AI startups steal the show, grabbing over a third of all funding, while the rest of the venture ecosystem remains tepid in Q2’24.

Even as investors remain highly selective with their dealmaking, they’re reserving their dry powder for fewer, bigger deals in areas with strong growth potential like AI.

Based on our deep dive below, here is the TL;DR on the state of venture:

- Venture funding climbs for a second straight quarter, reaching $65.7B, up 8% quarter-over-quarter (QoQ). However, while funding gained momentum, deals slid for the ninth quarter in a row to 6,230. Global deal volume is now less than half of what it was at its peak in Q1’22.

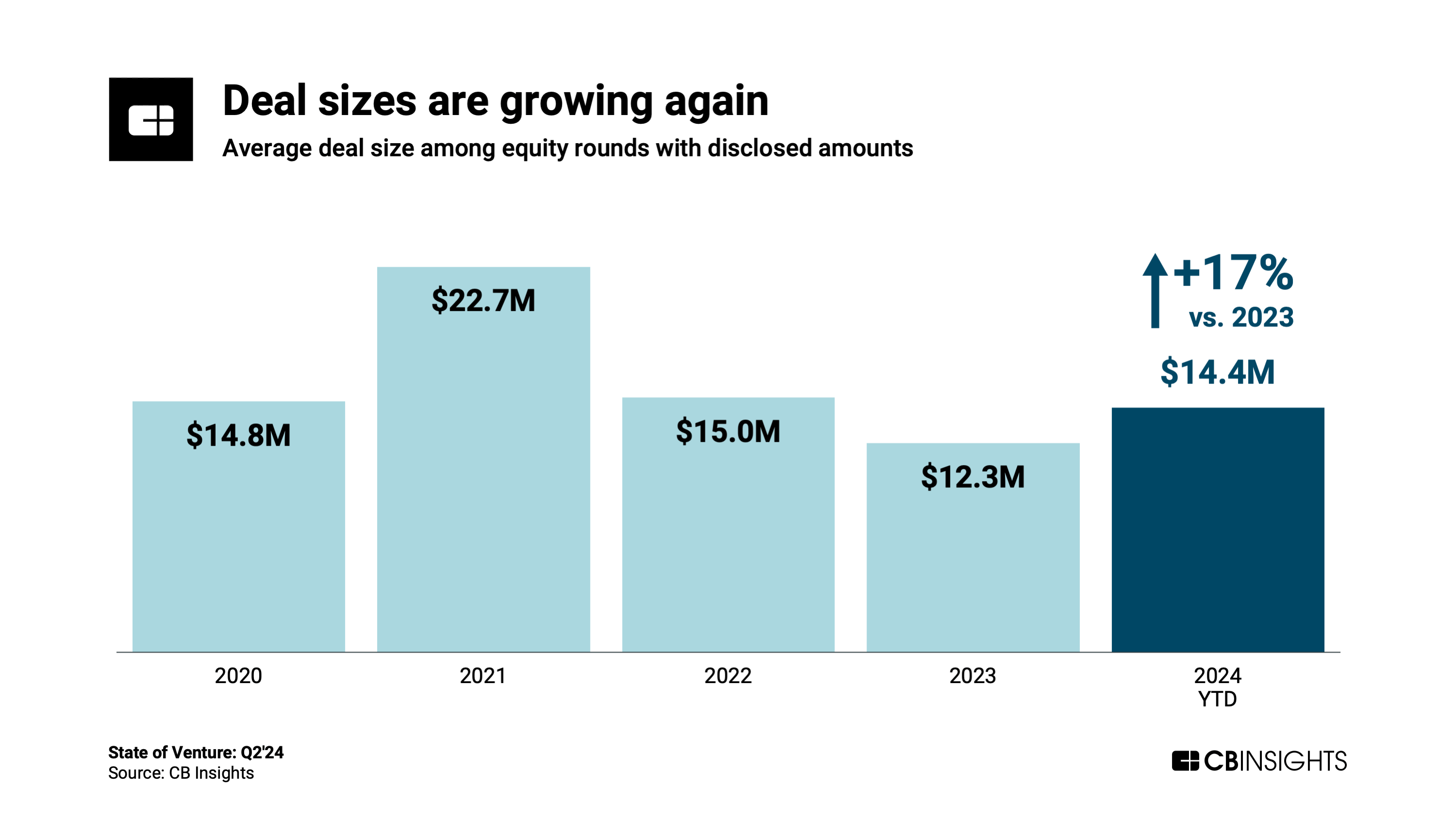

- At $14.4M, the average deal size is up 17% this year so far vs. 2023. Even in a more cautious investing environment, the deals that do happen have ballooned in size as investors put more behind select startups.

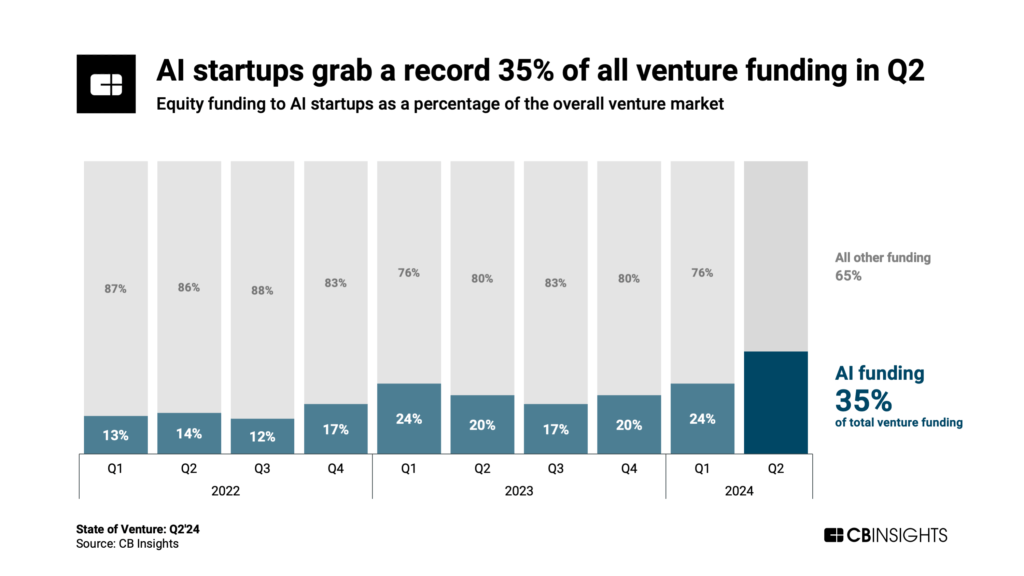

- AI startups are dominating global funding, capturing 35% in Q2’24. This is the highest quarterly share on record. AI startups drew $23.2B in Q2’24 — up 59% QoQ — driven by mammoth $1B+ deals to Elon Musk’s xAI as well as Scale, CoreWeave, and others.

