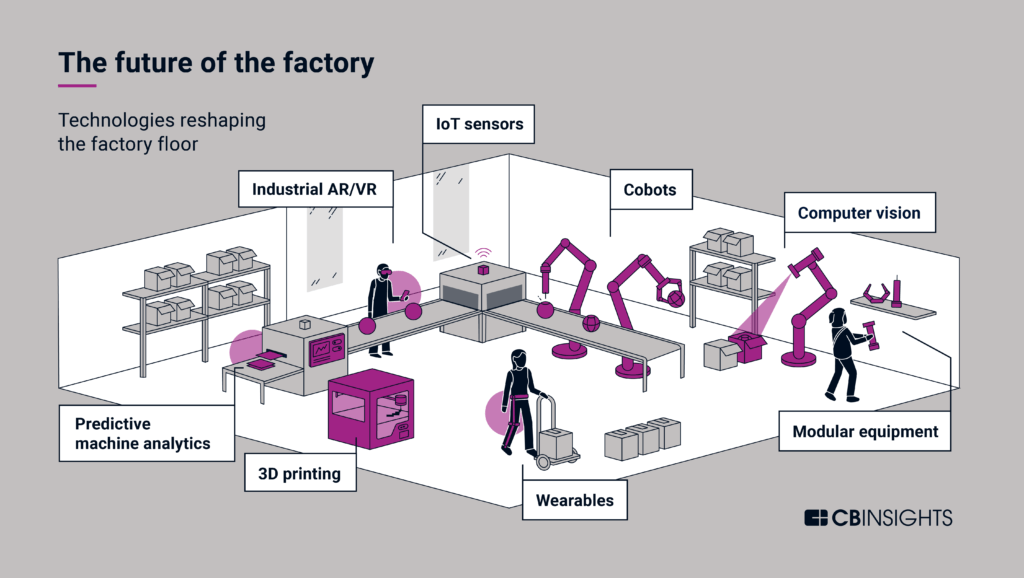

Facing enormous pressure to stay competitive, manufacturers are turning to technology to digitize and automate operations. We take a look at the evolution of manufacturing and where technology is bringing it next, from human-powered exosuits to collaborative robots and beyond.

In response to global disruption, the manufacturing sector has changed dramatically since 2020. Manufacturers are increasingly looking to new technologies — from advanced robotics in R&D labs to computer vision in warehouses — that increase productivity to remain competitive.

The timelines and technologies will vary by sector, but nearly every manufacturing vertical (e.g., cars, electronics, pharmaceuticals, warehousing, etc.) will see sweeping change in the next decade. Digitization and automation of the factory are lucrative long-term investments because they decrease costs of labor, increase uptime, and slash error rates.

FREE REPORT: 2022 TECH TRENDS

De-risking supply chains. The electrification of everything. Fusion energy. Get our 70-page analysis of the tech trends shaping industries from manufacturing to financial services in 2022 here.

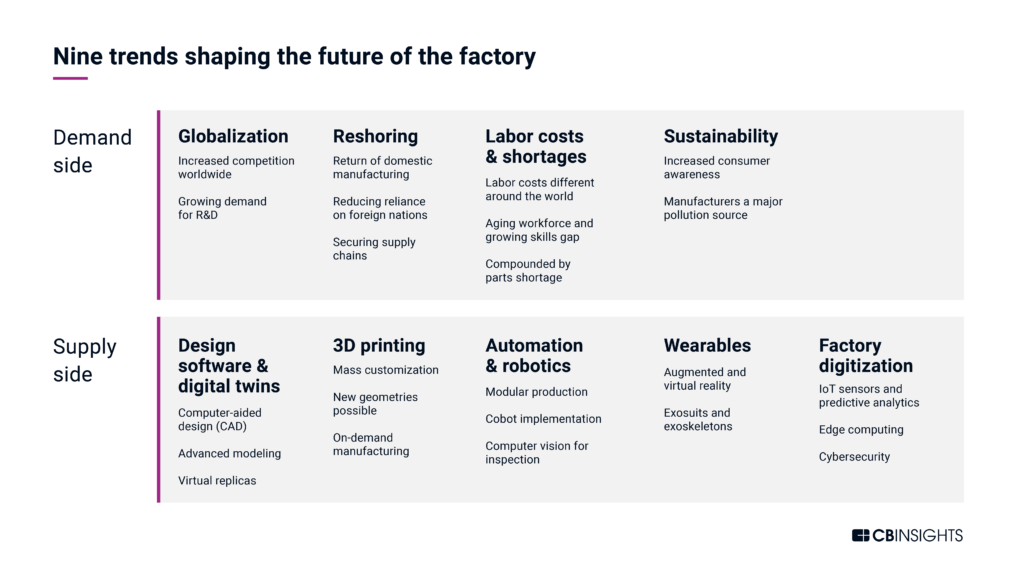

In this report, we examine demand factors — including macroeconomic and social trends like reshoring and the push for sustainability — that are driving change in manufacturing. From there, we delve into emerging supply-side technologies that will shape the factory of the future.

Table of Contents

- The current market

- Demand side

- Globalization

- Reshoring

- Labor costs & shortages

- Sustainability

- Supply side

- Design software & digital twins

- 3D printing

- Automation & robotics

- Wearables

- Factory digitization

- Looking ahead

The current market

Since 2020, the effects of the Covid-19 pandemic, natural disasters, and trade tensions have severely disrupted the global economy. Combined with surging consumer demand, labor shortages, and continued supply chain issues into 2022, manufacturers have major challenges to overcome.

