We dive into the evolution of mobile wallets and where the technology is going next, from AI-based financial assistants to super wallets and beyond.

These days, you may be more likely to download your wallet from an app store than pick it out at a department store.

The mobile wallet industry has seen significant advances in the last decade, changing the way people manage and spend their money, and the tasks that these wallets can perform have rapidly expanded.

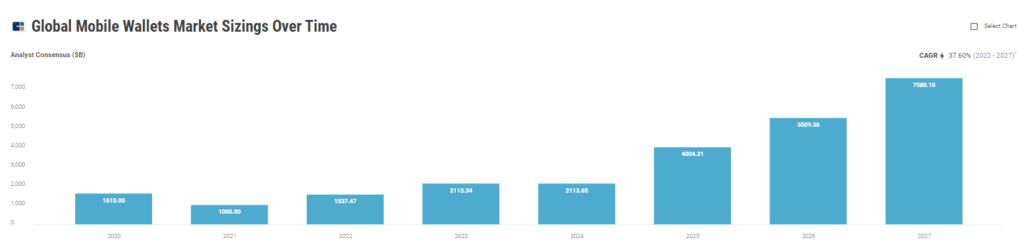

In turn, the mobile wallet sector has become one of the fastest-growing industries in the world: it’s currently worth around $1T and is estimated to grow to over $7T by 2027, according to CB Insights Industry Analyst Consensus.

We cover the key areas mobile wallets will expand next, including:

- “Super wallets” replace single-function digital banking & payments solutions

- AI-powered financial assistants enable ultra-personalization and budget automation

- Mobile wallets turn into digital IDs and a place to store documents

- Wearable devices complement mobile wallets

GET THE FULL REPORT

But first — what’s at stake?

Why it matters: Digital wallets are transforming the way people manage every aspect of their lives. A growing number of companies are striving to become the go-to app for all things finance — combining a wide range of payments, banking, credit, investment, and insurance products in a single platform — while others are allowing users to store important documents and access cards on their smartphones for everyday use. With a wide reach and daily touchpoints, the digital wallet category is poised to have a substantive impact on individuals’ day-to-day lives — but only if new solutions can deliver on reliability, scale, and convenience.

Why now: Innovation within the digital wallet space is being driven by customer demand for convenience, automation, and customization, as clients increasingly seek to manage all their financial matters in one place. The Covid-19 pandemic has also accelerated the need for contactless money management and ID solutions, resulting in the growing adoption of mobile solutions in payments, banking, and other financial services categories.

And without a clear leader in the US market, existing financial services players now have their eyes set on becoming the go-to mobile wallet app for all things finance and more.

The players looking for an edge: The future of the wallet is largely being shaped by fintech players like SoFi, Venmo, MoneyLion, Block, M1 Finance, and Revolut, which offer easy-to-use, mobile-friendly platforms. Tech giants like PayPal and Apple are also aiming to become the go-to money management apps, and looking to leverage their vast user networks, brand recognition, and UX expertise to gain quick traction among users.

The rise of super wallets

Traditional physical wallets are primarily for making payments, carrying our cards and cash — and otherwise disconnected from other areas of our financial lives.

In contrast, digital “super wallets” are giving users access to a much wider range of financial resources and tools. They can still make payments, but they can also help make investments, take out loans, track accounts, and more.

WHAT ARE SUPER WALLETS?

Mobile wallets today are, in essence, a way of organizing existing financial accounts. The standard mobile wallet works as a safe, virtual storage for tokenized credit cards, debit cards, and bank account information.

But as the payments landscape evolves, a growing number of digital wallets are moving beyond the single-function app approach, adding on financial offerings that go beyond facilitating payments — such as loans, insurance, investing, and digital banking. Different features can help players differentiate themselves in the already crowded mobile wallet market, and avoid becoming just another payments app on a user’s phone.

The result increasingly looks like what we can call a financial super app, or super wallet: a connected ecosystem where users can manage payments, savings, investments, crypto, budgets, loans, insurance, and more, all in one place.

