The global venture ecosystem experiences a sharp pullback in 2022, with funding dropping by 35% from 2021.

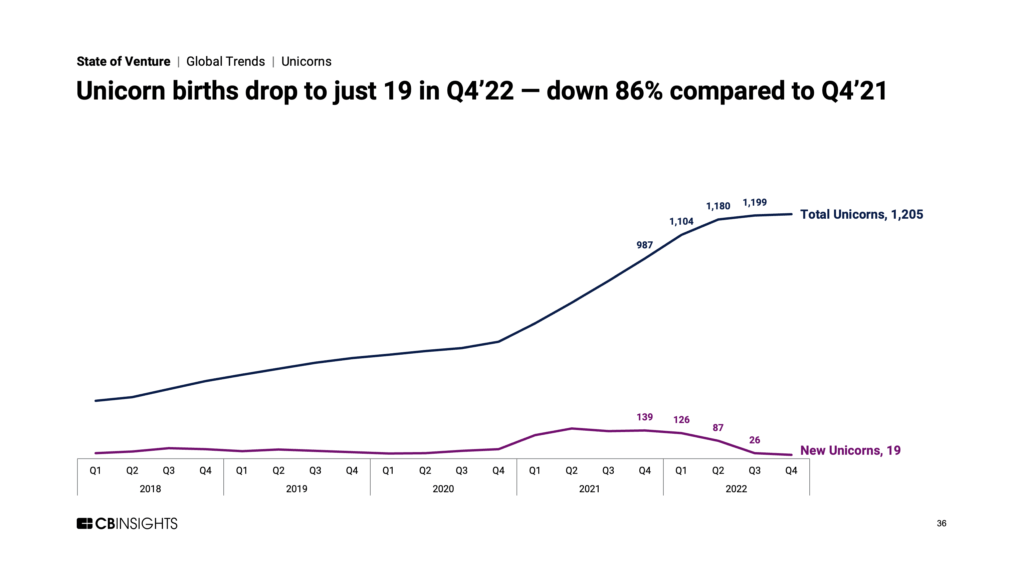

Global venture funding reached $415.1B in 2022, marking a 35% drop from a record 2021. The funding slowdown was especially severe in the second half of the year, with Q4’22 funding clocking in at $65.9B — down 64% YoY to return to pre-Covid levels.

US-based companies accounted for just under half (48%) of all funding and 34% of all deals in 2022. Some of the country’s largest rounds in Q4’22 went to Anduril, Form Energy, and NetSPI.

Other 2022 highlights across the venture ecosystem include:

Other 2022 highlights across the venture ecosystem include:

- US venture funding hit $198.4B in 2022 — down 37% from 2021, but up 31% when compared to 2020. Deals to US-based startups dropped 7% YoY to reach 12,141.

- Global IPO count dropped by 31% in 2022 to 716. M&A deals also took a hit, dropping by 8% to 10,037. SPAC deals saw the largest drop among exits types in 2022, falling by 44% from their peak in 2021 (140) to 78.

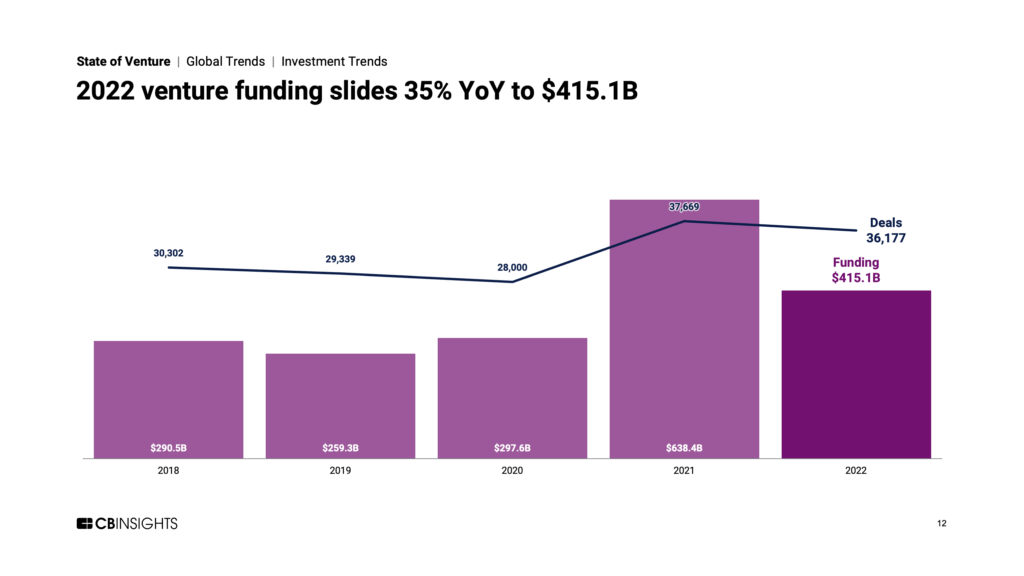

- Unicorn births steadily declined throughout 2022, sinking to a low of 19 new unicorns in Q4’22 — an 86% drop compared to Q4’21.

- $100M+ mega-rounds collectively accounted for $190.1B in funding in 2022, marking a 49% drop from 2021. The number of global mega-rounds dropped by 42% to 923 in 2022.

- Digital health funding saw the sharpest YoY drop among sectors analyzed, falling by 57% to hit $25.9B across 2,122 deals in 2022. Digital health was the only sector where both funding and deals in 2022 dropped below 2020 levels.

- Fintech funding also continued to contract. Fintech companies raised $10.7B across 972 deals in Q4’22, marking an 18% drop QoQ and a 16-quarter low.

- Africa-based companies raised $991M in Q4’22 — a 164% jump QoQ. On an annual basis, Africa drew $3.1B in funding in 2022 — a new annual record for the continent.

Download the full State of Venture 2022 Report to dig into all these trends and more.