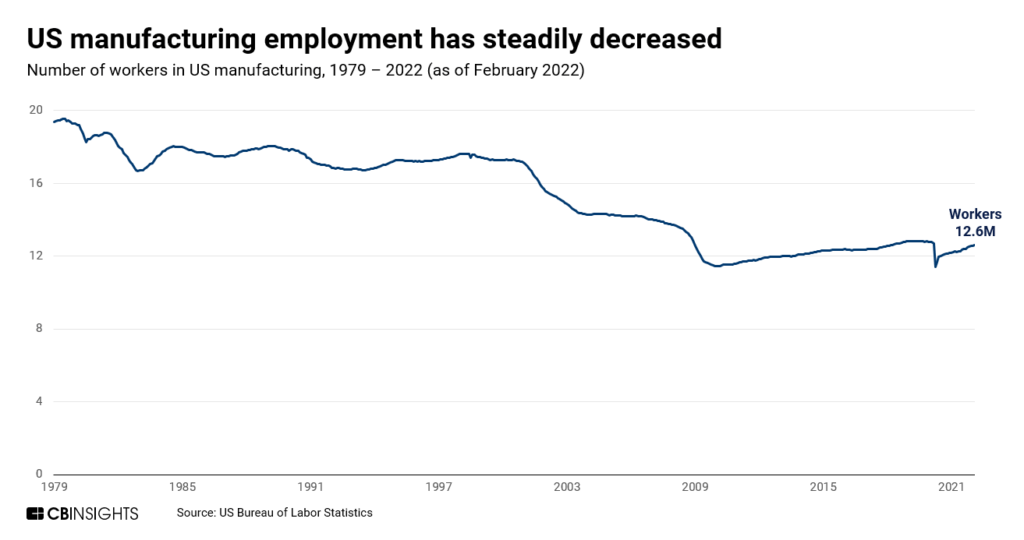

For decades, the sector has experienced significant employment decreases, especially when accounting for population growth. In the US, according to the US Bureau of Labor Statistics, manufacturing reached a peak of around 19.5M jobs in 1979, while falling to a low of 11.5M in 2010. Aside from Covid-19 disruption — which caused total manufacturing jobs to drop by 1.3M before quickly rebounding — manufacturing employment has since ticked up to around 13M jobs today.

The manufacturing workforce is shrinking on a global scale. Both Australia and Canada experienced an employment decrease from around 23% of total employment in 1991 to around 19% in 2019, according to World Bank data. Meanwhile, during that same period, manufacturing employment decreased from around 30% to 18% in the UK.

There are 2 main reasons for this trend:

- As China has opened to the global economy, manufacturing has shifted overseas — though some of it is now returning due to reshoring.

- Manufacturing productivity is increasing, which means fewer workers are needed to achieve the same results. Manufacturing value added has remained at around 16% of global GDP, even with decreasing employment.

Despite representing nearly one quarter of US GDP as of 2020, manufacturing remains an area of relatively low digitization. For instance, most countries around the world average fewer than 200 robots per 10,000 employees, suggesting there is plenty of headroom for automation and robotics investment on the factory floor.

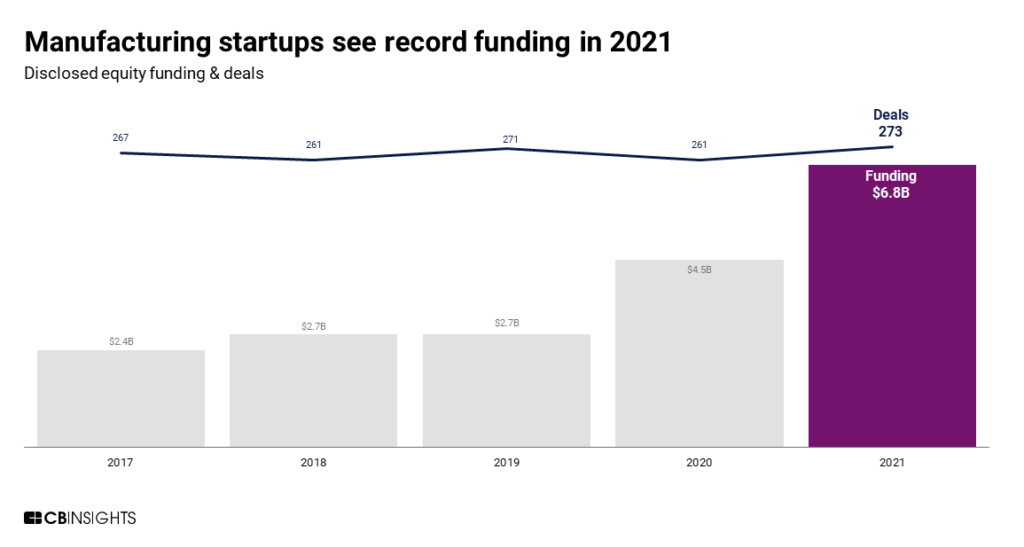

This is translating to record levels of investment in manufacturing tech companies. Over the past 5 years, equity funding to the sector has nearly tripled to reach $6.8B in 2021. During that time, the number of deals plateaued at around 270 annually, suggesting that the average deal size is increasing as the market matures and companies move into later stages of growth.

The Covid-19 pandemic initially slowed digitization efforts. About 38% of manufacturers surveyed by Deloitte hit the brakes on smart factory investments in 2020. Nevertheless, by 2021, 80% of manufacturers reported that smart factories are key to their future success, according to a Plex report. Investment will likely continue to pour into the sector.

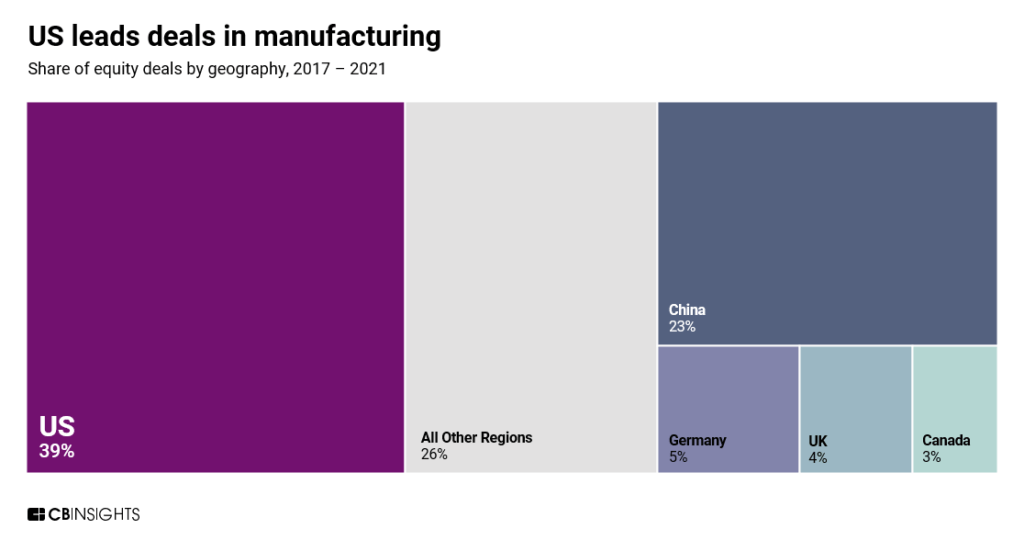

The country with the highest share of deals since 2017 is the US, at 39%, followed by China, at 23%.

Labor costs are higher in the US than in most countries around the world, necessitating the investment in advanced technologies like robotics, predictive analytics, and 3D printing to compensate for the inability to simply hire more workers. This also explains why the leading countries with robotics investment — South Korea, Singapore, Japan, and Germany — all carry high labor costs.

But labor costs are not the only driver of technology investment and adoption. Below, we dig into the demand- and supply-side elements ushering in manufacturing’s technological revolution.

