Blockchain is transforming everything from payments transactions to how money is raised in the private market. Will the traditional banking industry embrace this technology or be replaced by it?

Blockchain technology has received a lot of attention over the last decade, propelling beyond the praise of niche Bitcoin fanatics and into the mainstream conversation of banking experts and investors.

In September 2017, JP Morgan Chase CEO Jamie Dimon derided Bitcoin: “It’s worse than tulip bulbs,” he said, referencing the 17th-century Dutch tulip market bubble. “It won’t end well. Someone is going to get killed.” Lloyd Blankfein, senior chairman of Goldman Sachs, echoed that thought, saying, “Something that moves 20% [overnight] does not feel like a currency. It is a vehicle to perpetrate fraud.”

Despite the skepticism, the question of whether blockchain and decentralized ledger technology (DLT) will replace or revolutionize elements of the banking system remains.

And this very loud and public backlash against cryptocurrencies from banks begs another question: What do banks have to be afraid of?

The short answer is “a lot.”

Blockchain and banking: The role of DLT in financial services

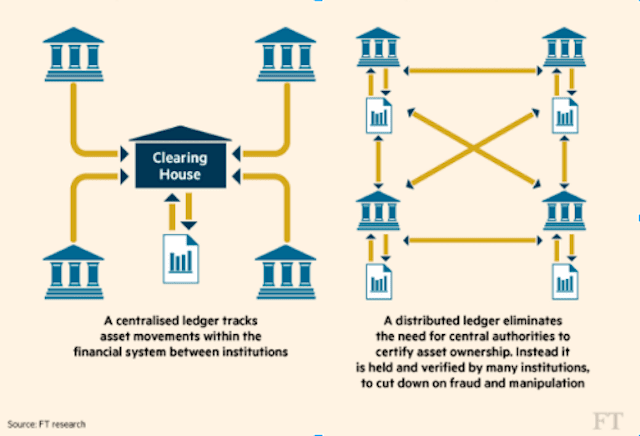

Blockchain technology provides a way for untrusted parties to come to an agreement on the state of a database, without using a middleman. By providing a ledger that nobody administers, a blockchain could provide specific financial services — like payments or securitization — without the need for a bank.

Further, blockchain allows for the use of tools like “smart contracts,” self-executing contracts based on the blockchain, which could potentially automate manual processes from compliance and claims processing to the distribution of content from a will.

For use cases that don’t need a high degree of decentralization — but could benefit from better coordination — blockchain’s cousin, “distributed ledger technology (DLT),” could help corporates establish better governance and standards around data sharing and collaboration.

Blockchain technology and DLT have a massive opportunity to disrupt the $7T+ banking industry by disintermediating the key services that banks provide, including:

- Payments: By establishing a decentralized ledger for payments (e.g., Bitcoin), blockchain technology could facilitate faster payments at lower fees than banks.

- Clearance and Settlement Systems: Distributed ledgers can reduce operational costs and bring us closer to real-time transactions between financial institutions.

- Fundraising: Initial Coin Offerings (ICOs) are experimenting with a new model of financing that unbundles access to capital from traditional capital-raising services and firms.

- Securities: By tokenizing traditional securities such as stocks, bonds, and alternative assets — and placing them on public blockchains — blockchain technology could create more efficient, interoperable capital markets.

- Loans and Credit: By removing the need for gatekeepers in the loan and credit industry, blockchain technology can make it more secure to borrow money and provide lower interest rates.

- Trade Finance: By replacing the cumbersome, paper-heavy bills of lading process in the trade finance industry, blockchain technology can create more transparency, security, and trust among trade parties globally.

- Customer KYC and Fraud Prevention: By storing customer information on decentralized blocks, blockchain technology can make it easier and safer to share information between financial institutions.

Read on for a deep dive into how blockchain technology could turn the traditional banking industry on its head while enabling new business models through technology. To learn about the other industries blockchain is affecting, take a look at our article on 65 industries blockchain could disrupt.

1. Payments

Takeaways

- Blockchain technology offers a secure and cheap way of sending payments that cuts down on the need for verification from third parties and beats processing times for traditional bank transfers.

- 90% of members of the European Payments Council believe blockchain technology will fundamentally change the industry by 2025.

Today, trillions of dollars slosh around the world via an antiquated system of slow payments and added fees.

If you work in San Francisco and want to send part of your paycheck back to your family in London, you might have to pay a $25 flat fee for a wire transfer and additional fees adding up to 7%. Your bank gets a cut, the receiving bank gets a cut, and you’re charged exchange rate fees. Your family’s bank might not even register the transaction until a week later.

