To sustain the cryptocraze, Coinbase will need to foster real applications of cryptoassets — and not just speculation.

Coinbase is the most popular consumer-facing cryptoasset exchange in the United States. Operating since 2012, the company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum.

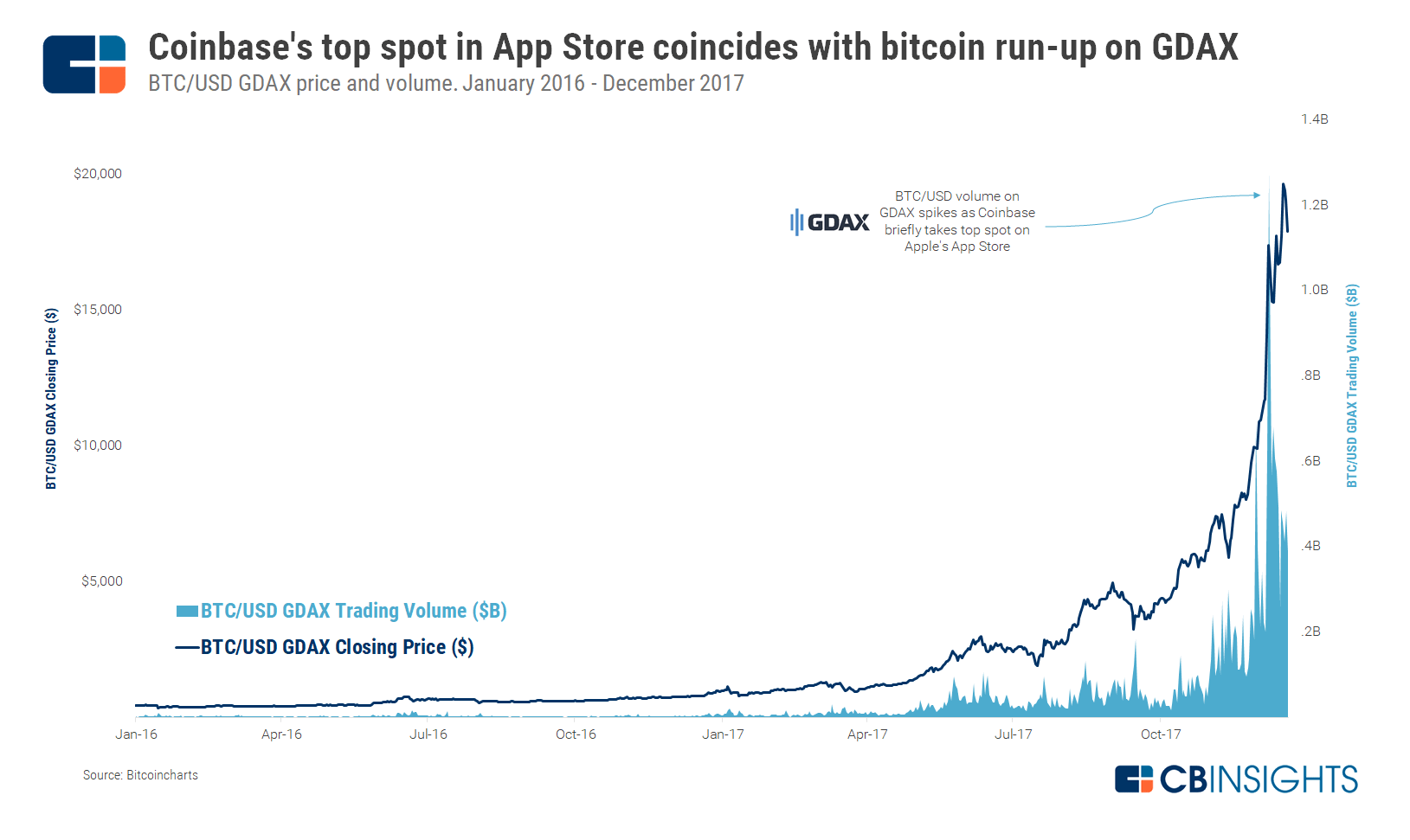

The company already has significant visibility with consumers in a sector that was once exclusively the province of cryptoasset enthusiasts. In May 2021, the company’s mobile app once again reached the top spot on Apple’s App Store after slipping from that position in 2017.

Though the app’s hold on the number one spot was brief, Coinbase has soared in popularity and turned itself into the on-ramp for mainstream crypto investors by positioning itself as a safe harbor among cryptoasset exchanges. The company has never been hacked, unlike many of its competitors. Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance.

DOWNLOAD THE full TEARDOWN

This has helped Coinbase secure nearly $540M in equity financing from some of the biggest-name VCs, and vaulted the company into the unicorn club.

The company made history in April 2021 by being the first crypto company in the world to go public. Coinbase listed on Nasdaq, and its direct listing opened at $350 per share, $100 above its set reference price. Its valuation reached over $112B at one point during its debut but closed at about $86B.

While Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. The company’s stated goal echoes cryptoasset enthusiasts’ ultimate vision: to create a new, “open financial system.”

Coinbase’s CEO Brian Armstrong said that the company’s core mission is “to increase economic freedom in the world.” And to achieve that mission, Coinbase will execute on a three-pronged strategy that positions and promotes crypto assets as an investment vehicle, a new financial system, and an app platform.

For the time being, though, Coinbase looks a lot like a traditional financial services player. The company makes money by charging fees for its brokerage and exchange. It also custodians user funds, like a bank, and decides which cryptoassets to list, like the NASDAQ or NYSE.

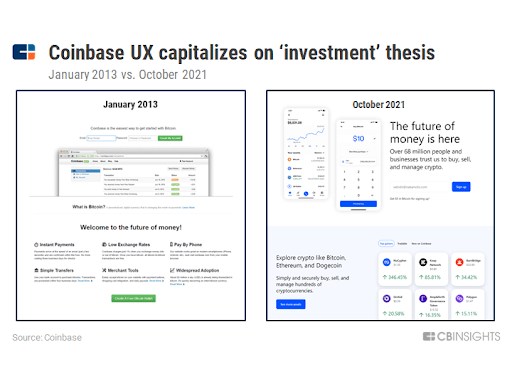

Coinbase thus finds itself caught between worlds: it’s the most well-funded blockchain company in the United States, but it’s a centralized company, not a decentralized ledger. The company once advertised cryptoassets as the “future of money,” but now positions itself as a way to “buy and sell digital currency.” In many ways, Coinbase is a centralized on-ramp to a decentralized ecosystem.

This begs the question: how does Coinbase view the assets that it enables customers to buy and sell? Is it still interested in encouraging crypto adoption to build a new financial system, or primarily occupied with encouraging the speculation that fuels its core lines of business?

In this report, we examine Coinbase’s strategy, financing history, product offerings, business initiatives, threats and future opportunities. We dig into how Coinbase operates, how it’s capitalizing on cryptoasset speculation, and what it’s doing to push forward blockchain technology.

TABLE OF CONTENTS

- WHAT IS COINBASE?

- Coinbase History

- Coinbase & GDAX

- Hosted wallets

- Custody

- Coinbase Wallet

- Coinbase Prime

- Coinbase Commerce

- Product for developers

- Other products

- How Coinbase makes money

- COINBASE AS A CRYPTOASSET KINGMAKER

- From currency to investment

- User metrics

- Security

- Regulatory compliance

- Ease-of-use

- The Coinbase effect

- COINBASE VALUATION & INVESTORS

- THE ROAD AHEAD: AN OPEN FINANCIAL SYSTEM

- An expansion strategy

- Coinbase’s acquisitions

- Coinbase Ventures

- Challenges & Risks

- CLOSING THOUGHTS

Style notes: “Cryptoassets” includes all coins, tokens, and digital assets traded on cryptoasset exchanges. “Bitcoin” refers to the Bitcoin ledger, or protocol, while “bitcoin” refers to the asset or a unit of account on the Bitcoin ledger. This is reflected for all cryptoassets in this report.

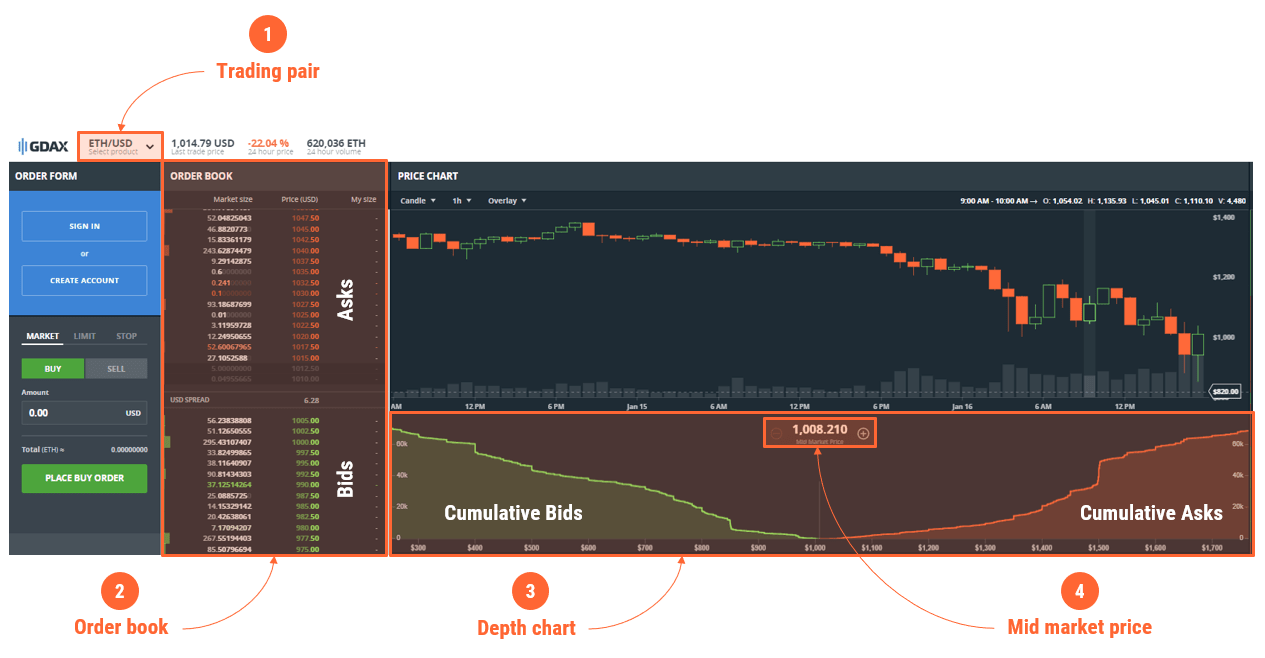

Cryptocurrency exchanges 101

Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: through mining or through an exchange.