Demand side

Global competition drives demand for new solutions

Globalization has increased competition for manufacturers worldwide, particularly as manufacturing has shifted to countries with low labor costs. This competition has driven declines in the US share of global manufacturing activity from 29% in the early 1980s to a low of about 16% in 2011, according to the Congressional Research Service. It has since increased to over 18% (as of 2018) due to reshoring.

In addition to a decline in manufacturing output in the US, increased imports from China have led to a decreased product markup, according to a paper from the Federal Reserve. At the same time, additional competition has pushed up the quality of products. That may be good news for the average consumer, but it has been tough for the manufacturers absorbing the added costs.

In order to compete, countries such as the US, Japan, South Korea, and European nations are exploring new technologies to reduce costs across the manufacturing process.

For example, GlobalFoundries, a producer of advanced semiconductors, has invested in extensive automation and robotics at its Malta, New York facility. The goal was to reduce production time and error rates, while moving people off the factory floor and into specific control rooms — in effect making each worker more productive and increasing product quality. In June 2021, the company announced it would expand the facility and construct a new fab (also in Malta) that will double its capacity.

Source: GlobalFoundries

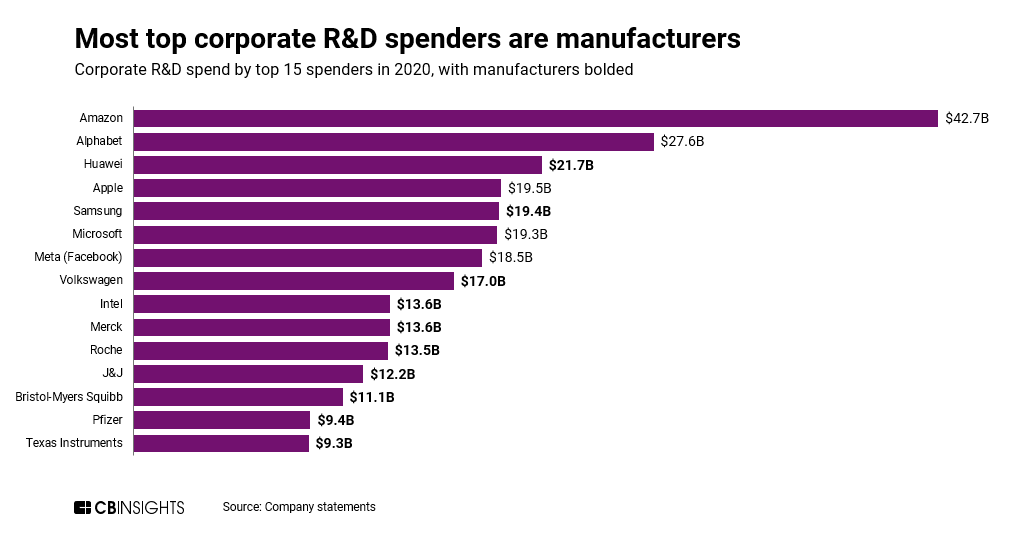

Globalization has also resulted in increasing demands for R&D, where new manufacturing processes — including digitization and automation efforts — are developed. Major companies across pharmaceuticals, technology, aerospace, and other sectors now invest billions of dollars each year into R&D, with many manufacturers topping the list of corporate spenders.

Manufacturers are also spreading this R&D spend across more countries as they seek to better understand local markets, engage local talent and infrastructure, and more.

With further integration across the planet and relative ease of shipping items around the world, manufacturers will continue to face the effects of globalization for decades to come.

Reshoring increases among high-cost nations

There is intense political pressure around the developed world for companies to stop offshoring manufacturing. But the combination of connected international supply chains, affordable labor, reduced business costs, and government financial incentives is difficult for companies to ignore. This resulted in significant manufacturing employment losses among developed countries in recent decades.

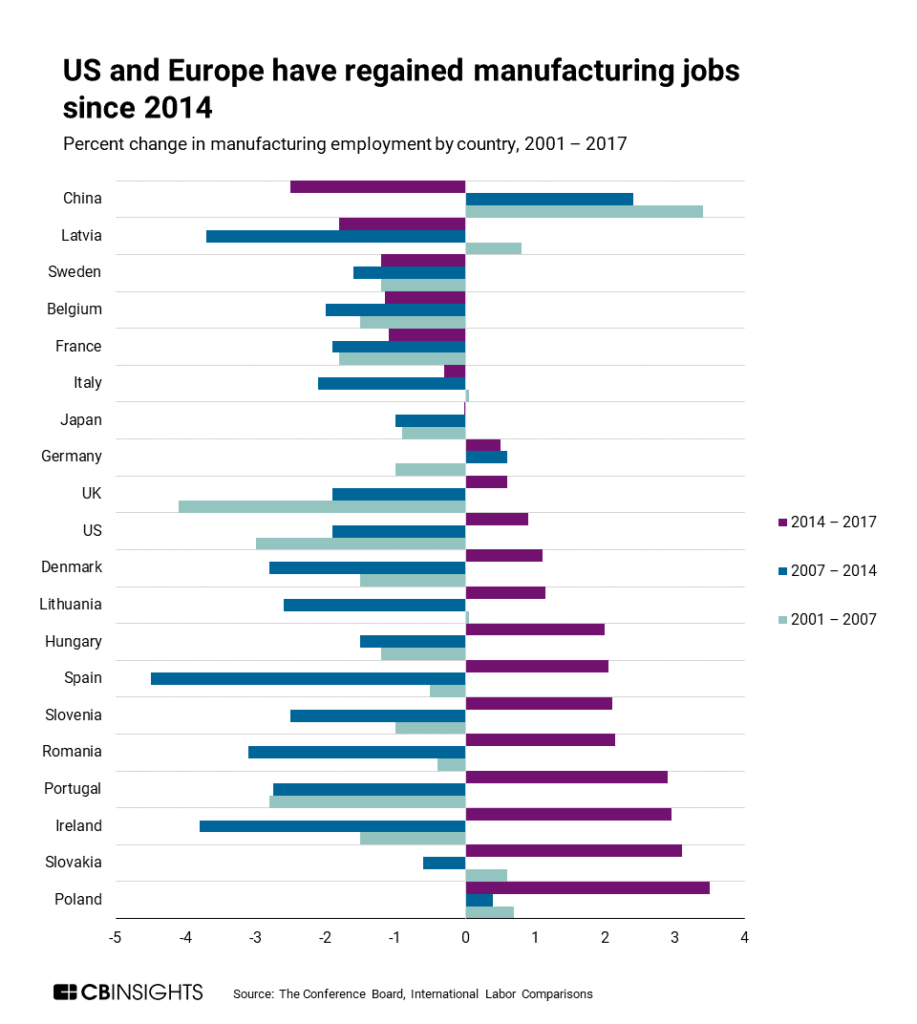

However, since 2014, reshoring — the process of companies bringing overseas manufacturing back to their home countries — has led to growth in employment figures across the US and much of Europe. Meanwhile, manufacturing has moved away from China since 2014.

