The Series B round brings Fi to a $315M valuation — the company was last valued at $160M in June 2021. Here are the top-line bullets you need to know.

Fi, an Indian neobank focused on millennials, has raised $50M in a Series B. The round drew participation from Sequoia Capital, B Capital Group, Ribbit Capital, and Falcon Edge Capital.

How’s the company performing?

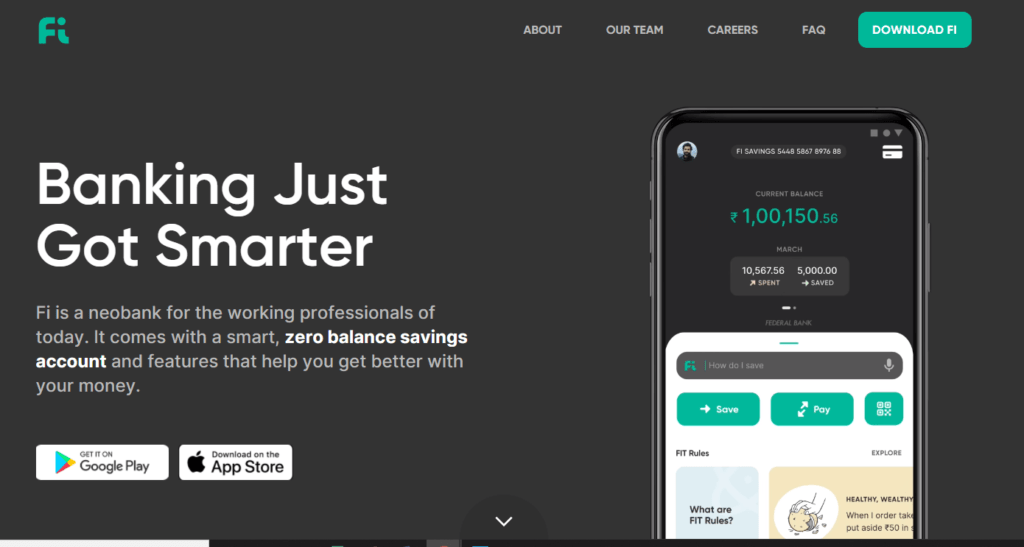

- India-based Fi provides digital banking solutions to help millennials understand and manage their finances. It offers a savings account along with a debit card, which is issued in collaboration with Federal Bank.

- According to the company, over 1M users had registered on its waitlist to open a savings account.

- Fi has posted zero operating revenue in FY’21, and its losses have exceeded $6.7M.

- Apart from Federal Bank, the company has partnerships with Visa, NCPI, and PCI DSS.

Source: Fi

Why does the market matter?

- The global digital banking market is projected to grow at a CAGR of 8.9% to reach a value of $1.61T by 2027, according to Research Dive.

- Estimates project that 3.6B individuals — roughly 1 out of every 2 adults — will use digital banking services across mobile and desktop platforms by 2024.

- Global shutdowns and branch closures have spurred the adoption of digital banking amid the Covid-19 pandemic.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.