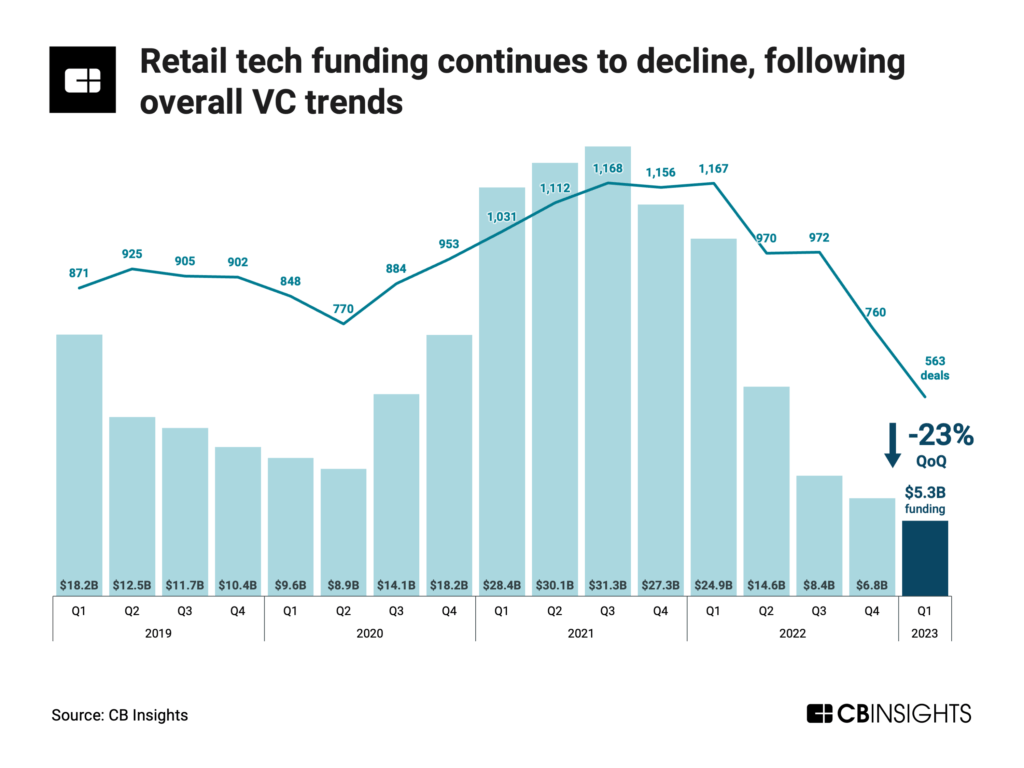

Retail tech funding declines by 23% in Q1’23 as deals plunge and investor attention shifts toward early-stage rounds.

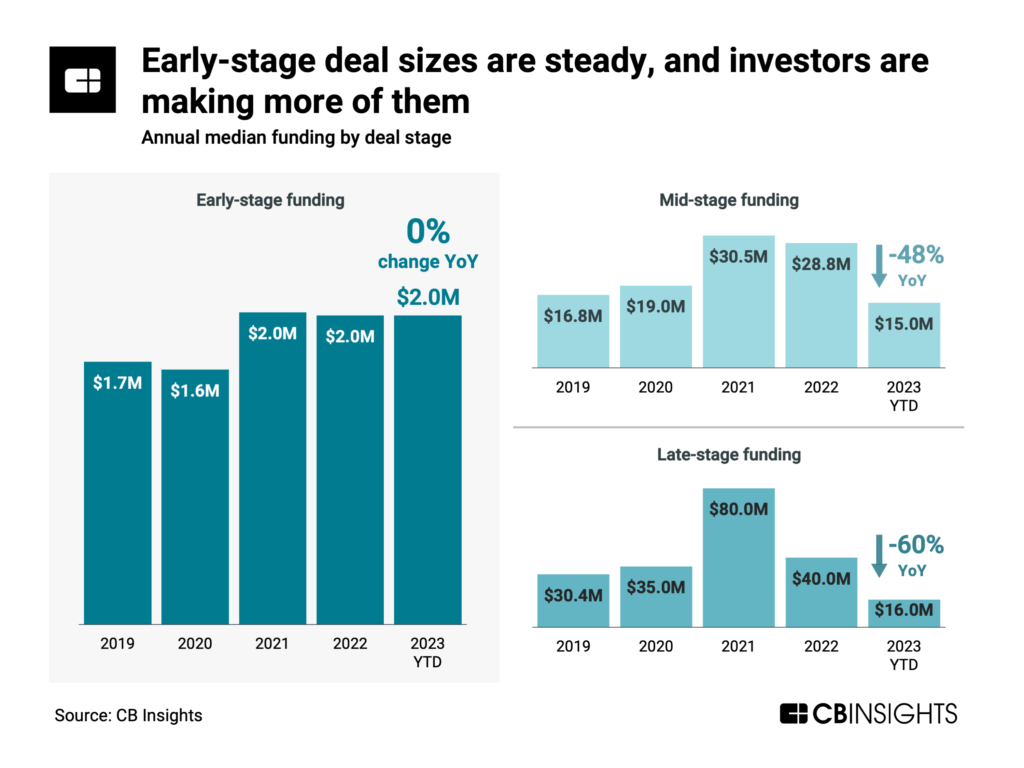

Funding and deals in retail tech continued to fall in Q1’23, mirroring declines in the broader venture landscape. But more focus on early-stage deals and strength in some sectors point to continued investor interest in retail tech.

Using CB Insights data, we dug into the retail tech and innovation landscape in Q1’23, including:

- The continued decline in retail tech funding in Q1’23, to its lowest level since Q2’16

- Early-stage deal strength in retail, and where the money is going

- A steady quarter for exits, with 9 IPOs and a slight uptick in M&A activity

- The handful of mega-rounds that buoyed food & meal delivery funding

- The 11% quarter-over-quarter increase in US funding

Let’s dive in.

Retail tech funding declined 23% quarter-over-quarter (QoQ) in Q1’23, hitting its lowest quarterly level since Q2’16. Meanwhile, deals fell 26% to 563, the lowest quarterly tally since Q4’14.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.