Three factors are behind the current acceleration of reshoring efforts:

- The advancement of automation, robotics, digitization, and other technologies that increase worker productivity. As these technologies become cheaper, they make it more economically feasible to reshore manufacturing, even given higher labor costs.

- Covid-19. With strict lockdowns among many Asian nations, motivation for reshoring increased, since lockdowns among Western nations were typically less intensive. In 2020, there were 109K jobs reshored to the US, with 46% of these positions coming from China, according to one report. Covid-19 was listed as the main reason, and most of those positions were in pharmaceuticals and personal protective equipment (PPE).

- Growing demand to reduce reliance on foreign nations and establish secure supply chains, especially in critical industries like semiconductors and advanced packaging. Governments are increasingly concerned about hostile countries causing severe economic damage by restricting trade, and this is leading to a resurgence of reshoring. For example, Intel recently partnered with DARPA on supply chain security and increasing domestic manufacturing, while Europe is looking for strategic autonomy in semiconductors.

Labor costs and shortages are common around the world

The difference in manufacturing labor costs around the world is significant, ranging from $60 per hour in Switzerland to $39 in the US and around $5 in Mexico and China, according to The Conference Board. With labor-intensive industries, such as textiles and consumer electronics, this cost disparity is difficult to ignore and a critical reason for the shift of manufacturing to low-cost countries.

High labor costs are also driving demand for robotics and automation. In fact, it is estimated that robotics could reduce labor costs 16% globally by 2025.

Countries like Japan and South Korea have aggressively adopted robotics to combat labor costs and constraints. Both nations face an aging population and overall population decrease, making robots necessary to fill roles previously filled by people. Japan-based industrial robot makers produced more than 50% of robots supplied worldwide in 2017, while South Korea utilizes more industrial robots per 10,000 employees than any other country.

Source: International Federation of Robotics

Around the world, manufacturing is being squeezed by labor and skills shortages. People over 55 years old make up increasingly larger portions of the technical workforce in the US, signifying that young employees are not replacing older ones in high-enough totals. Meanwhile, technical demands for manufacturing have grown, making it more difficult to hire the right workers. As a retired Siemens executive told the New York Times, “People on the plant floor need to be much more skilled than they were in the past. There are no jobs for high school graduates at Siemens today.”

The effects of Covid-19 increased labor shortages further, with 80% of US manufacturers finding it difficult to hire during the pandemic, per a Society for Human Resource Management report. Meanwhile, job openings increased by 33% in the US since Q4’19. Similarly, they increased by 30% in Israel and 54% in Australia.

The shortages are not limited to labor. There is a physical parts shortage across industries, most notably within semiconductors. This is forcing creative engineering, with companies redesigning products for more supply chain resilience. Ford, for instance, recently partnered with GlobalFoundries and NXP Semiconductors to create more resilient designs, while General Motors announced partnerships with semiconductor suppliers to double down on North America-based manufacturing.

Overall, these trends are causing more demand for automation, robotics, and other technologies to enable higher-efficiency workers and more resilient supply chains.

Sustainability initiatives are front and center

Manufacturers are increasingly aware of their environmental impact, especially given consumer demand for sustainable practices. Reducing energy and water usage in facilities can lead to significant cost savings.

Energy use in manufacturing accounts for 24% of global greenhouse gas emissions with another 5% from various industrial uses, according to Our World in Data. The manufacturing sector also contributes to detrimental environmental and health effects such as water, air, and noise pollution.

In response, a number of companies are developing clean manufacturing solutions.

- Solidia Technologies is making cement production — which it claims is responsible for 5-7% of carbon emissions globally — more sustainable by offering 2 solutions: its cement manufacturing tech, which reduces emissions by up to 40%; and its concrete curing tech, which uses CO2, not water. This technology could save up to 3T liters of water annually, in addition to consuming CO2 from the atmosphere.

- Similarly, Fortera has developed a process that turns CO2 into cement, reducing emissions by more than 60% per ton. In October 2021, the California-based company expanded into Europe.

- Considering that the steel industry is one of the top three CO2 producers in the world, decarbonizing steel production is also a necessity. H2 Green Steel is a Sweden-based company founded in 2020 whose main focus is decarbonizing steel production using energy from fossil-free sources, including green hydrogen. The company is building a factory in northern Sweden, which it hopes to complete by 2024. By 2030, the company plans to produce 5M tons of green steel.

Source: H2 Green Steel

- Before a company tackles carbon management, it must first understand its current emission levels. Sweep‘s platform allows users to input various aspects of their business and see how they contribute to emissions. Sweep users can also create goals for lowering their environmental footprint and keep track of their progress.

- Innovations in the agricultural sector are also addressing decarbonization. Nitricity, a California-based startup, allows farmers to produce carbon-free nitrogen fertilizer on-site. Its technology relies on just electricity, air, and water. In August 2021, the startup raised a $5M seed investment.

- Beyond carbon emissions, TerraCycle serves to reduce waste by recycling material that is repurposed as building supplies and consumer goods. It last raised a $25M Series A in 2020 and has operations in 21 countries, working with major brands such as Nestlé and PepsiCo.

FREE REPORT: 2022 TECH TRENDS

De-risking supply chains. The electrification of everything. Fusion energy. Get our 70-page analysis of the tech trends shaping industries from manufacturing to financial services in 2022 here.

Supply side

The confluence of demand-side market factors — from labor shortages to sustainability demands to increasing competition — is pushing global manufacturers to adopt new technologies that promote digitization and automation on the factory floor.

This wave of digital transformation, labeled Industry 4.0 (for the fourth industrial revolution), comprises a sweeping range of emerging technologies that aim to improve every aspect of industrial operations. We explore 5 key tech trends below.

Design software & digital twins

From drug production to industrial design, the planning stage is crucial for mass production. Fortunately, there are many tools and technologies to help designers, scientists, and engineers across industries work more efficiently.

