Regulations and technical challenges have slowed drone delivery’s expansion. However, successful pilots and full-service operations are pushing leaders like Zipline ahead.

Drone delivery is a complex market. Providers face everything from shifts in intricate regulations to technical hurdles like crashes and safety concerns.

As a result, success in the field has been varied: Walmart has made 10K+ drone deliveries with its partners, but Amazon’s Prime Air program, once the poster child for the technology, saw significant layoffs early in 2023.

But the market has seen some promising activity in recent months.

In August, Walmart announced its fourth drone partnership: drones from Alphabet’s Wing will deliver orders from 2 Walmart stores in Dallas.

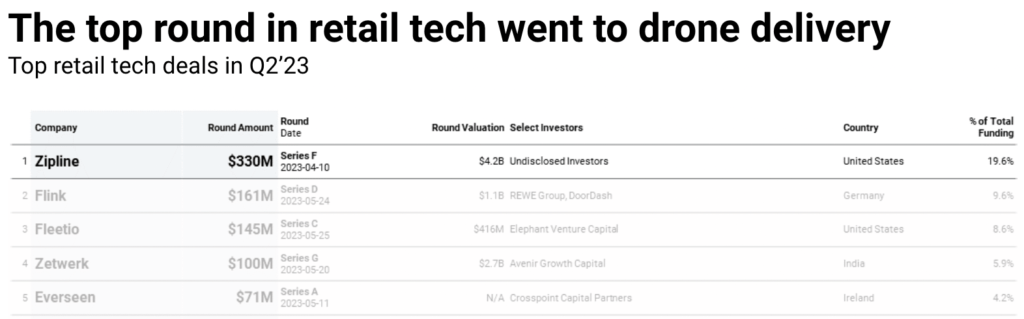

That announcement came a few months after another Walmart drone partner, Zipline, raised a $330M Series F round, marking the biggest retail tech deal in Q2’23.

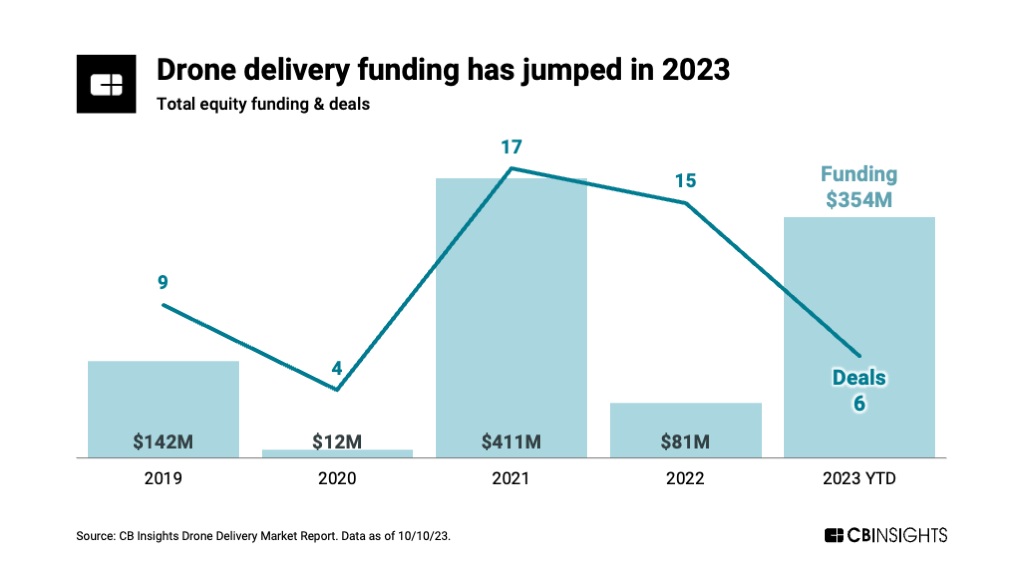

Largely driven by Zipline’s mega-round, drone delivery startups have raised $354M in 2023 so far. This marks a more than 4x increase from 2022.

So what’s going on? Is drone delivery ready to take off — or will there be a failure to launch?

The answer remains mixed.

