Generative AI holds transformative potential for financial services, but unlocking it won't come without addressing security and regulatory concerns along the way. We break down how financial institutions and fintech startups are navigating the emerging space.

Financial services firms face a unique set of challenges.

For one, describing and marketing financial products to customers is often an uphill battle, both because of the complex nature of these products and because of strict regulatory oversight. These same aspects can make internal operations difficult to streamline and automate.

Generative AI has the potential to address these challenges by sifting through, summarizing, and personalizing complex information at scale to improve customer experiences and employee productivity. It can also generate synthetic data to support mission-critical machine learning (ML) applications like fraud detection.

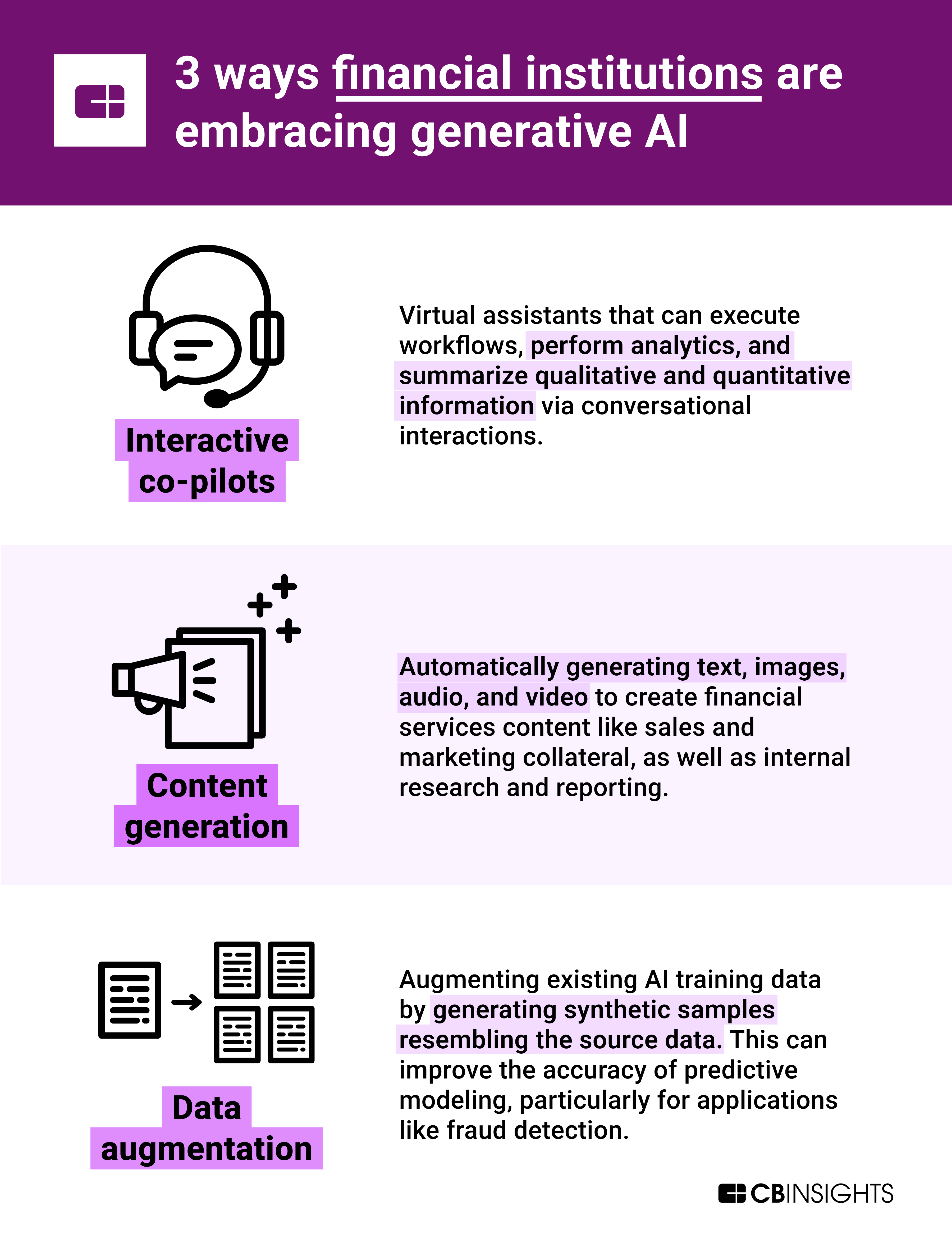

Across sub-sectors of financial services, there are 3 broad approaches financial institutions are taking to implement genAI solutions:

Incumbents are eyeing a wide range of areas where they can drive efficiencies. LPL Financial CEO Dan Arnold, for instance, sees AI as a potential “additional team member” across functions.

Source: CB Insights — LPL Q2’23 Earnings Call

It’s still early days, but large financial services firms like Morgan Stanley, Mastercard, JPMorgan Chase, Wells Fargo, RBC, and Capital One have already launched genAI-powered initiatives, partnering with companies like OpenAI, TIFIN, Kasisto, Salesforce, and CogniCor.

Below, we dig into how these genAI programs are taking shape.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.