Mining has high barriers to entry. Participating in a mining pool or operating mining “rigs” can be expensive and complicated. For the more novice consumer, fiat-cryptoasset exchanges and brokerages – like Coinbase, Kraken, and Bitstamp – have established themselves as the primary on-ramps to this asset class. These allow consumers to trade fiat (e.g. USD, GBP) for cryptoassets (e.g. BTC, ETH, LTC).

There are a couple of important terms to understand when discussing exchanges.

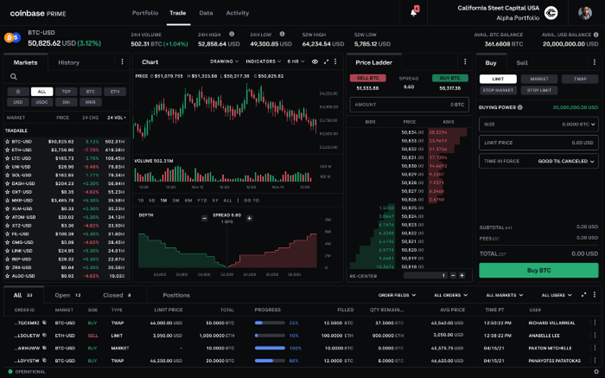

- First, the “trading pair” (or, “currency pair”) is the product being traded. In the above screenshot the product is ETH, and the “quote currency” is USD. This means that traders are buying and selling the cryptoasset ethereum, priced in dollars.

- The order book shows all the bids and asks at a given time. A “bid” is the price at which a buyer will buy, and an “ask” is the price at which a seller will sell. The order book also shows the aggregate amount of asks and bids (supply and demand) at a given price, called the “market size.”

- The “depth chart” is another way to visualize the order book, showing cumulative bid and ask orders over a range of prices. Coupled with volume — or, the total amount traded over a given time period — the depth chart provides a good way to measure “liquidity.” Liquidity describes how easy it is to turn an asset into cash. For instance, if ethereum suddenly saw a massive sell-off, there might not be enough buyers, or enough “liquidity,” for sellers to sell to.

- Lastly, the “mid-market price” is the price between the best “ask” price and the best “bid” price. It can also be defined as the average of the current bid and ask prices. The “price” of an asset (as quoted on Yahoo Finance or Bloomberg, etc.) is a direct function of the bids and asks in the market, which in turn reflect supply and demand.

What is Coinbase?

Coinbase history

Coinbase was founded in July 2011 by former Airbnb engineer Brian Armstrong and was first funded by Y Combinator. In 2012, co-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin.

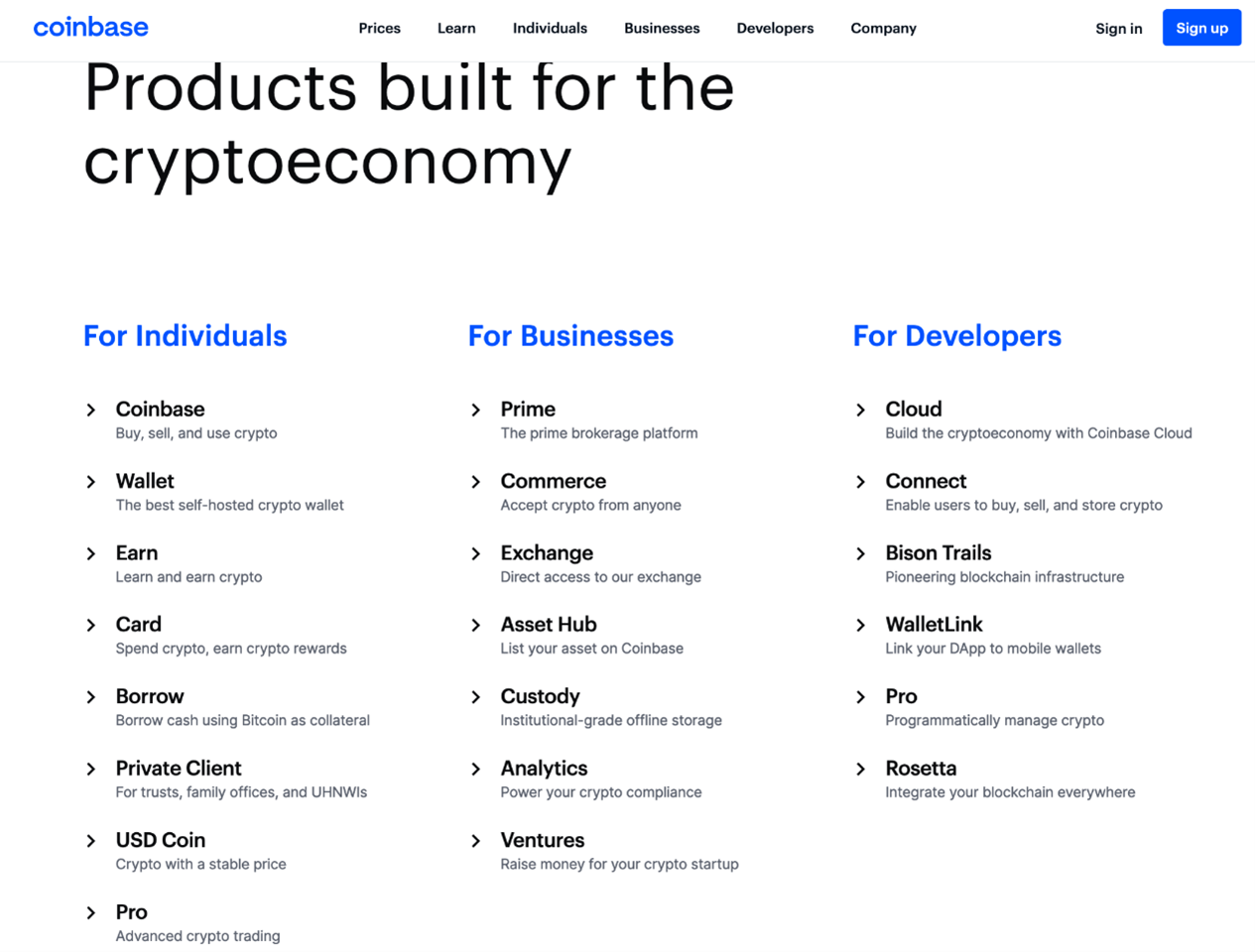

Today, Coinbase operates in over 100 countries, and its 21 products can be divided into 3 primary lines of business:

- For individuals: Coinbase, Wallet, USD Coin

- For businesses: Prime, Commerce, Exchange

- For developers: Cloud, Connect, WalletLink

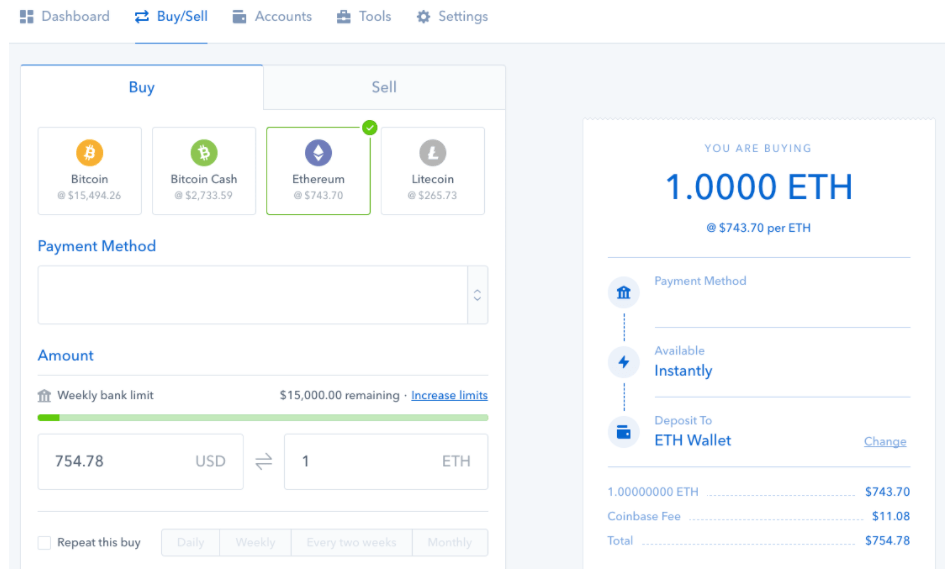

Coinbase & Coinbase Pro

Coinbase operates both an order book exchange, called the Global Digital Asset Exchange (GDAX), and a brokerage, called Coinbase.