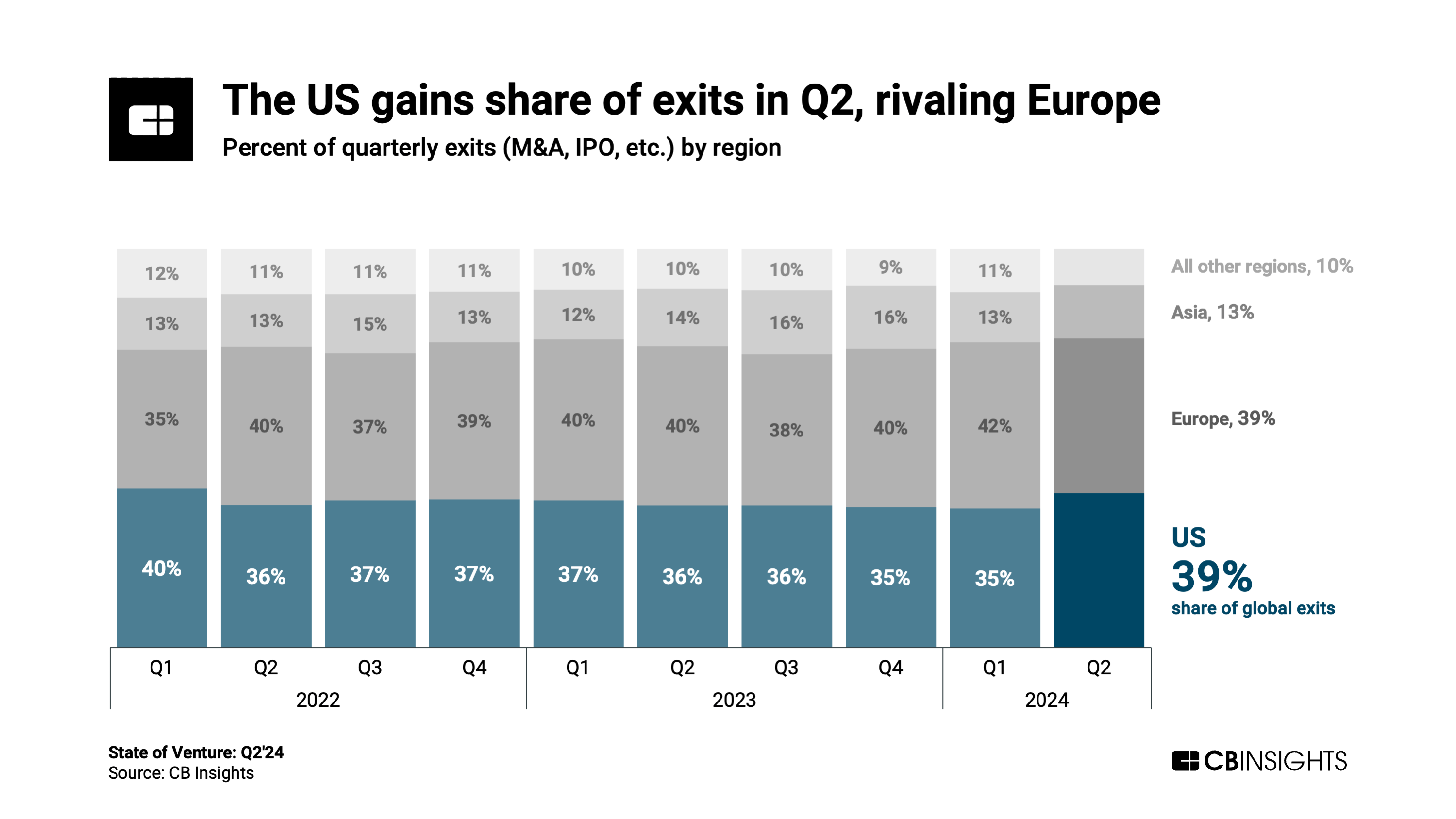

- The US is attracting a greater portion of exit activity, with exit share rising 4 percentage points QoQ to 39%. This represents its highest share in 2 years. Top US-based exits in Q2’24 included IPOs from Tempus and Rubrik — both valued at over $5B — as well as Hyundai’s acquisition of Motional priced at $4.1B.

