Two blockbuster deals buoy an otherwise flat quarter for the sector.

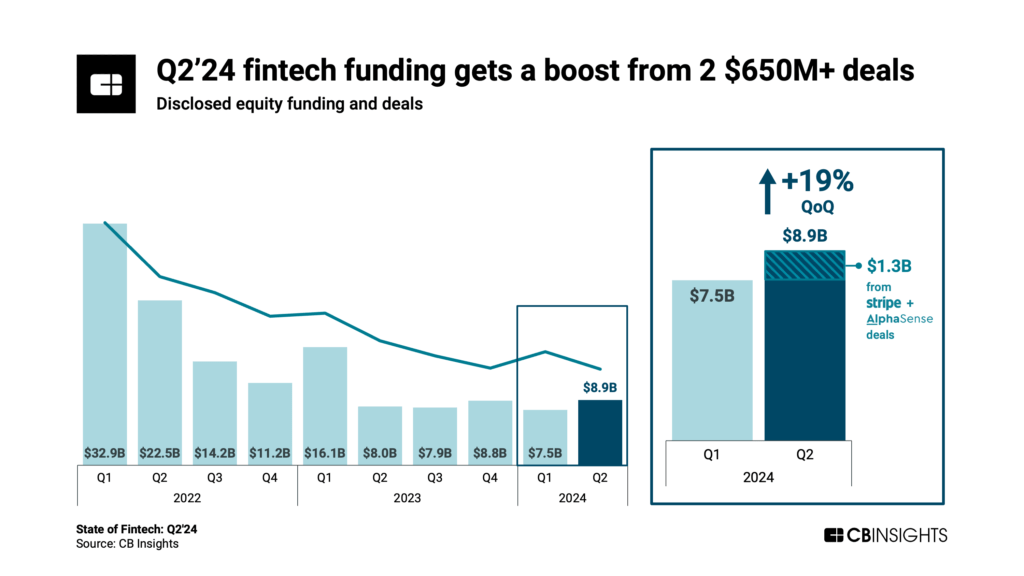

On the surface, Q2’24 was a return to growth for fintech, with funding increasing 19% quarter-over-quarter (QoQ) to $8.9B.

However, two huge deals — for market intelligence firm AlphaSense and payments juggernaut Stripe — obscured the reality that it was another tepid quarter for the sector as a whole.

Based on our deep dive in the full report, here is the TL;DR on the state of fintech:

- Funding increases by 19% quarter-over-quarter (QoQ), buoyed by 2 blockbuster deals. Quarterly funding rose in Q2’24 to $8.9B. But if it weren’t for 2 late-stage deals for Stripe ($694M) and AlphaSense ($650M), funding would have remained flat QoQ. A 16% decline in deal volume also indicates fintech investors remain cautious.

- Average deal size decreases to $12.8M, down 4% vs. 2023. The slight decline in average deal size YTD highlights broad stagnation in fintech deal sizes. Yet, when looking at the median, deal size has ticked up from $3.1M in 2023 to $4M this year. The 29% increase could signal strength in the long tail of smaller fintech deals.

- Mid- and late-stage deal share is at 20% YTD, up from 18% in 2023. In a more favorable operating environment, investors are showing greater confidence in later-stage companies than they did in the past 2 years — especially in areas like payments and lending. In payments, mid- and late-stage rounds make up 27% of deals YTD, vs. 21% in 2023. In digital lending, mid- and late-stage deals make up 35% of deals YTD, compared to 20% in 2023.

