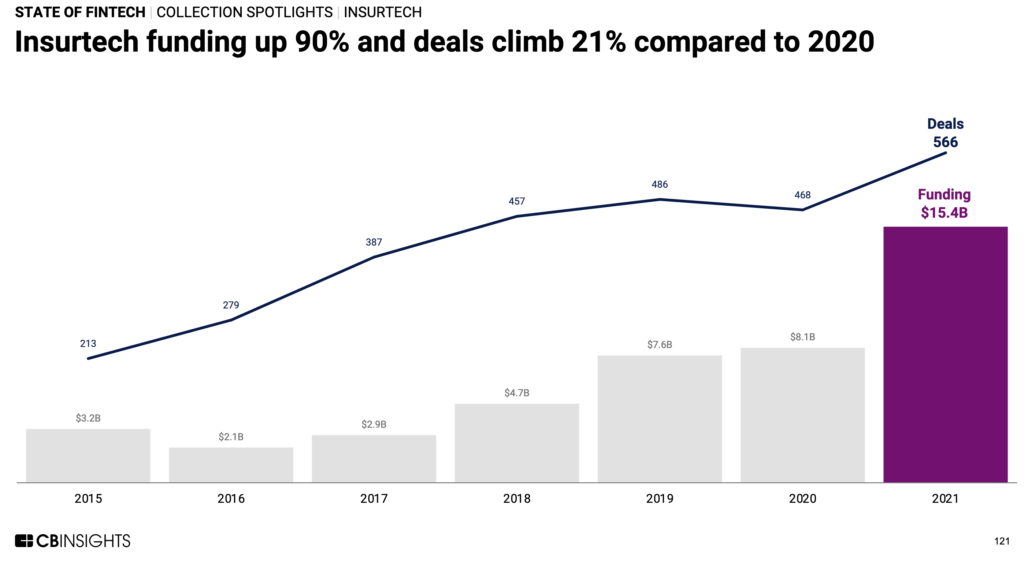

Insurtech funding and deals nearly doubled in 2021. With investors betting big on digitizing the insurance industry, we look at the investment trends shaping the insurtech space in 2022.

Insurtech funding soared to an all-time high of $15.4B in 2021 — up nearly 2x compared to the year prior — across 566 deals.

This torrent of capital is already reshaping the future of the insurance industry. Below, we look at some of the emerging insurtech trends, including:

- US- and Asia-based startups drove insurtech’s mammoth Q4’21. As a result of regulatory and cultural differences, insurtech startups tend to primarily work in the regions and countries in which they are founded.

- Investors placed big bets on later-stage, more established insurtech companies in 2021. While early-stage rounds still make up the majority of the deals, their decline in overall deal share signals that the insurtech space is maturing.

- Life and health insurance mega-rounds provided a lot of funding momentum in Q4’21 — 2 big deals alone made up nearly half of all insurtech funding in Q4’21.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.