Open plans to use the Series C funding to expand globally. Here are the top-line bullets you need to know.

Open, an Indian neobank for SMEs, has raised $100M in a Series C. This round drew participation from 3one4 Capital Partners, Temasek, Tiger Global Management, Google, and SBI Investment.

How’s the company performing?

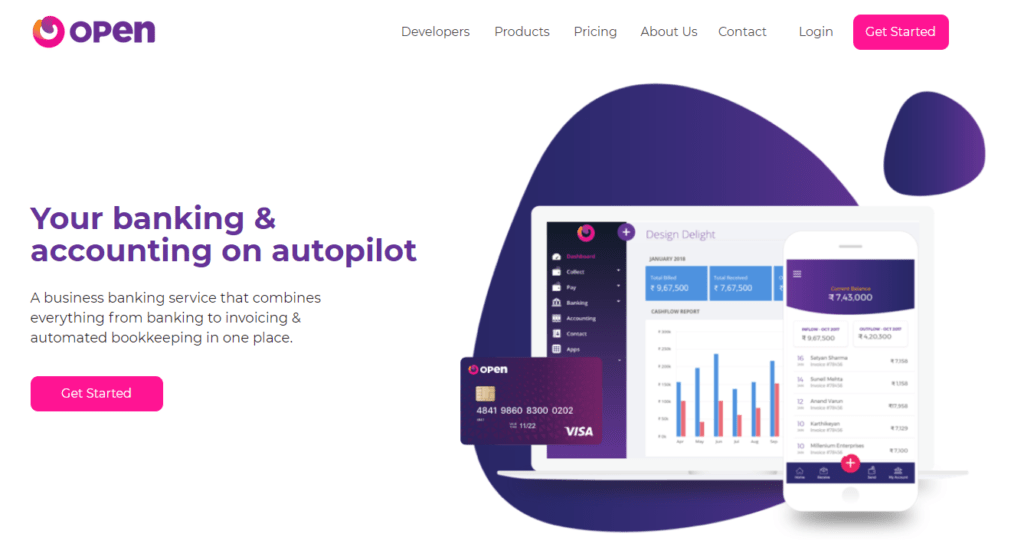

- India-based Open offers neobanking services, such as accounting, bookkeeping, digital banking, and invoicing, to SMEs and startups.

- The company has inked partnerships with over 12 banks across India and provides services to more than 2M SMEs. It claims that over 90K SMEs are added to its platform each month and that it processes 20B transactions annually.

- Open offers its neobanking technology to banks under a white-label licensing agreement.

- The company has around 500 employees.

Source: Open

Why does the market matter?

- The global digital banking market is projected to grow at a CAGR of 8.9% to reach a value of $1.61T by 2027, according to Research Dive.

- 3.6B individuals — roughly 1 out of every 2 adults — will use digital banking services across mobile and desktop platforms by 2024.

- Global shutdowns and branch closures amid the pandemic have accelerated the adoption of digital banking.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.