The company has raised $65M in Series B funding to accelerate product development. Here are the top-line bullets you need to know.

Taptap Send, a cross-border money transfer platform, has raised $65M in a Series B round that drew participation from Spark Capital, Slow Ventures, Breyer Capital, and Unbound, among others.

How’s the company performing?

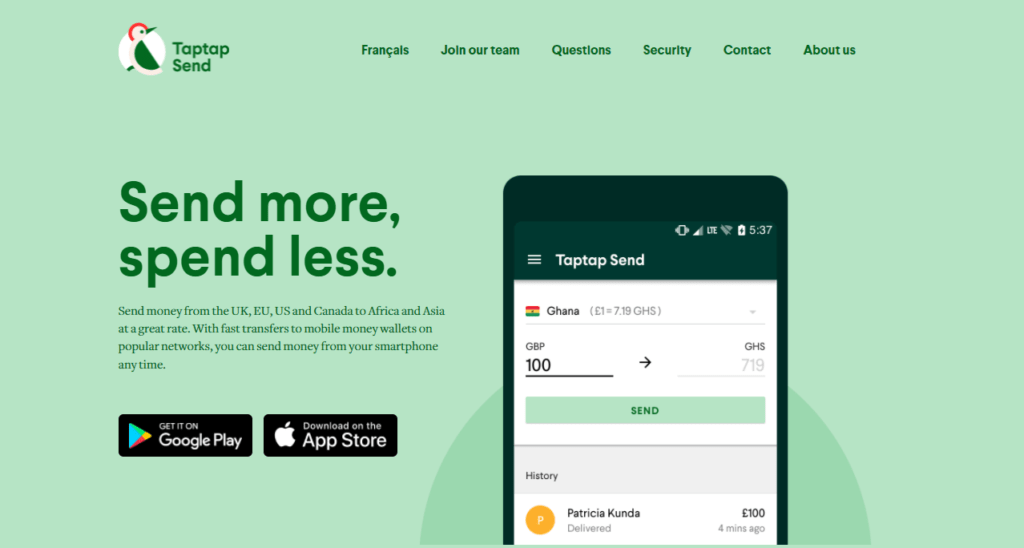

- UK-based Taptap Send helps users initiate, manage, and receive instant cross-border payments without paying any additional fees.

- Amid the Covid-19 pandemic, the company has grown more than 8x.

- The startup is currently supported by a team of more than 100 employees.

- Taptap Send currently operates across 20 countries, including Bangladesh, Ethiopia, Nepal, Morocco, Madagascar, Ghana, Senegal, Zambia, and Pakistan.

Source: Taptap Send

Why does the market matter?

- The global digital remittance market is expected to reach $42.5B by 2028, growing at a CAGR of 13.3%, according to Grand View Research.

- The high costs and slow speeds associated with traditional remittance processes have increased the demand for digital money transfer solutions.

- The adoption of mobile banking services has accelerated amid pandemic-related lockdowns and social distancing regulations.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.