More advanced traders (including small institutional players, like cryptoasset hedge funds and family offices) buy and sell cryptoassets on GDAX and determine the mid-market price. Coinbase (the brokerage) then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top.

In practice, retail investors can buy and sell directly from Coinbase’s brokerage, like they might buy a stock from Scottrade or Charles Schwab. Coinbase’s brokerage fees range from roughly 1.5% to 4.0% depending on the user’s payment method; due to increased risk, credit cards come with higher fees than bank transfers. Traders on GDAX pay significantly lower fees.

Of note, Coinbase’s brokerage buys cryptoassets from GDAX, instead of from an outside exchange. This gives the company a secure in-house source of liquidity. Given how often exchanges are hacked or otherwise compromised, this is quite important; Coinbase’s brokerage doesn’t have to rely on anyone else for liquidity.

Hosted wallets

A common mantra found in the cryptoasset community is “be your own bank.” Accordingly, Bitcoin enthusiasts promote what they call “private key management solutions,” which means storing a long string of random numbers or letters offline, either on a piece of paper or on a dedicated storage device (a “hardware wallet”). Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever.

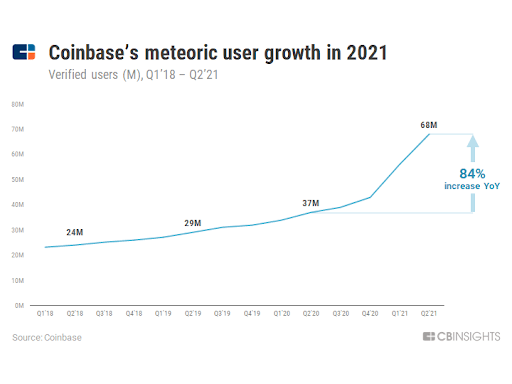

Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. Today, the company has over 68M users.

Coinbase’s customers typically fall into one of two groups: (1) investors, and (2) those transacting with cryptoassets. For investors, Coinbase encourages transferring funds into its “cold storage” vaults, which it guarantees against Coinbase hacking. These vaults are disconnected from the internet and offer increased security. For those transacting (or trading on other exchanges), Coinbase allows users to send funds from Coinbase to other wallets.

Custody

Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value climbed this past year. In order to capitalize on this sidelined institutional money, Coinbase announced “Custody” in November 2017. Coinbase’s institutional holdings increased by 170% to $122B in the first quarter of 2021.

Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. Custody supports 90% of crypto assets — including Polkadot, Litecoin, and FTX Token — by market capitalization. The service is geared toward larger players on Wall Street and costs up to $10,000 in implementation fees, a management fee of 50 basis points on an annual basis, and a minimum balance of $500,000.

Custody is not the first mover in the space. Digital Currency Group’s Genesis Trading has offered institutional players OTC (“over the counter”) trading in cryptoasset markets since 2013, while the Winklevoss Capital-backed Gemini was founded in 2015. Other major OTC providers catering to institutions include Circle, which has raised $713M in venture financing, and DRW’s Cumberland.

Circle said in July 2021 that it would go public via a special purpose acquisition company (SPAC) at a valuation of $4.5B. Circle and Coinbase run a joint stable coin project called the Centre Consortium. The USD Coin is the second-largest cryptocurrency stablecoin, worth $27B.

Additionally, traditional exchanges like the Chicago Board Options Exchange (CBOE) and CME now offer futures trading for cryptoassets, with the CBOE also recently filing for a bitcoin ETF. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold.

Coinbase Wallet

While Coinbase remains focused on its core brokerage and exchange businesses, supporting Coinbase Wallet remains one of the company’s long-term priorities. Wallet is a mobile app that allows users to buy, store, and trade 500+ crypto coins, digital collectibles, NFTs, and more. The app can also be used to lend out crypto assets and earn interest.

At a high level, the aim with Coinbase Wallet is to give users broader access to decentralized applications built on top of various ecosystems like Ethereum and Bitcoin. In this way, Coinbase hopes that Toshi could allow for the building of viable crypto use cases, beyond speculation.

Some current examples include Cent, where users can ask questions and offer bounties for the best answers. Coinbase Wallet launched in April 2017, and has since been installed by millions of users in the Google Play Store alone.

Source: Google Play Store

Critics of Coinbase Wallet point to the app’s centralization. Wallet is built, maintained, and effectively controlled by Coinbase, which might discourage developers from building on top of it.

To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on.

Coinbase Wallet is a hot wallet, which means it stores cryptocurrencies online. This makes users more susceptible to cyber attacks and crypto hacking.

On the flipside, and as a function of centralization, Coinbase can make quick changes to Wallet without community consensus. Coinbase also has a significant number of existing users, brand recognition, and money to spend, which could bode well for Coinbase Wallet’s future adoption.

Coinbase Prime

In September 2021, Coinbase launched Coinbase Prime, which enables institutional investors to buy, store, and trade crypto assets on a massive scale. The platform, which had its beta launch in May, offers various advanced features that aren’t typically available to retail investors.

Users that want to execute large trades are provided with high-touch market assessment and pre-trade support. For instance, Coinbase helped the consumer tech company Meitu to purchase and store $90M worth of bitcoin and ethereum. Institutional investors can also easily move their assets between trading balance and vault.

Coinbase Prime features a smart order router as well. This proprietary technology routes trades to the Coinbase Exchange and a network of partner crypto exchanges to find the best price for the trade.

Source: Coinbase

Coinbase also touts its crypto custodian services that institutional investors find particularly important. They deal with large sums of fiat money and cryptocurrencies that need to be well protected.

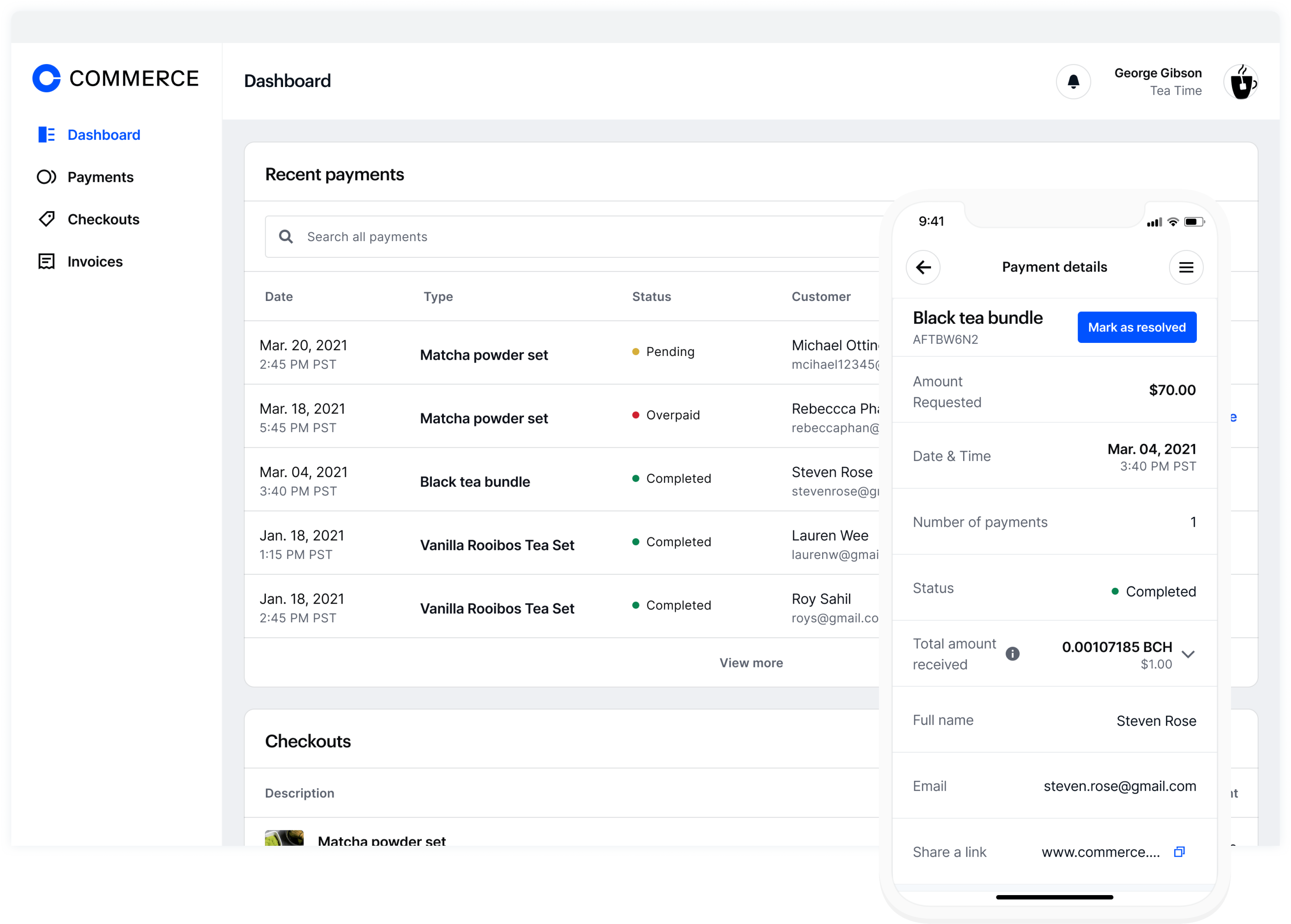

Coinbase Commerce

Businesses can use the Coinbase Commerce platform to accept crypto payments.

Companies that sell a smaller number of products can use Hosted Checkout and payment option buttons to enable customers to pay with Bitcoin, Bitcoin Cash, DAI, Ethereum, Litecoin, or USD Coin. Companies can choose which of these cryptocurrencies they want to accept.