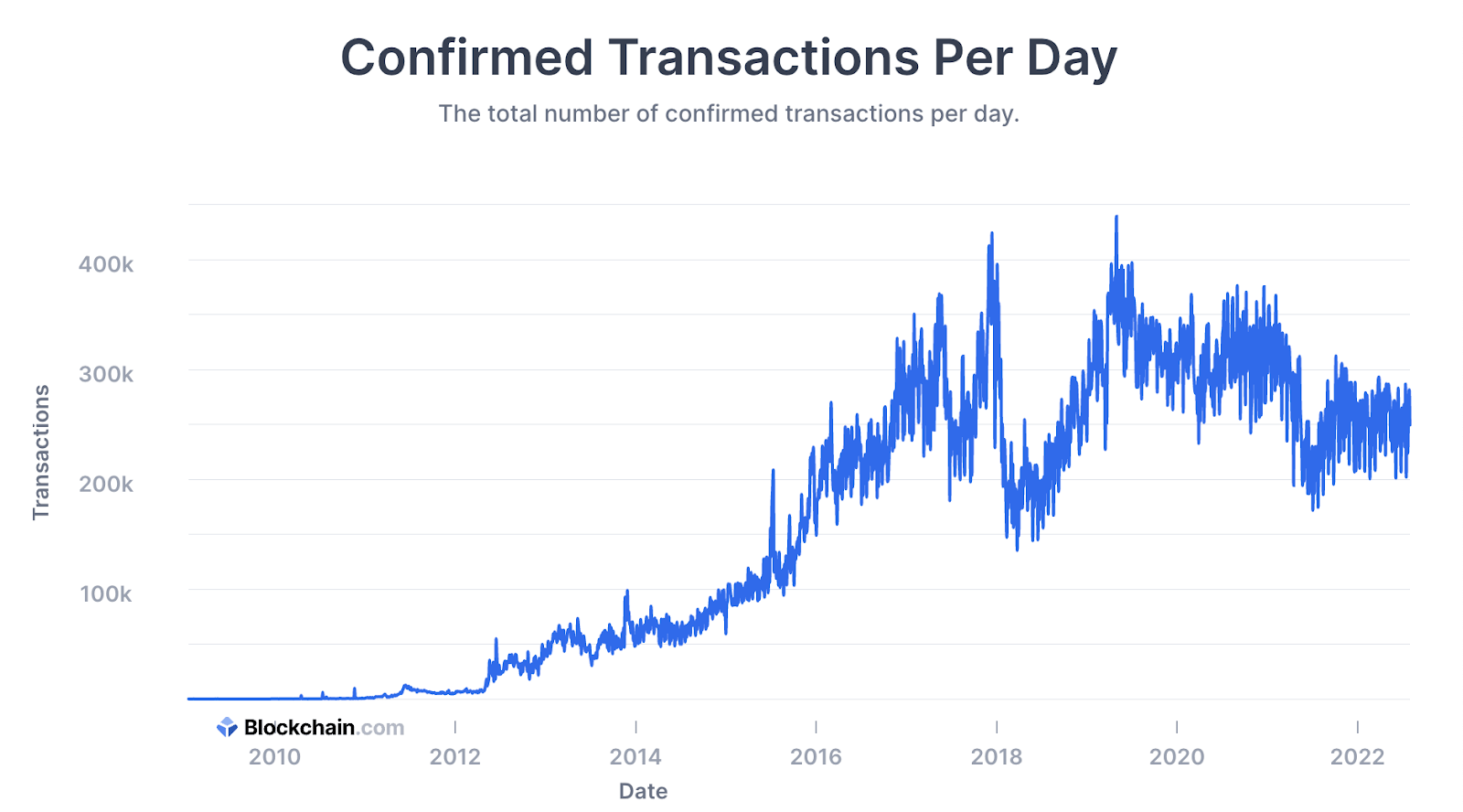

The number of confirmed Bitcoin transactions per day has grown from just over 50,000 in January 2014 to over 249,000 as of August 2022. Source: Blockchain.com

Facilitating payments is highly profitable for banks, providing them with little incentive to lower fees. For instance, cross-border transactions in C2B and B2B generated $175B in payments revenues in 2020.

Cryptocurrencies like bitcoin and ether are built on public blockchains (Bitcoin and Ethereum, respectively) that anyone can use to send and receive money. Public blockchains cut down on the need for trusted third parties to verify transactions and give people around the world access to fast, cheap, and borderless payments.

Bitcoin transactions currently take 25 minutes on average to settle, although this can lengthen to hours or even days in extreme cases. That’s still not perfect, but it represents a leg up from the average 3-day processing time for bank transfers. And due to their decentralized and complex nature, crypto-based transactions are difficult for governments and regulatory bodies to control, observe, and shut down.

Developers are also working on scaling cheaper solutions to process crypto transactions more quickly. Bitcoin Cash and TRON, for example, have relatively low-priced transactions at an average of less than a penny each.

Examples of improved payments through blockchain

While cryptocurrencies are a long way from completely replacing fiat currencies (like the US dollar) when it comes to payments, the last couple of years have seen mostly upward growth in transaction volume for cryptocurrencies like bitcoin and ether. In fact, the Ethereum network became the first to settle $1T in transactions in one calendar year in 2020.

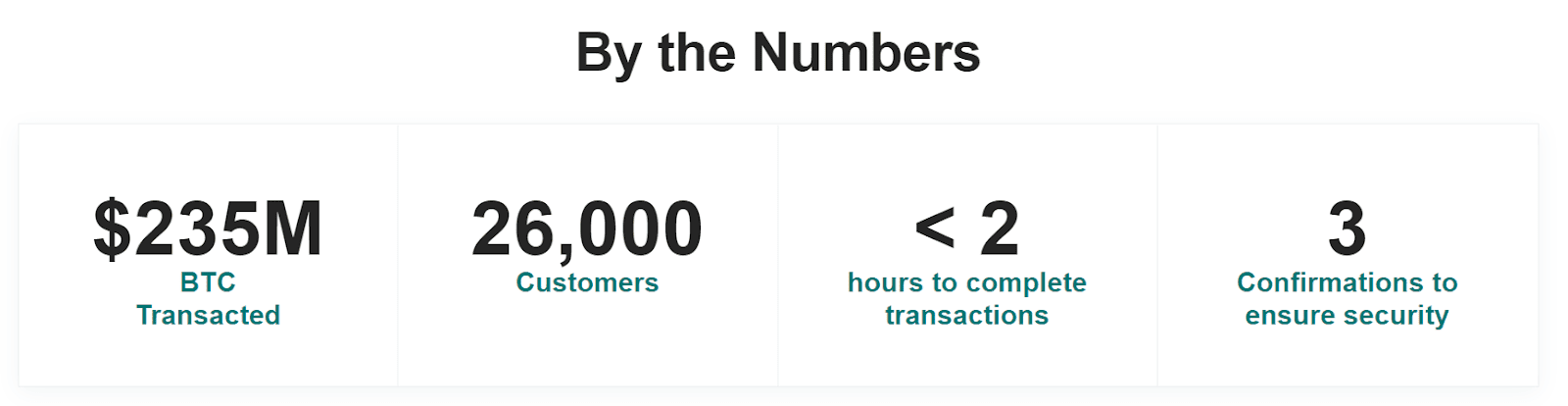

Some companies are using blockchain technology to improve B2B payments in developing economies. One example is BitPesa, which facilitates blockchain-based payments in countries like Kenya, Nigeria, and Uganda. The company has processed millions of dollars in transactions, reportedly growing 20% month-over-month.

Source: BitPesa

BitPesa is also widely used for remittances sent throughout sub-Saharan Africa, the most expensive region in the world for sending money. Crypto payments platforms such as BitPesa have led to a reduction of over 90% in transfer fees in the region.

Blockchain companies are also focusing on enabling businesses to be able to accept cryptocurrencies as payment. For example, BitPay, a payment service provider that helps merchants accept and store bitcoin payments, has a number of integrations with e-commerce platforms like Shopify and WooCommerce. In 2022, it announced support for DoorDash and Uber Eats payments. To pay for their food, cryptocurrency owners have 3 different payment options: purchase an Uber Eats or DoorDash gift card with their crypto wallet, pay with their BitPay Card, or order from Menufy or Takeaway.com, which accept direct cryptocurrency payments.