FIRST MOVERS

Asia has been a hotbed for this trend, with a number of digital wallets here evolving into successful super apps — diversifying beyond payments into food delivery, taxi-hailing, restaurant and hotel booking, and even gaming.

The most well-known examples include China’s hugely popular AliPay and WeChat apps, which both started out as digital wallets and later leveraged their vast payments infrastructure to add services. Today, both apps can be used for a broad range of everyday functions, from buying groceries and clothing to purchasing insurance and stocks.

Outside of Asia, a number of European fintech companies are following a similar strategy. Paris-based Lydia started out in the digital wallet category as a P2P payments platform, then later introduced debit cards, IBANs, and personal loans, as well as stock and crypto trading. The company raised a $100M Series C round in December, officially reaching unicorn status with a $1B valuation. Meanwhile, UK-based competitor Revolut (a self-described “global financial super app”) offers a similar range of financial products and services in 20+ countries across the world. The company launched its super app in the US in March 2020 and applied for an official bank charter a year later.

In the US, several fintech companies are testing the super app waters. These moves signal that there could soon be stiff competition here, and for good reason: whoever secures the go-to super app status and gains widespread customer trust and adoption will likely become one of the most valuable companies in the US.

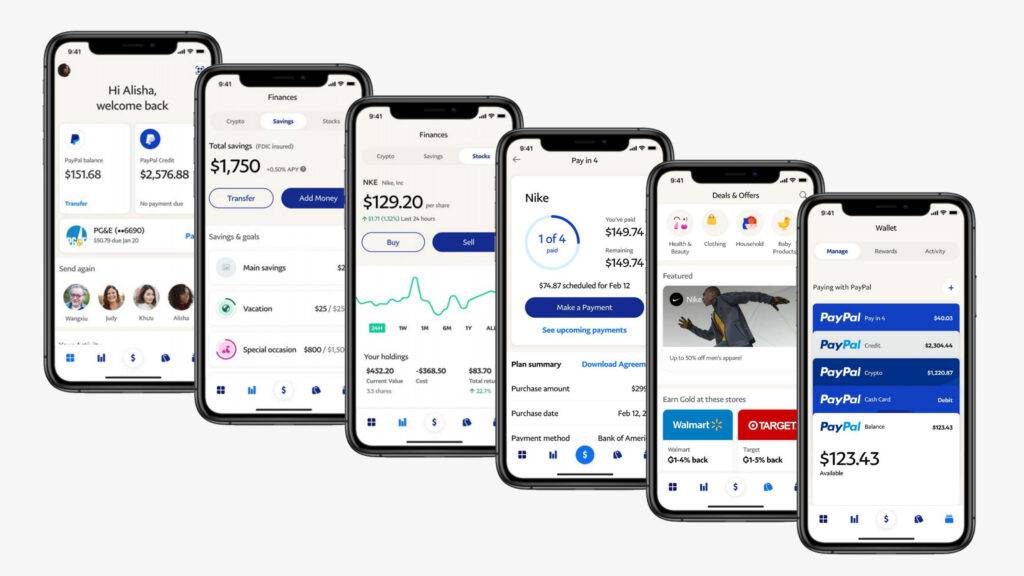

One well-known example here is PayPal, which launched its own version of a financial super app in the US in 2021, taking a deliberate step into the territory of other giants like WeChat and AliPay. On top of the PayPal app’s existing mobile wallet, P2P payments, and charity donation features, the super app introduced banking and personal finance offerings, including:

- High-yield savings accounts, in partnership with Synchrony Bank Financial

- A bill management tool that helps users track, review, and pay their bills

- A new direct deposit feature that helps users access paychecks 2 days early

- Credit access and BNPL offerings

- Gift card and reward offerings

- In-app shopping function that offers loyalty rewards

- Crypto buying/selling

PayPal’s new services include high-yield savings accounts, stock and crypto investing options, and new deposit features. Source: PayPal

By combining payments, banking, personal finance, and e-commerce in a single platform, PayPal aims to create an end-to-end financial ecosystem that users won’t need to — or won’t want to — leave.