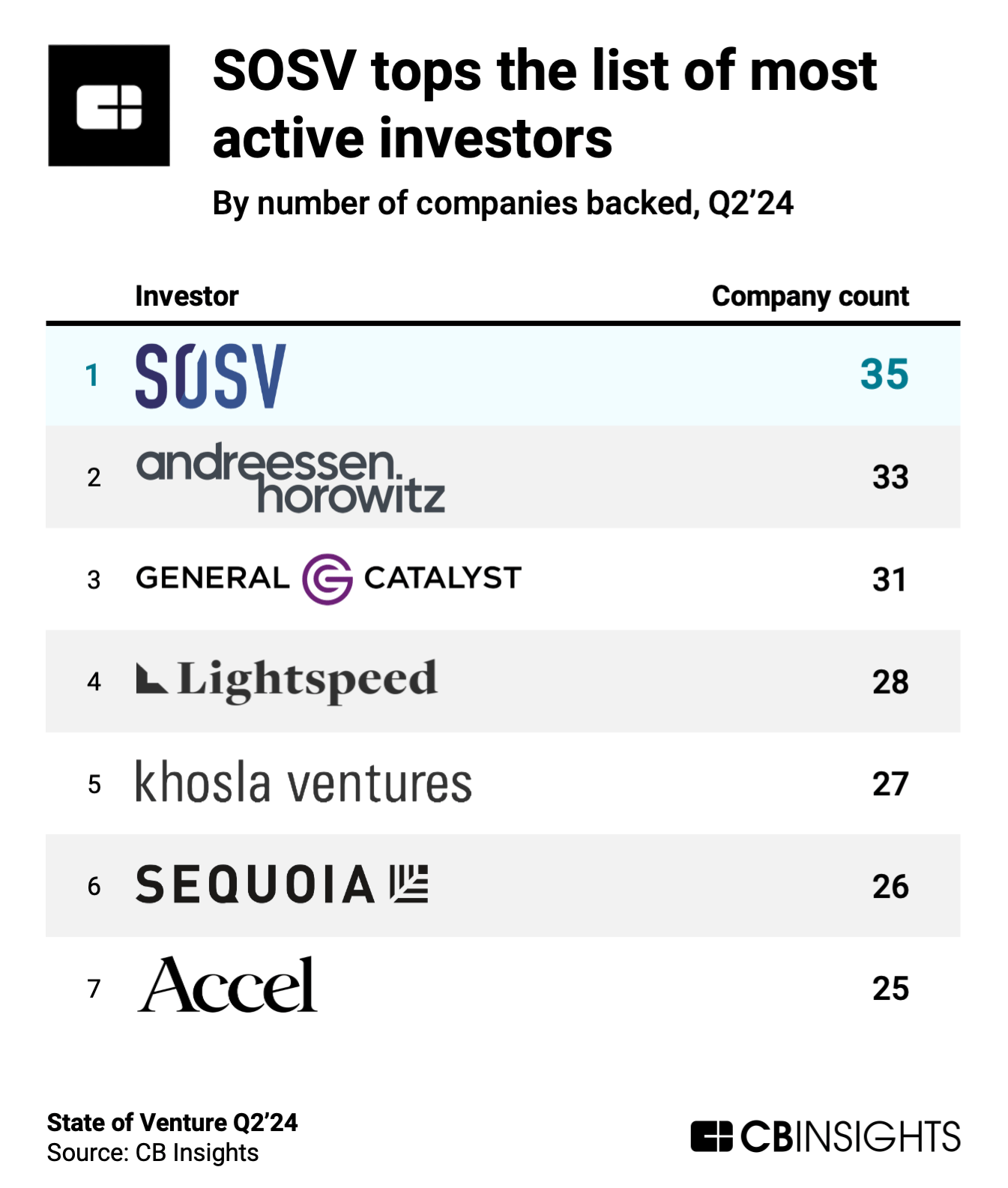

- SOSV is the most active venture investor, backing 35 companies in Q2’24. It’s followed by Andreessen Horowitz (33 companies), General Catalyst (31 companies), and Lightspeed Venture Partners (28).