Ethereum-based payments platform AirFox, which was acquired by Brazil-based retailer Via Varejo in May 2020, partnered with MasterCard to allow customers to pay using its banQi app at global points of sale, as well as at every Via Varejo location.

HUPAYX, a South Korea-based crypto payments startup, partnered with several South Korean businesses in 2019 to create a payments network. At the time, this enabled consumers to pay using the HUPAYX mobile app and point-of-sale infrastructure at over 400,000 stores, including duty-free stores and shopping complexes.

In the payroll space, companies such as Bitwage and PaymentX enable companies to pay their employees in cryptocurrency. Once the employer transfers the salary to the crypto payroll provider, it automatically converts it from fiat to cryptocurrency and makes it available in the employee’s crypto wallet. While crypto payroll appeals to all companies that want to attract workers with innovative salary payment options, it’s especially beneficial to organizations with a global workforce, as it’s quicker and cheaper compared to wire transfer.

Blockchain technology is also being used to facilitate micropayments, which represent amounts usually less than a dollar. For instance, SatoshiPay, an online cryptocurrency wallet, allows users to pay tiny amounts to access paid online content on a pay-per-view basis. Users can load their wallets with bitcoin, US dollars, or any other payment token supported by the app.

One big factor driving the coming disruption of the payments industry is the fact that the infrastructure supporting it is just as liable to disruption — the world of clearance and settlements.

2. Clearance and Settlements Systems

Takeaways

- Distributed ledger technology could allow transactions to be settled directly and keep track of transactions better than existing protocols like SWIFT.

- Ripple and R3, among others, are working with traditional banks to bring greater efficiency to the sector.

The fact that an average bank transfer — as described above — takes 3 days to settle has a lot to do with the way our financial infrastructure was built.

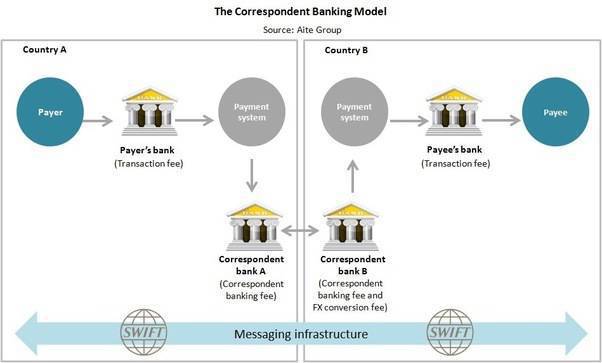

It’s not just a pain for the consumer. Moving money around the world is a logistical nightmare for the banks themselves. Today, a simple bank transfer — from one account to another — has to bypass a complicated system of intermediaries, from correspondent banks to custodial services, before it ever reaches any kind of destination. The two bank balances have to be reconciled across a global financial system composed of a wide network of traders, funds, asset managers, and more.

If you want to send money from a UniCredit Banca account in Italy to a Wells Fargo bank account in the US, the money transfer will be executed through the Society for Worldwide Interbank Financial Communication (SWIFT), which sends 44.8M messages a day for more than 11,000 financial institutions.

Source: Aite Group

Because UniCredit Banca and Wells Fargo don’t have an established financial relationship, they have to search the SWIFT network for a correspondent bank that has a relationship with both banks and can settle the transaction — for a fee. Each correspondent bank maintains different ledgers, at the originating bank and the receiving bank, which means that these different ledgers have to be reconciled at the end of the day.

The centralized SWIFT protocol doesn’t actually send the funds; it simply sends the payment orders. The actual money is then processed through a system of intermediaries. Each intermediary adds additional cost to the transaction and creates a potential point of failure.

Blockchain technology, which serves as a decentralized “ledger” of transactions, could disrupt this state of play. Rather than using SWIFT to reconcile each financial institution’s ledger, an interbank blockchain could keep track of all transactions publicly and transparently. That means that instead of having to rely on a network of custodial services and correspondent banks, transactions could be settled directly on a public blockchain.

Further, blockchain technology allows for “atomic” transactions, or transactions that clear and settle as soon as a payment is made. This stands in contrast to current banking systems, which clear and settle a transaction days after a payment.

That might help alleviate the high costs of maintaining a global network of correspondent banks. An Accenture survey among 8 global banks found that blockchain technology could bring down the average cost of clearing and settling transactions by $10B annually.

Examples of improved transactions through blockchain

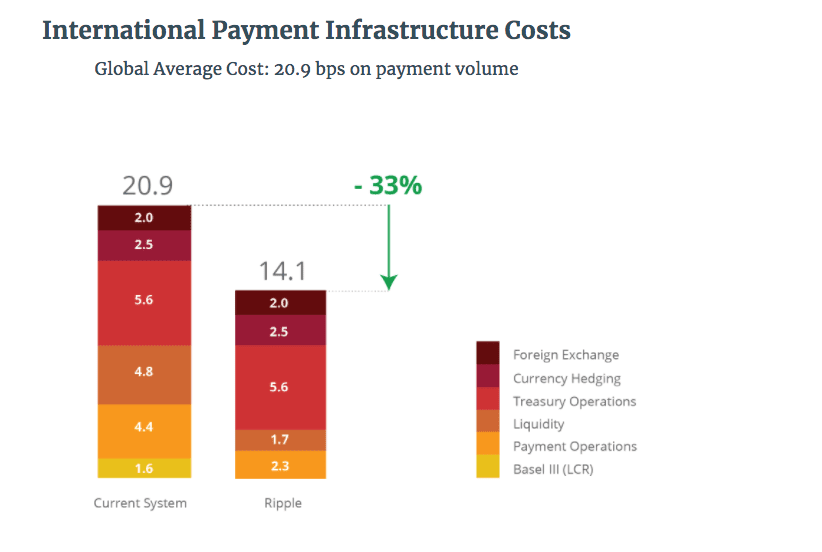

Ripple, an enterprise blockchain services provider, is one of the most prominent players working on clearance and settlement. While the company is best known for its associated cryptocurrency XRP, the venture-backed company itself is building out blockchain-based solutions for banks to use for clearance and settlement.

SWIFT messages are one-way, much like emails, which means that transactions can’t be settled until each party has screened the transaction. By integrating directly with a bank’s existing databases and ledgers, Ripple provides banks with a faster, two-way communication protocol that permits real-time messaging and settlement. Ripple currently has over 300 customers in over 40 countries signed up to experiment with its blockchain network.