Businesses that run their shops on major eCommerce platforms can integrate Coinbase Commerce into their checkout process. Coinbase offers integration with 12 eCommerce services, including Shopify and Magento. The crypto giant also offers an API for users who want to explore advanced functionalities.

Merchants can withdraw received crypto coins to their Coinbase account. They can then exchange crypto into USDC (a stablecoin whose value represents a single US dollar) or for fiat and withdraw money to their linked bank account. These crypto coins can also be moved to a vault.

Source: Coinbase

Coinbase Commerce is one way the crypto giant makes it easier for companies to integrate crypto into their commerce operations. Another way is by supporting stablecoins. In 2018, Coinbase and the payments infrastructure firm Circle launched USD Coin (USDC). USDC can act as a stable digital dollar that customers can use to buy items offered by crypto companies, whether it’s tickets for blockchain games or NFTs. Users can also send USDC to their friends while being sure that the value won’t change.

Products for developers

Coinbase has built a string of APIs, products, infrastructure systems, and secure services geared towards developers. These tools aim to make it easier for developers to connect to Coinbase customers, integrate cryptocurrencies, build crypto businesses, and more.

Connect, for instance, is an API that teams can use to connect their apps to more than 60M Coinbase customers. Developers can also use the Commerce API to enable merchants to accept crypto payments.

Coinbase Pro’s trading API is another useful tool. Developers can use it to help professional traders place orders and access market data.

In January 2021, Coinbase acquired Bison Trails. Founded just 3 years before this acquisition, the startup makes it easier for developers to connect to, read from, and write to blockchain networks. Bison Trails also helps companies to do staking, mining, and writing smart contracts. The acquisition will allow Coinbase to be of even more value to developers, enabling them to participate in multiple blockchains, build apps, run node clusters, and more.

Other products

Coinbase boasts an impressive number of other products as well. For instance, the company offers Coinbase Card, a Visa debit card that lets users spend their crypto assets held in a Coinbase account and make ATM withdrawals. Shoppers can earn up to 4% back in crypto rewards for purchases.

Coinbase also lets users borrow up to $100,000 using bitcoin as collateral. Users can borrow up to 40% of the value of their bitcoin portfolio and receive cash on PayPal or bank accounts. The balance can be paid off on a schedule that works for customers.

Coinbase Analytics is a product that helps with compliance efforts. Financial institutions, government agencies, and crypto businesses may use this product to investigate fraudulent activities and link crypto transactions to real-world entities. The product helps organizations follow money across different transactions and monitor risk at scale.

Source: Coinbase

Coinbase’s products make investing in crypto easier, support the growth of crypto as a new financial system, and reinforce the value of crypto as an app platform for individuals, businesses, and developers.

Users are embracing a variety of products Coinbase offers. The company’s chief product officer Surojit Chatterjee says that “around 30% of our users are using more than one product. People are using Coinbase for sending, receiving, borrowing, lending or saving.”

Coinbase also announced in October 2021 that it plans to launch an NFT marketplace to compete with OpenSea. The company’s blog states, “Coinbase NFT will make minting, purchasing, showcasing, and discovering NFTs easier than ever. We’re making NFTs more accessible by building intuitive interfaces that put the complexity behind the scenes. We’re adding social features that open new avenues for conversation & discovery.”

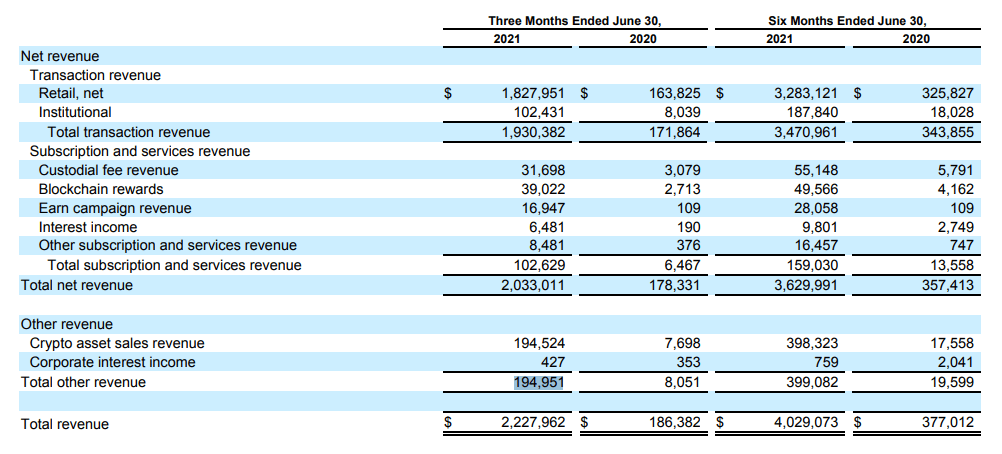

How Coinbase makes money

Coinbase’s revenue in 2020 reached $1.3B but this figure pales in comparison to 2021 financial results. The company reported $2.2B in revenue in Q2 2021 alone and a net income of $1.6B. This money comes from three different revenue streams.

Transaction revenue from retail and institutional investors is the first source of money. Coinbase charges transaction fees of anywhere from 0.5% to 3.99%, depending on the payment type, users’ country of residence, account type, the value of the transaction, and more. In Q2 2021, Coinbase reported $1.8B in revenue from retail transactions fees and $102.4M in revenue from institutional transaction fees.

Source: Coinbase SEC filings

Subscription and services revenue is the next source of revenue. This $102.6M income stream covers custodial fees, blockchain rewards, interest income, and other types of services.

The third source of revenue is the sales of crypto assets that Coinbase owns. The company may sometimes sell its own assets to customers and record this as its revenue. In Q2 2021, this revenue stream was worth nearly $195M.

The company is still heavily dependent on retail transaction fees, but it’s showing early successes in growing other revenue streams. For instance, it grew revenue earned from institutional investors, such as hedge funds and family offices, from $8M to $102.43M in only a year.

Coinbase also doubled its subscription and services revenue in Q2 2021. The company is also benefiting from the rise of non-fungible tokens (NFTs) that are most often based on Ethereum and drive demand for its underlying coin, ether.

Coinbase as a cryptoasset kingmaker

Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation.

This development is largely a result of cryptoassets evolving into an investment vehicle. Coinbase’s excellence in security, regulatory compliance, and ease-of-use has helped drive up user numbers. When Coinbase gives its “stamp of approval” to a given cryptoasset, millions of users can then trade it, which often drives up prices.

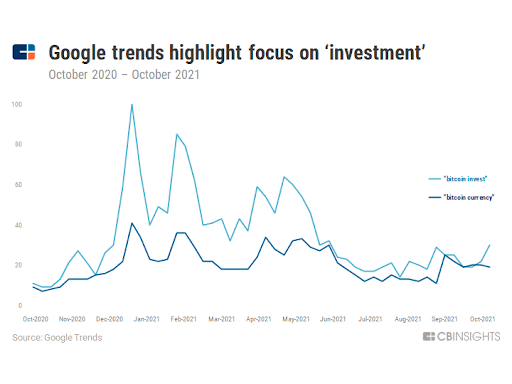

From currency to investment

Where bitcoin and other cryptoassets were once considered a “means of exchange” and an alternative payments system, they are now more often called a “store of value” and an investment opportunity.

Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective payments network. Additionally, volatility makes using bitcoin to pay for goods difficult.

Fred Wilson of Union Square Ventures pointed to this volatility in a recent blog post, writing: “This was a Bitcoin t-shirt I bought in the summer of 2013 [for .18 BTC]. At today’s prices, that t-shirt cost me $830 […] You can’t keep spending something that goes up as much as Bitcoin has.” That number is considerably higher today.

However, the volatility of Bitcoin did not prevent Wilson’s USV from investing $2.5M in Coinbase. At the end of the first day of trading for Coinbase shares, USV’s stake was worth $4.6B.

Coinbase has overhauled its messaging and user experience to capitalize on this trend, with the company’s homepage now encouraging users to “buy and sell digital currency,” where it once welcomed users to “the future of money.” This makes a lot of sense as a brokerage: Coinbase brings in revenue on every trade (based on volume), and is therefore incentivized to encourage frequent trading and investment.

While the uptake for Coinbase’s initial promise of “instant payments [and] widespread [bitcoin] adoption” was slow, merchants and consumers seem to be warming up to the idea. Electric vehicle maker Tesla, fast-food brands Restaurant Brands International and Yum Brands, and big tech companies such as PayPal are among some merchants that now accept bitcoin as a means of payment.

Coinbase is also making moves to make cryptocurrencies a more acceptable form of payment. To this end, the company has launched Coinbase Card in the US, UK, and EU. The Visa debit card can be used to make payments and withdraw cash from an ATM. The company said in June 2021 that customers could now link their Coinbase Card with Apple Pay and Google Pay to make payments with crypto simpler.

User metrics

Astounding user growth validates Coinbase’s messaging shift. According to the company’s second-quarter earnings, it had 8.8M users who transacted monthly on its platform, up from 1.5M a year earlier. Coinbase has 68M verified users and over $180B in cryptoassets on its platform.

Coinbase raked in over $2B in revenue in the quarter ended June 30, 2021, and a net profit of $1.6B.

Security

Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. The most well-known hacked exchange was Mt. Gox, which lost 850,000 bitcoins to hackers in early 2014, worth $450M at the time. Those coins would be worth around $55B at the peak Bitcoin price of $65K in April 2021.

The 2021 hacking of Poly Network was even more severe: a mix of cryptocurrencies worth $600M was stolen in what is being called the biggest-ever cryptocurrency theft. Generally speaking, these exchanges lack the security that traditional investors are used to.

