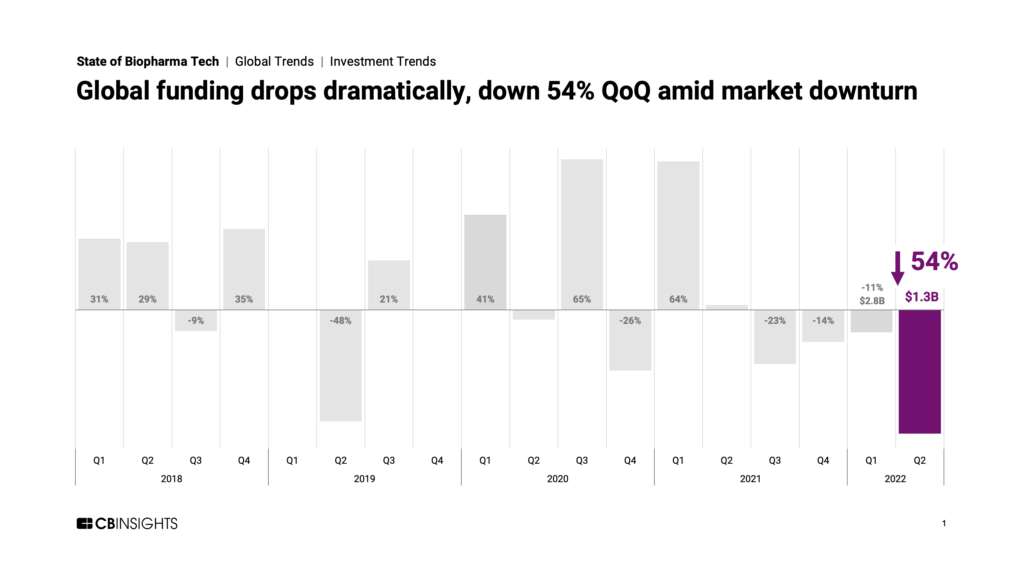

Investment in global biopharma tech falls to its lowest level in recent years.

Global biopharma tech funding reached $1.3B in Q2’22 — down 54% from the previous quarter, continuing the decline from record highs in 2021. The decrease in funding and deals affected all geographies.

Below, check out just a few highlights from our 54-page, data-driven State of Biopharma Tech Q2’22 Report. For deeper insights, all the record figures, and a boatload of private market data, download the full report.

Q2’22 highlights across the biopharma tech ecosystem include:

- Early-stage deal share is on pace to drop for the fourth consecutive year, representing just 38% of total deals in 2022 YTD.

- At $1B, the US raised the most biopharma tech funding among global regions in Q2’22, despite a 57% QoQ decline.

- The total number of biopharma tech unicorns dropped for the first time, as BenevolentAI went public via SPAC. There now remains just 1 unicorn outside of the United States (China’s XtalPi).

- After 22 IPOs in 2021, this year has seen just 2 in Q1 and zero in Q2. However, M&A deals did increase QoQ, suggesting that corporations may be more acquisitive as private company valuations drop.

- The most valuable private biopharma tech companies are Tempus (worth $8.1B), Caris Life Sciences ($7.8B), and Ro ($7B).

Download our Q2’22 State of Biopharma Tech Report to learn about all these trends and more.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.