Source: Ripple

Ripple also helps settle cross-border transactions in a shorter period. If a trader in Mexico wants to send money to their counterpart in the US, a traditional bank transaction would require that both traders have local currency accounts in the countries in which they wish to receive their money. Ripple removes this requirement. The trader in Mexico can simply use Mexican pesos to buy XRP tokens through the exchange to pay their American counterpart. The US trader can change these XRP tokens for dollars. And this entire transaction can happen in a fraction of a second, Ripple claims.

R3 is another major player working on distributed ledger technology for banks. It aims to be the “new operating system for financial markets.” It raised $107M in May 2017 from a consortium of banks like Bank of America, Merrill Lynch, and HSBC, although it has also lost some key members, such as Goldman Sachs, which departed because it wanted more operational control over the system.

R3’s technology was used by Switzerland’s central bank for a pilot to settle large transactions between financial institutions using digital currencies. The Swiss National Bank (SNB) said in December 2020 that the project, called Project Helvetia, was a success. SNB successfully completed Phase II of the project in January 2022, which tested digital currency for transaction settlement with 5 commercial banks.

Additionally, in 2021, R3 announced a partnership with the Singapore-based ASEAN Financial Innovation Network. The collaboration aims to enable financial service providers to develop central bank digital currency applications. It also partnered with OneHypernet to develop a blockchain multilateral netting solution for the pooling of funds to easily execute payments.

Projects like Ripple and R3 are working with traditional banks to bring greater efficiency to the sector. They’re looking to decentralize systems on a smaller scale than public blockchains by connecting financial institutions to the same ledger in order to increase the efficiency of transactions.

Blockchain technology is also playing a role in the political sphere. In response to sanctions that cut Russian banks out of the SWIFT system, a Russian company is reportedly developing a SWIFT blockchain alternative. According to financial experts, however, the likelihood of it replacing SWIFT is minuscule.

Blockchain projects are doing more than just making existing processes more efficient, however. While still in their early days — and while we continue to see mostly experiments, pilots, and proofs-of-concepts (PoCs) take form — they’re creating entirely new types of financial activity. The fundraising space is a notable example of this.

3. Fundraising

Takeaways

- In initial coin offerings (ICOs), entrepreneurs raise money by selling tokens or coins, allowing them to fundraise without a traditional investor or VC firm (and the due diligence that accompanies an investment from one).

- Blockchain company EOS raised over $4B in its year-long ICO ending in 2018.

- While ICO activity has declined in recent years, this model still demonstrates blockchain’s potential impact when it comes to reshaping traditional fundraising.

Raising money through venture capital is an arduous process. Entrepreneurs put together decks, sit through countless meetings with partners, and endure long negotiations over equity and valuation in the hopes of exchanging some chunk of their company for a check.

In contrast, some companies are raising funds via initial coin offerings (ICOs), powered by public blockchains like Ethereum and Bitcoin.

In an ICO, projects sell tokens, or coins, in exchange for funding (often denominated in bitcoin or ether). The value of the token is — at least in theory — tied to the success of the blockchain company. Investing in tokens is a way for investors to bet directly on usage and value. Through ICOs, blockchain companies can circumvent the conventional fundraising process by selling tokens directly to the public.

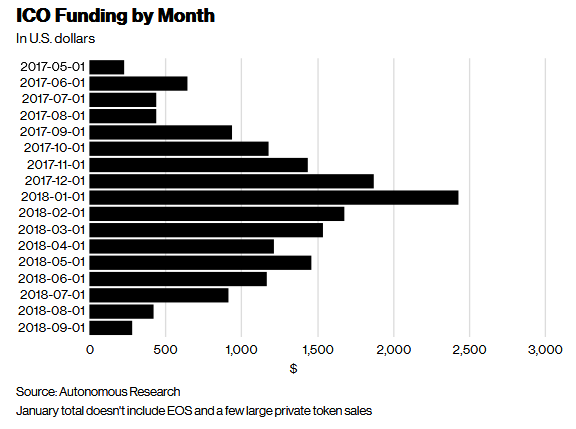

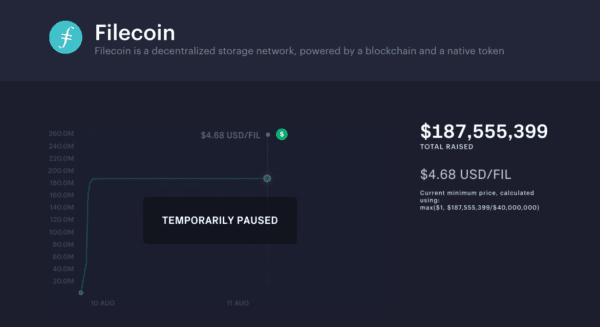

Some high-profile ICOs have raised hundreds of millions — even billions — of dollars before proof of a viable product. Filecoin, a blockchain data storage startup, raised $257M in 2017, while EOS, which is building a “world computer,” raised over $4B in its year-long ICO. Since then, however, the EOS blockchain has floundered, due to issues ranging from a dwindling user base to important developers moving on from the project.

ICOs themselves have also struggled in the years since 2017. While use remained hot into 2018, the bubble burst halfway through the year, sending ICO funding into a downward spiral.

In recent years, ICOs have also been challenged by regulators, who have closely monitored the sales and are cracking down on violations.

In February 2021, for instance, the SEC brought charges against individuals that allegedly engaged in digital asset fraud, which included unregistered ICOs. According to the SEC, the individuals used two ICOs to defraud investors of more than $11M.

At the same time, initial coin offerings represent a paradigm shift in how companies finance development.

First, ICOs occur globally and online, giving companies access to an exponentially larger pool of investors. You’re no longer limited to high-net-worth individuals, institutions, and others who are able to show the government that they’re credible investors.

Second, ICOs give companies immediate access to liquidity. The moment you sell a token, it’s priced on a 24-hour global market. Compare that to 10 years for venture-backed startups. As Earn CEO Balaji Srinivasan says, “The ratio between 10 years and 10 minutes to get the option of liquidity is up to a 500,000x speedup in time.” We’re already seeing the impact of ICOs on the fundraising market.

Venture capital firms have taken notice, with Sequoia, Andreessen Horowitz, and Union Square Ventures, among others, all directly investing in ICOs, as well as gaining exposure by investing in cryptocurrency hedge funds.

Venrock partner David Pakman has said, “There’s no question that crypto will disrupt the business of venture capital. And I hope it does. The democratization of everything is what has excited me about technology from the beginning.”