Venmo, a Gen Z-friendly PayPal subsidiary, is taking a similar route. Since its acquisition, Venmo has added a cash account, a debit card, a credit card, direct deposit, in-store QR payments, shopping, crypto investments, and a bunch of other features.

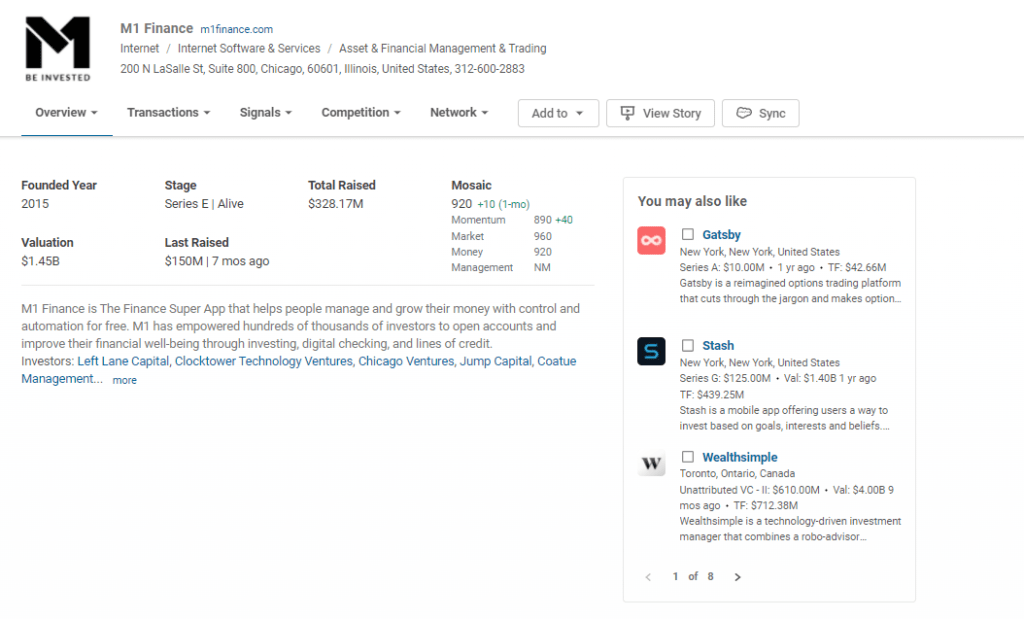

Fintechs SoFi, MoneyLion, M1 Finance, and Block (formerly Square) also have their eyes set on super app status. SoFi started out as a student loan financing company, later introducing banking, investment, insurance, and credit products. MoneyLion branched out from lending to offer banking and investing. The new Block app combines a similar range of services, including P2P transfers and trading on its Cash App platform, lending through its AfterPay acquisition, and payments on Square, its core merchant platform.

While the number of US-based super apps is expected to rise in the next few years, the quest to become the go-to super app will be a long journey, fueled by stiff competition that’s emerging between fintechs, legacy players, and big tech.

IMPLICATIONS

- Super apps will be the dominant fintech strategy of the next decade, and pose a growing threat to legacy financial players as well as single-function fintech apps

- Fintech-based super apps will see substantial competition from tech giants like Apple and Google, which will leverage their vast user networks and product ecosystems to build similar functionality.

- The first few super apps in the US will likely be limited to financial services, not offering food delivery, hotel booking, or social media within the same platform (unlike their Asia-based counterparts).

AI-powered financial assistants

A traditional wallet can hold your money, but it can’t help you choose where to spend it. Going beyond the one-stop-shop convenience offered by super wallets, the AI-powered financial assistants of the future could help users make smart, customized decisions about their money.

WHAT ARE AI-POWERED FINANCIAL ASSISTANTS?

Artificial intelligence is setting a new standard for consumer-facing financial services apps, signaling that AI-powered “smart” financial assistants could play a major role in the future of personal finance.

