Based on an analysis of comparable company valuation data, the embattled India-based edtech unicorn might be worth less than $2B.

Once valued at $22B, Byju’s, the India-based edtech unicorn, is now likely worth less than the total equity capital ($4.6B) it has raised.

Our analysis of comparable company valuation data suggests Byju’s valuation may be under $2B. In other words, the company’s real business model was raising capital and not building products that generate revenue.

We break down the data below.

Valuations and comps

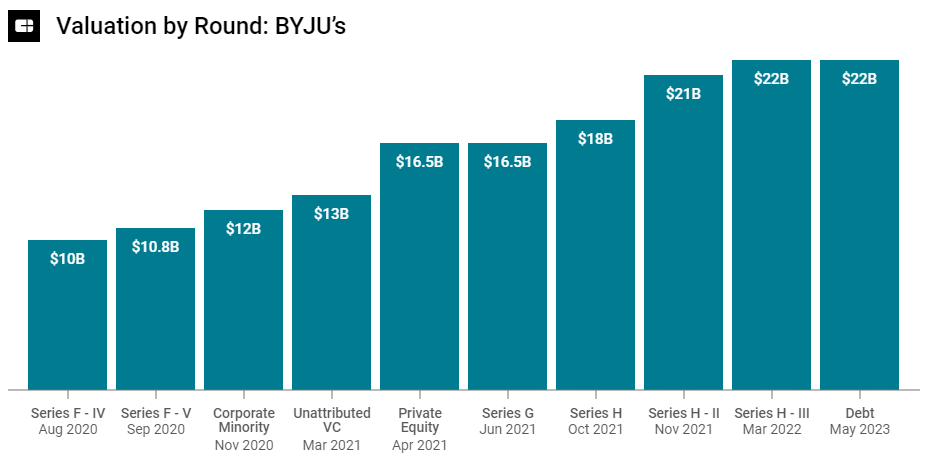

Byju’s was last valued at $22B in the third tranche of its Series H.

The company raised capital at a breathtaking rate.

The graph below from CB Insights doesn’t even fit all Byju’s financing history — its Series F was raised over 5 tranches.

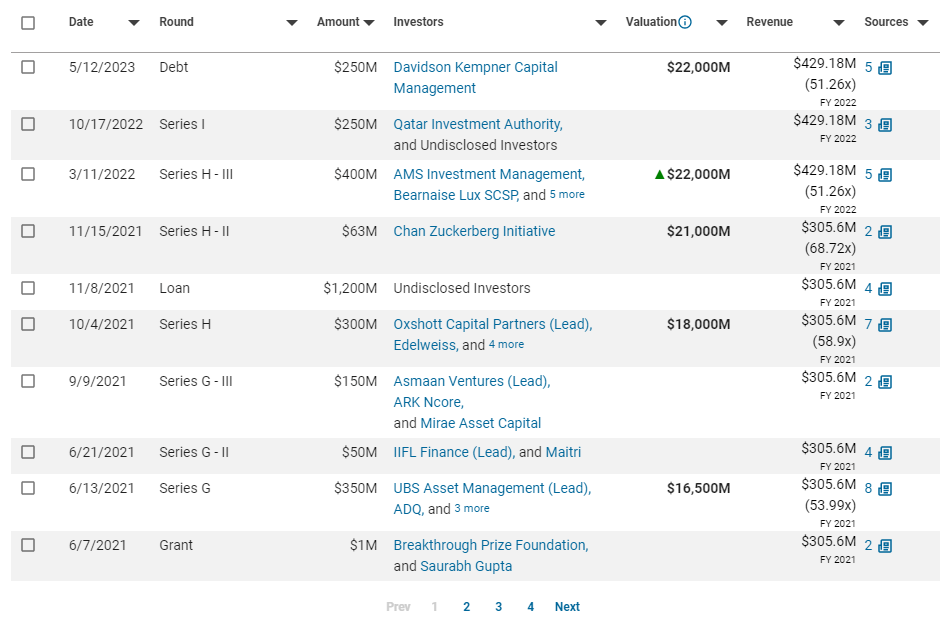

The company attracted a wide range of investors including:

- Sovereign wealth funds (Qatar Investment Authority)

- Asset managers (Davidson Kemper Capital Management, UBS Asset Management, BlackRock, Tiger Global Management, AMS Investment Management)

- Non-profits (Chan Zuckerberg Initiative, Breakthrough Prize Foundation)

- PE/growth equity/VC (Silver Lake, DST Global, General Atlantic)

- Corporations (Tencent)

And that’s just a small number of them as the screenshot from CB Insights highlights.

