We share our rationale, data, and views on valuation.

This analysis is part of our series on 2024 M&A predictions. See all 10 matchups here.

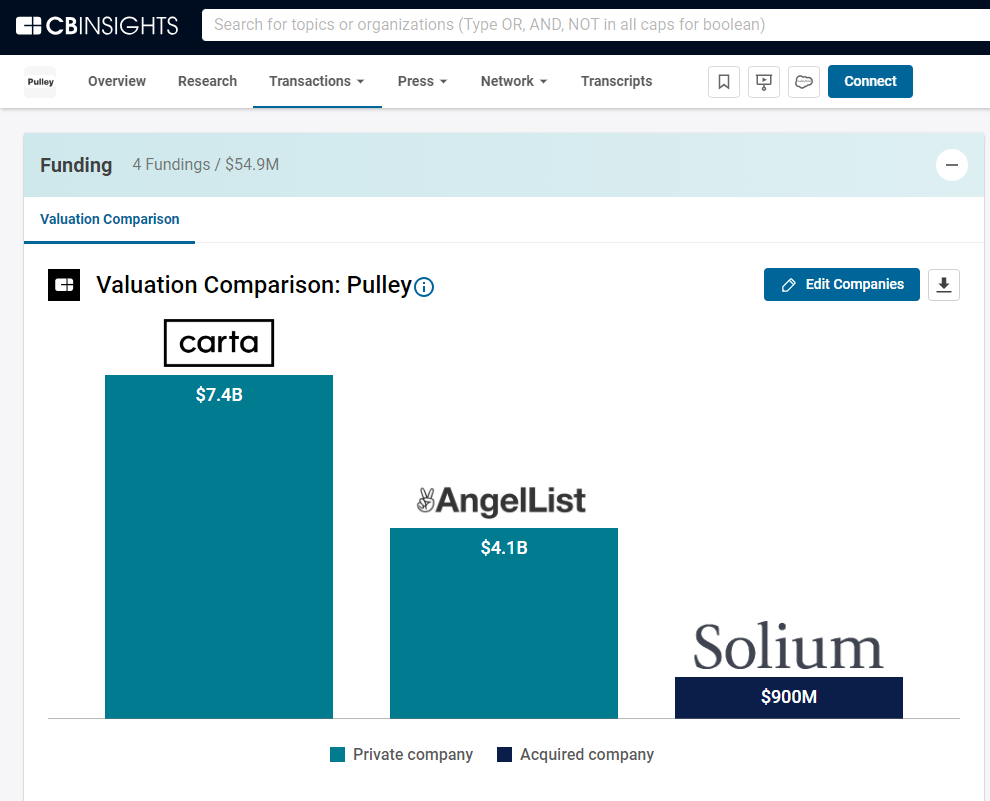

Pulley is part of the crowded equity cap table management space and appears to be doing well against the likes of Carta based on a mining of the software buyer interview transcripts on CB Insights.

We predict it will be an attractive target for employee management platform Rippling in 2024.

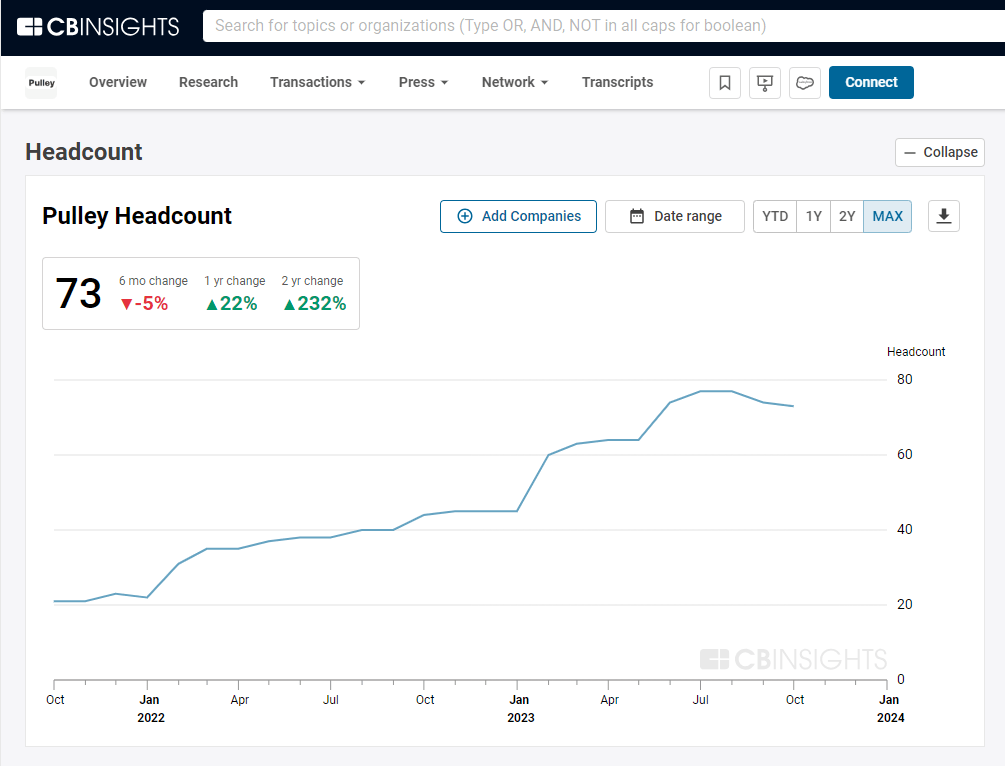

It’s still a relatively small company growing quickly — which means it could be a good fit for Rippling CEO Parker Conrad’s culture of having founders in the company.

So why would Rippling acquire Pulley?

- Merges Rippling’s HR and IT solutions with Pulley’s cap table and equity management.

- Creates a streamlined startup operations platform ideal for startups needing both HR infrastructure and equity planning tools.

- Enables more cohesive employee data management, from payroll to equity distribution appealing to a broader range of startups and growth-stage companies.

- Done right, it could set a new standard for holistic employee management platforms.

- Would also maintain parity with or likely be a better equity management offering than what Rippling competitor Deel is offering after its January 2023 acquisition of Capbase.

Find our next M&A prediction in this series — GLG acquires Tegus — here.

If you aren’t already a client, sign up for a free trial to learn more about our platform.