SOFTWARE speeds up PRODUCT DESIGN

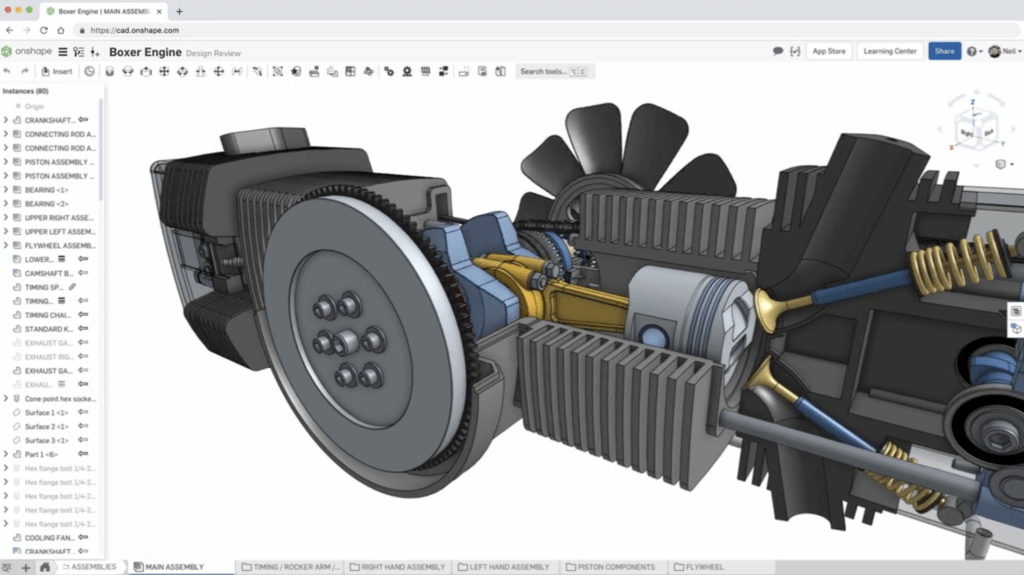

Today, most advanced manufacturers rely on computer-aided design (CAD) software — 2D and 3D design and modeling software allowing the design of autos, satellites, equipment, and others. This industry is projected to grow 10% annually through 2028. Two leading companies are Dassault Systèmes, the maker of SolidWorks and CATIA, and Autodesk, the software developer of AutoCAD.

However, there are others that serve more specialized applications. Microfabrica focuses on 3D CAD for microelectromechanical systems (MEMS), which are miniature devices with both mechanical and electrical components. Meanwhile, Onshape builds software combining CAD, data management, and business analytics. Both companies were acquired in 2019.

Onshape’s design software. Source: Onshape

When a part is developed, it may be necessary to run engineering simulations to ensure that it can withstand the application. This is where finite element analysis software is needed. COMSOL Group‘s software, for instance, models everything from aerodynamics to heat transfer to fluid flow. Similarly, Dynardo develops analysis software for things like reliability, sensitivity, and robustness. It was acquired in 2019 by Ansys, a major player in the engineering software field, for $33M.

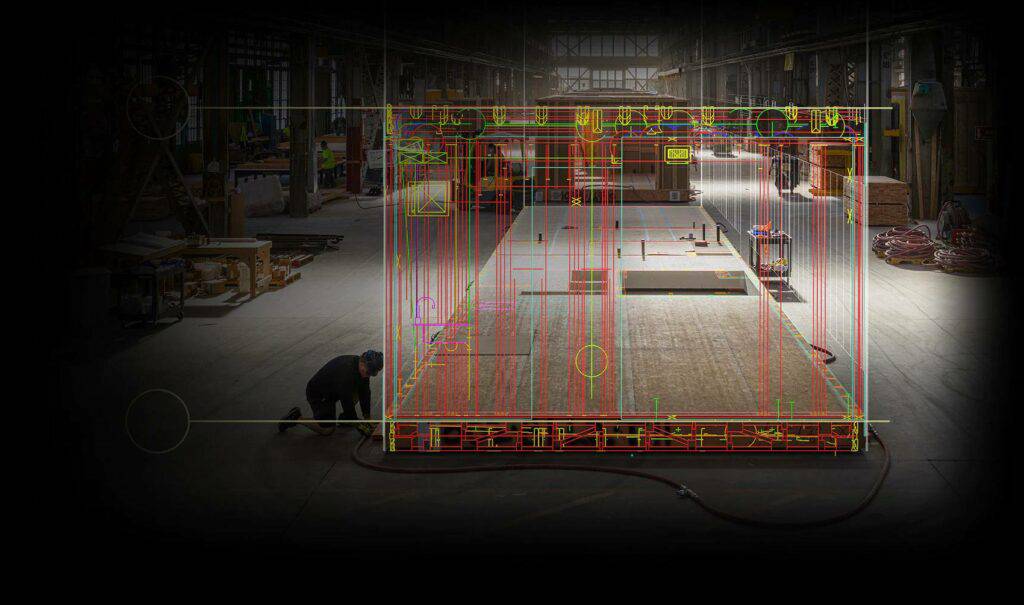

DIGITAL TWINS HELP REDUCE COSTLY DESIGN ITERATIONS

A consistent challenge with the development and production phases of manufacturing is understanding what’s occurring in real time. This is where digital twins come into play.

At its most basic level, a digital twin is a virtual model to reflect a physical object. This can include a virtual representation of a product to assist with the design phase, reducing the number of iterations needed to get it correct. Or it can be a monitoring system for a factory floor, so workers can know all parameters at all times.

A major competitor in this field is NavVis, which uses its indoor spatial intelligence platform to make digital representations of factory floors. It has raised over $94M to date, and has partnered with major companies like Autodesk, integrating into its construction cloud software to assist with construction planning and management.

Similarly, Sight Machine focuses on AI for the factory floor, including applications like deploying predictive analytics to increase factory uptime, reducing scrap material to increase sustainability, or detecting bottlenecks more quickly to increase productivity.

Automation & robotics

Over the past few decades, many human jobs within mass-production assembly lines were automated due to higher labor costs, increased quality demands, and faster production requirements. Consumer tastes have also broadened, and manufacturers are trying to keep up with increasing demands for customization and variety.

In turn, manufacturers have implemented systems like industrial robotics to improve safety, efficiency, and product customization. Adoption has accelerated as robots get cheaper, more accurate, and safer to use.

Visions for Industry 4.0 involve a completely intelligent factory where networked machines and products communicate through IoT technology — with the goal of not only prototyping and assembling a specific series of products, but also iterating those products based on consumer feedback and predictive information.

MODULAR PRODUCTION ENABLES CUSTOMIZATION

Before we reach a world where humans are largely uninvolved with manufacturing, modular design can help existing factories become more flexible.

Modularity allows the factory to further streamline for customization and get more models off the same lines. Modularity can also come in the form of smaller parts, or modules, that go into a more customizable product. Or it can come as equipment, such as swappable parts on robots and machines, allowing for a greater variety of uses.