Examples of improved fundraising through blockchain

While the majority of ICOs thus far have been for pre-revenue blockchain projects, we’re seeing more and more technology companies build around a paradigm of decentralization.

Messaging app Telegram, for example, raised $1.7B via ICO. The idea behind the ICO is to sell tokens to users and bootstrap a payment platform on top of the messaging network. If, as blockchain advocates predict, the next Facebook, Google, and Amazon are built around decentralized protocols and launched via ICO, it will eat directly into investment banking margins.

Several promising blockchain companies have emerged around this space. Companies like CoinList, which began as a collaboration between Protocol Labs and AngelList, are bringing digital assets to the mainstream by helping blockchain companies structure legal and compliant ICOs. For instance, decentralized finance platform Ondo Finance was able to raise $10M in a CoinList ICO. In 2021, CoinList’s monthly trading volume grew to $1B.

Demand for Filecoin’s ICO on CoinList was so high that it caused server overload within an hour of launch. Filecoin ultimately raised over $257M via ICO.

CoinList has developed a bank-grade compliance process that blockchain companies can access through a streamlined API, helping projects ensure everything from due diligence to investor accreditation. While CoinList’s platform is designed for blockchain projects, its focus on reducing the logistical and regulatory load around fundraising is being mirrored in the public markets. Investment banks today are experimenting with automation to help eliminate the thousands of work hours that go into an IPO.

And CoinList is just the start. A number of companies are emerging around the new ICO ecosystem, from Waves, a platform for storing, managing, and issuing digital assets, to Republic.co’s crypto initiative, which is aimed at helping people invest in ICOs for as little as $10.

Of course — given regulatory pronouncements — ICO activity should be taken with a grain of salt, particularly given that the bubble of unregulated ICOs largely burst after 2018. Even aside from regulatory pressure, there’s no doubt that many of these projects will fail altogether.

What’s interesting is that they’re testing out blockchain technology that could replace the functions of traditional banks. This is not just limited to company fundraising but also to the underlying fabric of securities.

GET THE LIST OF BLOCKCHAIN 50 COMPANIES

The Blockchain 50 is our annual ranking of the 50 most promising companies within the blockchain ecosystem.

4. Securities

Takeaways

- Blockchain tech removes the middleman in asset rights transfers, lowering asset exchange fees, giving access to wider global markets, and reducing the instability of the traditional securities market.

- Moving securities on blockchains could save $17B to $24B per year in global trade processing costs.

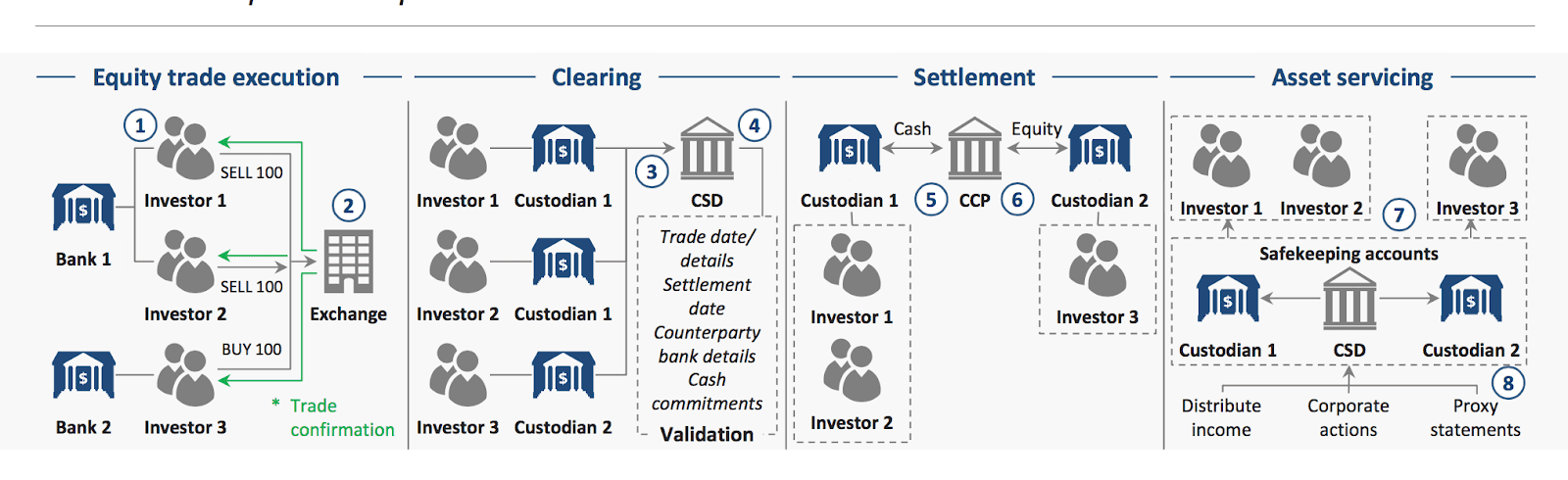

To buy or sell assets like stocks, debt, and commodities, you need a way to keep track of who owns what. Financial markets today accomplish this through a complex chain of brokers, exchanges, central security depositories, clearinghouses, and custodian banks. These different parties have been built around an outdated system of paper ownership that is not only slow but can be inaccurate and prone to deception.

Say you want to buy a share of Apple stock. You might place an order through a stock exchange, which matches you with a seller. In the old days, that meant you’d spend cash in exchange for a certificate of ownership for the share.

This grows a lot more complicated when we’re trying to execute this transaction electronically. We don’t want to deal with the day-to-day management of the assets — like exchanging certificates, bookkeeping, or managing dividends. So, we outsource the shares to custodian banks for safekeeping. Because buyers and sellers don’t always rely on the same custodian banks, the custodians themselves need to rely on a trusted third party to hold onto all the paper certificates.

Settling and clearing an order on an exchange involves multiple intermediaries and points of failure.

In practice, that means that when you buy or sell an asset, that order is relayed through a whole bunch of third parties. Transferring ownership is complicated because each party maintains its own version of the truth in a separate ledger.

Not only is this system inefficient, but it’s also imprecise. Securities transactions take between 1 and 3 days to settle because everyone’s books have to be updated and reconciled at the end of the day. Because there are so many different parties involved, transactions often have to be manually validated. Each party charges a fee.

Blockchain technology promises to revolutionize financial markets by creating a decentralized database of unique, digital assets. With a distributed ledger, it’s possible to transfer the rights to an asset through cryptographic tokens, representing assets “off-chain.” While Bitcoin and Ethereum have accomplished this with purely digital assets, new blockchain companies are working on ways to tokenize real-world assets, from stocks to real estate to gold.