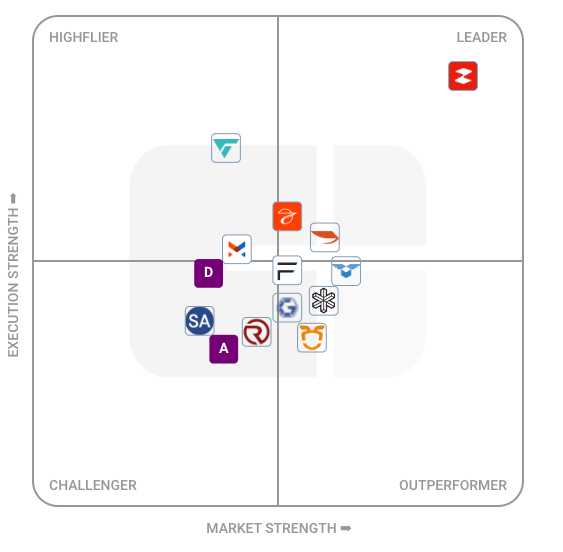

Few drone operators have emerged as leaders. In our drone delivery ESP Ranking — which identifies and ranks leading companies in the landscape — only Zipline has separated itself from the pack.

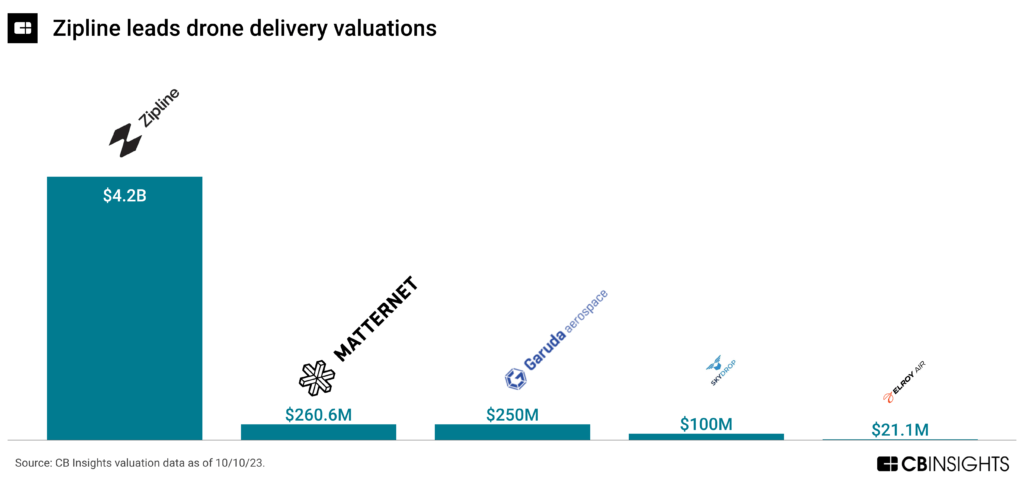

Zipline leads among drone delivery providers when it comes to valuations as well.

Notably, the company has grown through several successful proofs of concept.

In 2016, it started with medical delivery in Rwanda and other markets in Africa with less regulatory pressure. Now, the company is expanding across verticals in the US, including grocery and meal delivery, via partnerships with major players like Walmart and Sweetgreen.

But there’s still potential for other players in the market.

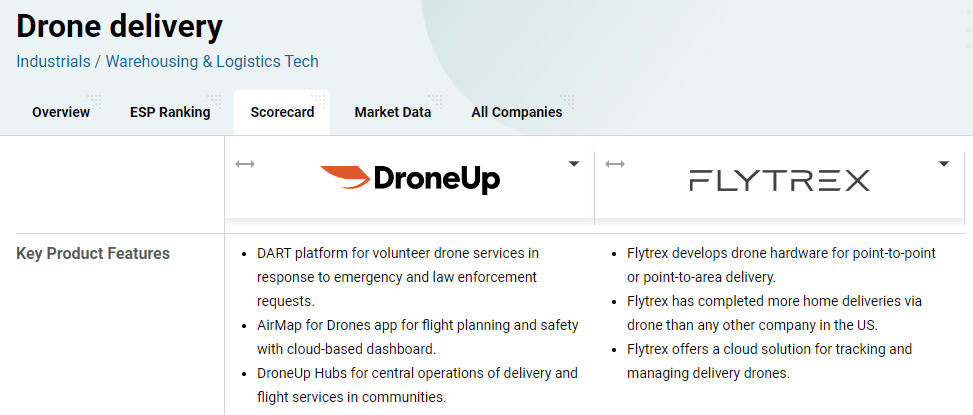

For instance, besides Zipline and Wing, Walmart has partnered with DroneUp and Flytrex.

When we look at the CB Insights drone delivery scorecard, both companies share a key highlight: full-service solutions that allow for broader tracking and management of deliveries and drones.

The takeaway: in this nascent and heavily regulated market, customers are prioritizing execution and ease of use. Consistent pilots and partnerships as well as full-service operations are driving wins for the leaders.

Dig into more metrics on this market — including employee headcount and valuations — using our drone delivery market report.

If you aren’t already a client, sign up for a free trial to learn more about our platform.