Standard budgeting tools are traditionally limited to historical data aggregation, with only basic analysis or insight. The smart financial assistants of the future will go far beyond this. Powered by AI and ML capabilities and vast sets of consumer data, these assistants will take on the role of a smart advisor who continuously reviews clients’ subscriptions and bills, manages their budgets, proposes saving and investing strategies, and provides other relevant feedback on how to reach financial goals.

More advanced smart assistants may also become more interactive and proactive — discretely notifying users of discounts at their most frequented stores while shielding them from incessant marketing, creating custom budgets, or seeking out the best loan rates and insurance options based on a specific user’s needs.

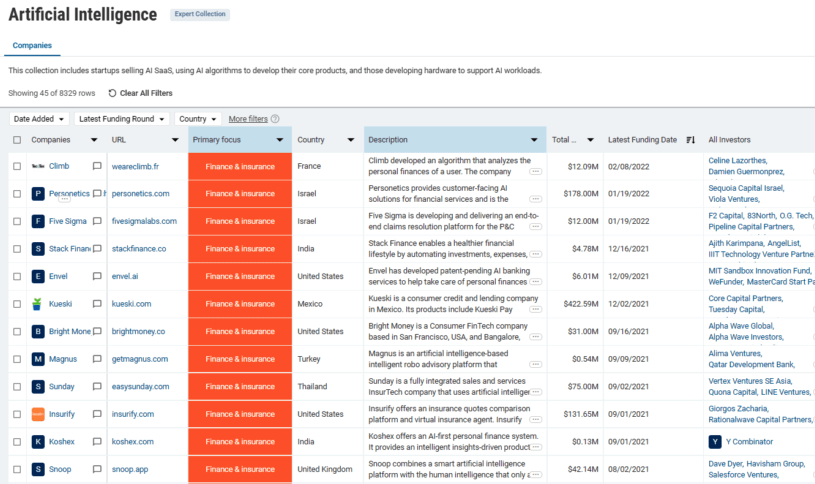

From saving and spending insights to retirement planning and investment advice, artificial intelligence has become a powerful tool for fintech companies to offer automated yet customized services to customers. Source: CB Insights Artificial Intelligence Expert Collection

GET THE FULL REPORT

FIRST MOVERS

A new generation of fintech startups is already leveraging AI to automate different aspects of money management. AI-powered robo-advisors Betterment, SigFig, and Personal Capital automate asset allocation, portfolio rebalancing, and tax-loss harvesting, while robo-advisor-turned-banking-app Wealthfront (now in the process of being acquired by UBS) is testing out its “Self-Driving Money” product that claims to automate all facets of money management from bill payments and loan approvals to savings and investments. The company’s AI-based robo advisor creates customized investment portfolios, tracks user saving and spending habits, and offers personalized financial advice.