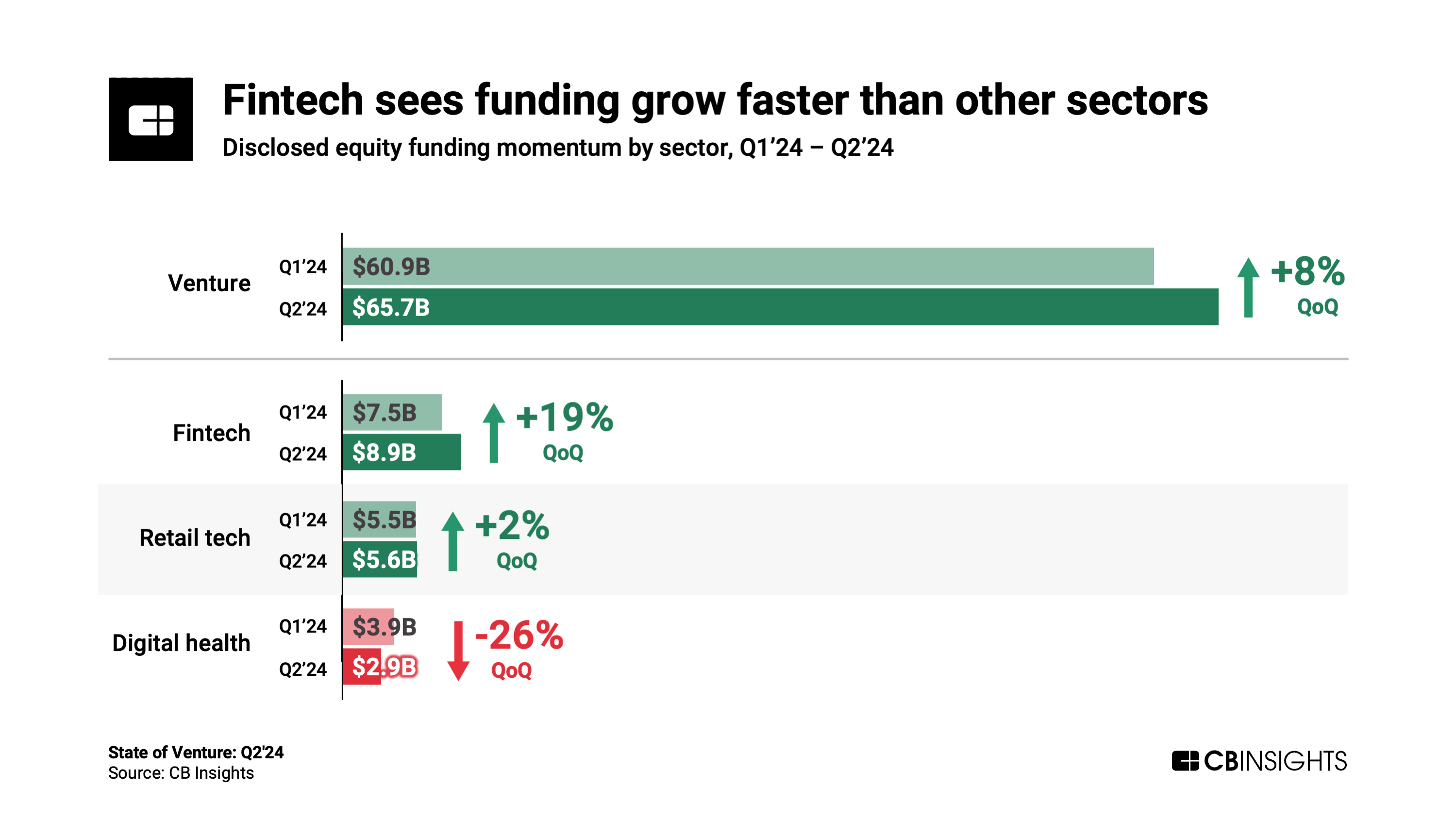

- Fintech funding rebounds 19% QoQ to hit $8.9B — a 5-quarter high — led by $600M+ rounds to Stripe and AlphaSense. But it was a different story for the retail tech and digital health sectors: retail tech funding was stagnant from Q1 to Q2, while digital health funding slipped by 26%.

- Quarterly funding to startups in Asia falls below $10B for the first time since 2014. The drop was especially severe in China, where some international investors have pulled back or retreated altogether amid rising geopolitical tensions. Meanwhile, the US and Europe — the two largest regions for venture investment — each saw funding grow by double-digit percentages in Q2’24.

Venture funding ticked up for a second consecutive quarter, reaching $65.7B in Q2’24. Nearly half of this funding (47%) came from mega-rounds (deals worth $100M+). xAI’s $6B round alone represented nearly one-tenth of the global total and helped prevent funding from declining QoQ.