Coinbase is the exception to this rule. Investments and funds are held and insured by Coinbase, with the majority of cryptoassets stored offline in cold storage vaults, and the remainder insured by Lloyd’s of London. Funds held in USD wallets on Coinbase are covered by the FDIC and insured up to $250,000.

Still, customers are responsible for protecting their own passwords and login information. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Coinbase recommends that customers turn on two-factor authentication and place funds into cold storage in order to thwart would-be hackers.

Regulatory compliance

As mentioned, exchanges that handle fiat-cryptoasset trading pairs (e.g. BTC/USD, BTC/GBP) are the primary consumer on-ramps to cryptoassets. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. Coupled with the sector’s nascency, regulatory bodies have struggled to define, legislate, and tax cryptoassets.

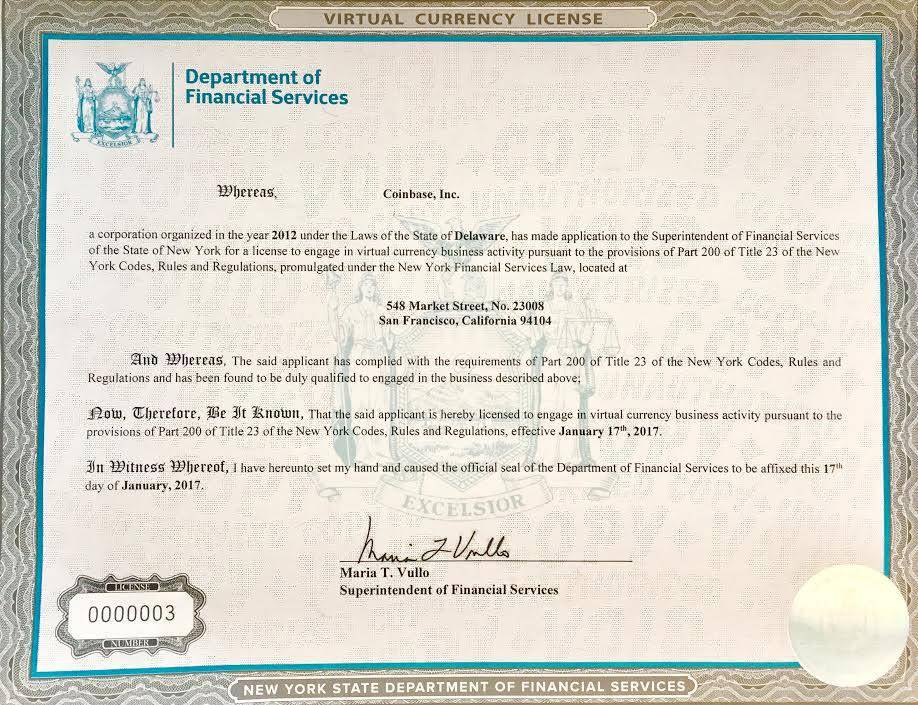

In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. Coinbase has made a point of complying with state-by-state money transmission laws, and is one of a few companies to hold a New York Virtual Currency License, or “BitLicense.” A common critique of the BitLicense is its prohibitive cost; over ten companies moved their headquarters from New York to other locales in 2015 after the license was announced.

Source: Coinbase

Other regulations that Coinbase complies with include registration as a Money Services Business with FinCEN, and the Bank Secrecy Act and Patriot Act. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. The company says it is “committed to obtaining licenses as needed to comply with local laws” of countries where it operates its digital currency business.

Taken as a whole, Coinbase’s focus on compliance offers safety and assurance for consumers and regulators alike.

Relationship with law enforcement

Similarly, Coinbase has cooperated heavily with law enforcement. Coinbase follows strict identity verification procedures to comply with regulations like KYC (Know Your Customer) and AML (anti-money laundering), and to track and monitor cryptoassets sent to and from its site.

As touched upon earlier, the company complies with the Bank Secrecy Act, which the company says “requires Coinbase to verify customer identities, maintain records of currency transactions for up to 5 years, and report certain transactions,” and the Patriot Act, which has famously been criticized for making it easier for the US government to intercept people’s phone conversations.

Coinbase is therefore a boon for regulators and law enforcement in deciphering decentralized black market activity. Blockchain tracking companies, like Chainalysis, work with Coinbase (and other exchanges) to assist in AML enforcement. As US Treasury Secretary Steve Mnuchin put it in a recent interview: “If you have a wallet to own bitcoins, that company has the same obligation as a bank to know [you as a customer, and] we can track those activities.”

At the same time, Coinbase has pushed back against what it sees as government overreach. In one public instance, the IRS requested customers’ records for the period between 2013-2015. November 2017 court documents from the case nicely summarize the dispute: “That only 800 to 900 taxpayers reported gains related to bitcoin in each of the relevant years and that more than 14,000 Coinbase users have either bought, sold, sent, or received at least $20,000 worth of bitcoin in a given year suggests that many Coinbase users may not be reporting their bitcoin gains.”

Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. The company has since agreed to give the IRS records on 14,000 users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns.

More recently, Coinbase CEO Brian Armstrong took to Twitter to detail how the Biden administration’s proposed infrastructure bill, which aims to introduce a tax on crypto transactions, could hurt innovation in the nascent industry.

While cryptocurrencies have remained a largely unregulated sphere so far, the bill aims to enforce stricter taxes on cryptocurrency transactions by making them taxable as capital gains and losses, similar to stock trading. The provision is expected to bring in $28B in revenue for the government over the next decade.

Many crypto industry insiders, including Fred Wilson, had concerns about the broad definitions of a crypto trader that the bill was based on. They feared that in its current state, the bill would also encompass Bitcoin miners and could “push innovation offshore.”

A major win for the crypto industry came in August 2021 when Senator Rob Portman, author of the provision in the bill, agreed to revisit the wording of the provision and exclude Bitcoin miners from having to pay taxes on their mining activities.

Accusations of insider trading

Cryptoasset trading remains largely unregulated and is something of a “wild west” for speculators. Pump-and-dump schemes and fraudulent initial coin offerings are rampant. Additionally, and as we’ve explored in prior reports, large initial coin offerings run the risk of overcapitalization; raising too much money could disincentivize founders from building the product in question, turning founders building companies into money managers.

Although Coinbase has generally kept its brand reputation clean, recent events have spurred rumors of insider trading and “front-running.” According to numerous reports, the price of bitcoin cash on global exchanges spiked in the hours leading up to Coinbase’s launch of bitcoin cash trading. Such a price movement is certainly suspect.

Armstrong released a strongly worded statement after the event, pointing to Coinbase’s employee guidelines: “We’ve had a trading policy in place for some time at Coinbase. The policy prohibits employees and contractors from trading on ‘material non-public information,’ such as when a new asset will be added to our platform.”

Of concern, the statement did not reference any federal or state regulations enforcing said employee policies, underscoring the sector’s nascency in regulatory and legislative circles.

More recently, Coinbase came under scrutiny when some of the company’s executives, including Armstrong and CFO Alesia Haas, sold $5B worth of COIN stock shortly after it was listed. A company spokesperson said that the early investors and executives still held a majority of their holdings.

Ease of use

In addition to its security and regulatory compliance, Coinbase’s user interface and mobile application have helped the company position itself as the de-facto US cryptoasset brokerage. In comparison to earlier iterations, Coinbase’s current user experience is simple, clean, and well-suited for cryptoasset retail investors.

Most notable is Coinbase’s mobile app. A testament to the company’s brand, it was the most downloaded app on Apple’s App Store in early December 2017. The app briefly regained the top spot on the Apple App Store in May 2021.

It’s unlikely that bitcoin would ever have hit the mainstream without a company like Coinbase, which provides an easy-to-use, trusted means of buying and selling cryptoassets.

As mentioned, Coinbase’s KYC and AML requirements require users to strictly verify their identities, which has proven difficult for users to do via Coinbase’s mobile app. In many cases, users have reported long wait times for verification.

Coinbase has also struggled with general customer support. Many users have complained about a lack of access to customer service in the event of being locked out of their accounts or even being hacked.

In response, Coinbase said that it would increased the size of its 24/7 customer support team and launch a customer support live chat, among other things. As of September 2021, the rating of the Coinbase app for Android smartphones rose to 4.4, while the app for iPhones has a 4.7 rating.

The Coinbase effect

All of these factors — strong security, regulatory compliance, ease-of-use, and a focus on investment — have enabled Coinbase to emerge as something of a cryptoasset kingmaker for investors.