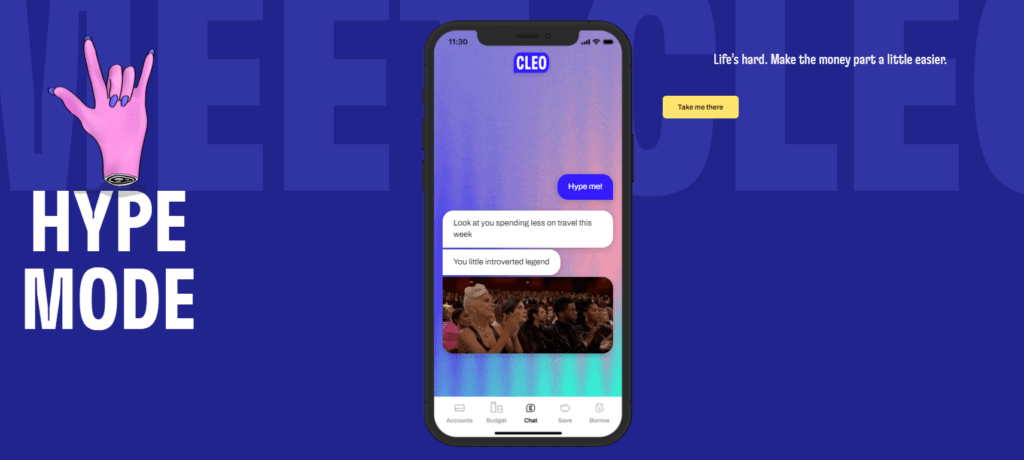

Beyond robo-advisors, a number of personal finance apps also rely on AI to offer a customized and automated money management experience. Trim, an AI-based money-saving assistant, reminds users to pay their bills, negotiates medical costs, and cancels under-utilized subscriptions. Cushion uses AI algorithms to find and negotiate bank and credit card fees in a user’s bank account. UK-based Cleo AI, an AI-based chatbot, provides message-based personalized advice to users, answering questions on whether they can afford something or which habits are negatively impacting their budget.

Cleo AI’s chatbot can integrate with Facebook Messenger, Amazon’s Alexa, and Google Home, providing an interactive user experience through both text and voice. Source: Cleo.AI

OliviaAI, MintZip, Wizely, and Charlie (now Chime) are also employing AI technology to offer personalized financial recommendations.

IMPLICATIONS

- Natural language processing and understanding documents will be key in “humanizing” virtual assistants, as well as in helping them grasp and solve complex financial issues.

- Privacy and security will be crucial for financial assistants, which will need to access sensitive financial and biometric information to function well.

- Expect a jump in fintech acquisition activities, especially between different financial services verticals. The 2021 acquisitions of TrueBill by Rocket Mortgage, Charlie by Chime, OliviaAI by Nubank, and Trim by OneMain show a clear consolidation trend among personal finance apps and other verticals.

- More legacy players will look to offer AI-based financial assistants, such as Bank of America’s launch of its AI assistant Erica, and Intuit’s 2020 acquisition of Mint.

Digital ID wallets

Wallets have long been the go-to carrier for IDs like drivers’ licenses, office badges, and student cards — but now, digital ID wallets are offering an intangible alternative.

These wallets, which are becoming especially important in an era of increased need for vaccine verification and contactless identification, can also securely save a wider range of identifying data, from medical histories to office keys.

WHAT ARE DIGITAL ID WALLETS?

The Covid-19 pandemic has pushed governments and businesses to reconsider their approaches to payments, identity verification, and access control, speeding up the adoption of mobile and contactless alternatives in all 3 areas.

Among these, the payments sector has seen the highest adoption of mobile alternatives, resulting in speculation that mobile wallets will broadly replace cash and plastic cards within the next decade. However, mobile wallets have the potential to transform more than just transactions.

A new generation of mobile wallets called “digital ID wallets” are emerging as an all-in-one solution to friction in not only payments but also ID verification and access management. By adding scanning and document encryption to their capabilities, digital ID wallets can offer a secure virtual storage alternative for a lot of what is found in physical wallets today.

The standard digital ID wallets of the future will store payment information along with other essential documents, including state IDs, SSNs, passports, citizenship information, medical records, home and office keys, and even biometric information such as fingerprints and face scans.

These wallets will enable more seamless ID verification, checkout, access, and travel experiences than ever, automatically sharing minimally viable user information related to user activity and transactions. For example, at a basic level, digital ID wallets could confirm a user’s age with the checkout system at the liquor store, share an access card with the security system at an office, or offer passport information to the identity reader at an airport.

