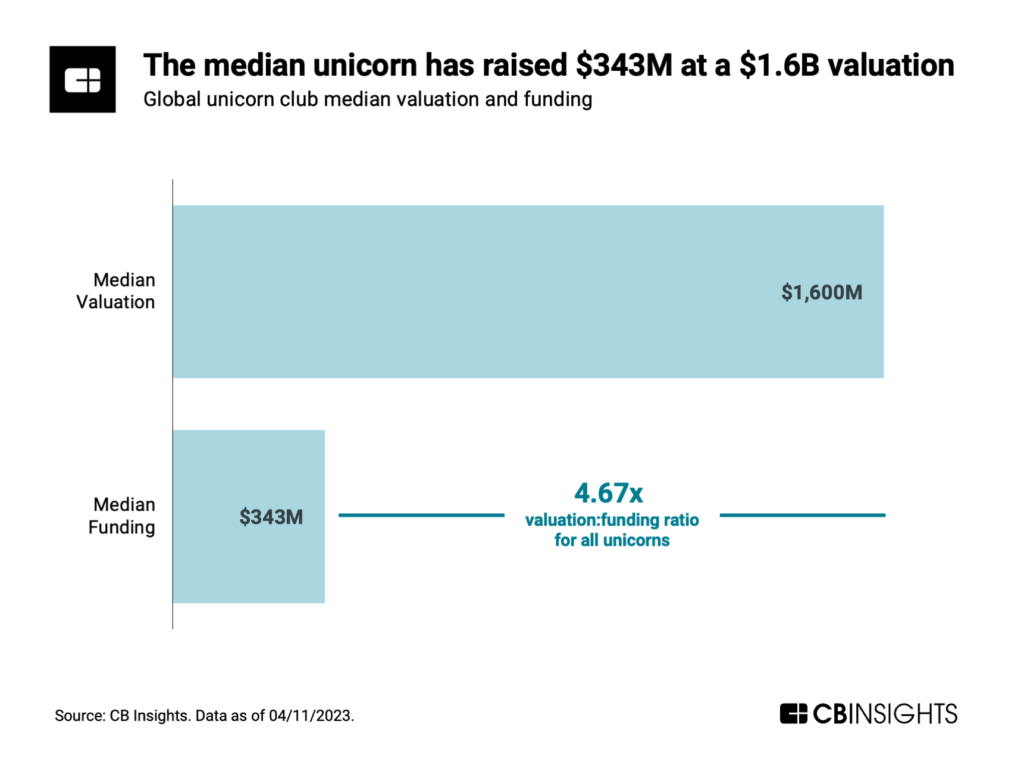

- Median funding for unicorns is high. The median unicorn has raised over $300M to reach its unicorn status.

- Many unicorns have proven inefficient in translating high funding rounds into value. Smaller unicorns especially have tended to be “overfed” and are less able to generate higher valuations in comparison to their substantial funding.

- The focus on profitable growth will intensify to achieve higher valuations, given the public market pressure on many of yesterday’s unicorn darlings.

Valuations haven’t grown proportionally with funding

Today, the median unicorn has raised $343M in equity funding with a valuation of $1.6B.

Looking at the ratio of valuation to funding (valuation:funding) can illuminate how efficient a company has been in translating funding into value. If the valuation:funding ratio is high, it means the company has been able to generate a high enterprise value with the funding it raised, and is often considered more efficient.

The unicorns of 5 years ago relied less on outside investment to build their valuation, when the median unicorn exited at a valuation of 6.9x its funding. Today, the median ratio has fallen by roughly a third.

When breaking down the 1,200+ unicorns into industries, we can see which industries have the most capital-efficient unicorns. For instance, auto tech and advanced manufacturing both have median unicorn valuations of $2B — but advanced manufacturing unicorns have done this with nearly $200M less in funding.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.