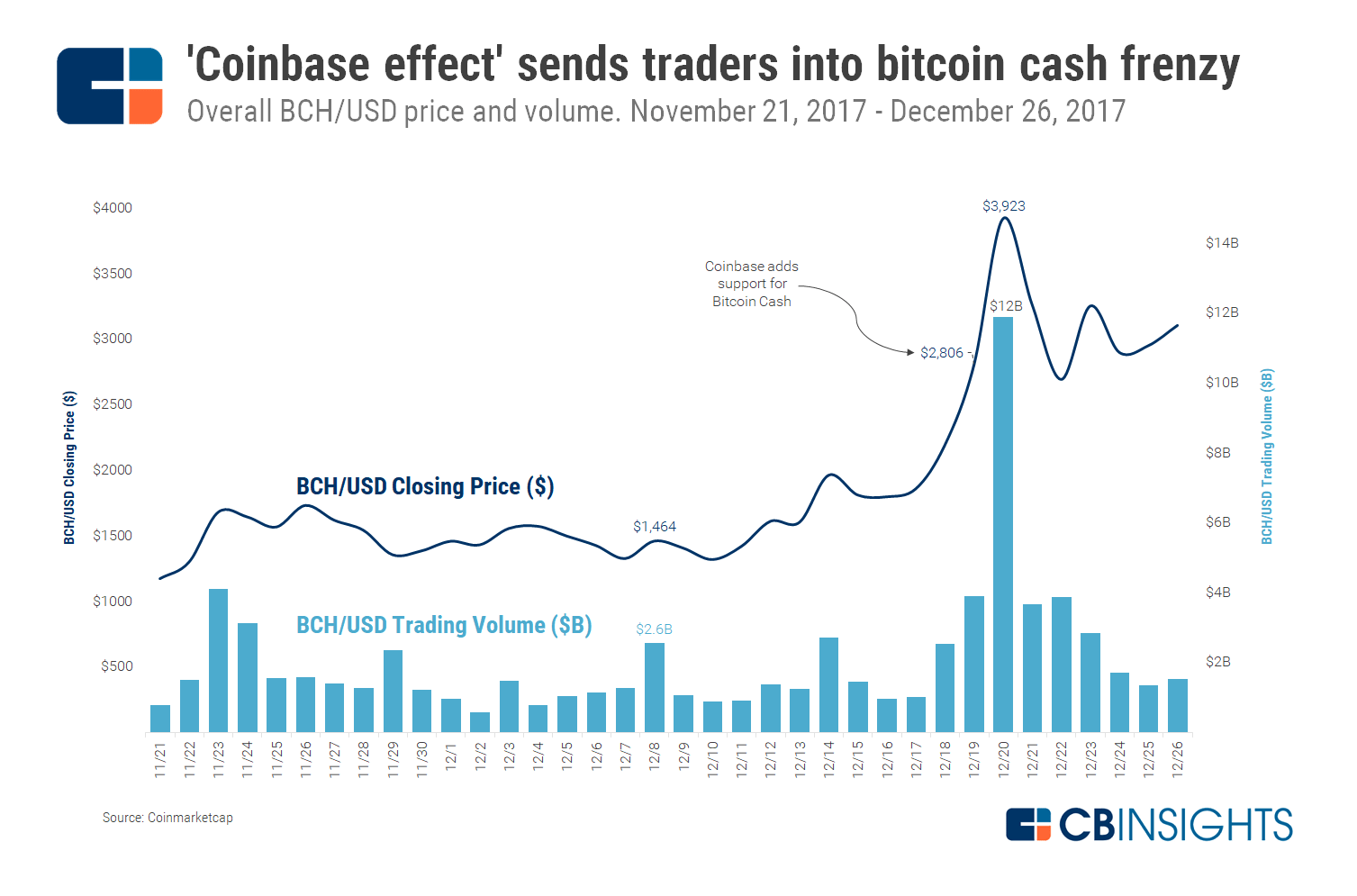

One example of this was its recent addition of bitcoin cash. At around 7pm EST on December 19th, 2017, Coinbase surprised users by listing a fourth asset: bitcoin cash. Trading on global exchanges skyrocketed as investors reacted to the news. A day after the announcement, bitcoin cash closed at $4,000 on some exchanges, up from around $2,200 two days earlier. Volume soared as well, from $2.5B on December 18th, to almost $12B on December 20th, an increase of 380%.

However, almost none of this trading was happening on Coinbase. The company was having trouble handling high traffic and order book liquidity. Four minutes after listing bitcoin cash, with the price swinging from $3,500 to near $9,000 on its exchange, Coinbase paused its bitcoin cash order book.

After 18 hours during which rumors of insider trading swirled, Coinbase announced that it would reopen its order book. The company cautioned in a blog post that “if significant volatility [was] observed, GDAX [would] pause trading.”

While just one instance, this event speaks volumes. Cryptoassets are difficult to obtain (especially in current market conditions), so an “accessibility premium” is often at play: when a cryptoasset is more accessible, it tends to rise in price.

The bitcoin cash listing is one example of this “Coinbase effect,” but there are others: Ari Paul of Blocktower Capital cited a 30% rally for litecoin the day of its listing, as well as a 14% rally for ethereum when it was first listed on Coinbase in July 2016. In June 2021, the price of meme cryptocurrency Dogecoin jumped 21% on news that it would be available for trading on Coinbase Pro.

Such data highlights the company’s central role in the sector: Coinbase is best at making cryptoassets easy to buy, store, and ultimately, access. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors.

Coinbase valuation and investors

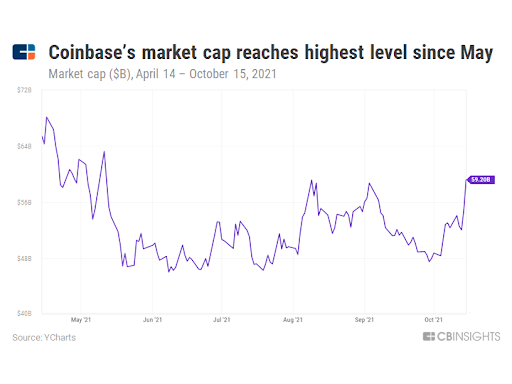

While Coinbase reached a $100B valuation on its first day of trading, its market cap in September 2021 was $54.61B. To maintain and justify its initial $100B valuation, the company will have to beat competitors and become the world’s largest financial exchange.

Looking at past investors, Coinbase has attracted a mix of venture and corporate investment. In total, Coinbase has raised nearly $540M across 15 equity financings since 2012 (including its seed round, not shown on the above graphic). Brand-name venture investors — Union Square Ventures and Andreessen Horowitz chief among them — got in early, and have continued to participate in funding rounds to the company.

Large financial institutions, like the NYSE and USAA, were part of the company’s $75M Series C in January 2015. According to an NYSE press release, the Series C investment helped “[support] Coinbase’s growth utilizing [NYSE’s] global distribution capabilities and market expertise.” Indeed, Coinbase would launch the “Coinbase Exchange” geared toward professional investors in the same month. This would later rebrand to the “Global Digital Asset Exchange,” or GDAX. In November 2015, USAA partnered with Coinbase to allow their customers to monitor their cryptoasset wallet balances when they log into their USAA accounts.

Also of note, Japanese players Bank of Tokyo Mitsubishi UFJ and NTT DoCoMo contributed to Coinbase’s Series C-III in July 2016.

Coinbase launched operations in Japan in August 2021 by partnering with Mitsubishi UFJ Financial Group, a banking group that has 40M customers in the country. Coinbase started by offering 5 cryptocurrencies — bitcoin, ethereal, litecoin, stellar, and bitcoin cash — and plans to add more for trading in Japan.

The crypto company registered with Japan’s financial watchdog in June after going on a hiring spree in 2020 to prepare for its launch. Coinbase first announced plans to enter Japan in 2018.

The road ahead: an open financial system

With all this, the question remains: is Coinbase simply profiting off of Bitcoin mania, or building upon the asset’s original vision for a new, open, and global financial system?

The answer is most likely a bit of both. Coinbase’s over $100B valuation at its trading debut nodded to the Bitcoin mania. At the same time, Coinbase is hedging its core business against increased competition, execution risk, and an uncertain cryptoasset market by adding more cryptoassets and exploring possible use cases for blockchain technology with Toshi.

An expansion strategy

Coinbase CEO Brian Armstrong recently laid out a strategy that will guide the company in the next 5+ years. The growth strategy is based on three pillars:

- Crypto as an investment. Investing in crypto remains Coinbase’s core business. The company plans to keep adding new cryptocurrencies to its platform faster than before. Coinbase will also provide professional traders with sophisticated trading tools similar to those in traditional markets. This institutional infrastructure will enable institutions of all sizes to invest in crypto markets. Lastly, Coinbase plans to continue expanding to countries where it currently doesn’t operate.

- Crypto as a new financial system. Coinbase will build new products that help crypto holders use their coins and access decentralized finance tools. The company also plans to develop tools that allow businesses to accept crypto, while users will be able to earn money by staking (earning a reward while holding certain cryptocurrencies). Armstrong also promises that the platform will provide access to borrowing and lending opportunities.

- Crypto as an app platform. Coinbase believes that crypto innovation extends beyond financial use cases. The company will help its users to discover new crypto apps and will provide funding for projects through Coinbase Ventures. Also, the Coinbase crypto infrastructure will be open to non-crypto organizations to provide them with access to the cryptoeconomy.