Mass production is already refashioning itself to handle consumer demand for greater customization and variety. In 2020, according to a BCG survey, 86% of those surveyed in the auto industry said that they expect plant structure — which includes multidirectional layout, modular line setup, and sustainable production — to be important for the factory of the future. And startups are capitalizing on the push toward modular parts.

Vention, for instance, makes custom industrial equipment on demand. Choosing from its modular parts, all a firm needs to do is upload a CAD design of the equipment it wants and then wait 3 days to receive the specialized tooling or robot equipment.

Vention’s platform. Source: SolidSmack

ROBOTICS TAKE OVER THE FACTORY AND WAREHOUSE

Industrial robotics were long seen as responsible for eroding manufacturing jobs, which, until recently, were on the decline for decades. But the latest wave of robotics augments what a human worker can accomplish.

Cobots (collaborative robots) are programmable through assisted movement. They “learn” by someone first moving them manually, then they copy the movement going forward. These robots are considered collaborative because they can work alongside humans.

Robotics are invaluable for monotonous jobs such as packaging, sorting, and lifting. Cobot manufacturer Universal Robots says some of its robot arms pay for themselves in 195 days on average. The cost of collaborative robots can range from $10,000 to $50,000.

Manufacturers are ramping up investment in robots. From Q3’20 to Q3’21, there was a 32% increase in robot orders in North America, according to the Association for Advancing Automation.

For heavy-duty machining, significant market share is taken by big industrial players like Mitsubishi, Fanuc, and Yaskawa — although a new wave of startups are emerging to compete.

While even the best robots still have limitations, some economists believe automation could lead to a drastic restructuring of labor.

In the near term, the reprogrammable nature of cobots will allow manufacturing firms to better customize and work in parallel with existing equipment and employees. In the longer term, automated factories will likely employ fewer human laborers and would require highly skilled employees who know their way around complex software and machinery.

Robotics could eventually serve as the engine behind “lights-out” manufacturing, which is manufacturing with no human labor at all.

COMPUTER VISION HANDLES QUALITY INSPECTION

In mass production, checking whether every product meets specification is a dull job limited by human fallibility. In contrast, future factories will employ machine learning for real-time analysis of the factory and computer vision to scan for imperfections that the human eye might miss.

This makes quality assurance increasingly embedded in the codebase of an organization. Machine learning data platforms like Sight Machine and Uptake are able to codify lean manufacturing principles into the inner workings of systems.

Meanwhile, venture-backed startups like Instrumental are training AI to spot manufacturing issues. Famed AI researcher Andrew Ng has a startup called Landing AI that focuses on AI visual inspection solutions. In November 2021, the startup raised a $57M Series A. It is already working with Foxconn, an electronics contract manufacturer based in Taiwan that works with some of the largest companies in the world, such as Apple.

Another startup in this space is Neurala. With $34M in funding so far, the company uses deep neural network technology that imitates human perception and learning to improve machine vision, resulting in better quality control.

But it’s not just startups in the computer vision space.

In 2021, Google launched its Visual Inspection AI solution to help organizations improve quality control. The tool is for various industries, including car and electronics manufacturing. Google claims organizations can deploy this tool in just a few weeks in the factory or on Google Cloud.

Many imperfections in electronics aren’t even visible to the human eye. The ability to instantaneously identify and categorize flaws will automate quality control, making factories more adaptive.

3D printing

After the product is designed, prototyping is often the next step. Manufacturers across sectors are relying on 3D printing to remain competitive and tighten the feedback loop in bringing a product to launch. According to a 2021 Sculpteo survey, accelerating product development is the #1 priority for firms using 3D printing.

With immersive design solutions, users can get a real-life feel of the design before it’s manufactured. This process also makes physical prototypes redundant.

3D PRINTING SPEEDS UP DEVELOPMENT ACROSS VERTICALS

Beyond its traditional AutoCAD software, Autodesk is a bellwether for the future of prototyping and collaboration technology. The company is no stranger to investing in cutting-edge technology such as 3D printing, including companies like Carbon, among many others.

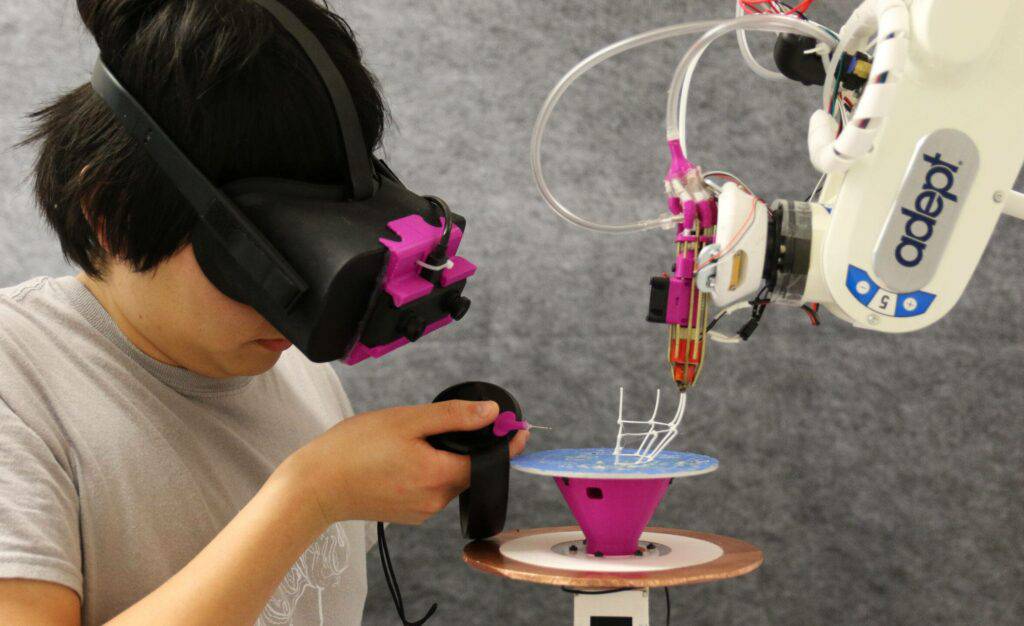

Similarly, Apple has imagined augmented reality (AR) and virtual reality (VR) facilitating the design process in combination with 3D printing. Using the CB Insights database, we surfaced an Apple patent that envisions AR “overlaying computer-generated virtual information” onto real-world views of existing objects, effectively allowing industrial designers to make 3D-printed “edits” onto existing or unfinished objects.

The patent envisions using AR through “semi-transparent glasses,” but also mentions a “mobile device equipped with a camera,” hinting at potential 3D printing opportunities on an iPhone.

Further, a researcher at Cornell has demonstrated the ability to sketch with AR/VR while 3D printing. Eventually, the human-computer interface could be so seamless that 3D models can be sculpted in real time.

