$100M+ mega-rounds drive growth in corporate venture capital-backed funding in Q2’24, while deal activity falters.

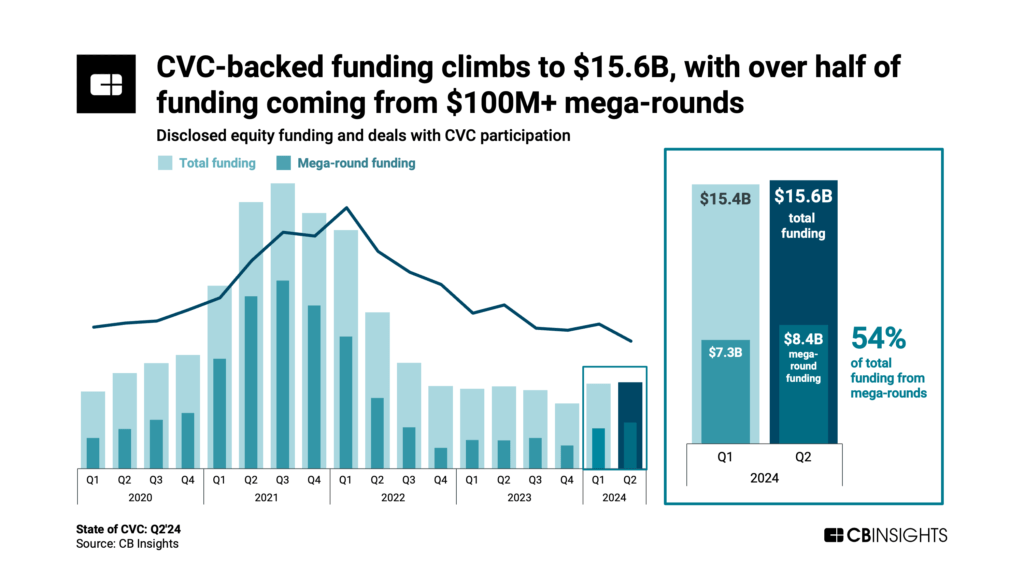

In Q2’24, funding with participation from corporate venture capital (CVC) outfits grew for the second straight quarter, ticking up from $15.4B to $15.6B, while deals fell 12% quarter-over-quarter (QoQ) to 782 — their lowest total since Q1’18.

Massive rounds to AI companies were a key driver of the funding growth, with 3 of the 5 largest CVC-backed deals this quarter going to AI infrastructure players Scale ($1B), Mistral AI ($502M), and Cohere ($450M).

Based on our 124-page report, here is the TL;DR on the state of CVC:

- Global CVC-backed funding climbs to $15.6B in Q2’24. Over half ($8.4B) of this funding came from $100M+ mega-rounds. Meanwhile, global deal volume declined by 12% QoQ to 782. This drop was particularly pronounced in Asia, which saw a 24% drop in deals QoQ.

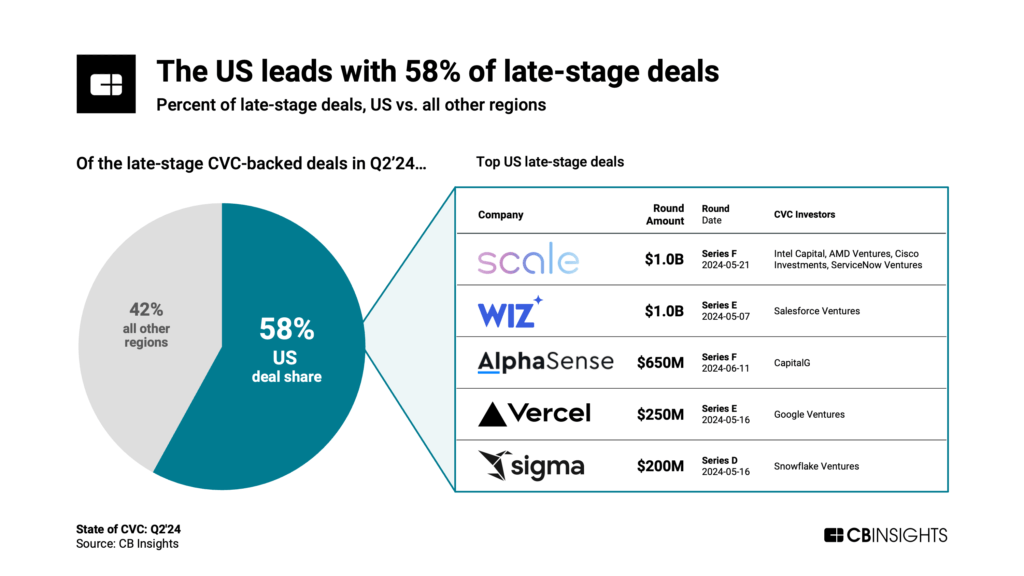

- This year, the average CVC-backed deal size is $26.6M, up 27% from $20.9M in full-year 2023. The increase is due in part to billion-dollar deals to startups like Scale ($1B Series F, backed by the CVC arms of Intel, AMD, Cisco, and ServiceNow) and Wiz ($1B Series E, backed by Salesforce Ventures).

- CVC-backed funding to digital health startups falls 57% QoQ to 0.6B, its lowest point since Q4’17. Retail tech and fintech saw similar decreases, with funding down 52% and 8% QoQ, respectively. Companies not explicitly focused on AI face challenges raising funds in the weakened venture market.

- Quarterly CVC-backed funding in China slips to $0.2B, a 60% QoQ decrease. Deal volume also fell 24% QoQ to 59, its lowest level since 2015. China’s tech market has faced significant challenges, including rising macroeconomic concerns, escalating geopolitical tensions, and a strict regulatory environment.