The potential for disruption is massive. The four largest custody banks in the US — State Street, BNY Mellon, Citi, and JP Morgan — each oversee over $12T of assets under custody. While fees typically represent a small percentage, profits come from the sheer volume of assets. Using blockchain technology, tokenized securities have the potential to cut out middlemen such as custodian banks altogether, lowering asset exchange fees.

Further, through smart contracts, tokenized securities can work as programmable equity — paying out dividends or performing stock buybacks through a couple of lines of code. Finally, putting real-world assets on blockchain technology has the potential to usher in broader, global access to markets.

Examples of improved securities processes through blockchain

There are a number of blockchain technology companies that want to help migrate trillions of dollars of financial securities to the blockchain. For instance, Polymath launched its blockchain network, Polymesh, in 2021, with 14 regulated financial entities serving as node operators that could validate new blocks on the chain. Since then, Polymath also added investment firm Greentrail and digital asset exchange Huobi as node operators.

Meanwhile, financial institutions aren’t sitting still. The Australian Stock Exchange plans to replace its system for bookkeeping, clearance, and settlements with a blockchain solution, developed by Digital Asset Holdings, by April 2023. In the UK, the London Stock Exchange is also moving toward blockchain solutions with its recent hiring of a head of group digital assets. The news followed the UK government announcing its plan to introduce legislation that would support the development and use of DLT, as well as cryptocurrency and stablecoins.

In 2017, enterprise-focused blockchain company Chain — since acquired by Stellar — successfully orchestrated live transactions between Nasdaq and Citi’s banking infrastructure via integration. Meanwhile, Overstock’s CEO launched a trading platform called tZERO, which aims to create a blockchain-backed dark pool, or private exchange, for securities that might be listed on the Nasdaq.

Finally, in 2019, HSBC said it planned to digitize private investment transaction records by moving $20B worth of assets onto its Digital Vault blockchain. The move was driven in part by investor demand for real-time information surrounding their assets.

While tokenized assets are a promising use case for blockchain technology, regulation remains an important hurdle to consider. Regulatory and legislative guidance will be key to the success of these nascent projects.

The worlds of the consumer, the financial institution, and blockchain are slowly converging. Another space where that convergence has the potential to completely upend the way finance operates today is lending and credit — a domain that’s no stranger to disruption.

5. Loans and Credit

Takeaways

- Blockchain-enabled lending offers a more secure way of offering personal loans to a larger pool of consumers and would make the loan process cheaper, more efficient, and more secure.

- The first live securities lending took place in 2018 with a $30.5M transaction between Credit Suisse and ING.

Traditional banks and lenders underwrite loans based on a system of credit reporting. Blockchain technology opens up the possibility of peer-to-peer (P2P) loans, complex programmed loans that can approximate a mortgage or syndicated loan structure, and a faster and more secure loan process in general.

When you fill out an application for a bank loan, the bank has to evaluate the risk that you won’t pay them back. It does this by looking at factors like your credit score, debt-to-income ratio, and home ownership status. To get this information, it has to access your credit report provided by one of 3 major credit agencies: Experian, TransUnion, and Equifax.

Based on that information, banks price the risk of default into the fees and interest collected on loans.

This centralized system can be hostile to consumers. Nearly 1 in 3 Americans has a subprime credit rating, according to Experian, which is a significant obstacle to accessing loans at affordable interest rates. Further, concentrating this sensitive information within 3 institutions creates a lot of vulnerability. The September 2017 Equifax hack exposed the credit information of nearly 150M Americans.

Alternative lending using blockchain technology offers a cheaper, more efficient, and more secure way of making personal loans to a broader pool of consumers. With a cryptographically secure, decentralized registry of historical payments, consumers could apply for loans based on a global credit score.

While blockchain projects in the lending space are still in their infancy, there are a couple of interesting projects out there around P2P loans, credit, and infrastructure.

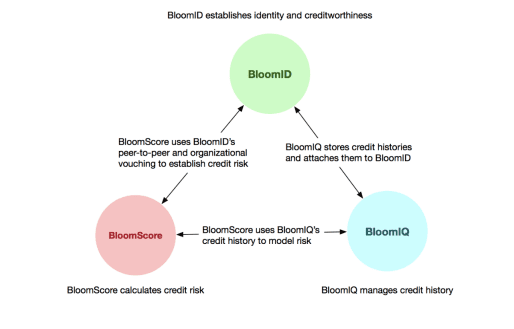

The Bloom protocol seeks to issue credit based on a track record of successful identity attestation on the network, without trusted third parties. Source: Bloom

Examples of improved lending through blockchain

One company, SALT Lending, lends cash using a blockchain. Users of SALT Lending’s platform can borrow money against any bitcoin, ether, or blockchain asset as collateral. Loans are approved based not on a borrower’s credit score but on the value of the collateral. To use this platform, a user must buy the platform’s cryptocurrency, SALT. This grants a user membership to be able to take out loans.

In 2022, SALT Lending partnered with Cion Digital to extend crypto lending solutions to more than 5,000 car dealerships in the US. Those looking to purchase a vehicle will be able to use crypto as collateral for a loan, to make a down payment, or to buy a car outright.

Dharma Labs, a protocol for tokenized debt, stood as another example of improved lending using blockchain. It aimed to provide developers with the tools and standards necessary for building online debt marketplaces. But in early 2022, OpenSea acquired Dharma Labs and shut down the Dharma app as part of the acquisition.

Blockchain startup Bloom has brought credit scoring to the blockchain with a protocol for managing identity, risk, and credit scoring using blockchain technology. Its 2020 partnership with credit bureau TransUnion also enabled Bloom users to check their credit score for free on the app, as well as get an overview of their loans and credit cards.

While most of these projects focus on creating liquidity through loans around people’s existing crypto assets, they’re also jumpstarting the infrastructure that will enable bigger disruption in loans via blockchain.

6. Trade Finance

Takeaways

- The use of blockchain and distributed ledger technology can support cross-border trade transactions that would otherwise be uneconomical because of costs related to trade and documentation processes. It would also shorten delivery times and reduce paper use.

- With approximately 80%–90% of world trade relying on trade finance, the influence of blockchain on the market would be felt globally throughout all industries that use cross-border trading.

Trade finance exists to mitigate risks, extend credit, and ensure that exporters and importers can engage in international trade.