FIRST MOVERS

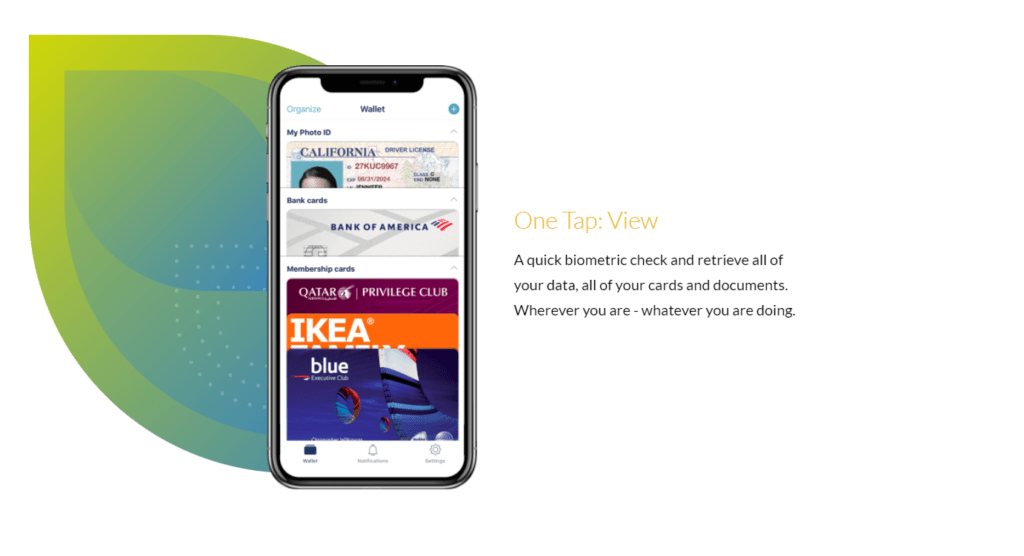

The idea of a catch-all mobile wallet is not entirely new. A number of mobile wallets currently store user information on payments, driver’s licenses, boarding passes, movie tickets, and gift card coupons. Digital wallet app Folio scans and stores important documents, such as debit and credit cards, state IDs, passports, driver’s licenses, and health cards. The app also facilitates payments and information sharing, allowing businesses to send nudges to a user’s phone to request information.

From state IDs and gym access cards to medical records, a broad range of documents can be scanned and stored in Folio. Source: Folio.ID

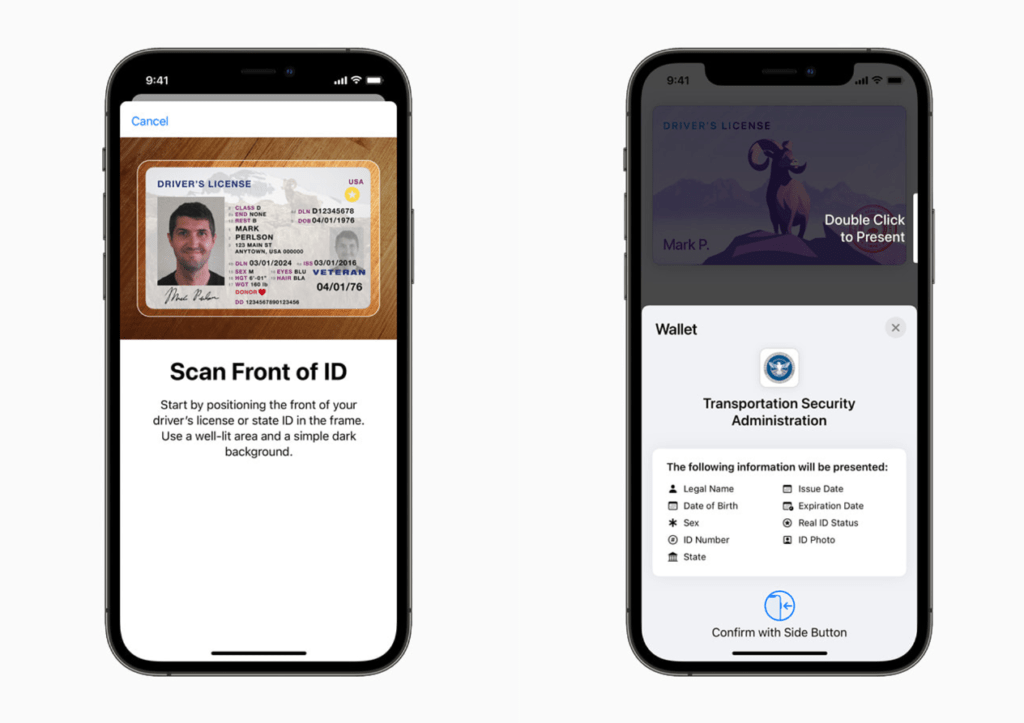

Apple is also eager to take on digital ID wallets. Apple Wallet already stores users’ debit and credit cards, car keys, tickets, and boarding passes. On top of that, the company has recently announced plans to launch digital IDs for Apple Wallet, allowing users to add their driver’s licenses and state IDs to their iPhones and Apple Watches. The ID feature is supported by TSA checkpoints in 8 states so far, and the company is planning to expand to retailers and venues next.

