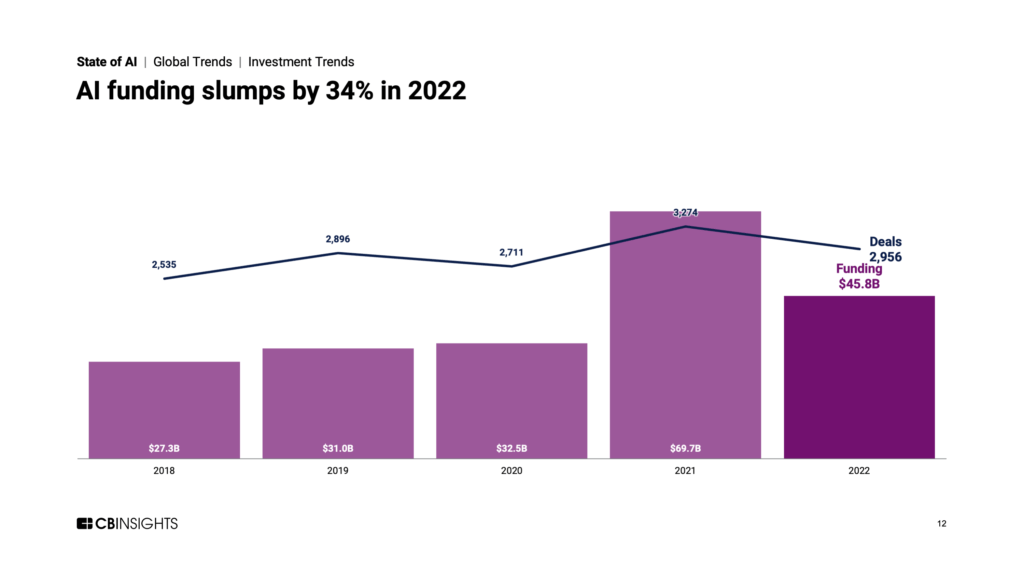

Global AI funding fell by 34% in 2022 but rebounded on a quarterly basis in Q4'22 — breaking a streak of 4 quarters of decline.

Global AI funding fell to $45.8B in 2022 — down 34% from 2021’s record tally but still significantly above pre-2021 levels. Annual deals held up better, sliding 10% to hit 2,956.

This annual funding drop aligned with broader VC funding activity, but AI’s quarterly performance bucked the overall trend in Q4’22. While AI funding increased 15% quarter-over-quarter (QoQ) to reach $9.3B in Q4’22, venture funding as a whole saw a 19% fall over the same period.

Other 2022 highlights across the AI ecosystem include:

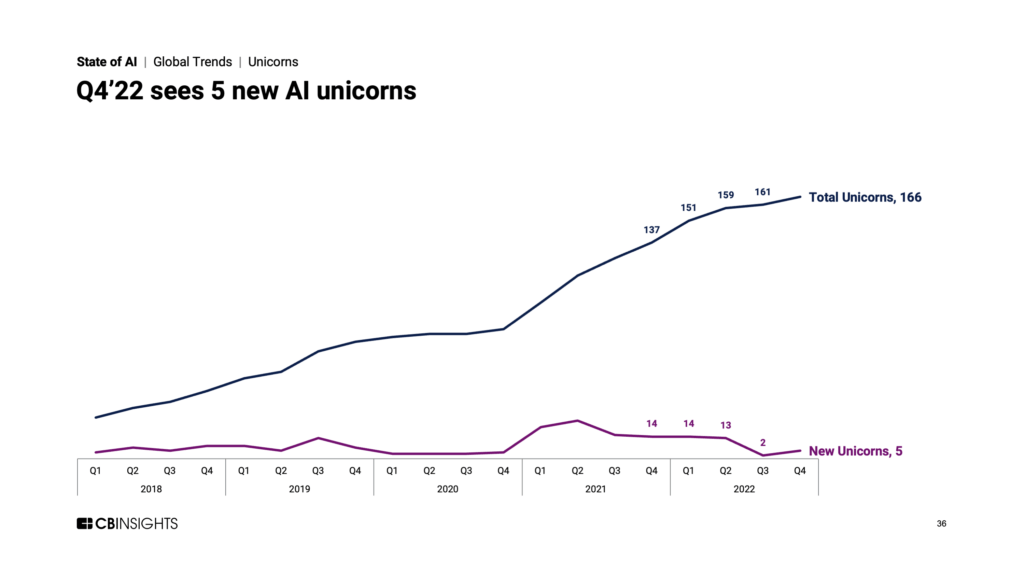

- In 2022, the total AI unicorn herd reached 166 with 34 new unicorn births. This is just less than half the number born in 2021. In Q4’22, 5 AI unicorns emerged — quickening the pace QoQ but at a slower rate than in 2021. Additions in Q4’22 included Stability AI, a generative AI company that raised a $101M seed round.

- The number of mega-rounds in 2022 plummeted from 2021’s record high to just 115, a 39% drop. These deals represented $21.8B in funding, down 47% year-over-year (YoY). The top AI round was a $1.5B Series E to defense tech startup Anduril.

- AI exits fell across the board in 2022, with the number of M&A deals, IPOs, and SPACs all tumbling. M&A exits held up best, only falling by 17% YoY to 259 deals. IPOs nosedived by 57% to 19. SPACs plunged by 50% to 8.

- Europe bucked the broader trend for AI investment activity. In 2022, AI deals increased by 6% to 616 — a record level for the region. Funding also held up relatively well, falling by 9% to $6.2B. The UK drove a great deal of this activity, accounting for 48% of Europe’s AI funding and 32% of its deals in 2022.

Download the full State of AI 2022 Report to dig into all these trends and more.