VC dealmaking slides to a 7-year low, while several blockbuster deals drive a modest rebound in funding.

Q1’24 was a mixed bag for the venture market.

Equity deal volume declined for an eighth straight quarter, but a handful of billion-dollar rounds — particularly in generative AI — helped drive funding up 11% quarter-over-quarter (QoQ).

Based on our deep dive below, here is the TL;DR on the state of venture:

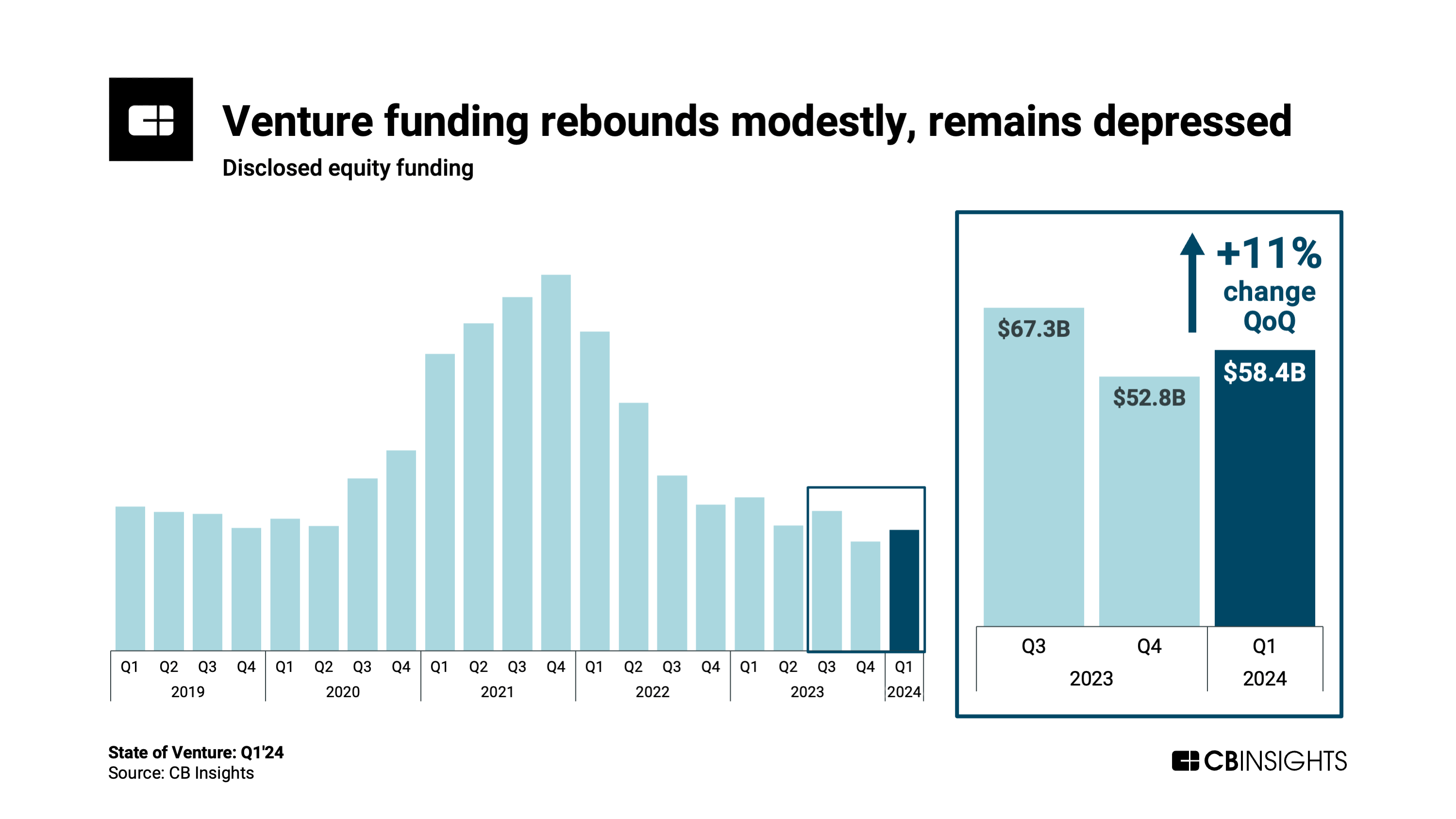

- Venture funding climbs 11% QoQ to $58.4B. Q1 funding was buoyed by several massive deals, including Amazon’s $2.75B investment in generative AI company Anthropic. Despite the quarterly gain, funding remains down 21% vs. Q1’23 and 62% vs. Q1’22.