Coinbase’s acquisitions

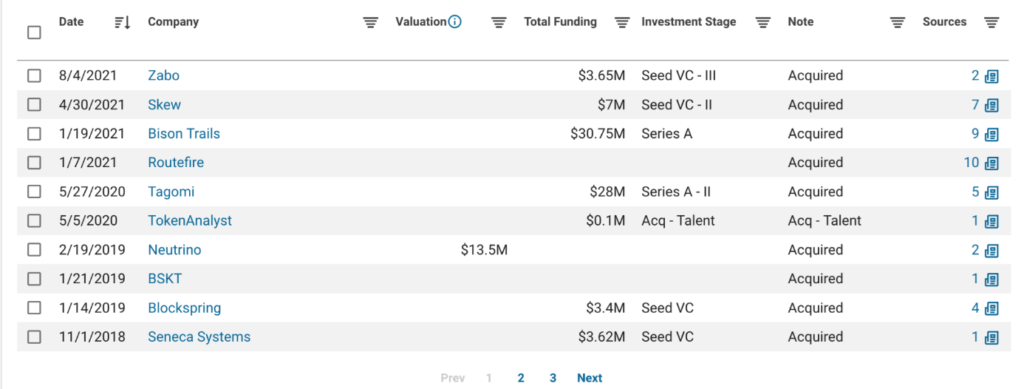

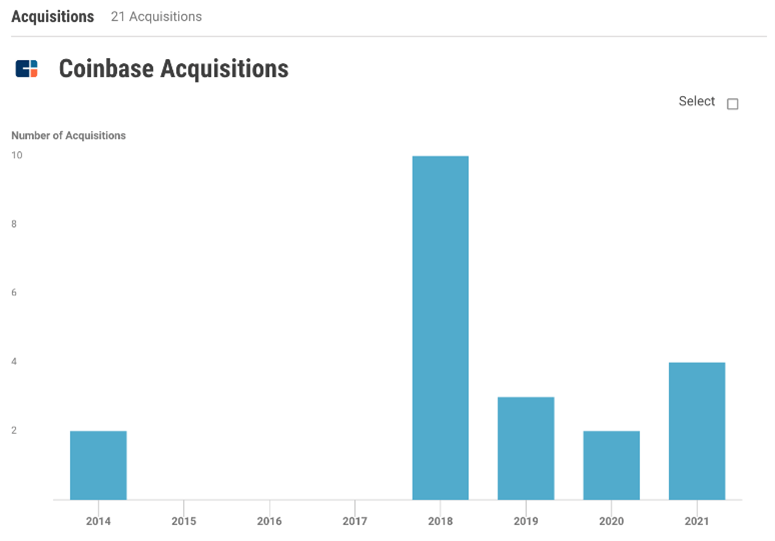

Coinbase has acquired 19 startups since the start of 2018, bringing the total to 21. These acquisitions help the company to execute its growth strategy and position crypto as an investment vehicle, a new financial system, and an app platform.

Source: CB Insights

In August 2021, for instance, Coinbase acquired Zabo, an account aggregation startup that enables users to see their balances and transaction histories from third-party accounts within the Coinbase app. Zabo’s API can pull data from multiple crypto exchanges, protocols, and wallets. Aggregating and standardizing data in a single app helps investors inform their trading decisions and tax calculations. Exchanges such as Robinhood and eToro offer insights only from accounts held on their platforms.

Coinbase also acquired Skew in 2021. The UK-based startup offers a platform that tracks and visualizes cryptocurrency markets in real time. It is geared towards professional traders and helps Coinbase further improve its offerings to institutional investors.

Acquiring Tagomi in 2020 was also part of a broader plan to offer institutional traders a Wall Street–level trading experience. Tagomi is a cryptocurrency brokerage platform that enables users to access 14 exchanges from a single account. This capability makes buying and selling crypto coins easier and faster.

A year before purchasing Tagomi, Coinbase acquired blockchain intelligence startup Neutrino. The company aims to simplify the process of mapping and tracking cryptocurrency transactions, which enables Coinbase to prevent theft and investigate ransomware attacks. Neutrino also tracks rising crypto tokens and assets.

Source: CB Insights

Coinbase had a major acquisition spree in 2018 to solidify its retail side of the product. Three years later, the company seems to be using acquisitions to improve its offering to institutional investors. As Coinbase looks to diversify its revenue streams and decrease reliance on transaction fees from retail investors, we may well see further acquisitions in the years ahead.

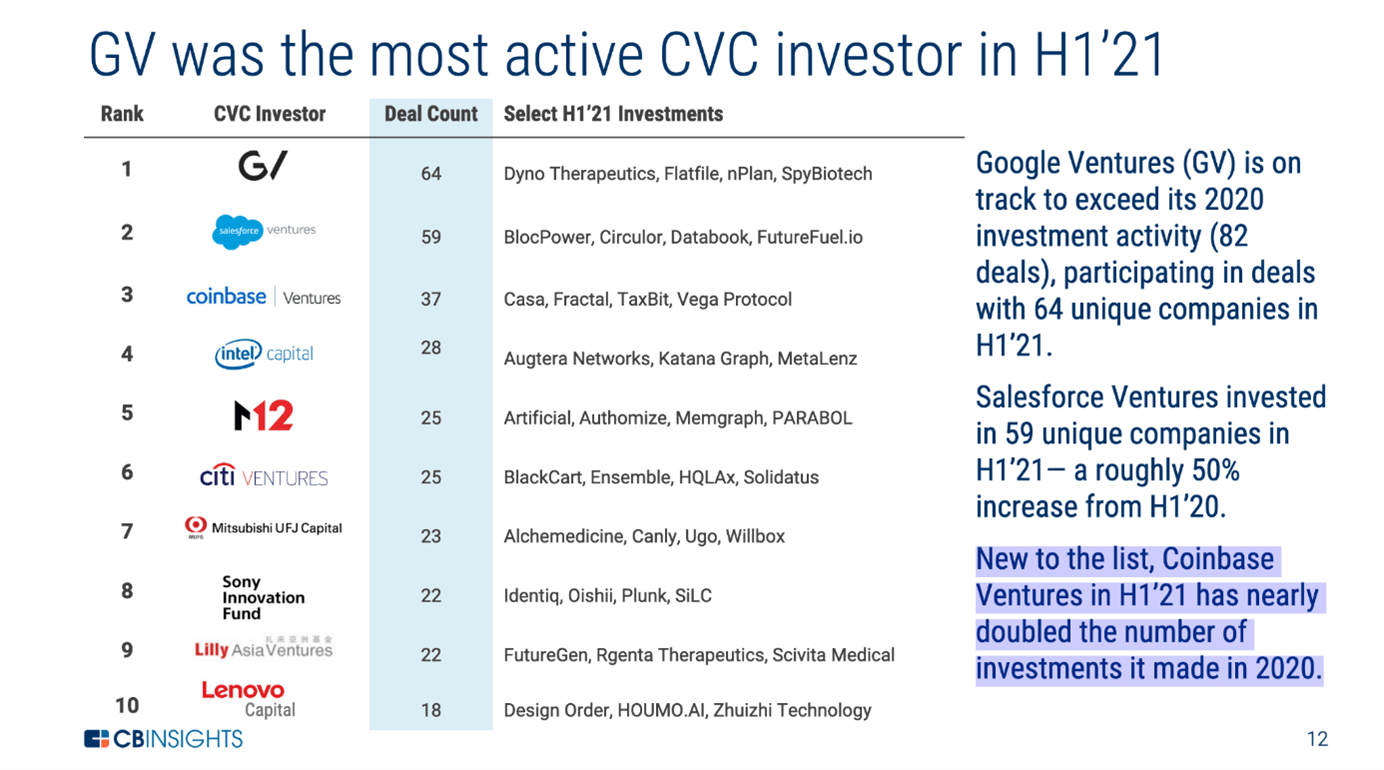

Coinbase Ventures

Coinbase is an active investor through Coinbase Ventures (CV), a venture arm launched in 2018. CV has invested in over 150 companies as of August 2021 and is the third-most active corporate venture capital (CVC) investor in H1 2021. As expected, most of the deals were for an array of crypto startups, including:

- TaxBit, an automated tool for paying crypto taxes

- Zora Labs, a marketplace for digital tokens

- Arweave, a digital storage service

- OpenSea, an NFT marketplace

Coinbase has also invested in DeFi companies, such as Vega Protocol, Saddle, Uniswap, and others. The crypto exchange giant has supported startups building decentralized exchanges, likely in a bid to gain exposure to a space that may challenge its core exchange product in the future.

But the company has also invested in some centralized exchanges that are similar to its product, like Pintu, Bitso, and CoinDCX. Emilie Choi, president and COO at Coinbase, says that investing in competitors is a policy endorsed by co-founder Brian Armstrong himself.

CV checks at the seed stage are between $50,000 to $250,000, and the amount can increase for later-stage deals. CV usually joins rounds led by established VC firms but avoids taking board seats and committing to strategic help.

Challenges and risks

Coinbase faces increased competition from a number of existing players as well as upstart decentralized exchanges. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market.

Competition

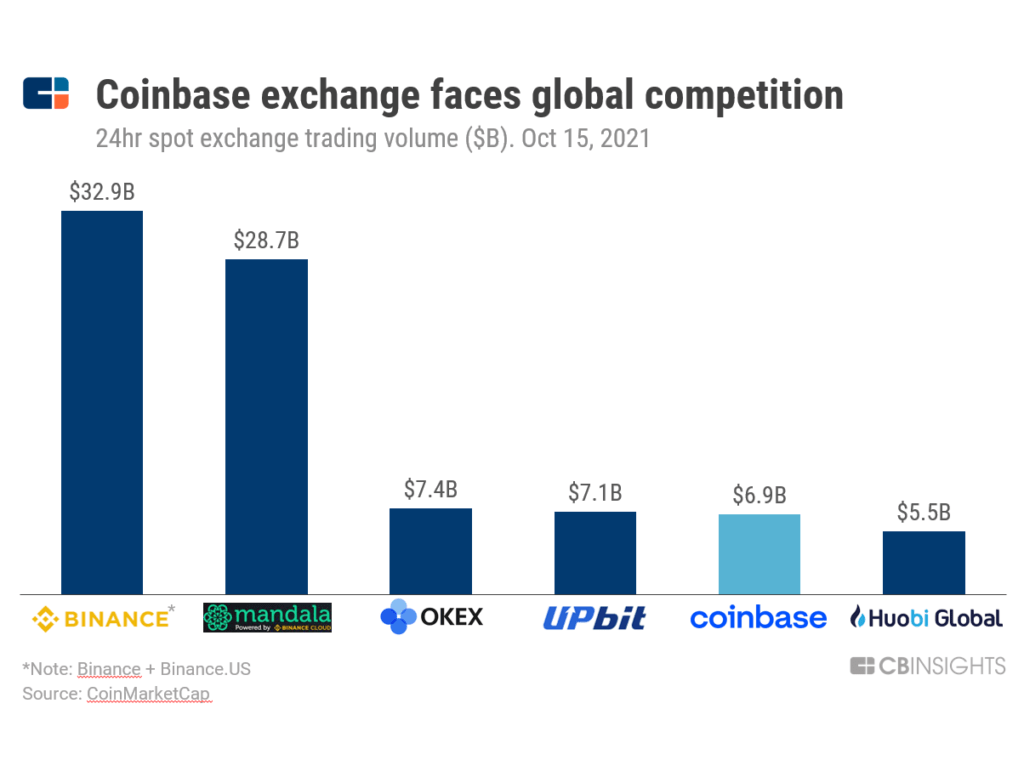

Coinbase and Coinbase Pro face direct competition from a number of fiat-cryptoasset exchanges. Bitfinex, Bitstamp, Kraken, and bitFlyer are Coinbase’s main competitors, although there are others, including traditional brokerages like Robinhood (which now supports cryptoasset trading in all US states except Hawaii, and Nevada).Coinbase has also expanded to support crypto-crypto pairs (e.g., BTC/ETH) in 42 countries, including the US, Canada, India, Brazil, and South Korea. As a result, the company now also competes with Binance. Binance is the largest cryptoasset exchange by volume (with over $25B worth of cryptoassets exchanged on October 11, 2021) but only supports crypto-crypto trading pairs.

