We break down the generative AI landscape across funding trends, top-valued startups, most active VCs, and more.

2023 was a record year for generative AI investment.

Funding to the space shot up 5x in 2023 compared to the previous year, while deals increased by 66%. There are already 36 genAI companies that have hit unicorn status.

As the tech evolves, big tech companies and waves of new startups are aggressively building out generative AI capabilities to meet the demand from businesses looking to adopt the technology. This is driving an expansion in the breadth of genAI use cases, from tech to secure LLMs to models tailored to specific domains.

Using CB Insights data, we cut through the noise to understand the generative AI landscape. Below, we cover:

- Equity funding and deal trends

- Company breakdown by funding stage

- Where the money’s going in generative AI

- Top valuations in generative AI

- Most active lead investors

- Top exits in generative AI

2023 was a breakout year for investment in generative AI startups, with equity funding topping $21.8B across 426 deals.

The year’s 5 largest rounds all went to companies focused on core generative AI infrastructure:

- OpenAI, AI poster child and maker of ChatGPT ($10B corporate minority)

- Inflection AI, which focuses on human-computer interfaces ($1.3B Series B)

- Anthropic, an AI model developer and research outfit ($1.8B across 2 corporate minorities)

- Databricks, a data integration and analytics platform ($504M Series I)

- Aleph Alpha, Germany-based LLM developer ($500M Series B)

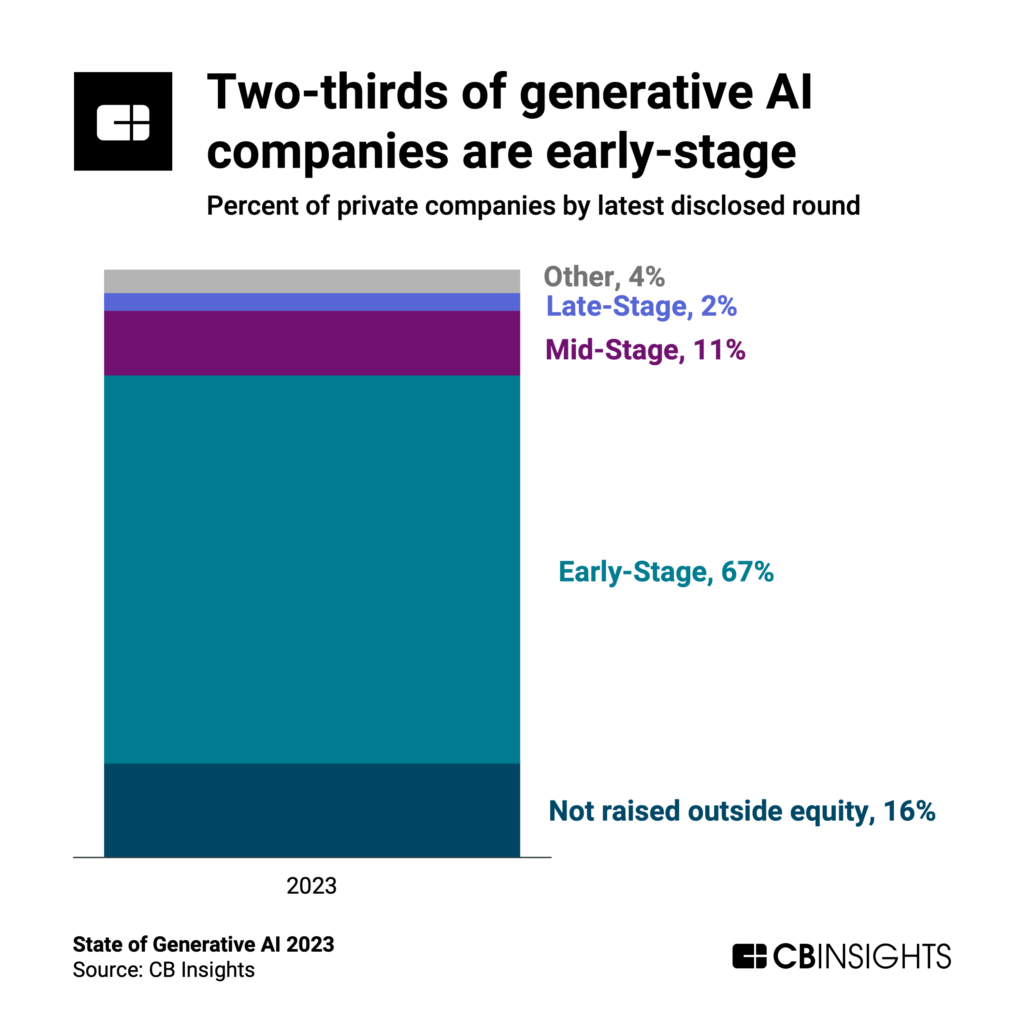

Even with the massive uptick in funding, the generative AI space is still largely nascent.

Of almost 800 generative AI companies we’ve identified, 16% have yet to raise any outside equity funding and about two-thirds are Series A or earlier. Less than 15% are mid- to late-stage startups.

The generative AI infrastructure category saw over 77% of funding in this space in 2023 across a third of the deals, this funding haul was partly driven by the capital-intensive nature of developing large language models. The top deal was Microsoft’s $10B round to OpenAI in January 2023 — though even with this unusually large round excluded, generative AI infrastructure was still the top category by funding.

Horizontal applications snagged almost half the generative AI deals last year. This category includes industry-agnostic solutions, including code generation, sales & outreach, and video editing tools. We also include personal AI companions such as Inflection (which raised a $1.3B Series B in 2023 — the largest deal in this category) and Character.ai ($190M Series A), as well as AI agent startups like Adept ($350M Series B) in this category.

Vertical applications made up the smallest share of funding and deals last year, with only $1.2B raised across 81 deals. These industry-specific solutions span spaces like gaming, legal, and healthcare. The top round in this category in 2023 was a $273M Series C raised by protein & drug design startup Generate Biomedicines.

Check out our generative AI market map for detailed descriptions of these categories and other areas.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.