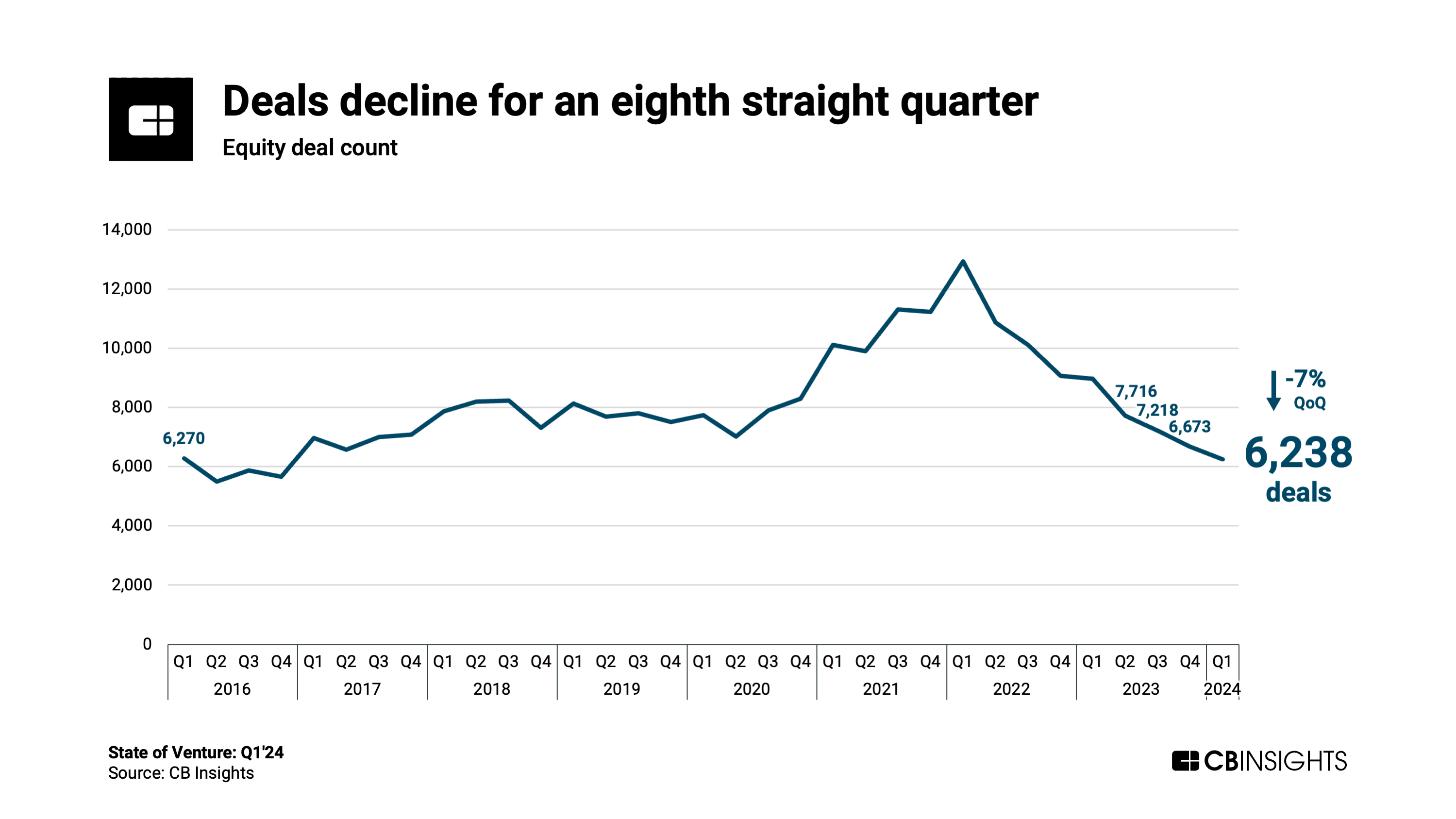

- Deals slide for an eighth straight quarter, down 7% to 6,238. Asia and Europe saw 8% and 9% declines, respectively, in VC deal activity. The US, on the other hand, bucked the global trend, seeing deals tick up 1% QoQ.

