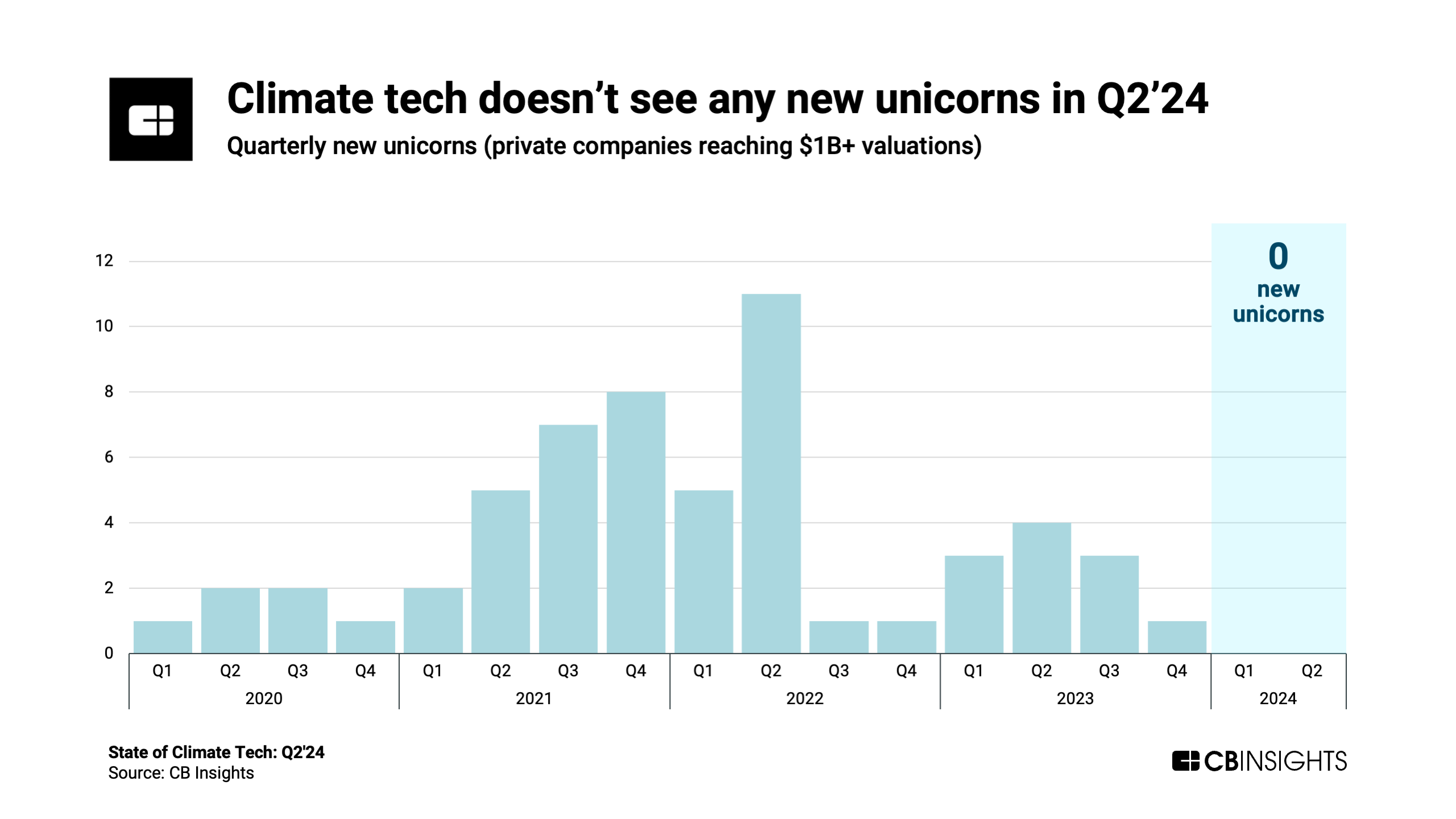

Climate tech experiences a unicorn drought as funding continues to drop.

