This news comes on the heels of its Series F round. The funding will help Creditas explore acquisition opportunities and support geographical expansion. Here are the top-line bullets you need to know.

Creditas, a digital lending platform, has raised $260M in a Series F round that drew participation from SoftBank Group, VEF, Fidelity Investments, Lightrock, and Wellington Management, among others.

HOW’S THE COMPANY PERFORMING?

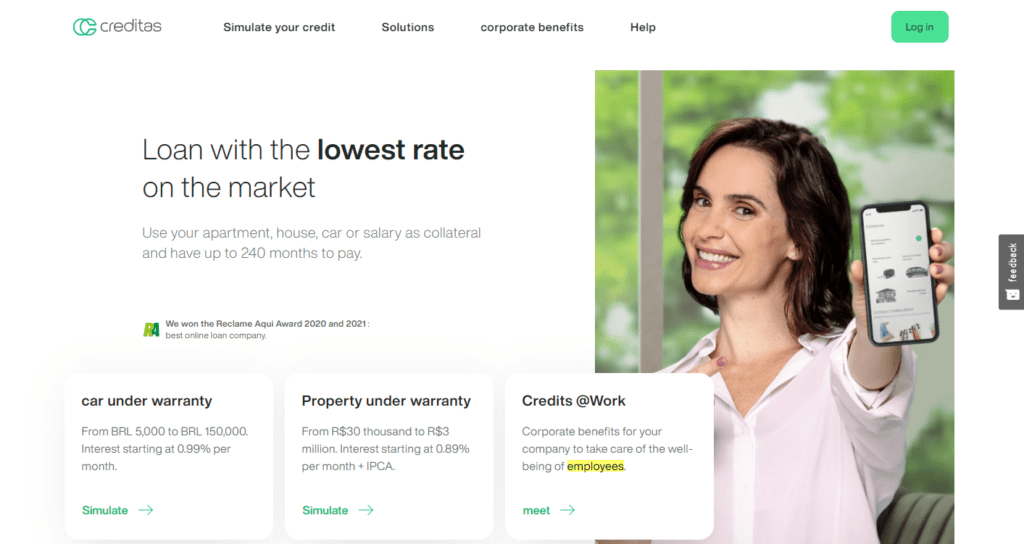

- Brazil-based Creditas (formerly BankFacil) offers collateralized loans to consumers.

- The company expects that its annualized revenue for 2021 will come in at $200M.

- Its credit portfolio under management grew from $189.3M in Q3’20 to $532M in Q3’21.

- Creditas currently employs over 4.2K people across São Paulo, Porto Alegre, Recife, Curitiba, Mexico City, and Valencia.

Source: Creditas

WHY DOES THE MARKET MATTER?

- The global digital lending platform market is expected to reach a value of $27.1B by 2028, growing at a CAGR of 18.13%, according to Verified Market Research.

- Widespread digitization has contributed to the increased adoption of digital banking, particularly among younger populations. In fact, 97% of millennials use mobile banking, according to Insider Intelligence. This has increased the demand for digital lending services, contributing to growth in this market.

- Covid-19 has also accelerated the adoption of digital lending services across sectors.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.