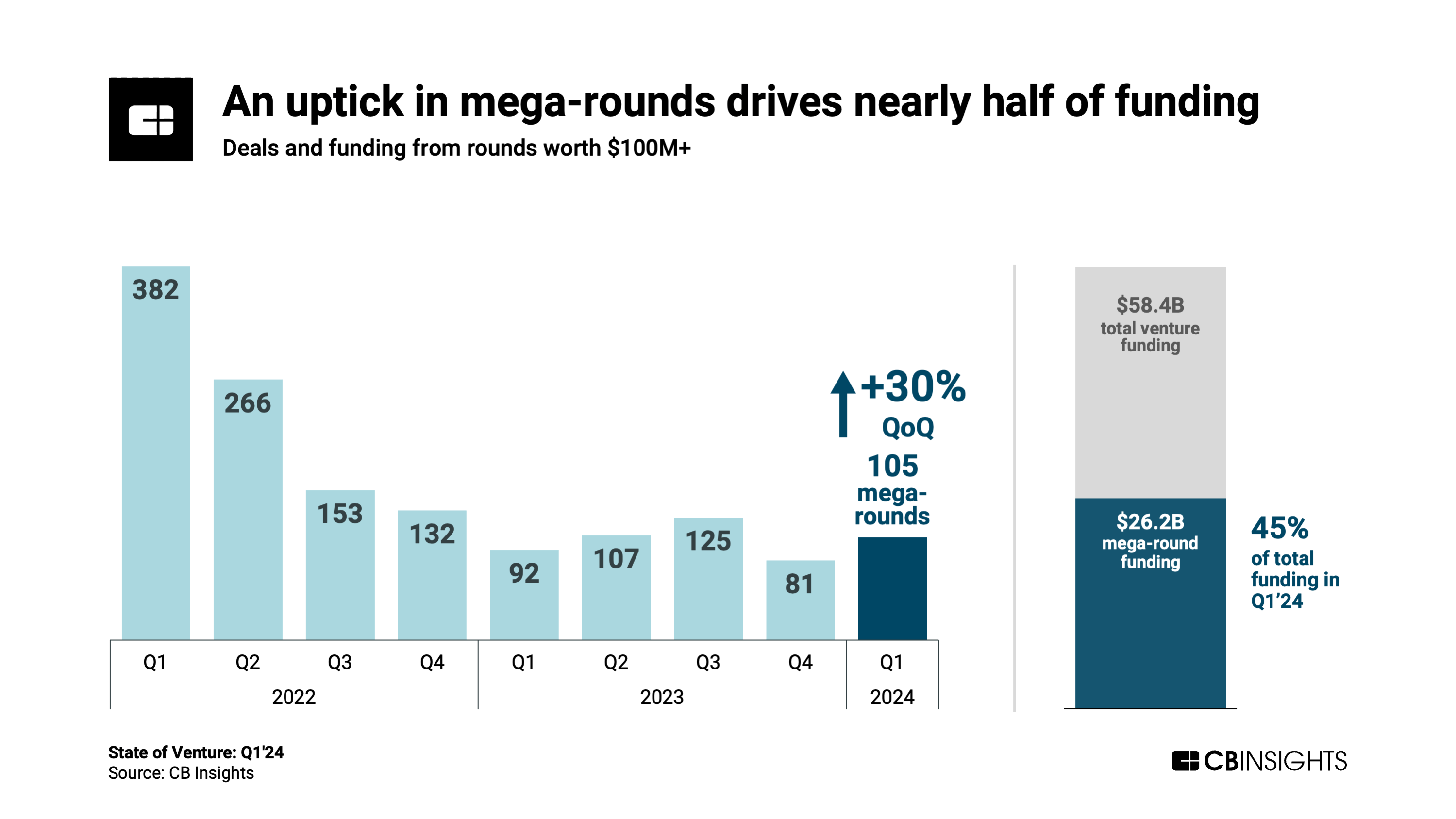

- Mega-rounds (deals worth $100M+) are a bright spot, growing 30% QoQ to 105. These large deals represented 45% of total funding in the quarter, up 11 percentage points from the previous quarter. Corporate investors like Amazon, Disney, and Alibaba were behind some of the largest deals.

