We share our rationale, data, and views on valuation.

This analysis is part of our series on 2024 M&A predictions. See all 10 matchups here.

Gong‘s valuation from its 2021 financing is just shy of publicly traded competitor ZoomInfo‘s market cap.

ZoomInfo has aggressively expanded into new GTM categories via acquisitions, including conversation intelligence — Gong’s primary offering — with its purchase of Chorus.ai in 2021.

But ZoomInfo has been seeing increasing price competition as CB Insights software buyer transcripts highlight.

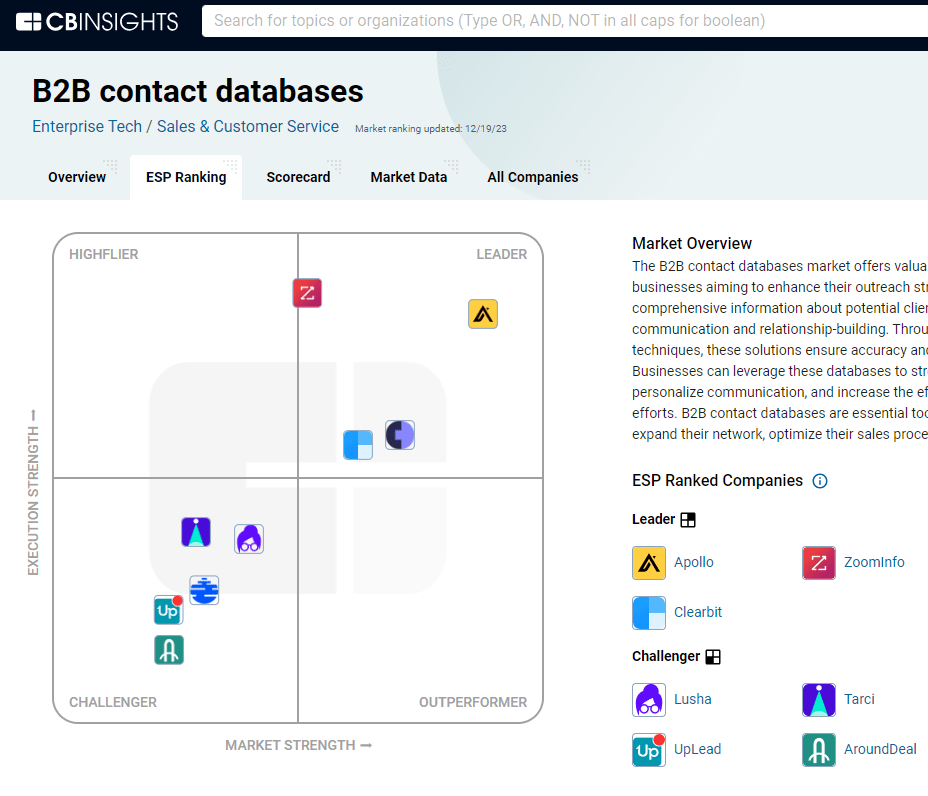

It’s ultimately resulted in losing its top spot to Apollo in our B2B contact databases ESP Vendor Matrix.

With ongoing consolidation in the sales and revenue operations market, we predict Apollo will be an attractive target for Gong in 2024 as it looks to compete on additional fronts with leading sales tech players.

Apollo, however, wouldn’t come cheap.

The company raised a unicorn round in August 2023 that valued it at $1.6B.

So why should Gong acquire Apollo?

- Combines Gong’s conversation intelligence with Apollo’s prospecting and engagement data for richer sales insights.

- Creates an all-in-one platform for sales teams, from lead generation to deal closure.

- AI capabilities of both platforms can be used for more advanced analytics and automated sales processes.

Find our next M&A prediction in this series — Hims merges with Ro — here.

If you aren’t already a client, sign up for a free trial to learn more about our platform.