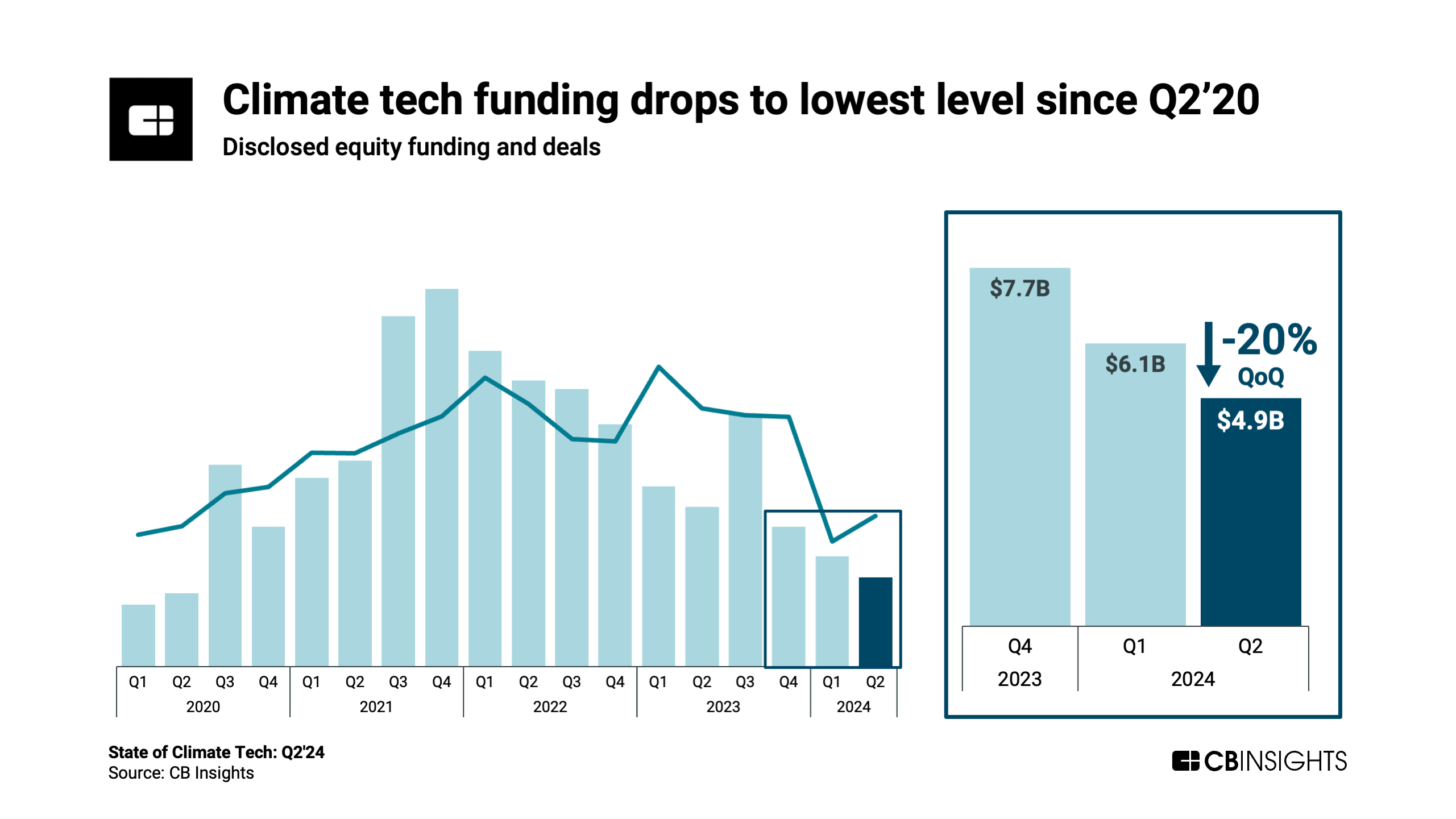

Climate tech funding dropped QoQ in Q2’24, reaching its lowest quarterly level since Q2’20. While deal count jumped QoQ, it still remained well below 2023’s quarterly totals.

Amid the funding decline, investors are favoring smaller mid- and late-stage deals. However, they are still willing to place early-stage bets where they see strong opportunities.

Based on our deep dive in the full report, here is the TL;DR on the state of climate tech:

-

- Global climate tech funding declines by 20% QoQ to $4.9B in Q2’24 — the lowest quarterly total since Q2’20. While deal count rebounded QoQ to 397 in Q2, it still came in well below 2023’s quarterly totals.

-

- Climate tech doesn’t see any unicorn births (private companies reaching $1B+ valuations) in Q2’24, marking climate tech’s second straight quarter without any new unicorns. This coincides with a decline in late-stage deal sizes — the median deal size at that stage is $38M in 2024 YTD, down 16% vs. full-year 2023.

-

- Late-stage deal sizes decline, while early-stage sizes show strength. The median late-stage deal size is $38M in 2024 YTD — down 16% from full-year 2023. In contrast, median early-stage size is up 39% YTD, suggesting that investors are still willing to place bets where they see strong early-stage opportunities. Two of the largest early-stage deals in Q2’24 went to Cylib and Aether Fuels. Both companies intend to use the funding to scale and support commercialization initiatives — goals that are generally communicated by later-stage companies.