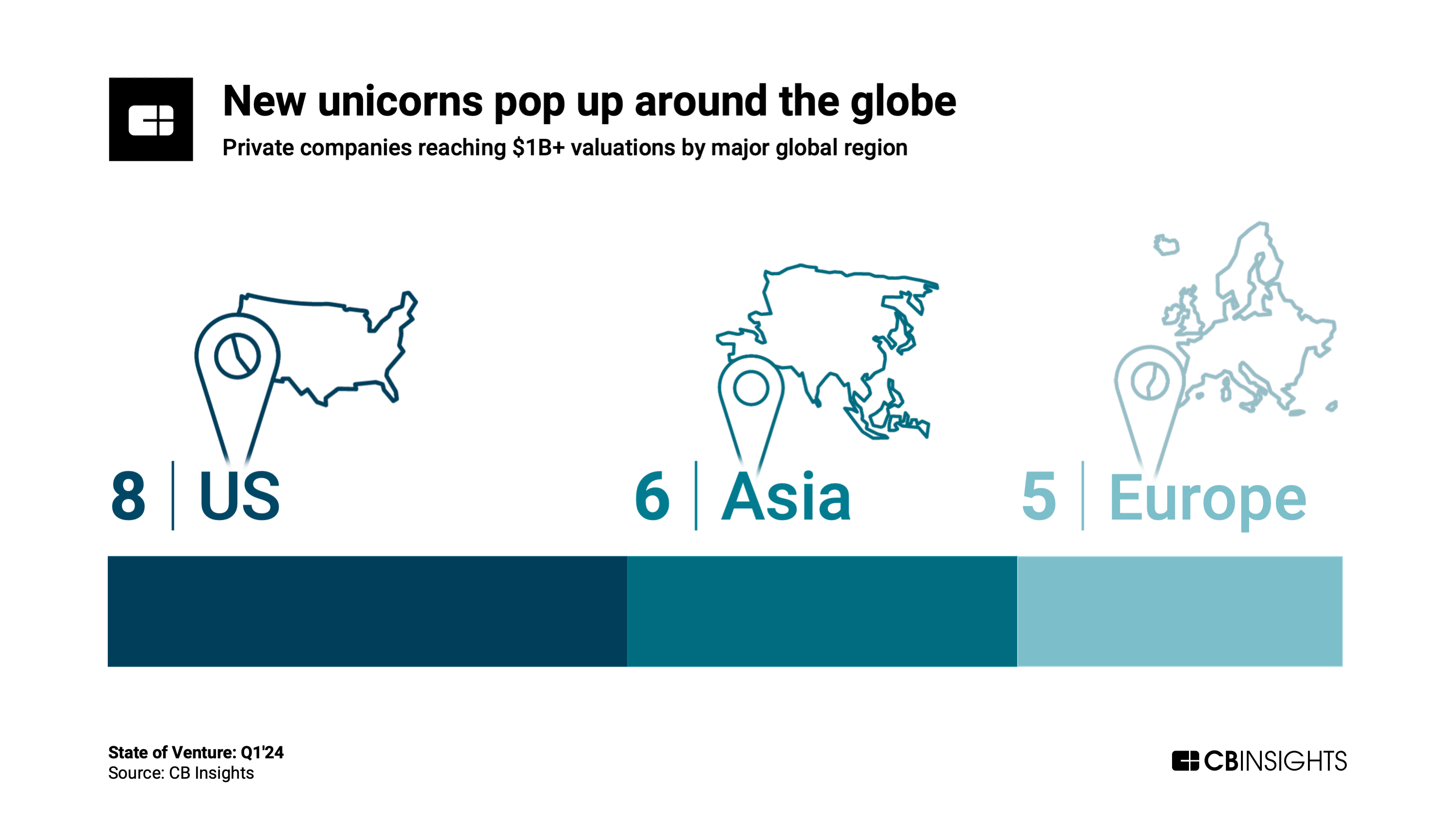

- The quarter sees 19 new unicorns spread across the US, Asia, and Europe, down slightly from 23 the previous quarter. Europe’s 5 new unicorns represented a 5-quarter high for the continent. The highest-valued unicorn birth in Q1’24 went to Figure, a humanoid robotics developer valued at $2.7B.

