Regions like the US and Asia and sectors like fintech have been hit hardest by the drop-off. Using CB Insights data, we break down what the shifting venture landscape means for the world’s billion-dollar companies.

In 2021, investment into tech startups exploded — more than doubling year-over-year (YoY) to reach $621B — and the number of unicorns (private companies worth $1B+) surged accordingly.

537 unicorns were born that year, amounting to more than 2 per business day.

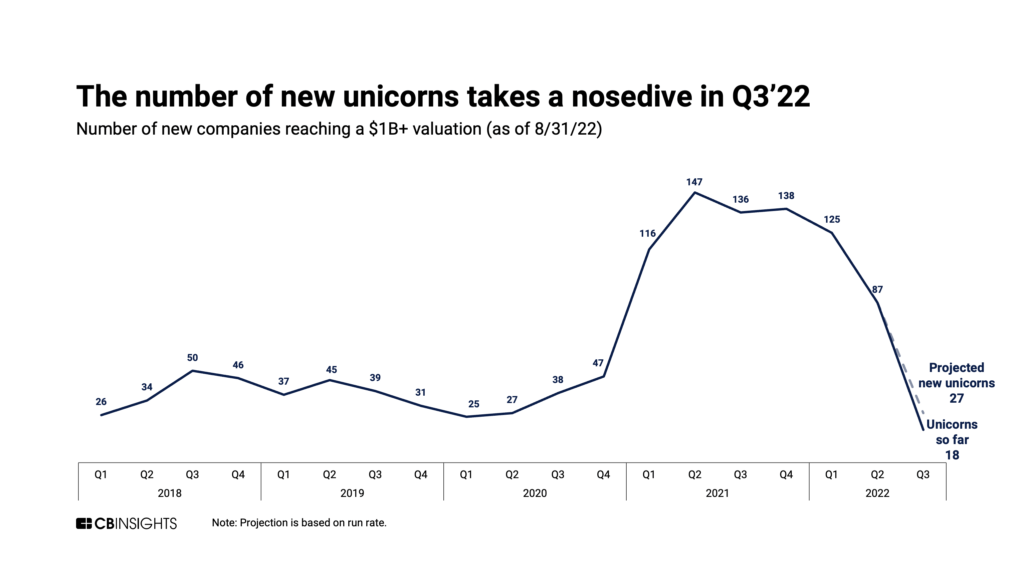

Now, as venture funding to startups ebbs, fewer unicorns are being minted each quarter. Q2’22 saw 87 new unicorn births — down to roughly 1.4 per business day.

Q3’22 has seen an even more severe drop-off so far. At the current pace, just 27 unicorns will be born by the end of this quarter. That’s less than 1 unicorn birth for every other business day.

Below, we dig into what’s driving the downward trend. We also cover how the slowdown is affecting global regions and sectors, how valuations and funding have shifted, and more.

Key takeaways

- Volatility in the public markets — fueled by an unstable macro environment — has put downward pressure on the most valuable private companies, forcing valuations to contract and driving investors away from large, late-stage rounds.

- The US and Asia have been most affected by the unicorn slowdown. Europe, on the other hand, watched its share of total unicorns increase quarter-over-quarter (QoQ) in Q2’22.

- Fintech has been hit hard, seeing a larger QoQ decline in new unicorns than any other sector. Meanwhile, digital health has remained resilient.

- Median valuations have fallen modestly across most investment stages, but there’s plenty of room for them to fall further.

- The power balance is shifting from founders to investors, who now have more leverage to invest at cheaper prices or structure deals for more downside protection.

What’s driving the slowdown in new unicorns?

2021’s unicorn stampede: The exuberant funding environment in 2021 — fueled by pandemic tailwinds like near-zero interest rates and the rapid adoption of digital technologies — drove unicorn births to record highs.

During that time, crossover investors like Tiger Global Management and Coatue Management ratcheted up their private-market dealmaking, pouring massive amounts of capital into funding rounds that sent valuations skyrocketing. In 2022, however, the meteoric growth has not been able to sustain itself.

Unstable macro conditions: The upward momentum continued into early 2022, with the unicorn list reaching 1,000 for the first time in February. However, macro trends like inflation, rising interest rates, and geopolitical crises — such as the war in Ukraine — arose to shock the public markets.