Source: Cornell University

Manufacturers of the future will rely on intelligent software to make their R&D discoveries. A 3D printer is already a staple in any design studio. Before ordering thousands of physical parts, designers can use 3D printing to see how a future product looks.

ENABLING MASS CUSTOMIZATION AND NEW GEOMETRIES

Compared to some traditional mass production processes, 3D printing will never beat the economies of scale. But for smaller runs, fulfillment using additive manufacturing can make sense.

Manufacturers will increasingly turn to 3D printing as mass customization takes off within certain consumer products.

Shoes are one popular use case to watch. For example, Adidas has partnered with Carbon to mass-print custom athletic shoes. Other 3D printing services companies like Voxel8 (recently acquired by Kornit Digital) are geared specifically toward shoes.

Meanwhile, startups developing or commercializing complex materials are taking off in the 3D printing world. Companies like Markforged employ printers capable of anything from metals to carbon fiber composites, where others like Boston Micro Fabrication are developing composites with rare structures and exotic physical properties. In July 2021, Markforged went public and announced an annual 53% revenue increase in Q3’21.

Xometry offers on-demand additive manufacturing and computer numerical control (CNC) machining — a subtractive method that carves an object out of a block of material — fulfilling part orders across its networks of workshops. Its platform allows users to simply upload a 3D file and get quotes on milling, 3D printing, or even injection molding for parts. In 2021, Xometry went public.

Source: Autodesk

An important benefit of 3D printing is the ability to make shapes that are otherwise impossible. For example, imagine machining a honeycomb from a block of metal, compared to 3D printing it layer by layer. This is important for aerospace companies like Relativity Space, which uses the technology for large-scale industrial print jobs. The company recently opened a 1M-square-foot factory in California after receiving $650M in Series E funding.

Wearables

What manufacturing looks like has changed drastically in a short time with new technologies augmenting workers’ efficiency and manpower.

Covid-19 acted as an accelerant here, with 76% of manufacturing executives reporting that they started using artificial intelligence and other innovative technologies because of the pandemic, according to Google Cloud.

Here’s how emerging tech like AR and VR, exosuits, and other wearables are fitting into the factory of the future.

AR AND VR ARE DIGITIZING THE INSTRUCTION MANUAL

Augmented reality is able to boost the skills of industrial workers. For instance, AR can analyze complicated machine environments and use computer vision to map out machine parts, like a real-time visual manual. This makes highly skilled labor like field service a “downloadable” skill.

Many AR makers envision the tech working like a hands-free “internet browser” that allows workers to see real-time stats of relevant information. RealWear offers a small but robust display in front of the eye. The company partnered in 2021 with Librestream and NOV to create an AR solution that connects frontline workers with remote experts to help them make real-time decisions.

Others like Scope AR do similar work in field service using mobile and iPad cameras, employing AR to highlight parts on industrial equipment and connecting to support experts in real time. This saves on the travel costs of flying out employees to repair broken equipment. Earlier this year, the company released WorkLink Create, an application that enables users to make and share AR content at work.

RE’FLEKT, an enterprise AR developer from Munich recently acquired by PTC, built a platform for turning CAD data into augmented reality applications for maintenance and training. Jaguar Land Rover used RE’FLEKT ONE to build a training app that would allow employees to acquire “X-ray vision” into a car and identify the exact component or repair needed.

Tech giant Microsoft offers HoloLens, a mixed reality headset that can be used not only in manufacturing but also in education, healthcare, and engineering. Mercedes-Benz technicians, for instance, use HoloLens while repairing vehicles. The device allows users to get live input from a remote expert in case of complex issues, and they can also share visual content on the display to help the technician.

Virtual reality is also critical in many manufacturing processes, seeing significant industry adoption in recent years. This is useful for applications like technical training, remote servicing of equipment, and design review. For example, Ford has a mandatory VR review for all cars that go into production.

EXOSUITS ARE BECOMING STANDARD FOR DIFFICULT JOBS

Exoskeleton technology is finally reaching factory floors, which could drastically reduce the physical toll of repetitive work. Startups here are making wearable high-tech gear that carries much of the load.

Ekso Bionics piloted its EksoVest suit at Ford assembly plants in Michigan, which resulted in work injuries decreasing by 83%. The EksoVest reduces wear from repetitive motion and, unlike some competing products, provides lift assistance without batteries or robotics. Outside the industrial setting, the company also supports patients in neurorehabilitation who are relearning how to walk.

Source: Ford Media Center

Sarcos is another well-known exosuit maker, more strictly focused on remote-controlled robotics and powered exoskeletons. Its robotic exoskeleton, which a worker can put on or take off in 30 seconds, can help a user lift and put down 200 pounds repeatedly for a work session of up to 8 hours. In late 2021, the company went public via SPAC.

In similar territory is StrongArm Technologies, which makes posture-measuring and lift-assisting wearables. StrongArm touts predictive power to intervene before risk of injury or incident. In December 2020, the company released FUSE FLEX, a smaller and more powerful safety wearable.

Where humans are still needed for some dangerous tasks, wearables and exoskeletons will augment human ability while also promoting safety.

Factory digitization

The average cost of unplanned downtime for large manufacturing companies is $532,000 per hour, per a Senseye report. Meanwhile, according to lean manufacturing metrics, world-class manufacturing sites are working at 85% of theoretical capacity. The average factory is only at about 60%, meaning there is vast room for improvement in terms of how activities are streamlined.

The maturation of this industry over the next few decades will first require basic digitization.

Initially, we are seeing more digital machines appear in the factory. Later, that digitization could translate into predictive maintenance and true predictive intelligence. Yet there are serious barriers for manufacturers to take on the new burden of analytics.

Factory floors typically contain old machines with decades of production left in them. In addition to significant cost, sensors tracking temperature and vibration are not made with a typical machine in mind, lengthening the calibration period and efficacy.

When a manufacturing plant for Harley-Davidson went through an IIoT sensor retrofit, Mike Fisher, a general manager at the company, said in a WSJ interview that sensors “make the equipment more complicated, and they are themselves complicated. But with the complexity comes opportunity.”

The results were staggering, reportedly lowering the bike production time from 3 weeks to 6 hours.

FROM REACTIVE TO PREDICTIVE

To put it simply, operational technology (OT) is similar to traditional IT, but tailored for the manufacturing space. Where the typical IT stack includes desktops, laptops, and connectivity for knowledge work and proprietary data, OT manages the direct control or monitoring of physical devices.