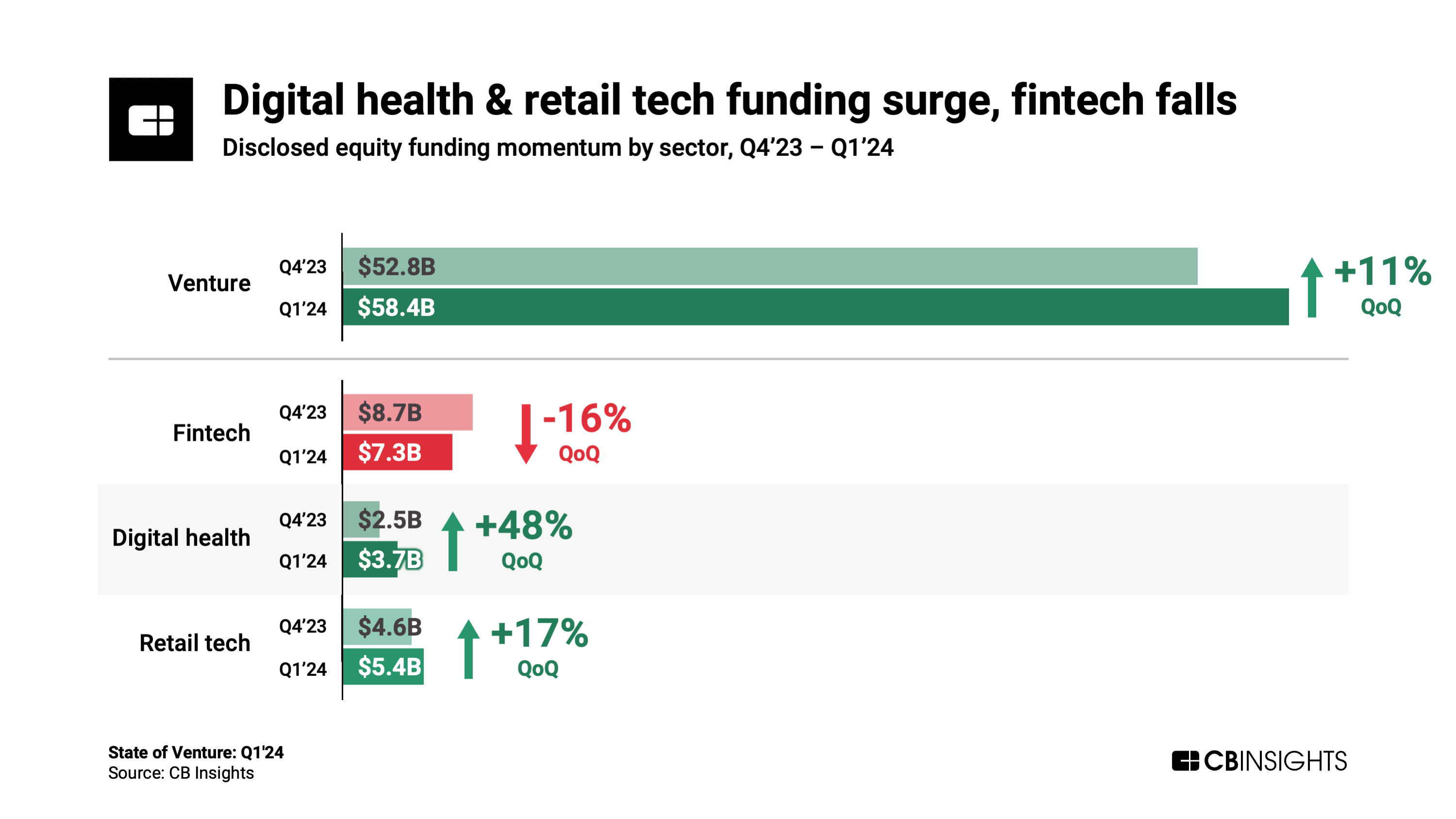

- The fintech sector takes a hit, with funding falling 16% QoQ, while digital health and retail tech see gains. Digital health funding surged by nearly 50% in Q1’24, driven by multiple biotech mega-rounds.