Some previously high-flying tech stocks, such as pandemic darlings like Robinhood and Zoom, as well as big tech giants, plunged, and many late-stage startups delayed or canceled plans to go public.

The venture market tightens: This year, venture funding has shrunk with each passing quarter, with some crossover investors pulling back significantly after experiencing massive losses in their public funds.

Mirroring their public-market peers, several high-profile, late-stage startups have already seen their valuations slashed. Some investors have also marked down the value of their private-company portfolios.

Exits cool off: The decline in unicorn births cannot simply be attributed to more companies exiting before they can raise unicorn-minting rounds. The uncertainty of public market performance is keeping many late-stage companies from seeking an exit via IPO or SPAC, especially in the US. In Q2’22, M&A deals fell to their lowest level since Q4’20.

As exits fall alongside funding, investors have become less certain that they will see blockbuster returns from portfolio companies. This has had a chilling effect on the late-stage deals that previously garnered huge valuations.

Which regions are producing fewer unicorns?

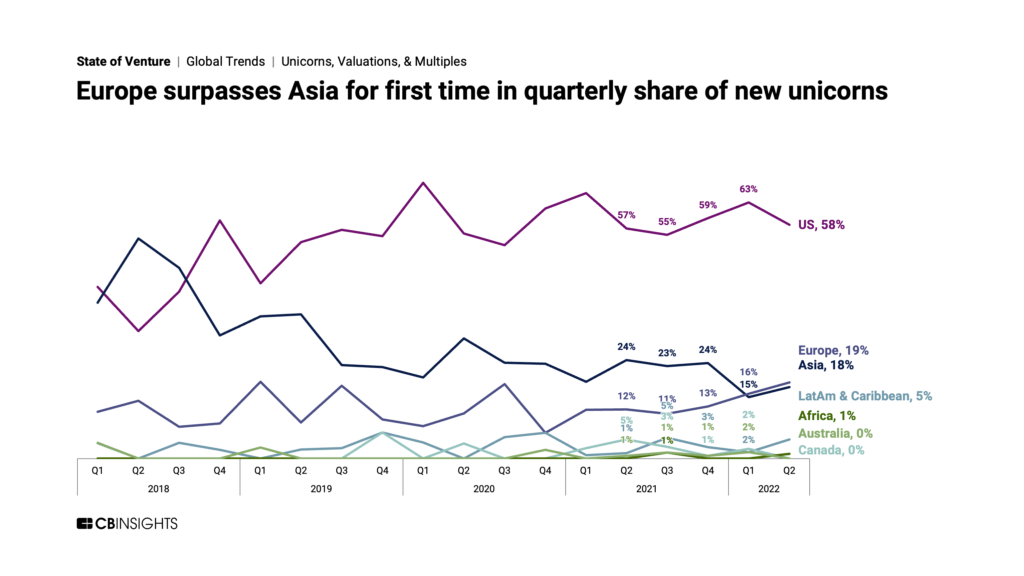

The slowdown in new unicorns has been felt most intensely in the US and Asia.

The US saw its share of new unicorns fall by 5 percentage points in Q2’22. Meanwhile, Asia experienced a more sustained decline: in Q2’22, its share of new unicorns came in at below 20% for 2 straight quarters for the first time in recent memory.

Europe, on the other hand, climbed to a recent high in share of new unicorns, with 19% in Q2’22, marking 3 quarters of growth and surpassing Asia’s share.

Three of the quarter’s top 10 most valuable unicorn births came out of Europe: SonarSource (Switzerland, $4.7B), BackBase (Netherlands, $2.7B), and Oura (Finland, $2.6B).

Europe’s funding environment also held strong — it saw just a 13% drop in funding QoQ in Q2’22, the smallest decline among major regions (the US and Asia both saw 25% decreases).

Its resilience can be chalked up to a few factors. For one, interest rates were hiked earlier in the US than in Europe, leading to a swifter pullback in the US venture market. Additionally, non-VC investors like Tiger Global and SoftBank — driving forces behind 2021’s surge in massive, late-stage funding rounds — have historically paid much more attention to startups in the US and Asia than in Europe. When they began to retreat this year, Europe was left relatively less affected.

However, with the EU’s and UK’s central banks starting to raise interest rates, Europe could see an acceleration in the decline of its investment activity — which could negatively impact the number of new unicorns that come out of the continent.

Which sector has seen the biggest decline in new unicorns?