Apple Wallet IDs are currently supported in Arizona, Georgia, Connecticut, Iowa, Kentucky, Oklahoma, Maryland, and Utah, where users can use their Apple Wallet IDs at TSA checkpoints. Source: Apple

The digital ID wallet sector is expected to boom in the next decade, making it easier to always have access to digital copies of the documents we currently keep in our wallets (or even more inconveniently, in our filing cabinets). While the initial groundwork for digital IDs has already been laid, gaining consumer trust will require a fair amount of effort. Cooperation from legacy financial institutions and governments will also be crucial in the widespread adoption of digital IDs.

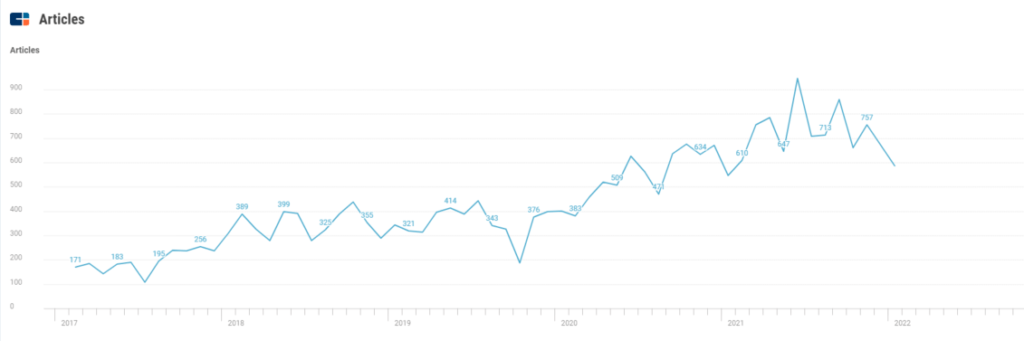

News mentions of “digital ID” and “digital identity” have been increasing steadily over the last few years. Source: CB Insights

GET THE FULL REPORT

IMPLICATIONS

- The digital ID wallet sector will boom in the next decade, providing customers with a myriad of digital ID options.

- As digital ID wallets gain adoption, governments will be incentivized to get on board, partnering with fintechs or launching their own digital ID wallets.

- Strong government regulation and policies will be required to manage privacy and the risks associated with digital wallet IDs.

- If implemented well, universal digital identity standards have the potential to significantly reduce fraud and crime rates in international transactions and travel.

Wearables as payment intermediaries

One reality of physical wallets? They take up physical space. Now, the digital wallets of the future aren’t only moving to our phones — they’re increasingly available on even smaller and more convenient wearable devices, from watches to key rings.

WHAT ARE PAYMENTS WEARABLES?

Wearables made their debut in the health and fitness category over a decade ago, where products like Fitbit smartwatches, Oura wellness rings, and Ivy tracker bracelets revolutionized health monitoring for individuals.

Today, the wearables industry is quickly expanding into payments, facilitating transactions without requiring users to touch their wallets or smartphones. There are plenty of untapped opportunities here: the global wearable payment device market was valued at $285B at the end of 2019 and is expected to soar to $1.3T by 2028.