- Silicon Valley sees $4 out of every $10 in US funding. Silicon Valley startups drew $14.4B in Q1’24 — more than 3x the next US metro (New York with $4.4B) — to capture 42% of the country’s funding. While that figure was driven up in Q1’24 by Anthropic’s $3.5B in cumulative funding, it’s not an anomaly: Silicon Valley has seen over a third of all US funding since 2020.

Below, we’ll explore these themes across 8 charts.

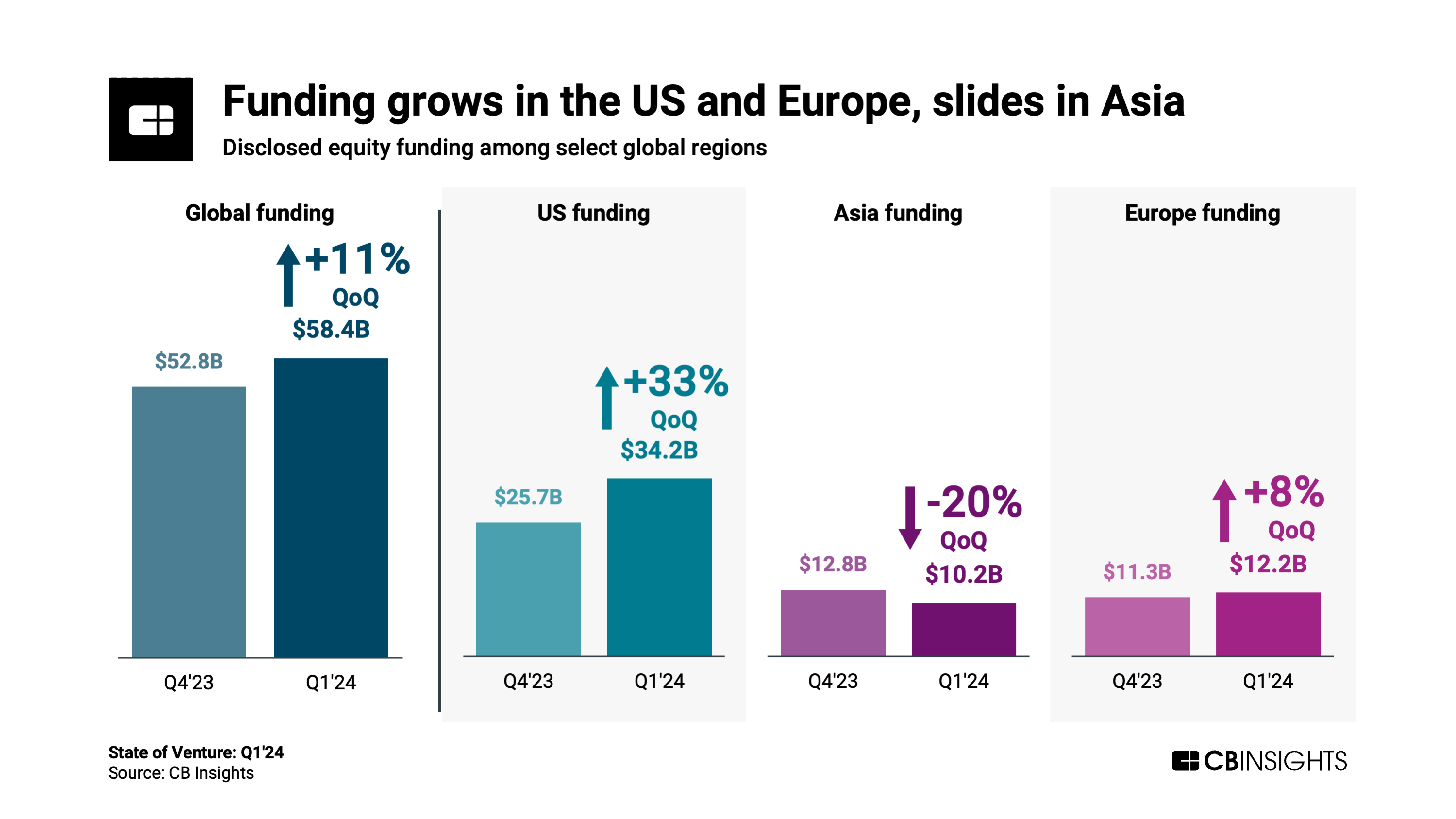

Global venture funding grew 11% QoQ in Q1’24, bouncing back from a recent low to reach $58.4B.

Despite the rebound, this figure marks a 21% decrease year-over-year and puts quarterly venture funding roughly where it was in 2017.

Meanwhile, dealmaking continued to slide in Q1’24. Equity deal volume slipped for an eighth straight quarter to 6,238, putting it in line with levels not seen since 2016/2017.

Globally, the US accounted for 39% of deals in the quarter — up 3 percentage points from Q4’23 — while Asia (31%) and Europe (24%) each lost 1 percentage point.

One of the bright spots in venture right now: mega-rounds (deals worth $100M+). These deals surged 30% QoQ (and 14% YoY) to hit 105 in Q1’24.

At $26.2B, funding from mega-rounds represented 45% of the quarter’s total funding — a rebound from 34% in Q4’23.

The uptick in mega-rounds points to investors’ sustained interest in blockbuster deals, especially in capital-intensive areas like large language model development.

