The Series E round helps bring Airwallex to a $4B valuation. Here are the top-line bullets you need to know.

Airwallex, a business banking tech and API platform provider, has raised $200M in a Series E. The round drew participation from DST Global, Salesforce Ventures, Sequoia Capital China, and 1835i, among others.

How’s the company performing?

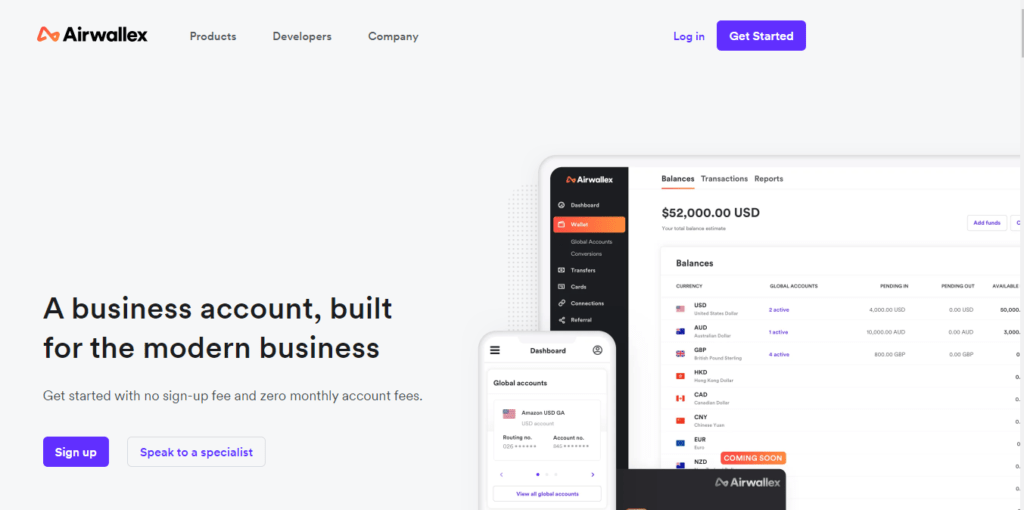

- Australia-based Airwallex provides business banking services directly to businesses. It also offers a set of APIs that companies can use to provide financial services to their own customers.

- Since its inception, the company has integrated with more than 50 banks and currently offers payment services across 95 countries.

- In the first half of 2021, Airwallex’s revenue grew almost 150% year-over-year.

- Airwallex has nearly 1000 employees across more than 20 global locations. It intends to add 30 more people by the end of 2021 in order to strengthen its position in newer markets such as the Netherlands, France, Italy, Germany, and Malaysia.

Source: Airwallex

Why does the market matter?

- The global digital payment market is projected to grow at a CAGR of 19.4% to reach a value of $236.1B by 2028, according to Grand View Research.

- The rise in e-commerce sales has led to an increase in digital transactions, boosting market growth. Moreover, increased investments by banks to enhance digital payment infrastructures and compete with major players like Google, Amazon, and Facebook have further contributed to this expansion.

- eWallets are witnessing increased “peer-to-peer” and “customer-to-business” payments due to the pandemic, and this trend is expected to continue.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.