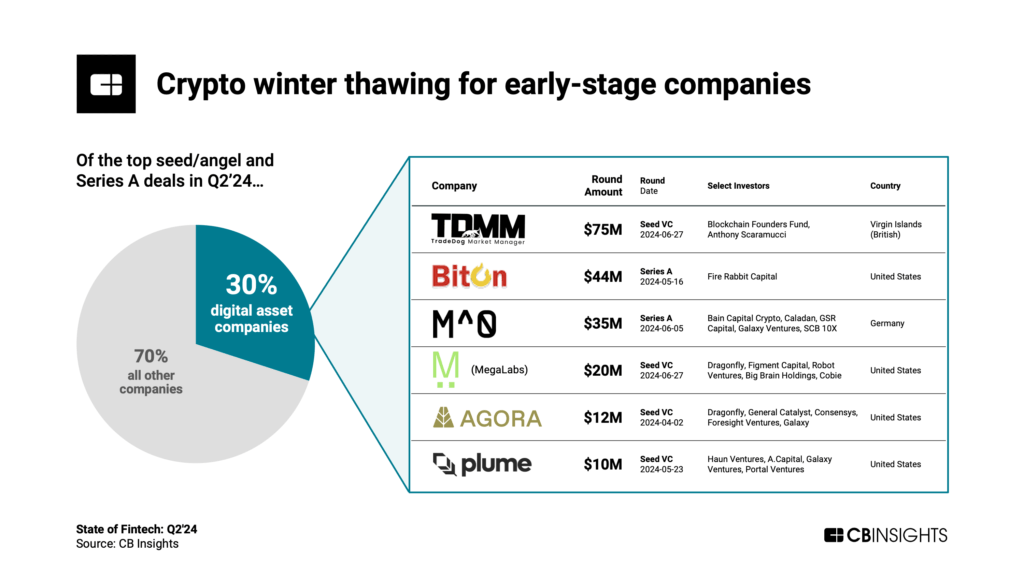

- 30% of the biggest early-stage deals are for digital asset companies. Crypto and blockchain-focused fintechs are receiving renewed focus, as the crypto winter thaws. Digital asset companies accounted for nearly one-third of the top 10 seed/angel and top 10 Series A rounds. The two largest early-stage deals in the crypto space went to digital asset infrastructure platforms TradeDog ($75M seed) and Biton ($44M Series A).

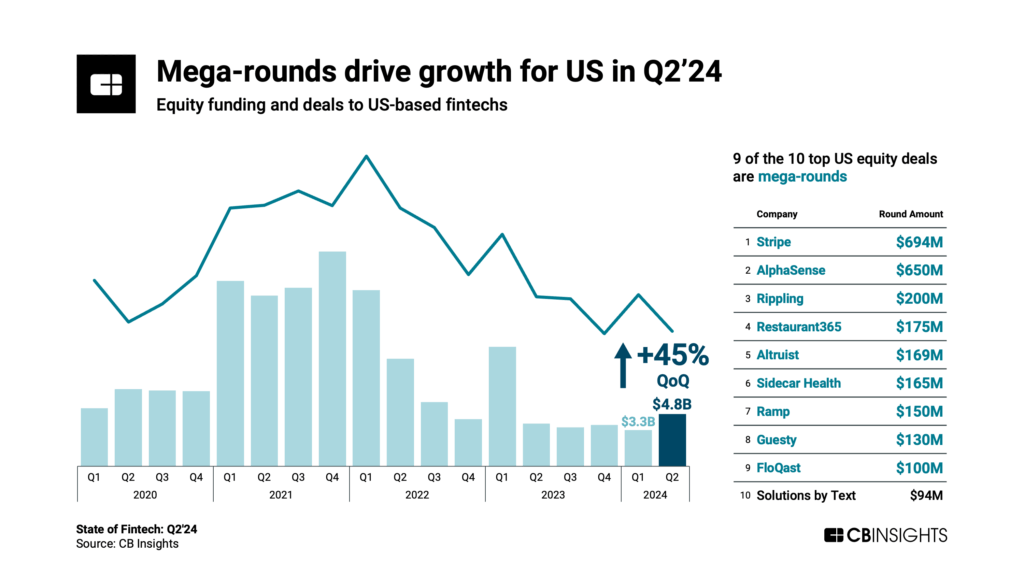

- US-based funding increases by 45% QoQ to $4.8B. In addition to the funding increase, the US led the world across a few metrics in Q2’24, including share of equity deals (40%) and exits (36%). Mega-rounds led the way: Nine of the 10 biggest deals in the US were worth $100M or more, the most since Q2’22. LatAm was the only other major global region with a funding increase, up by 22% to $442M.