Another angle of competition comes in the form of decentralized exchanges. 0x is a tokenized protocol for decentralized exchanges initially launched via a $24M ICO, and is gaining steam as decentralized exchanges — like Radar Relay — build on top of it. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. Still, activity is limited when compared to major centralized exchanges, and this threat should be considered on a longer time horizon.

Coinbase faces rivals in the digital asset custody sector as well. The company competes with Gemini and Blockchain.com for retail and institutional customers. BitGo, PAXOS, and NYDIG are custody competitors that primarily work with institutions.

Coinbase Wallet users also have many alternatives, such as hot wallets offered by Exodus, Electrum, and Mycelium.

Scaling

Coinbase has grown rapidly in the past several years. The company had around 43M users in December 2020 and that number rose to 68M in just 6 months. However, rapid growth has led to an increase in the number of customer complaints. From 2016 to 2021, the Federal Trade Commission and Consumer Financial Protection Bureau have received over 11,000 complaints filed against Coinbase. Customers were reportedly unable to reach customer service agents or get support after hackers drained their crypto coins.

In a blog post published in June 2021, Casper Sorensen, vice president of customer experience at Coinbase, highlighted that the company’s support staff had increased 5X since January. Coinbase now has over 3,000 employees in customer support roles. The company also plans to offer live chat and phone support by the end of 2021.

Coinbase suffered multiple outages in the past 2 years, including those in December 2020 and May 2021. Still, former asset trader Jon West says that the performance of major crypto exchanges “is the best they’ve ever performed when looking back at 2018 or 2019.” Coinbase introduced various technological upgrades to prevent outages during periods of high traffic. The company plans to integrate Layer-2 blockchains, like Polygon, on top of its products to enable faster and cheaper transactions.

But the scale of customer complaints was high enough to prompt CEO Brian Armstrong to address it during an earnings call in August 2021. He said, “So proud to report that we are doing much better [with customer service], but there’s always more to do. We’ve increased the headcount five times or so since January, beginning of this year, working on support specifically.”

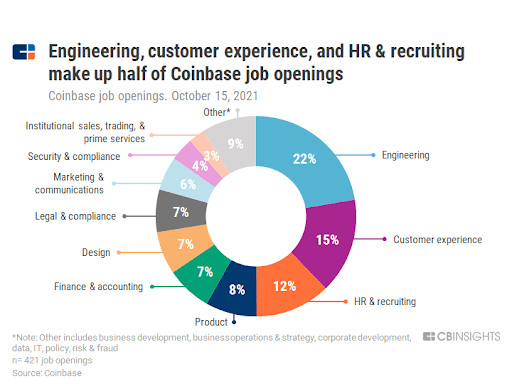

Coinbase is hiring for multiple roles to support its scaling efforts. Some of the key hires include Faryar Shirzad (Chief Policy Officer), Emilie Choi (president and COO), Max Branzburg (VP of product), and others. Shirzad joined Coinbase in May 2021 from Goldman Sachs, where he was the global co-head of government affairs.

Choi previously worked at LinkedIn as an M&A executive and she was promoted to her current role in December 2020 as Coinbase was preparing for its public debut. She was also instrumental in bringing Branzburg from Google. Marc Andreesseen of a16z is also set to play a more active role in board of directors while former Cisco CFO joined Coinbase and will chair the Audit and Compliance Committee.

In September 2020, Surojit Chatterjee said that the company has grown “product, design and engineering teams by more than 50% over the last three months.” Adopting a remote-first policy also made hiring easier as Coinbase can now tap into a wider talent pool.

The company has faced challenges as key employees have left for other ventures, prompting some to reference a “Coinbase mafia:”

- Olaf-Carlson Wee, an early product manager at the company, left in mid-2016 to start Polychain Capital, which is widely considered an elite cryptoasset hedge fund.

- Nick Tomaino, a business development hire, left in February 2016 to invest at venture firm Runa Capital, and recently started his own cryptoasset investment fund, 1confirmation.

- Charlie Lee created Litecoin (as a fork of the Bitcoin blockchain) in October 2011, and served as Coinbase’s director of engineering until June 2017.

- Former Coinbase product manager Linda Xie and software engineer Jordan Clifford launched a cryptoasset fund called Scalar Capital.

- In addition, Fred Ehrsam, co-founder of Coinbase, has since left the company to pursue other ventures.

- Antonio Juliano, a former engineer at Coinbase, started an exchange for trading cryptocurrencies, called dYdX.

- Former Coinbase VP of engineering Timothy Wagner and Shruthi Rao launched a virtual data lake platform Vendia.

- Former senior director of engineering at Coinbase Namrata Ganatra launched Sturish, an e-commerce growth platform.

Market risk

As a final challenge, Coinbase faces acute risk from market forces. Exchanges are particularly exposed to market demand. In the event of a market downturn, Coinbase could see its revenue drop precipitously. In Q2 2021, for instance, transaction fees from retail investors accounted for nearly 82% of total revenue.

Further, while Coinbase is directly exposed to risk from cryptoassets listed on its platform, it’s also indirectly exposed to other more volatile cryptoassets. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges.

This means that cryptoassets not listed on Coinbase could still have a material effect on Coinbase’s core businesses; if the market flees to safety (perhaps due to a regulatory crackdown) and trades back into fiat, Coinbase could face liquidity issues. In other words, a major sell-off in broader cryptoasset markets could make it hard to find buyers.

Disruptions and sell-offs in the crypto market would negatively impact multiple Coinbase business lines. Users would be earning less on staked crypto coins and would have fewer reasons to borrow cash using Bitcoin or use Coinbase Wallet. Also, institutional investors would likely become more conservative in using cryptocurrencies to diversify their portfolios. This turbulence could developers less willing to build crypto apps using Coinbase APIs and blockchain infrastructure.

REGULATORY RISK

Since its early days, Coinbase has invested in building relationships with regulators and acquiring key licenses, such as BitLicense from the New York Department of Financial Services. These efforts have paid off as the company has built a significant regulatory moat. Any potential competitor has to go through a myriad of legal procedures to get on the same level as Coinbase. Investors have also taken notice of this and Brian Armstrong was able to secure multiple funding rounds and then take his company public.

But regulatory advantage comes with risks. Laws may change and legislative processes are hard to influence. For instance, Coinbase and the entire crypto community were unable to influence the Senate and change language in the infrastructure package that might force wallet developers and miners to undergo extensive tax reporting.

The US Securities and Exchange Commission has also dealt a blow to Coinbase. The SEC warned the company that its proposed Lend product, which would allow users to earn interest on staked cryptocurrencies, represents a security risk. Coinbase postponed the product’s launch in response. Brian Armstrong said that the SEC refused to meet with him to discuss regulatory challenges and that “We’re committed to following the law. Sometimes the law is unclear. So if the SEC wants to publish guidance, we are also happy to follow that.”

Other jurisdictions are also working on new crypto regulations whose impact on Coinbase is yet to be revealed. The European Commission, for instance, is working on a piece of legislation that’s designed to define rules for crypto issuers and service providers in the European Union. Not many details about this regulation nor how it may affect crypto markets are available. Meanwhile, in China, cryptocurrency transactions were banned altogether as Beijing has intensified a crackdown on what it perceives as speculative investments.

Closing thoughts

Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities.

To hedge its exchange, Coinbase plans on adding more assets to its platform according to its “Digital Asset Framework.” Doing so would certainly pad the company’s pockets, but it would also allow a large user base to explore new use cases for blockchain technology. Additional assets, then, are both a hedge and a gamble on the sector’s future.

Coinbase Wallet plays an important role in these plans. It’s a source of customer growth and retention and supports a number of decentralized apps, coins, and NFTs with the plans to add many more. Wallet is proving useful as an entry point for users who then go on to explore more advanced crypto projects.

VC investors who supported Coinbase enjoyed massive returns as the company went public in April 2021. The company now has the additional resources and expertise needed to accelerate its growth. But achieving its goals will require handling not only market forces but also regulators and legislators around the world. With crypto gaining momentum, it’s becoming ever more important for the crypto industry to engage public policy makers.

Ultimately, Coinbase’s story mirrors the sector as a whole. Bitcoin and several other major crypto coins are closer to mainstream adoption but not yet in the way crypto enthusiasts would like them to be. Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible.

If you aren’t already a client, sign up for a free trial to learn more about our platform.