It is a pivotal part of the global financial system, and yet it frequently operates on antiquated, manual, and written documentation. Blockchain represents an opportunity to streamline and simplify the complex world of trade finance, saving importers, exporters, and their financiers billions of dollars every year.

Blockchain technology’s presence in trade programs has been increasing for a few years now, but its mainstream role in bills of lading and credit has only recently started to take shape.

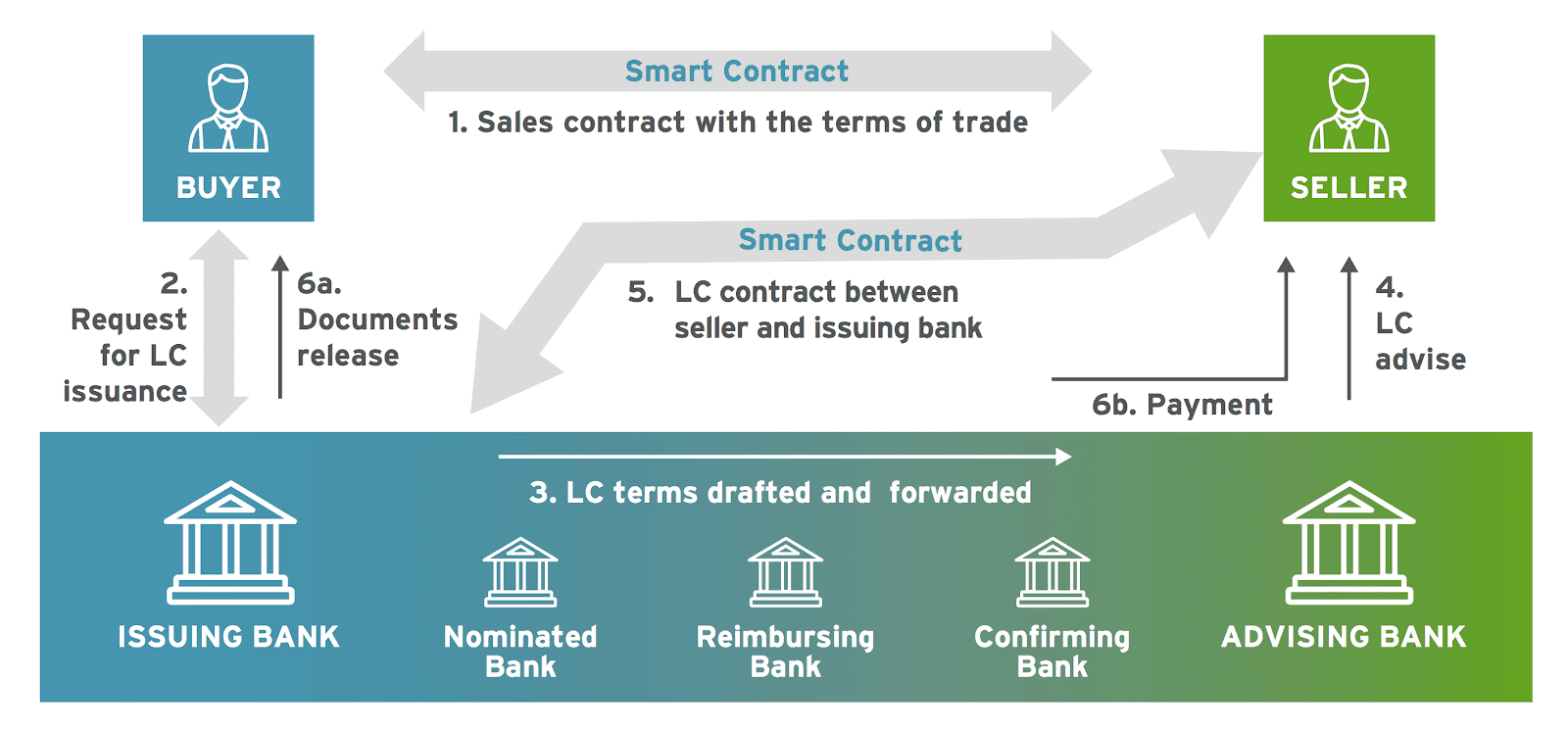

Like many industries, the trade finance market has long suffered from logistical setbacks stemming from old, outdated, and uneconomical manual documentation processes. Physical letters of credit, given by one party’s bank to the other party’s bank, are still often used to ensure that payment will be received.

Blockchain technology, by enabling companies to securely and digitally prove country of origin, product, and transaction details (and any other documentation), could help exporters and importers establish a greater degree of trust by providing each other with more visibility into the shipments moving through their pipelines.

For example, one of the greatest risks to trade parties is the threat of fraud, particularly due to the lack of confidentiality and oversight surrounding the flow of goods and documentation. This opens up the possibility of the same shipment being repeatedly mortgaged, an unfortunate occurrence that happens so often that commodity trade finance banks write it off as a cost of business.

Through blockchain technology, payments between importers and exporters could take place in tokenized form contingent upon delivery or receipt of goods. Through smart contracts, importers and exporters could set up rules that would enable automatic payments and cut out the possibility of missed, lapsed, or repeatedly mortgaged shipments.

Source: Cognizant

The adoption of blockchain technology in trade finance could also give buyers better insight into where their goods originate from and when they’ve been shipped. Under traditional systems, this information is often incomplete. But a blockchain could enable consumers to be updated at each step of the trade, further increasing trust and transparency.

Examples of improved trade finance through blockchain

Arguably, the time has come for blockchain in trade finance, with multiple companies and banks weighing in to find a solution that will stick.

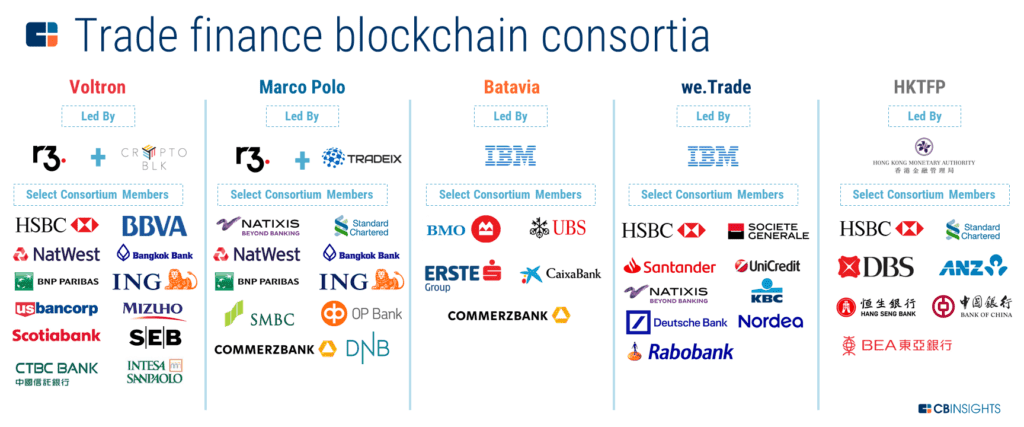

Standard Chartered and HSBC are 2 banks that have joined consortia dedicated to using blockchain technology to fix trade finance.