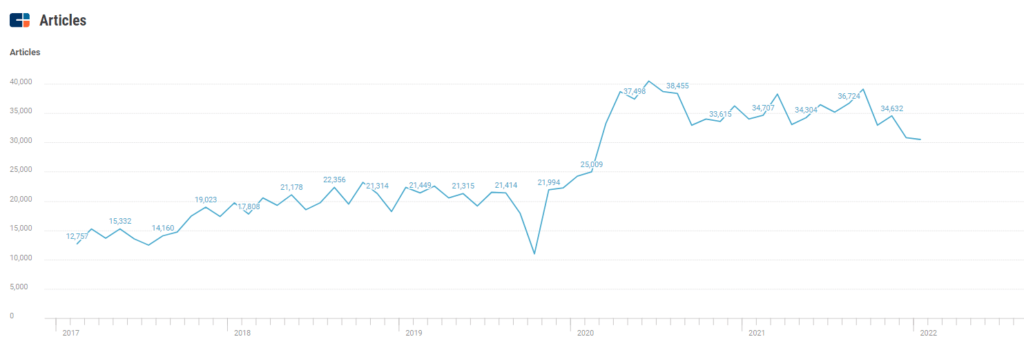

News mentions of “wearable wallet” and “wearable payments” peaked in 2020 amid the Covid-19 pandemic and remained elevated throughout 2021. Source: CB Insights

FIRST MOVERS

Tech giants Apple, Google, and Samsung are some of the first movers in this category. All 3 players already pair their mobile wallet offerings with smartwatches that enable contactless transactions (including in-house devices such as the Samsung Galaxy and Apple Watch). While Google doesn’t have a self-branded smartwatch yet, the company completed its Fitbit acquisition (along with Fitbit Pay) in 2021, and is rumored to be launching its own smartwatch, Pixel Watch, in 2022.

But the shift to wearable payments goes far beyond big tech and already spans across the globe. Bulgaria-based iCard offers digital wallets paired with NFC key fobs that can be attached to house keys. The company also offers its cards on Garmin Watch. US-based Bee claims to offer the world’s smallest wearable wallet, a 0.9-inch device that can be attached to watches, bracelets, bags, or keychains. Bee’s wearable device is activated via a fingerprint scan to add a layer of security and avoid accidental charges. Coil and PureWrist are two other examples of US-based companies that offer wearable wallets as watches or wristbands.

Bee’s 0.9-inch wearable device requires no charging and can be controlled through the BeeHive app, which offers additional management services. Source: Bee

Others have added broader capabilities to their wearable wallets. India-based Xenxo offers the S-Ring, which allows users to monitor health, play music, open locked doors, take calls, as well as make contactless payments. Similarly, Italy-based Flywallet offers a fingerprint-protected wearable wallet that can store cards, passwords, smart keys, and even digital IDs. Users can choose from Flywallet’s watch, bracelet, or keyring options.

More futuristic scenarios may bring a plethora of wearable options going mainstream, such as glasses, stickers, jewelry, contact lenses, or even microchips that can be inserted in a user’s hand. Advances are already taking place in some of these categories. Just a few months ago, London-based Walletmor launched its payment implants, a biopolymer device that can be implanted just under the skin. Sold for $299, the NFC-powered implant allows users to make payments with their hands or wrists.

In the post-smartphone world, wearable technologies will be a key expansion area for mobile wallet providers. In order to bring a more seamless payment experience to users, fintechs in this category will continue to develop new ecosystems of connected wearables devices, moving key functionalities away from their pockets and smartphones in the process.

IMPLICATIONS

- One key challenge for wearable wallets will be shifting their value proposition from nice-to-have to must-have. Mobile phones can already function as digital wallets, so wearables makers will need to convince consumers that they offer a differentiated — and more seamless — experience.

- The price point of wearable devices will be one of the deciding factors in gaining widespread adoption.

- The wearable wallet market will also need to address users’ privacy and security concerns, heightened by the limited history of the industry.

- Biometric payment tools will emerge as a strong alternative to wearable wallets by reducing individuals’ need to carry any type of device. Amazon’s palm scanning tool, Amazon One, is one such example.

Looking ahead

The wallets of the future will be safer and smarter, while continuing to become even more convenient.

Whether stored in a users’ smartphone or attached to their wrist, the next generation of mobile wallets will go beyond transaction facilitation, offering a variety of financial products as well as digital ID management and dedicated virtual assistants.

Equipped with advanced AI-driven analytics and customized user experiences, our wallets will play a larger role in our financial decisions over time, becoming reliable advisors and trusted sources of information for all things finance.

If you aren’t already a client, sign up for a free trial to learn more about our platform.