Despite the strong showing, deal volume slipped for a ninth straight quarter — sinking 7% to 6,230 — as investors remain cautious in the less exuberant market. The US, Europe, and Asia all saw deal count decrease QoQ, while it grew slightly across Canada, LatAm, Africa, and Oceania.

With deals down and funding up, the average deal size has climbed this year, pacing at $14.4M — up 17% compared to full-year 2023. Notably, it’s not just a few massive deals that are pulling that figure up: the median deal size has also grown from $2.5M to $3M over the same period.

Among investment stages, the median deal size has increased across early- and mid-stage rounds, while it has fallen slightly at the late stage.

One factor more than any other is driving gains in the venture market right now, and that’s AI. Startups developing AI solutions raised $23.2B in Q2’24 — accounting for 35% of the global total, the highest share ever recorded. This share has been trending up for several years now, especially since the arrival of OpenAI’s ChatGPT in late 2022.

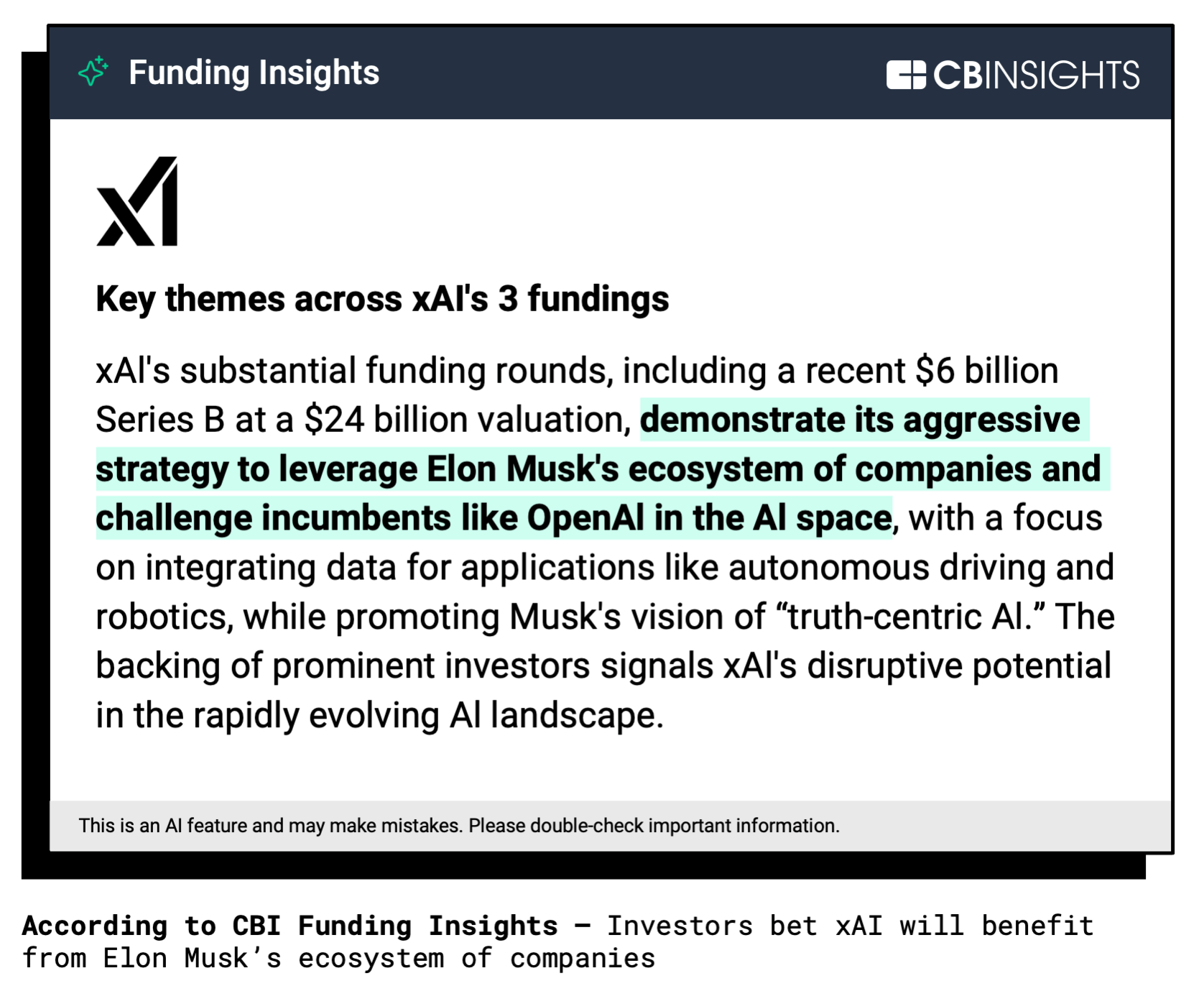

Leading the pack among AI startups, Elon Musk’s xAI outfit raised a whopping $6B round in Q2’24. The 1-year-old company, now valued at $24B, had no trouble finding investors, who believe xAI will gain a competitive edge