One of those consortia is Voltron, which operated a blockchain platform for digitizing paper letters of credit and was run by run by R3 and CryptoBLK. It conducted pilots in 14 countries and included over 50 corporates and banks in a worldwide trial, which resulted in processing times for letters of credit dropping from 5–10 days to less than 24 hours. In 2020, it rebranded itself as Contour, launching a digital trade finance network backed by R3 and several other banks.

These types of bets don’t always come to fruition. In October 2020, DBS and Standard Chartered announced that they were working on a blockchain-based trade finance platform called Trade Finance Registry in partnership with 12 other banks, including ABN AMRO, Deutsche Bank, ICICI Bank, and Lloyds. The platform was intended to help detect fraud and duplicate financing for a single transaction in real time.

However, the project ultimately abandoned blockchain: after a pilot built by Dltledgers, the Trade Finance Registry chose MonetaGo to build the platform. Instead of blockchain, MonetaGo chose to use confidential computing to prevent fraud, saying that blockchain wasn’t efficient enough for its needs on a global scale. This is a prime example of the tendency for blockchain projects to fall through as they move from theory to practice.

On the other hand, fintech companies such as Israel-based Wave have developed platforms that enable finance groups to provide letter credit transactions as a blockchain solution.

In 2016 Wave came together with Barclays to provide a blockchain solution to Ornua and Seychelles Trading Company that enabled them to streamline their supply chain, reduce transaction costs and documentation errors, and quickly transfer documents to customers around the world.

In this instance, the trade process for almost $100,000 of cheese and butter, from the issuing of the letter of credit to the approval of it, took less than 4 hours, drastically down from the traditional time of 7–10 days.

The Mediterranean Shipping Company and Hapag-Lloyd also use Wave’s electronic Bill of Lading solution, which eliminates paperwork and simplifies documentation for shipping companies. According to the Digital Container Shipping Association (DCSA), if 50% of shippers implemented electronic Bill of Lading solutions, like Wave’s, the shipping industry could save over $4B each year.

Blockchain and DLT have also enabled trade between Australia and Japan by facilitating trade-related processes from letter of credit issuance to the delivery of trade documents. Here, the trade process was carried out by Hyperledger Fabric — built by the Linux Foundation — and secured by IBM.

While all of these projects focus on creating simpler processes to secure trade financing, it is also critical that financial institutions complete their due diligence for each customer and transaction. And blockchain technology has proven capable of helping them do just that.

7. Customer KYC and Fraud Prevention

Takeaways

- Blockchains can store customer information on different blocks, which could help prevent attacks on customer information.

- Blockchain technology for KYC purposes can bring down costs for the banking sector by up to $160M annually.

Apart from the day-to-day activities of clearing transactions, processing payments, and trading, a bank also needs to onboard customers, verify their identities, and ensure that their information is in order. This process is called “know your customer” (KYC).

Banks can spend up to 3 months executing all KYC proceedings, which include verification of photo IDs, documents such as address proofs, and biometrics. A delayed KYC process may cause some customers to terminate their relationship. Twelve percent of companies said that they had changed their bank due to delays in the KYC process, according to a Thomson Reuters survey.

Apart from time and effort, complying with KYC rules also costs banks money. The same survey revealed that banks end up spending up to $500M annually on KYC compliance and customer due diligence.

Blockchain tech can help reduce the human effort and cost involved in KYC compliance. With KYC customer information stored on a blockchain, the decentralized nature of the platform would allow all institutions that require KYC to access that information. Using blockchain for KYC purposes could reduce personnel requirements for banks by 10%, equating to cost savings of up to $160M annually, according to Goldman Sachs.

Banks can also use blockchain tech to enhance fraud and cyberattack detection.

The rise of fraud and cyberattacks is one of the leading causes of concern for the banking industry, according to BNY Mellon Treasury Services. The reason being that banks have moved to store all customer information in centralized ledger systems, which makes that data particularly vulnerable to an attack.

By decentralizing the storage of information, blockchain technology helps prevent a hacker from easily gaining access to all of that customer information at once.

Another way of supporting safe transactions online is by using blockchain-based smart contracts. These contracts operate on an “if/then” basis, which refers to the idea that the next step of a given process won’t occur if the prior one hasn’t been completed. This could allow for more fail-safes to be built into the digital transaction process.

Examples of improved KYC through blockchain

Blockchain-based credit scoring platform Bloom allows customers to create blockchain-based profiles using its mobile application. Bloom’s identity monitoring tool, meanwhile, continually scans the internet and the dark web to identify any potential leaks of a customer’s information.

OnRamp, Bloom’s latest KYC and anti-money laundering (AML) compliance tool, features sanction and politically exposed person (PEP) screening as well as ID verification. A recent integration with Plaid also allows users to connect to and verify their bank account information.

Quadrata is another blockchain KYC solutions provider. It recently raised a $7.5M seed funding round to further develop the Quadrata Passport, which is currently available on the Ethereum blockchain. The Passport enables users to store verifiable compliance and KYC/AML identity information on a non-transferable NFT.

Similarly, HSBC, Deutsche Bank, and Mitsubishi UFJ Financial Group, in partnership with IBM, have tested a service to share KYC information via blockchain. They were able to eliminate the information collection duplication among different financial institutions as well as support the secure digitization and storage of all customer information.

Beyond the hype of blockchain technology

Disruption doesn’t happen overnight, and much of blockchain technology has yet to be perfected or widely tested.

Die-hard believers expect blockchain and cryptocurrencies to replace banks altogether. Others think that blockchain technology will supplement traditional financial infrastructure, making it more efficient.

It remains to be seen to what degree banks embrace the technology. One thing is clear, however: blockchain will indeed transform the industry.

If you aren’t already a client, sign up for a free trial to learn more about our platform.