The Series A funding helps bring Zolve to a $210M valuation. Here are the top-line bullets you need to know.

Zolve, a neo banking platform for those moving from India to the US (or vice versa), has raised $40M in a Series A. The round drew participation from Accel, DST Global, Lightspeed Venture Partners, Tiger Global Management, and Alkeon Capital Management.

How’s the company performing?

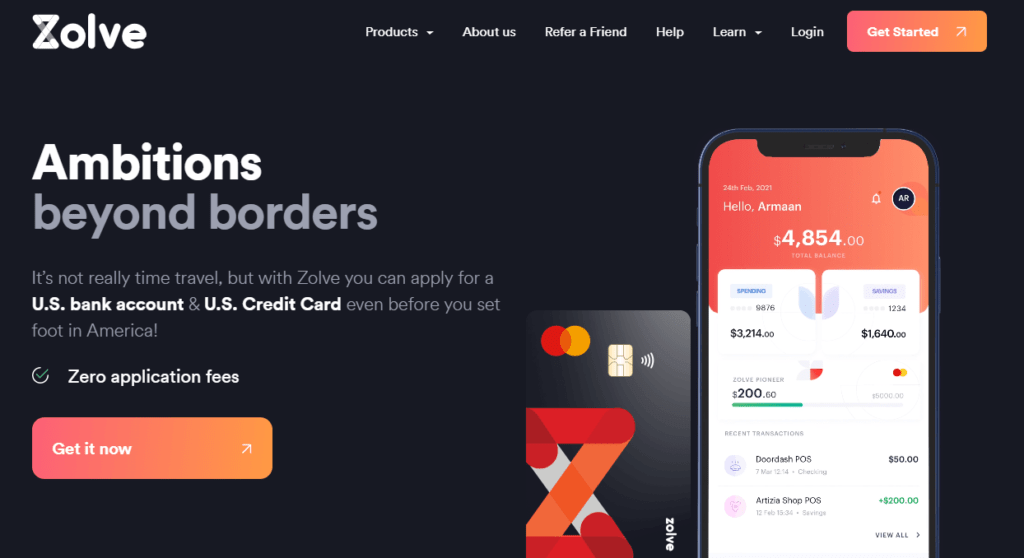

- India-based Zolve offers credit cards, debit cards, and local bank accounts to Indian immigrants in the US. The platform not only caters to immigrants from India but also those from Australia, the UK, Germany, and Canada.

- The company claims that it rolled out its credit card to roughly 2,000 customers last month.

- The startup has seen around $2M worth of deposits from its customers.

- Zolve’s employee base has grown to 100 from 5 earlier this year.

Source: Zolve

Why does the market matter?

- The global digital banking market is projected to grow at a CAGR of 8.9% to reach a value of $1.61T by 2027, according to Research Dive.

- Estimates project that 3.6B individuals — roughly 1 out of every 2 adults — will use digital banking services across mobile and desktop platforms by 2024.

- Global shutdowns and branch closures have spurred the adoption of digital banking amid the Covid-19 pandemic.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.