through integration with Musk’s network of companies (and their data). For instance, Tesla could use xAI’s latest multimodal AI model, which includes vision capabilities, to bring more advanced perception to its Optimus humanoid.

The Funding Insights from xAI’s CB Insights profile point to synergies between xAI and Musk’s other companies, like Tesla.

Other top AI rounds in Q2’24 went to:

- G42 — $1.5B investment from Microsoft

- CoreWeave — $1.1B Series C at a $19B valuation

- Wayve — $1.05B Series C from SoftBank, Nvidia, and Microsoft

- Scale — $1B Series F led by Accel, with backing from corporates including AMD, Amazon, Intel, and Nvidia

Customers can explore thousands of AI startups across industries and technologies in the CB Insights AI Expert Collection.

In Q2’24, the US saw 39% of all exits, which included both IPOs and M&A transactions. The figure represents an increase of 4 percentage points QoQ and puts the US in the No. 1 spot globally, tied with Europe.

Notably, US IPOs are gaining some strength, with Q2 seeing blockbuster debuts from Tempus (valued at $6.1B) and Rubrik ($5.6B). We predicted both companies would go public in our Tech IPO Pipeline report, published in late 2023.

Go deeper with CB Insights buyer interviews for Tempus and Rubrik to see what their customers are saying.

