The pandemic has driven telehealth funding to new heights — and investment hasn't slowed down. Below, we discuss the sector's market drivers as well as emerging themes and their key implications.

Telehealth usage skyrocketed at the onset of the Covid-19 pandemic. US telehealth visits increased 154% YoY in the last week of March 2020, according to the CDC.

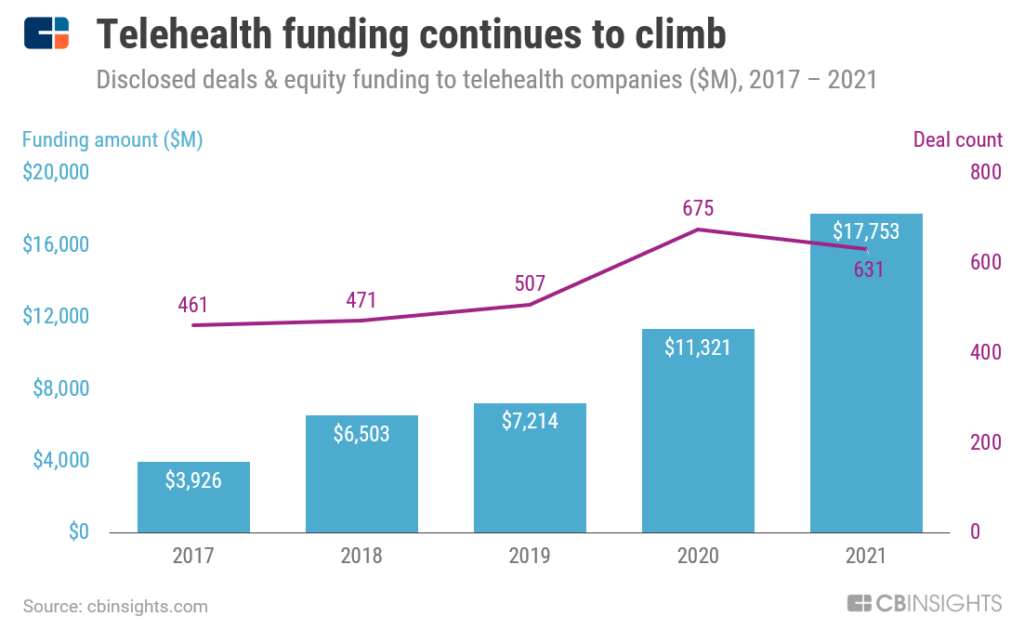

Now, 2 years into the pandemic, telehealth has become a key part of care delivery, and equity funding to startups in the space is at an all-time high.

In 2021, equity funding to telehealth companies reached nearly $18B, a 57% increase from 2020’s total. Mega-rounds ($100M+) largely contributed to the growth. For example, weight loss platform Noom and online pharmacy Ro both raised $500M+ rounds. Mental health startup Lyra Health also raised a $200M mega-round from Coatue Management and Sands Capital.

The telehealth space shows no signs of slowing down. In this brief, we’ll look at:

- The topline findings & implications for this growth

- The market drivers underlying this boom

- The categories receiving the most attention

To dig into all of the underlying data in this brief, sign up for a free trial to CB Insights here.

Telehealth

Companies developing, offering, or using electronic and telecommunication technologies to facilitate healthcare delivery from a distance.

Track Telehealth CompaniesWant to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.