We mined CB Insights data on thousands of North American investors to rank them based on their portfolio strength and ability to predict future winners.

Investors have pulled back drastically amid the venture downturn — especially in North America. In Q4’23, the US and Canada saw 10- and 6-year lows, respectively, in VC dealmaking.

But in venture capital, it’s all about the long game, and right now top investors are laying the groundwork for the next wave of tech success stories.

We used CB Insights data to sift through deals data for thousands of investors and rank them based on the strength and performance of their portfolios. Our scoring model factors in deal volume since 2023; unicorns in investors’ portfolios that were backed prior to a $1B valuation; and the share of portfolio companies invested in since 2018 that have gone on to exit. We also looked at the average Mosaic score — CB Insights’ proprietary algorithm measuring startup health and potential — across their recent investments.

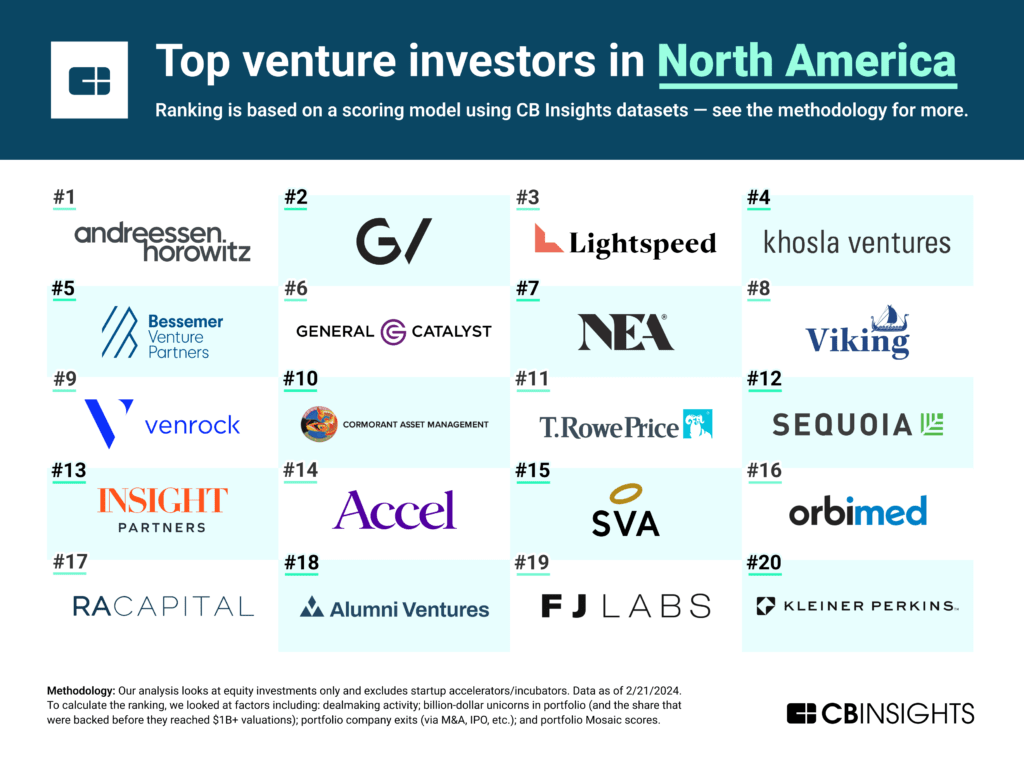

See our picks for the top 20 venture investors in North America below, and download the full report for a detailed breakdown of each one’s portfolio.

CB Insights customers can explore every equity deal from these investors since 2023 using this CB Insights platform advanced search. You can also track every new deal from these investors in real time using CB Insights home feeds:

Our analysis includes any firm that invests in private-market startups in exchange for equity. We include non-traditional VCs like crossover funds, asset management firms, and corporate VCs, but we exclude startup accelerators and incubators.

Venture firms — make sure we’re representing your full portfolio by contacting us here to set up a review of CB Insights’ coverage of your investments. It’s 100% free and will improve our ability to rank your firm in upcoming research.

Key takeaways

- Andreessen Horowitz (a16z) tops our ranking. The VC has backed over 1,600 deals to startups since its founding in 2009, participating in 154 since 2023 (as of 2/21/2024). It has 101 current unicorns (private companies valued at $1B+) in its portfolio, 69 of which it backed before they hit unicorn status.

- Among the top 20, 4 firms have invested in 100+ equity deals since 2023. These include a16z (154), General Catalyst (106), FJ Labs (101), and Alumni Ventures (100).

- Cormorant Asset Management has the best hit rate (54%) backing startups that go on to exit. It’s followed by RA Capital Management (45%) and OrbiMed Advisors (42%). Notably, all 3 are focused on healthcare, particularly biotech — an area where startups tend to IPO earlier than in other sectors, given the capital requirements for pushing drug candidates through clinical trials.

- Venrock, SV Angel, Khosla Ventures, and Accel lead in backing unicorns before they reach $1B+ valuations. Each of these firms backed at least 85% of their portfolio unicorns before they hit unicorn status, suggesting consistently high returns on paper. Accel has turned this into a repeatable business: It counts 95 current unicorns in its portfolio, and it invested in 81 of these before they became unicorns.

- T. Rowe Price leads in terms of the quality of its recent investments, as measured by CB Insights’ Mosaic score. Since 2023, its investments have averaged a Mosaic score of 788 (out of 1,000), led by companies like Databricks (930 Mosaic score) and Stash (900).