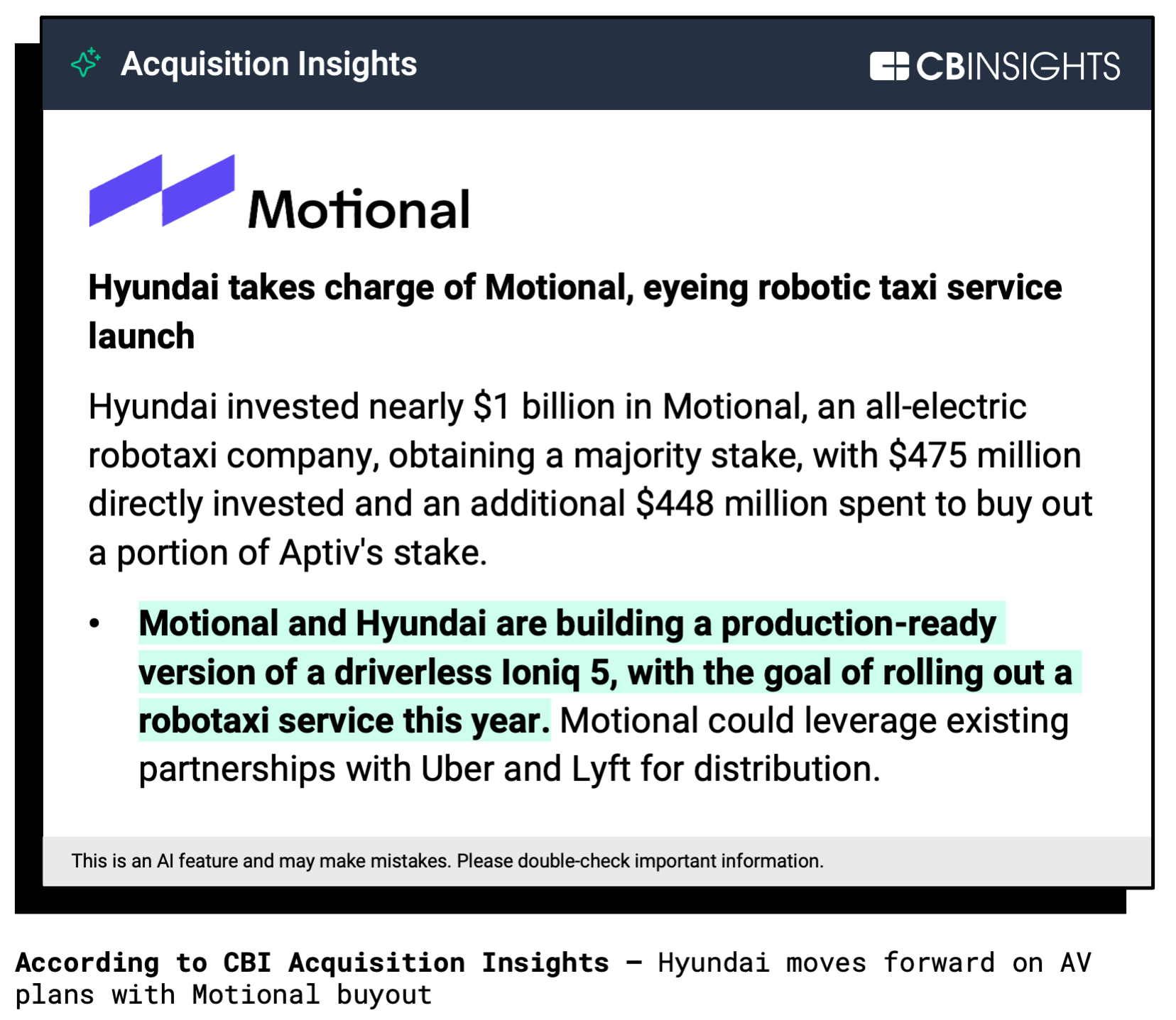

Meanwhile, the US venture market’s top M&A deal went to Motional, an autonomous driving startup founded as a joint venture between Hyundai and Aptiv. Hyundai took a majority stake in the company at a $4.1B valuation. Per the Funding Insights on Motional’s CB Insights profile, Hyundai and Motional are co-developing a robotaxi service with a target release of 2024.

The Acquisition Insights from Hyundai’s CB Insights profile break down the structure and goals of the Motional deal.

Around the world, the most active venture investor right now is SOSV. The firm, which primarily backs early-stage startups, invested in 35 unique companies in Q2’24, placing it ahead of a16z (33 companies), General Catalyst (31), and Lightspeed (28).

Customers can use this CB Insights platform search to see SOSV’s top portfolio companies ranked by Mosaic score — which measures a private company’s health — alongside data cuts like commercial maturity, headcount growth, and more.

Among industry sectors, fintech saw funding grow the most, watching it rise 19% QoQ to reach $8.9B. This marks a rebound for the sector vs. Q1’24. Top fintech deals in the quarter went to payments leader Stripe and market intelligence firm AlphaSense.

The retail tech and digital health sectors were worse off than fintech. Retail tech funding was roughly stagnant QoQ, while digital health funding plummeted to below $3B — its second-lowest quarterly level since 2016.

Among major global regions, the US and Europe outpaced the market as a whole for funding growth in Q2’24.

Asia, on the other hand, saw its funding fall 13% QoQ to $9.7B. The decline was most pronounced in China, where dollars tumbled more than 50% to $2.2B, whereas India, Singapore, and Japan all experienced funding growth QoQ.

The top two equity deals in the region went to United Arab Emirates’ G42 and India-based Zepto.

If you aren’t already a client, sign up for a free trial to learn more about our platform.