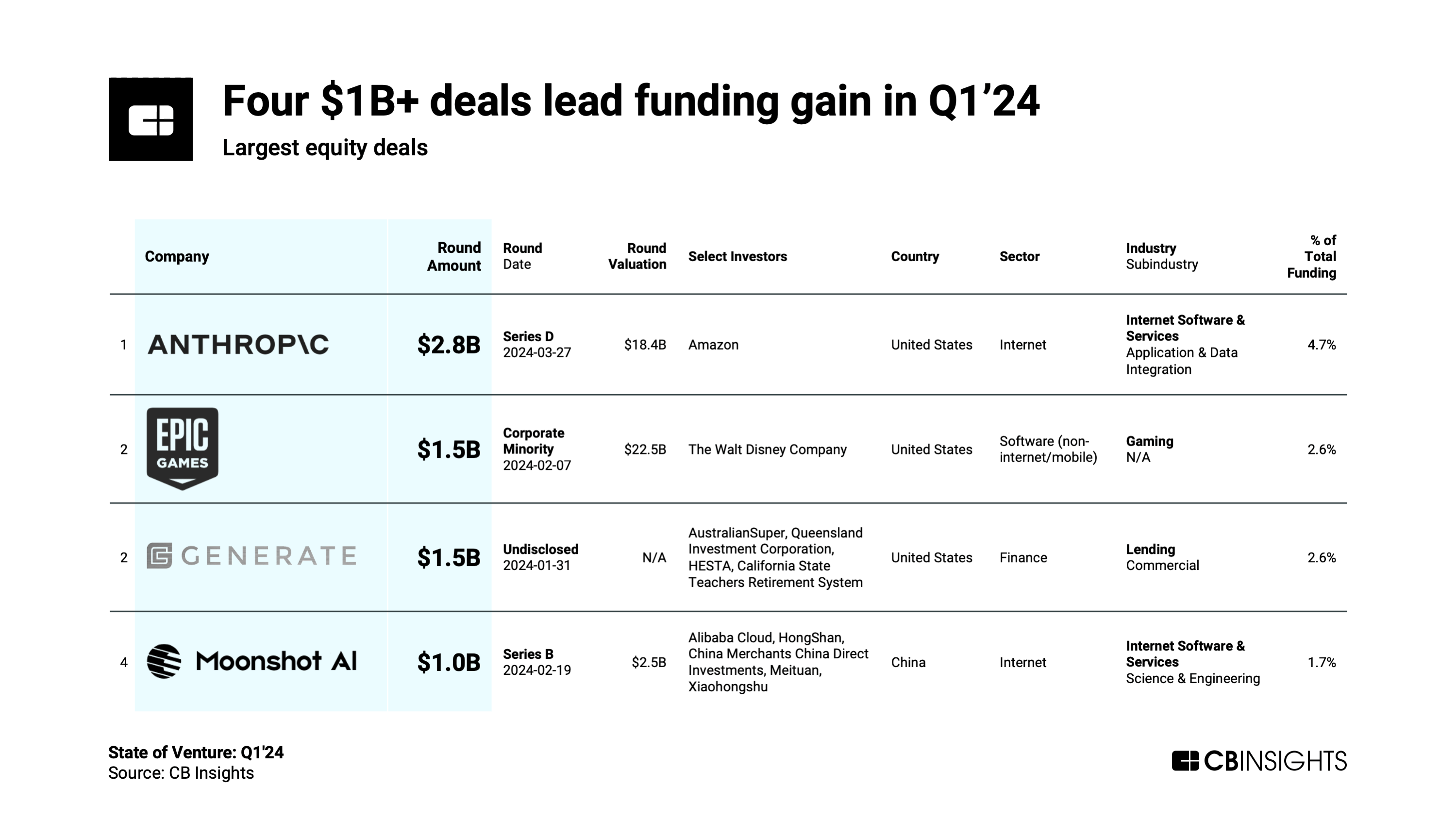

Q1’24 saw 4 deals reach $1B or more in value, with 2 of these deals going to generative AI companies (Anthropic and Moonshot AI). Amazon and Alibaba led these respective deals, pointing to global tech giants’ rabid interest in genAI.

The other 2 deals worth $1B+ went to Epic Games and Generate Capital. Disney’s $1.5B stake in Epic is its biggest move into gaming yet, while Generate Capital’s $1.5B round will go toward developing sustainable infrastructure projects.

After falling precipitously throughout 2022, the number of new unicorns (private companies valued at $1B+) has mostly stabilized quarter-over-quarter. Q1’24 saw 19 new unicorns, down slightly from 23 the prior quarter.

The new billion-dollar companies in Q1 were distributed across the US (8 new unicorns), Asia (6), and Europe (5).

Europe’s total, which represented a 5-quarter high in unicorn births for the continent, included new unicorns like Italy’s Bending Spoons ($2.6B valuation) and Netherlands-based Mews ($1.2B).

Some industries are seeing stronger funding momentum than others.

Digital health startups, for instance, saw funding soar 48% in Q1’24 to $3.7B. Top deals went to biotech firms Freenome ($254M Series F) and BioAge Labs ($170M Series D).

Fintech startups, on the other hand, drew 16% less funding in Q1’24 than the prior quarter. The fintech sector also saw its new unicorn count slip from 8 to 6 over the same period. Despite fintech’s funding losses, the sector was the only one to see an uptick in quarterly deal volume.