For manufacturers, the OT stack typically includes:

- Connected manufacturing equipment (often with retrofitted industrial IoT sensors)

- Supervisory control and data acquisition (SCADA) systems and human machine interfaces (HMI), which provide industrial control and monitoring

- Programmable logic controllers (PLCs), the ruggedized computers that operate factory machines

- 3D printers for additive manufacturing, and computer numerical control (CNC) machines for subtractive manufacturing

In a way, IT and OT are 2 sides of the same coin, and as manufacturing digitizes, the boundaries will continue to blur.

Today, the “brain” for most industrial machines is the PLC. Industrial giants like Siemens, Rockwell Automation, and Opto 22 all offer PLCs, but these can be unnecessarily expensive for smaller manufacturing firms.

This has created an opportunity for startups like Oden Technologies to bring off-the-shelf computing hardware that can plug into most machines directly, or integrate existing PLCs. This, in turn, allows smaller businesses to be leaner and analyze their efficiency in real time.

As digitization becomes ubiquitous, the next wave in tech efficiency improvements will focus on predictive analytics. The narrative today around the internet of things has suggested that everything — every conveyor and robotic actuator — will have a sensor, but not all factory functions are of equal value.

Augury, for example, uses AI-equipped sensors to listen to machines and predict failure. Most recently, the company reached unicorn status after raising a $180M Series E. Factory owners focused on cost will recognize that highly accurate sensors will deliver greater ROI than needless IoT.

NEW ARCHITECTURE AT THE EDGE

In the near future, advances in AI and hardware will allow IIoT as we know it to be nearly independent of centralized clouds.

Computing done at the “edge,” or closer to the sensor, is an important new trend. Edge computing offers significant benefits to manufacturers, including:

- Increased efficiency. Manufacturers can process their data close to the source where it is captured, allowing applications to operate faster.

- Lower costs. Manufacturers can avoid expensive cloud storage and processing fees, while processing their data on inexpensive local devices.

- Efficient bandwidth. As cloud usage increases, edge computing allows manufacturers to avoid competing for increasingly sparse and expensive bandwidth.

Companies like Saguna Networks (acquired by COMSovereign in 2021) specialize in edge computing, whereas Foghorn Systems does fog computing (think a cloud completed on-site, like a LAN). Both methods allow critical devices to operate safely without the latency of transmitting all data to a cloud.

This is important because cloud computing latency has drastic downsides in manufacturing. Cutting power to a machine fractions of a second too late can be the difference between avoiding and incurring physical damage.

In the longer term, edge computing lays down the rails for the autonomous factory. The AI software underpinning the edge is the infrastructure that allows factory machines to make decisions independently.

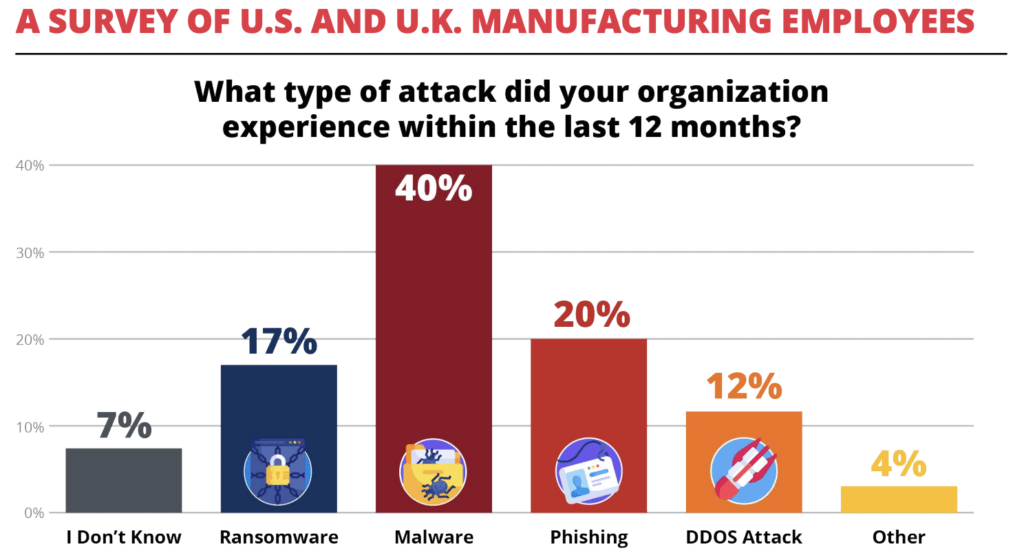

CYBERSECURITY IS A PRIORITY

In recent years, manufacturing has seen more ransomware attacks than any other industry (excluding the government sector). One out of 5 manufacturing companies surveyed by Morphisec in the UK and US were targeted by cyberattacks in the past year. And ransomware attacks don’t come cheap — manufacturing companies need an average of $1.5M to recover, according to Sophos.

As industrial companies adopt IoT technologies to monitor supply chains and machinery, they are also opening themselves up to vulnerabilities in operational security.

Source: Morphisec

High-profile examples of cyberattacks include the WannaCry ransomware attack, which caused shutdowns at the Renault-Nissan auto plants in Europe, and a ransomware attack on the Norway-based aluminum producer Norsk Hydro, which resulted in an estimated $41M of lost production capacity. A 2021 attack on IoT solutions provider Sierra Wireless forced the company to halt production until it dealt with the incident.

Consequently, critical infrastructure is a growing segment within cybersecurity. Startups like Bayshore Networks (acquired by OPSWAT) are offering IoT gateways, which bridge the disparate protocols for connected sensors, allowing manufacturers across many verticals to monitor their IIoT networks. Other gateway-based security companies like Xage are even employing blockchain ledgers so industrial sensors can share data securely.

Additionally, several of the most active enterprise cybersecurity investors are corporates with interests in OT computing. The venture arms of Dell (which makes industrial IoT gateways), as well as Google, GE, Samsung, and Intel are among the most active in this space.

Managing IIoT systems securely will continue to be a critical area for investment, especially as hack after hack prove vulnerability.

Looking ahead

Manufacturing is becoming increasingly efficient, customized, modular, and automated. But factories remain in flux. Manufacturers are known as slow adopters of technology, and many may resist making new investments. Nevertheless, as digitization becomes the industry standard, competitive pressure will escalate the incentive to evolve.

The most powerful levers manufacturers can pull will come in the form of robotics, AI, and basic IoT digitization. Extracting insights from data and investing in smart robotics will maximize output while minimizing costs and defects.

Meanwhile, as cutting-edge categories like wearables and AR are piloted in industrial settings, manufacturing could reach unprecedented levels of frictionless production and worker augmentation.

In the words of Henry Ford: “If you always do what you always did, you’ll always get what you always got.” To reach its full potential, the manufacturing industry will need to continue to embrace new technology.

If you aren’t already a client, sign up for a free trial to learn more about our platform.