Of the $6.1B it raised, ~$4.6B was in equity and ~$1.5B in debt.

In FY 2022, Byju’s is reported to have done $430M in revenue giving it a price/revenue multiple of 51x.

For every $1 of revenue it generated in 2022, it had raised $11 of equity capital.

In other words, fundraising was the business model.

Comps

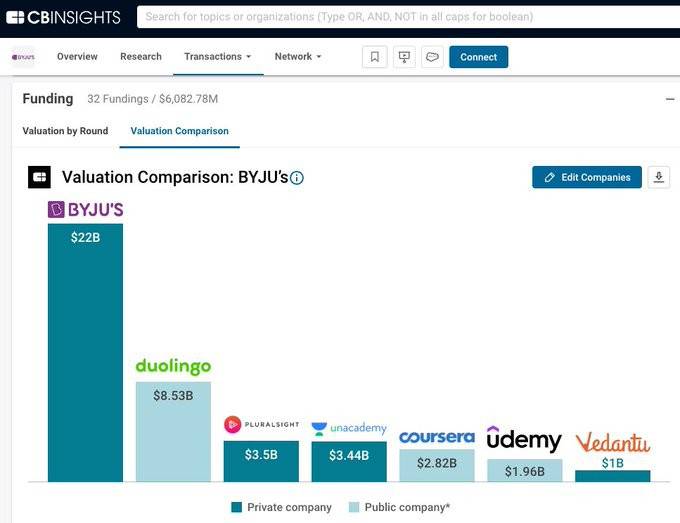

Within India, Byju’s is valued much higher than private peers like Vedantu, Unacademy, and Cuemath.

Compared to larger edtech companies (albeit not in India) — Duolingo, Coursera, Udemy, and Pluralsight — Byju’s’ valuation is untethered from reality.

- Duolingo ($8.5B market cap, $484M trailing twelve months (TTM) revenue)

- Coursera ($2.8B market cap, $609M TTM revenue)

- Udemy ($2.0B market cap, $678M TTM revenue)

- Pluralsight (acquired by Vista Equity for $3.5B in 2021, did $392M in revenue in 2020)

The implied price/revenue multiples for each of are:

- Duolingo 17.6x

- Coursera 4.6x

- Udemy 2.9x

- Pluralsight 8.9x

This works out to an average p/r multiple of 8.5x and a median p/r multiple of 6.8x.

If we apply these multiples to Byju’s revenue of $429M, we end up with a valuation range of $2.9B to $3.7B.

Both implied valuation figures are less than the $4.6B of equity raised.

We’d argue that these are still lofty valuations given:

- Pluralsight’s acquisition by Vista was in the boom times of 2021.

- Duolingo has built a remarkably efficient and highly retentive mobile app that Byju’s doesn’t have.

And so the better multiples to use are probably Udemy or Coursera and those would put the valuation of Byju’s at below $2B.

Other challenges

Even those multiples might be generous given Byju’s history of embellishing revenue and its reporting and governance challenges.

In July 2023, Prosus, which invested in Byju’s in 2023, stepped down from the company’s board writing:

“BYJU’S grew considerably since our first investment in 2018, but, over time, its reporting and governance structures did not evolve sufficiently for a company of that scale. Despite repeated efforts from our Director, executive leadership at BYJU’S regularly disregarded advice and recommendations relating to strategic, operational, legal, and corporate governance matters. The decision for our Director to step down from the BYJU’S Board was taken after it became clear that he was unable to fulfil his fiduciary duty to serve the long-term interests of the Company and its stakeholders.”

In June 2023, Prosus marked down its valuation in Byju’s to $5.1B — so investors have already lost faith.

Unfortunately, it looks like their mark downs will need to be higher.

Looking ahead

For those looking for value, Byju’s is likely going to look to extract value by shedding non-core assets.

It has done 18 acquisitions, often paying eye-watering valuations (likely with much in stock).

As the business needs to focus — and with those acquired founders now sitting on equity likely worth 70-90% less — there might be some assets of interest to an aggressive financial sponsor or strategic.