The funding helps N26 hit a valuation of just over $9B. Here are the top-line bullets you need to know.

N26, a fintech startup, has raised $900M in Series E funding. The round drew participation from Third Point Ventures, Coatue Management, and Dragoneer Investment Group, among others.

How’s the company performing?

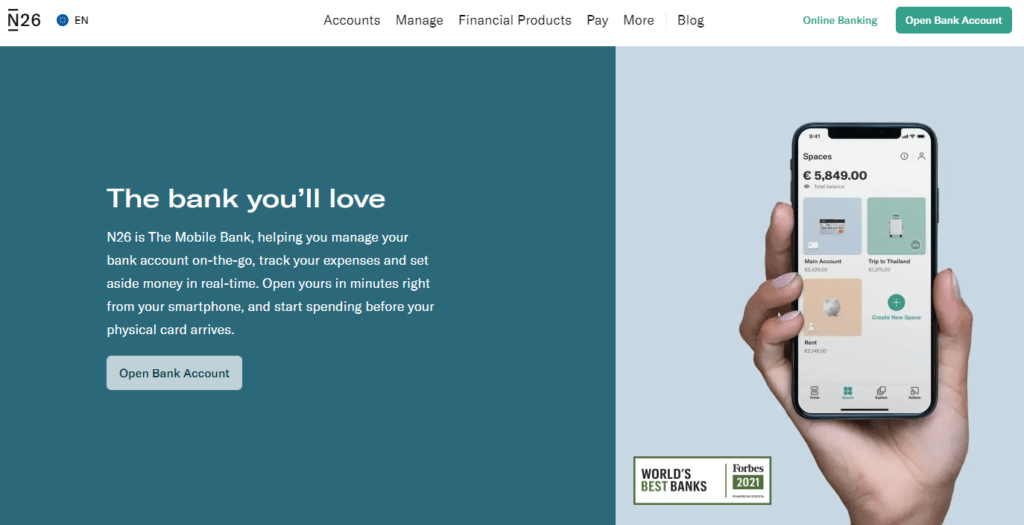

- Germany-based N26 offers digital bank accounts to its customers, helping them track their expenses and save money. Its products and services include personal bank accounts, business bank accounts, and various kinds of insurance and related services.

- It currently caters to about 7M customers across 25 markets.

- The company has 10 global offices in cities like Berlin, Madrid, Sao Paulo, and New York, and is supported by a team of over 1,500 employees.

Source: N26

Why does the market matter?

- The global digital banking market is projected to grow at a CAGR of 8.9% to reach a value of $1.61T by 2027, according to Research Dive.

- 3.6B individuals — roughly 1 out of every 2 adults — will use digital banking services across mobile and desktop platforms by 2024.

- Global shutdowns and branch closures stemming from the outbreak of Covid-19 are spurring the adoption of digital banking.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.