While the fintech sector accounted for 1 in 4 global unicorn club members in Q2’22, it saw its share of new unicorn births fall more than any other sector we analyzed. Its 20 new unicorns represented a decline of 44% QoQ and 58% YoY. The top fintech unicorn births in Q2’22 were KuCoin ($10B), Coda Payments ($2.5B), and Newfront Insurance ($2.2B).

After fintech, retail tech saw the next largest drop-off, with new unicorns declining by 28% QoQ and 46% YoY. Among its 13 new unicorns, the top births were Salsify ($2B), Material Bank ($1.9B), and Mashgin ($1.5B).

Meanwhile, the digital health sector held steady QoQ with 8 new unicorns. That number is down just 27% YoY, the least among sectors analyzed. The quarter’s top new unicorns were Oura ($2.6B), Clarify Health ($1.4B) and Biofourmis ($1.3B).

How have valuations shifted?

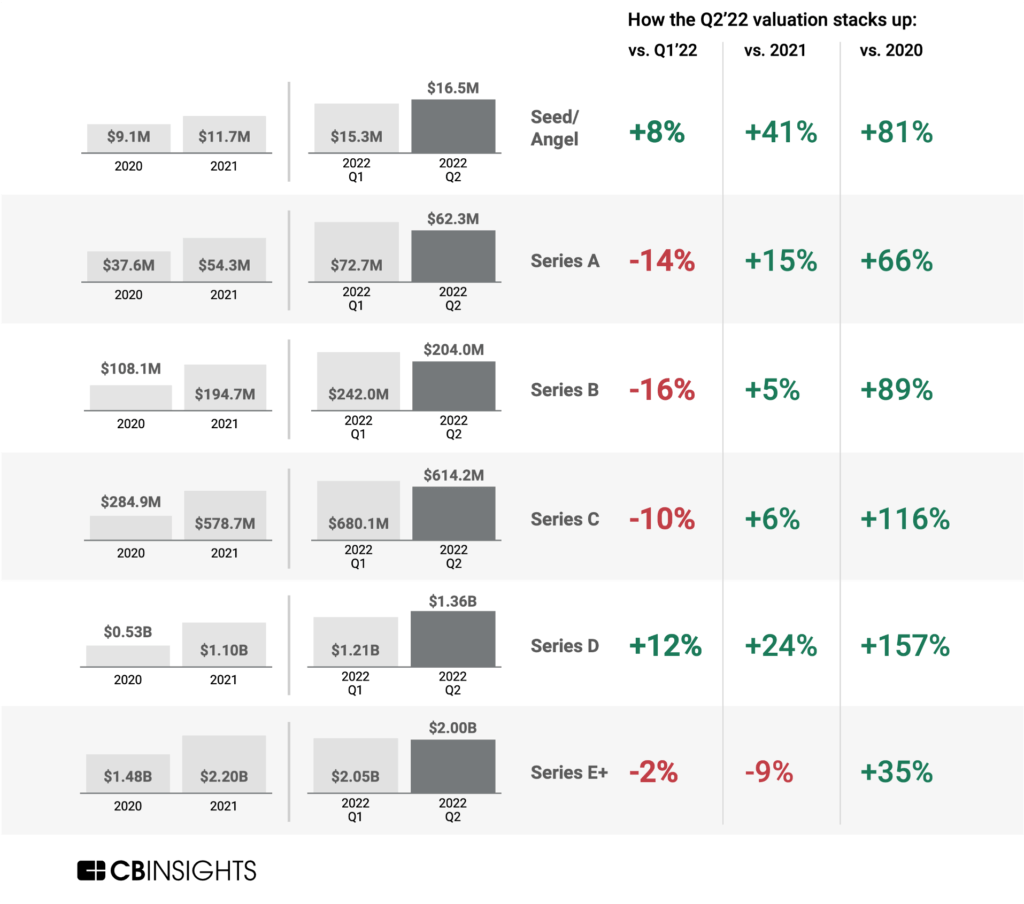

Valuations fell modestly across most investment stages in Q2’22. That said, valuations remain lofty compared to previous years, suggesting there’s room for them to fall further.

In Q2’22, only Series E+ rounds saw their median valuation fall below the full-year 2021 level. These have been the rounds most directly impacted by public market volatility.

Companies that raised large funding rounds in 2021 may be able to hold out for some time without needing to seek out more capital. However, companies burning through their cash may be forced to raise funding at a potentially significant discount.