Silicon Valley remains the undisputed leader among US metros for VC activity.

In Q1’24, Silicon Valley-based startups drew $14.4B in funding — 42% of the US total. This represented a 14-point surge QoQ in Silicon Valley’s share of funding, driven in large part by the excitement around AI. San Francisco-based Anthropic, an OpenAI competitor, was responsible for 10% of total US funding in the quarter.

Here are the funding totals for the top 5 US metros in Q1’24:

- Silicon Valley: $14.4B

- New York: $4.4B

- Los Angeles: $2.5B

- Boston: $2B

- Raleigh: $1.6B (driven by Epic Games’ $1.5B round)

On a global scale, funding climbed 33% QoQ in the US — more than Europe’s 8% increase over the same period. Asia, meanwhile, watched its funding total fall 20% to $10.2B, putting it in the #3 spot behind second-ranked Europe.

On a global scale, funding climbed 33% QoQ in the US — more than Europe’s 8% increase over the same period. Asia, meanwhile, watched its funding total fall 20% to $10.2B, putting it in the #3 spot behind second-ranked Europe.

The US accounted for 59% of total funding this past quarter — an increase of 10 percentage points from Q4’23. The top 3 largest deals in Q1’24 all went to US-based firms.

If you aren’t already a client, sign up for a free trial to learn more about our platform.