-

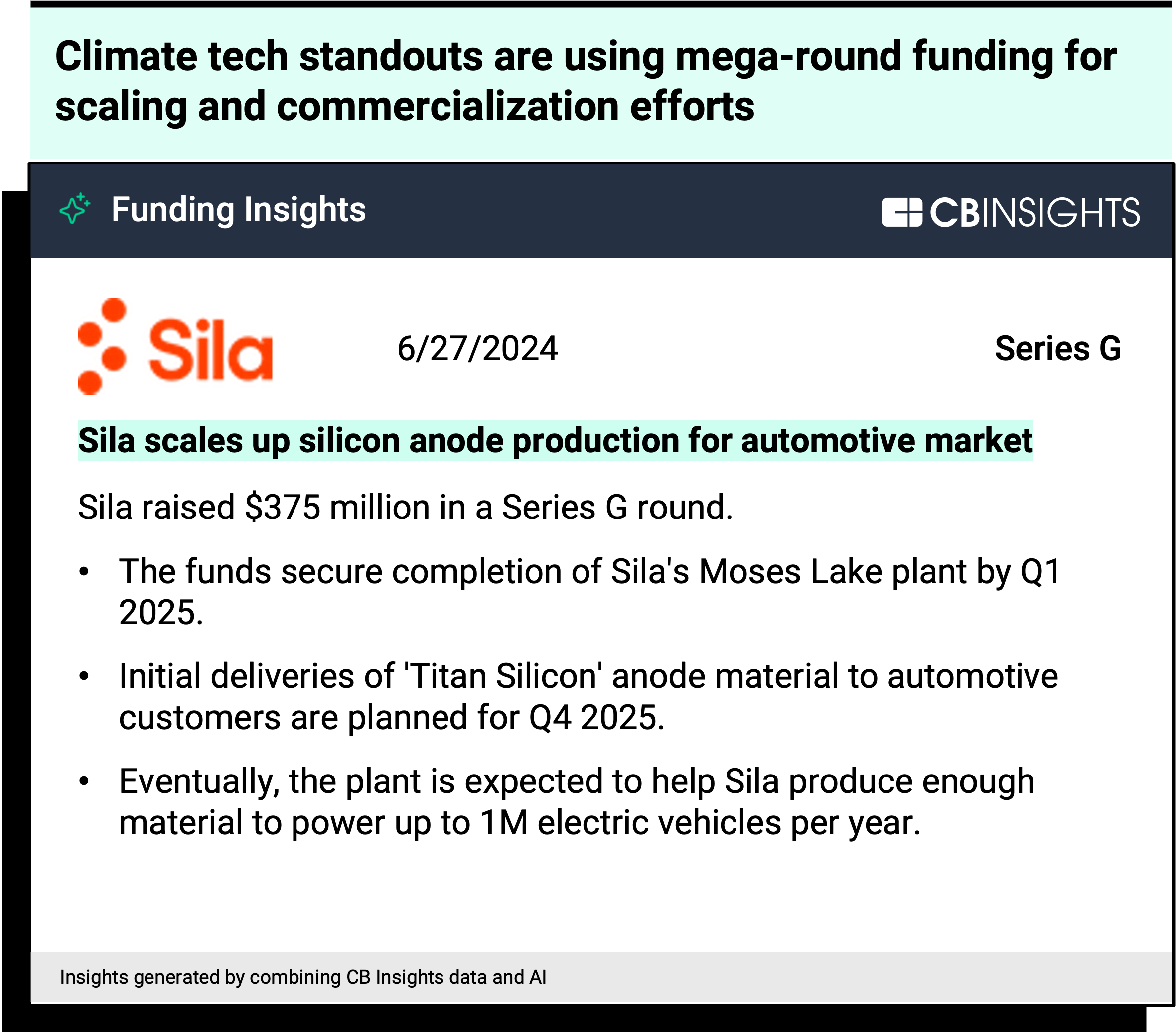

- $100M+ mega-rounds continue to trend down in Q2’24. Climate tech mega-rounds dropped from 17 in Q1’24 to 9 in Q2’24. The majority of Q2’24’s mega-round recipients are focused on scaling operations and achieving full-scale commercialization. For example, one of the quarter’s largest deals ($375M Series G) went to battery materials developer Sila, which plans to use the funding to ramp up silicon anode production.

Source: CB Insights — Sila Funding Insights

- Climate tech funding drops yet again in Asia. Climate tech startups in the region raised a total of $0.4B in Q2’24, down 33% QoQ and 89% YoY. China suffered the sharpest funding decline (-90% QoQ) among highlighted countries in the region. India and Japan watched funding fall by 28% and 57% QoQ, respectively.

More energy resources from CB insights

- 5 climate tech markets gaining momentum in 2024

- The grid tech market map: The companies tackling the growing need for reliable electricity

- The energy impact of generative AI: 3 technologies transforming the future of data centers

- Analyzing 15 oil & gas leaders’ tech priorities: Here’s where incumbents are buying, investing, and partnering

- Sodium-ion batteries are poised for a breakout moment — energy players should prepare

- Why energy giants should have green ammonia on their radar