As an example, Sweden-based buy now, pay later (BNPL) unicorn Klarna’s valuation skyrocketed during the pandemic to reach $45.6B in June 2021. After being driven up by online spending habits, its valuation came crashing down in July 2022. The company raised $800M in funding at a $6.7B valuation — an 85% drop.

The high-growth, high-loss business of BNPL has been hit hard by the downturn — especially as it largely relies on e-commerce volumes, which have dropped from pandemic highs. Affirm, a comparable public-market peer to Klarna, has seen its market cap fall by roughly the same margin since peaking in November 2021.

How has fundraising shifted?

As total VC dollars and deals have declined, investors have retreated from backing the late-stage companies that are most exposed to public market volatility.

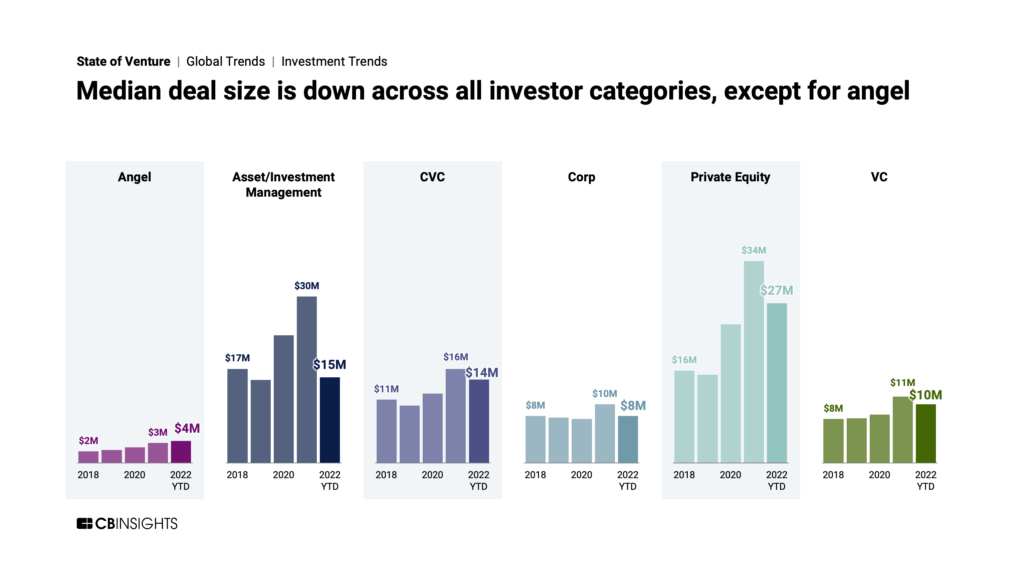

This broad trend has cut the median late-stage deal size (down 30% in 2022 YTD compared to full-year 2021) and the number of $100M+ mega-rounds (down 31% QoQ in Q2’22).

Last year’s most active investor, Tiger Global Management, has already shifted a vast portion of its private-market investing toward early-stage deals. It also announced that it would slow overall dealmaking through the end of the year.

Asset and investment managers like Tiger Global have seen the largest decline in median deal size among investor types.

A tighter funding environment — where investors are not competing as intensely for access to deals — means there will be fewer deals at the unicorn level, making it harder for any given company to achieve a valuation north of $1B.

What’s next?

Today’s abundance of unicorns is a vestige of 2021’s bullish venture ecosystem.

The ongoing slowdown in unicorns doesn’t mean companies won’t still hit billion-dollar valuations. It will simply be a matter of which ones can reach that milestone under increased investor scrutiny and a constrained monetary environment. Investors will seek out startups that are profitable and can use capital efficiently (for instance, not burning it at high rates to maintain growth).

For now, unicorns will likely avoid raising new funding if they can survive on their current cash, in order to steer clear of a down round that would lower their valuations. Otherwise, they may seek alternative deal terms — such as raising venture debt instead of equity or structuring deals to give investors a potentially higher payout — that limit the damage to their valuation or avoid a disclosed valuation altogether.

In effect, the balance of power is shifting from founders to investors. In this environment, companies will need to demonstrate they can balance sustainable growth with profitability to have a chance at reaching — or holding onto — a coveted $1B+ valuation.

If you aren’t already a client, sign up for a free trial to learn more about our platform.