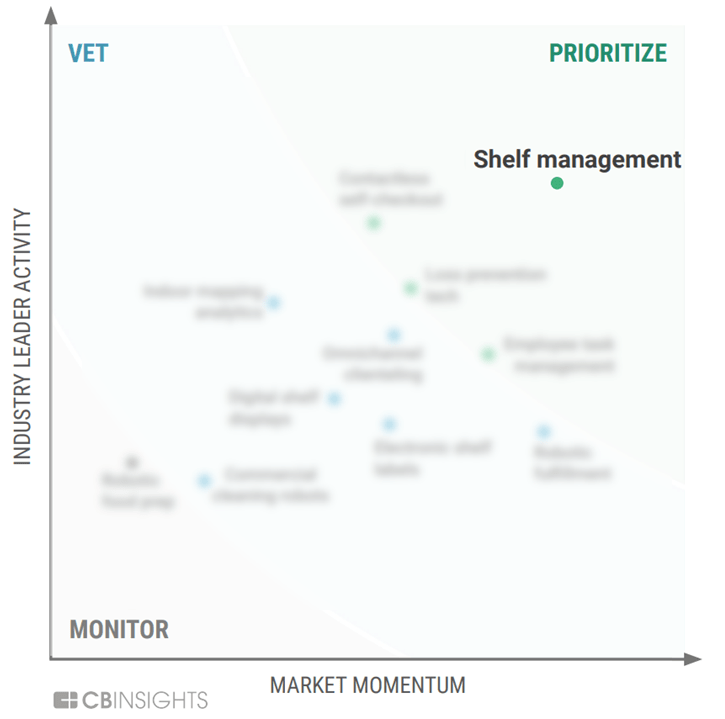

Shelf management solutions have garnered high market momentum and widespread industry leader adoption — making it a market worth prioritizing.

Clients can download the full Digitization And Task Automation For Retail Stores Report at the top left sidebar.

As shoppers continue to shift spending online, fulfillment and other e-commerce costs are slicing into retailers’ profits. To get the most out of their stores — which remain significant sources of profitability and sales — retailers are investing in tech that helps them run stores more efficiently and drive sales productivity.

Using CB Insights data, we examined tech markets across digitization and task automation for retail stores and ranked them across two metrics — market momentum and industry leader activity — to help companies decide whether to monitor, vet, or prioritize these technologies.

Shelf management earned a recommendation to prioritize, based on the market’s robust market momentum and industry leader activity.

Shelf management technology helps retailers monitor conditions in the store aisle. The complexity of the data tracked varies: while some tools simply monitor out-of-stocks, others can track marketing execution, while others help optimize promotional effectiveness.

Vendors use cameras, shelf sensors, mobile scanning, robots, and drones to collect data. From there, many synthesize that information with external data like other stores’ performance, weather, and holidays to help retailers forecast demand and optimize inventory, marketing, and pricing.

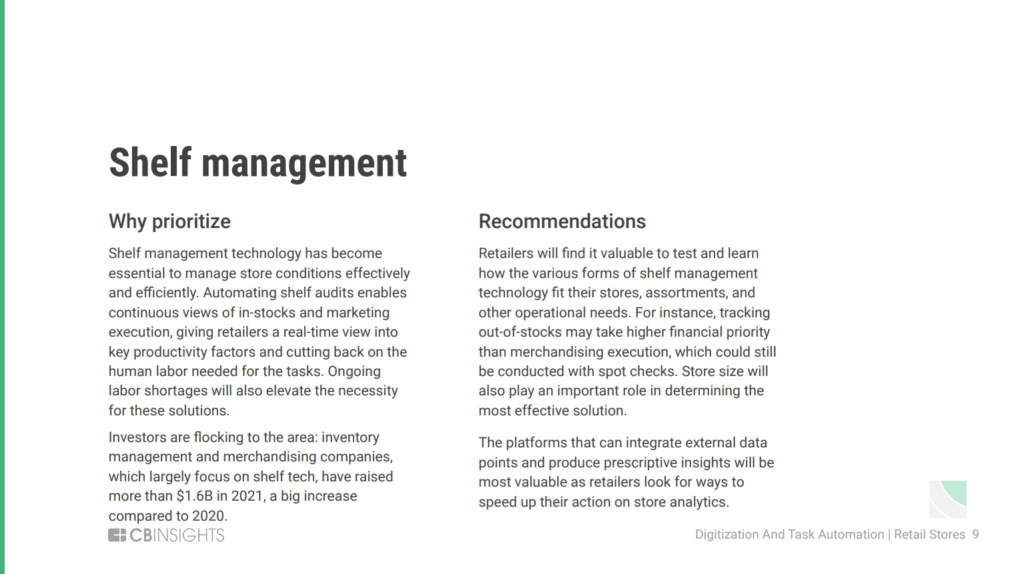

Shelf management technology has become essential to manage store conditions effectively and efficiently.

Retailers will find it valuable to test and learn how the various forms of shelf management technology fit their stores, assortments, and other operational needs. The platforms that can integrate external data points and produce prescriptive insights will be most valuable as retailers look for ways to speed up their action on store analytics.

Facts & figures: shelf management

- Funding: The shelf management tech companies analyzed for this report raised a record $709M in 2021.

- Top-funded companies: Top-funded companies in the space include Trax ($1B in total disclosed equity funding), Relex Solutions ($222M), and Scandit ($123M).

- Deal stage: As the market matures, deal share has increasingly trended away from early-stage deals towards proportionally more mid- and late-stage deals to companies in the space.

- Market size: The broader retail automation market is estimated to be a $20.5B industry, per CB Insights’ Industry Analyst Consensus.

Clients can dive into shelf management solutions and more in our complete MVP Technology Framework — Digitization And Task Automation For Retail Stores.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.