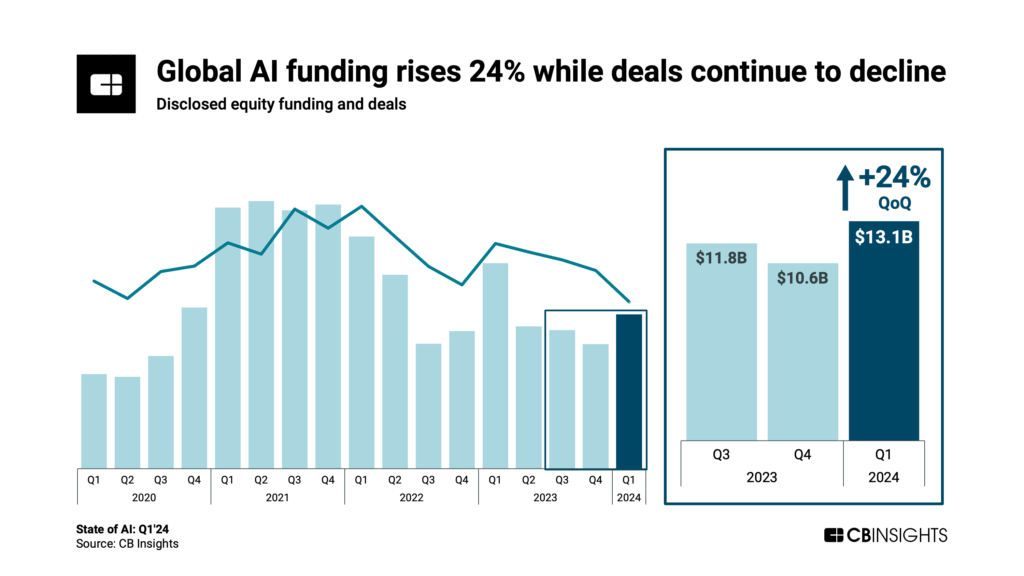

AI funding hits a 4-quarter high — fueled by massive genAI rounds — while deals continue to fall in Q1’24.

After declining for 3 consecutive quarters, AI funding rebounded by 24% QoQ to reach $13.1B in Q1’24. This outpaced the growth in broader venture funding (+11% QoQ).

Massive rounds to players like generative AI startup Anthropic were key drivers behind the jump, as overall AI deal volume dipped for the fourth straight quarter in Q1’24.

Here is the TL;DR on the state of AI:

- Global AI funding reaches $13.1B. AI funding increased 24% QoQ to reach $13.1B — its highest quarterly level since Q1’23. This outpaced the growth in broader venture funding (+11%). Meanwhile, AI deals slipped for the fourth consecutive quarter, hitting their lowest quarterly count since 2018 (739 deals). This drop was particularly pronounced in Asia, which saw a 30% drop in deals QoQ.

- Average deal size YTD in AI is $23.1M, up 21% vs. $19.1M in full-year 2023. A couple of genAI infrastructure players have had an outsized impact on this upward trend, raising massive $1B+ deals: Anthropic ($2.8B Series D) and Moonshot AI ($1B Series B). Notably, Anthropic raised an additional deal worth $750M in Q1’24, bringing its total funding for the quarter to $3.5B.

- AI unicorn births remain steady at 6 QoQ in Q1’24. Three of these new unicorns are generative AI model developers: Moonshot AI, Together AI, and Krutrim all reached $1B+ valuations in Q1’24.

- AI M&A exits drop 36% in Q1’24. There were 69 M&A deals for AI companies in Q1’24, marking a 36% decrease from Q4’23. Amid the downturn, Europe saw its share of broader global exits rise by 12 percentage points QoQ, while Asia experienced a 15-point drop. Meanwhile, the US’ share remained steady at 41%.

- US AI funding rises 52% QoQ to reach $9.3B. Asia was the only other major global region to see a funding increase (+6%) in Q1’24. Funding totals for both regions were heavily buoyed by the $1B+ rounds to genAI infrastructure startups Anthropic (US) and Moonshot AI (China).