Groww's valuation at present is 3 times higher than it was in April 2021. Here are the top-line bullets you need to know.

Groww, an online investing platform, has raised $251M in a Series E. The round drew participation from Alkeon Capital Management, Tiger Global Management, Y Combinator, Sequoia Capital India, Lone Pine Capital, and Propel Venture Partners, among others.

How’s the company performing?

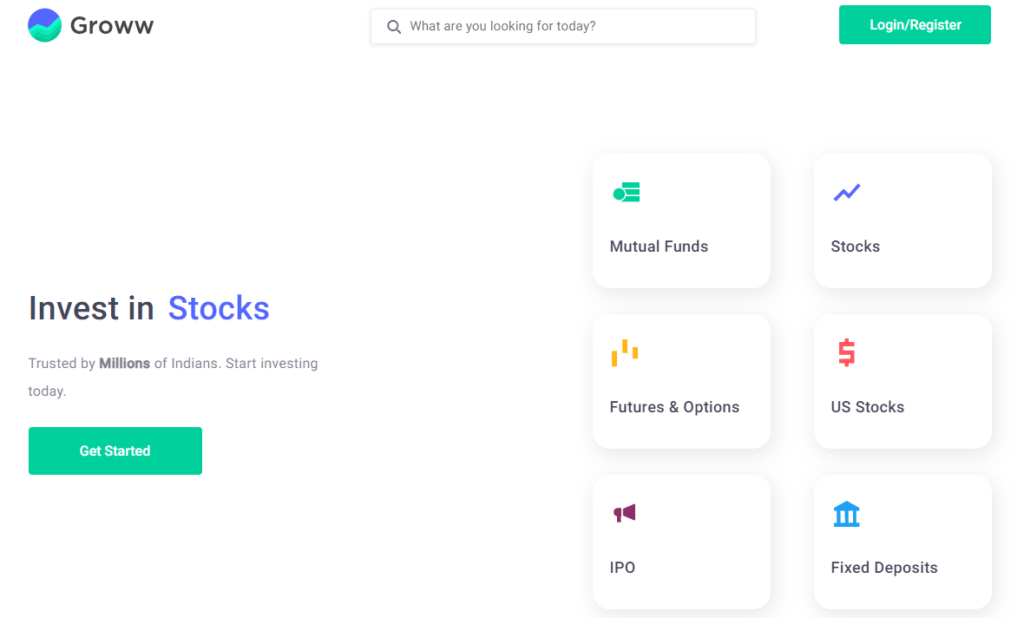

- India-based Groww’s platform enables retail investors to invest in special investment plans (SIPs) like mutual funds.

- The company has over 20M customers.

- Groww plans to offer crypto-based investments due to the growing crypto demand in India. It also intends to enable its users to invest in US stocks.

- The company registers over 250K new SIPs on its platform each month.

Source: Groww

Source: Groww

Why does the market matter?

- The wealth management platform market is projected to grow at a CAGR of 13.4% and reach a value of $3.2B by 2022, according to Markets and Markets.

- The increase in first-time investors and the growing adoption of alternative investment platforms have contributed to industry growth.

- Wealth tech startups have raised $12.7B across 380 deals in 2021 so far, up 115% from 2020’s 12-month funding total.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.